CBO forecast leaves no room for wishful thinking

The Congressional Budget Office’s latest forecast makes a convincing case that fiscal complacency is now dangerous for the U.S. economy. CBO projects the federal government will borrow an additional $12.4 trillion over the next 10 years. At the end of 2028, the federal government will have outstanding debt of $28.7 trillion, or 96 percent of GDP. Ten years ago, federal debt was equal to 39 percent of GDP.

In fact, CBO’s official projection is an optimistic scenario. It assumes Congress will let many of the tax-cutting provisions enacted in the recently passed tax legislation expire after 2025. It also assumes, even more implausibly, that the caps on defense and nondefense appropriations for 2020 and 2021 contained in the Budget Control Act of 2011 will remain in place, thus forcing deep cuts in federal spending. However, Congress just enacted a bipartisan agreement to raise the caps in 2018 and 2019 by nearly $300 billion over that two-year period. If the tax cuts are made permanent, and if discretionary appropriations grow with the rate of inflation after 2019, then the budget deficit over the next decade would be $15 trillion instead of the $12.4 trillion contained in CBO’s baseline forecast. In 2028, the annual budget deficit would widen to 7.1 percent of GDP, while total federal debt would reach 105 percent of GDP.

In fact, CBO’s official projection is an optimistic scenario. It assumes Congress will let many of the tax-cutting provisions enacted in the recently passed tax legislation expire after 2025. It also assumes, even more implausibly, that the caps on defense and nondefense appropriations for 2020 and 2021 contained in the Budget Control Act of 2011 will remain in place, thus forcing deep cuts in federal spending. However, Congress just enacted a bipartisan agreement to raise the caps in 2018 and 2019 by nearly $300 billion over that two-year period. If the tax cuts are made permanent, and if discretionary appropriations grow with the rate of inflation after 2019, then the budget deficit over the next decade would be $15 trillion instead of the $12.4 trillion contained in CBO’s baseline forecast. In 2028, the annual budget deficit would widen to 7.1 percent of GDP, while total federal debt would reach 105 percent of GDP.

CBO has not yet updated its long-term budget forecast, but when it does the projection will show federal debt exploding at an alarming rate, as population aging and health-care costs push entitlement spending up at a rapid pace. Last year, CBO projected that federal debt would reach 150 percent of GDP by 2047. An updated forecast will show federal debt reaching that level much sooner.

The federal government’s massive fiscal problems will not be solved with more rapid economic growth. CBO rightly credits the recently passed tax bill with boosting business investment, productivity, and the size of the labor force. These are all important, positive developments for an economy that has suffered from sub-par performance for far too long. But the agency also notes that wider federal deficits and more borrowing by the government are drags on economic growth — a view that fiscal conservatives should share. CBO expects real GDP to grow at an average annual rate of just 1.9 percent over the period 2018 to 2028.

Recently, a group of distinguished economists tried to make the case that the nation’s fiscal problems should not be blamed on the growth of entitlement spending. The facts say otherwise. In 1970, federal spending on Social Security, Medicare, and Medicaid was just 3.7 percent of GDP. In 2019, CBO expects spending on these programs to be 10.5 percent of GDP. Over the next 10 years, the federal government will spend an additional $15 trillion above what would be spent if total outlays were frozen at this year’s level. Of that amount, $9.8 trillion will go entitlement programs, and another $3.7 trillion will be devoted to paying interest on the national debt. The federal budget is heavily weighted toward entitlement spending and will become more so in the coming years.

Extract from the Original article by James C. Capretta , in American Enterprise Institute .

The interesting thing here is that this is from the ultra-conservative think-tank AEI.

It is the same olde story of the gop's utter fiscal incompetence. Again, for the very slow, "Cutting taxes grows our debt". There are no pie in the sky fairies who magically grow tax revenue when taxes are cut. "Economics is just math" - Bill Clinton...

Please show how much tax revenues have declined since the 1950's when we had much higher tax rates and more people actually paid into the system.

I think it's your job first to back up either of those two assertions before demanding someone show something.

That's the POINT!!!

We had higher tax rates back in the 1950's and even with the tax cuts we have gotten since then, revenue is increasing.

Unless you want to show us how tax revenue fell because of the tax cuts, of course, but we both already know you can't and won't.

And if I posted proof, you would merely attack the source. I have seen it before.

Of course revenues grew with inflation, increasing numbers of taxpayers and economic expansion. We were not running trillion dollar deficits back in the 1950s either. The fact is that Trump's and the gop's irresponsible tax cuts will result in trillion dollar deficient spending, again, after we had our debt back under control. My family lived very well on one income back in the 50s and 60s. We had a nice new house and two cars and all the kids went to college and graduated. Times were not tough for white middle class folk though that was not true for everyone. Also, while it is true that consumer expectations were different back then people did quite well despite the high by recent standards federal tax rates. In any case, it is what people take home after taxes that matters for those are the limited numbers of dollars chasing limited supplies of goods and services. So, do not be ridiculous...

So lowering the tax rate did not result in a loss of revenue.

Nicely stated.

Glad we can agree.

First, thanks for changing the subject to try to evade the false narrative you were trying to create and second for admitting you didn't have shit to back up whatever point you thought you were making. By the way, revenue as a percent of GDP has not always gone up after tax cuts as this chart from Christopher Chantrill's website. Note that as a percentage of GDP the general trend for tax revenues is downward in the decades since WWII. Of course, it clearly drops sharply during recessions which have been the trademark of the three previous republican administrations (Reagan and two Bushes):

Lower taxes, increase spending and the cons expect the debt to go down. I know math is hard but what the fuck? Are republicans really that dumb? Apparently they are.

No.

They know perfectly well that the consequence will be a national debt explosion. That's not a bug, in their strategy; it's a feature.

They will use the debt explosion to justify reducing social coverage - retirement, health, unemployment insurance, ... There will be no alternative, since it is unthinkable to raise taxes on the rich.

It is always so interesting to see the arguments over government and spending and how we need to control debt. Government is what we make it. It provides services to groups of people or corporations depending upon who is running the government. The question is always who is going to get the best deal and come away with the most from government.

When republicans are in office, we can almost be assured of the following:

a. the government is going to propose tax cuts that benefit the wealthy and corporations

b. there will be much smaller benefits that go to the middle class and poor

c. there will be increased contracts that go to large republican donors

d. there will be a temporary return to "trickle down" economics which will not work

e. there will be a call for "reform" of entitlement programs which will adversely affect those who are poor and middle income.

f. there will be a call for privatization of education, the veterans administration, all health care, and public infrastructure.

g. there will be military interventions that lead to a ramping up of the defense industry

h. those military interventions will not be counted initially against the budget or the deficit.

i. those military interventions will lead to massively increased defense budgets.

j. when the republicans leave office, the deficit will have grown quicker than when democrats were in office.....since revenues did not meet expectations while expenditures exceeded them.

When democrats are in office, we can almost be assured of the following:

a. there will be tax increases on the wealthy and corporations and tax cuts for the poor and middle class

b. there will be increases to entitlement programs

c. there will be decreases to military spending

d. there will be a return to public funding for education, the veteran's administration, and public infrastructure

e. there will be an attempt to initiate some time of guaranteed health care

f. the predominant economic theory will be Keynsian

g. there will be fewer military interventions throughout the world

h. there will be greater emphasis on civil rights and their implementation

I. there will be smaller budget deficits but the national debt will still rise, albeit at a slightly lower rate.

The question isn't who is a better manager. The question is who actually has the better formula for a successful America. For those of us on the left and on the center left, the more progressive, more human centered positions of the Democrats are a far better governing strategy for the great majority of American citizens.

Good summary.

Republicans are at it again, with Bush it was out of control spending adding an entire new government agency like Homeland Security, no plan on how to pay for years of war, and eventually announcing our total economic collapse and their plan was to bail out banks. For God's sake, how did this incompetence help Americans?

Then a Democrat comes along, picks up the pieces and drags us back up again, only to be constantly bashed for doing what was needed to solve the mess Republicans left behind.

Now the far right has their "Great White Hope" in office along with a Republican majority and they are right back at it with a vengeance. Doing everything for the banks, doing everything for Wall Street, doing everything to create a massive, massive, massive deficit.

They still spout lies like "tax cuts pay for themselves" just like they did under Bush.

Nothing has changed but the Republican increased hatred for the American people doing anything and everything to destroy the middle class. Repeating the same mistakes and foolishly believing that the glad handing campaign donors and the wealthy corporate sponsors are all that matter.

Americans need to wipe the right wing glitter from their eyes.

Vote, vote, vote and quit letting the far right and the far left divide us.

Oh no, we're mortgaging our children's future (in truth it would seem our great,great,great grandchildren's future).

Whatever became of all those deficit hawks from just a couple of years ago that used to ply the halls of Congress chanting that mantra?

Hehe, well it seems I was 100% correct about them, they were completely full of shit and merely used those lines for political points. They were never actually serious.

This is too funny !

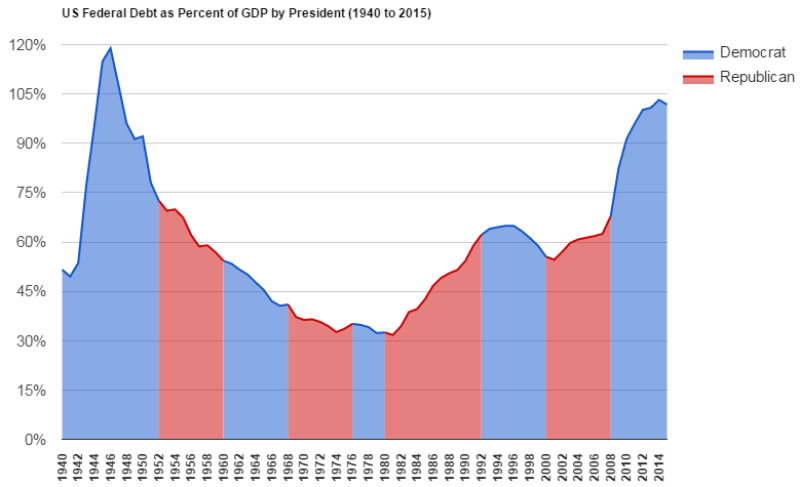

The same chart in the Articles main picture on the NT page, was used in this Piece too:

https://www.msn.com/en-us/news/opinion/no-republican-presidents-aren’t-responsible-for-most-of-america’s-debt/ar-AAw0yAi

“Every one of the last four Republican presidents has increased the deficit,” Leonhardt writes. “Every one of the last three Democratic presidents has reduced the deficit.” He even has a chart to prove it."

"I did notice a pattern. The above graph, like many of the other assertions in the article (Democrats cut corporate welfare and social programs? Obamacare held down deficits?), are misleading or highly debatable."

I guess it depends on who is saying what about something or another !