Two years after Trump tax cuts, middle-class Americans are falling behind

- Over the next two years, income for middle-class Americans is projected to grow at less than half the rate as for the richest 1%, a recent Congressional Budget Office found.

- The country's top-earning households will also enjoy a bigger decline in tax rates than all other groups.

- As a result, income inequality in the U.S. — already at a 50-year high — is expected to worsen.

Income for middle-class Americans is growing more slowly than for both top earners and the poor, according to the Congressional Budget Office. The analysis comes two years after President Donald Trump enacted the Tax Cuts and Jobs Act, a major overhaul in the nation's tax laws billed by the White House as a boon for the middle class.

After accounting for taxes and government benefits, the middle fifth of households will see their income grow by 6.6% through 2021, the CBO forecast — that compares with a 17% gain projected for America's richest workers. In dollars and cents, the middle 20% of families will have seen their income grow a total of only $4,400, to $70,300, between 2016 and 2021, the agency estimated.

Income for the top 1% is expected to rise nearly $200,000 over that same five-year period to nearly $1.4 million; the bottom 20% could see their annual income grow a total of $1,700 to $36,700.

The analysis factors in the impact of taxes and of government "transfers," which include benefit programs such as Medicaid and food stamps (but exclude social insurance programs like Social Security).

Thanks to the Tax Cuts and Jobs Act, top earners are also expected to get the biggest overall reduction in taxes over the five-year period studied by the CBO — their tax rate is projected to slide by 3 percentage points over the next two years, versus a dip of only 1 percentage point for the bottom 95% of earners, according to the CBO. The tax rate for households in the 96th to 99th percentiles is expected to fall by 2 percentage points.

The findings may fuel criticism that the lion's share of the gains from the 2017 tax law has gone to the rich and to corporations. The analysis also calls into question whether the nation's ongoing economic expansion — now in its 10th year — is significantly improving most Americans' standard of living, analysts said.

"Significant improvements in the quality of life of the middle class are not likely to come from general economic growth, or at least not anytime soon," wrote Brookings senior fellow Richard Reeves and research analyst Christopher Pulliam in a blog post assessing the CBO's projections.

To be sure, the gap between rich and poor has been widening for decades in the U.S., with the CBO noting that the top 1% enjoyed much faster average income growth from 1979 to 2016 than other groups.

Interestingly, before taxes and transfers, income growth since 1979 for both the lowest-earning and top-earning Americans has outperformed the middle-class — a trend the CBO expects to continue. Over the next two years, income for the bottom 20% of earners is forecast to grow 6.3% and to jump 12% for those at the top. That compares with a projected 5.8% income gain for the middle 20%.

Why the middle class is losing ground

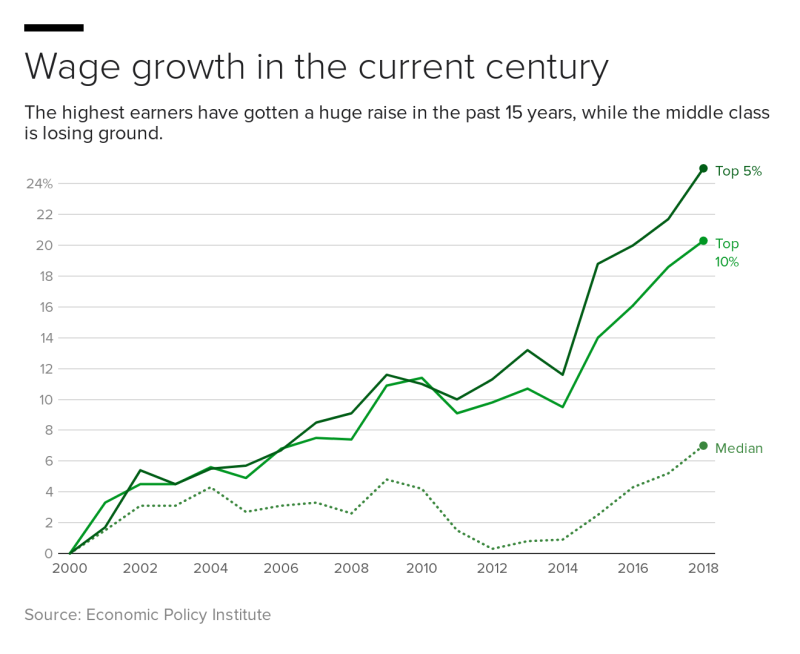

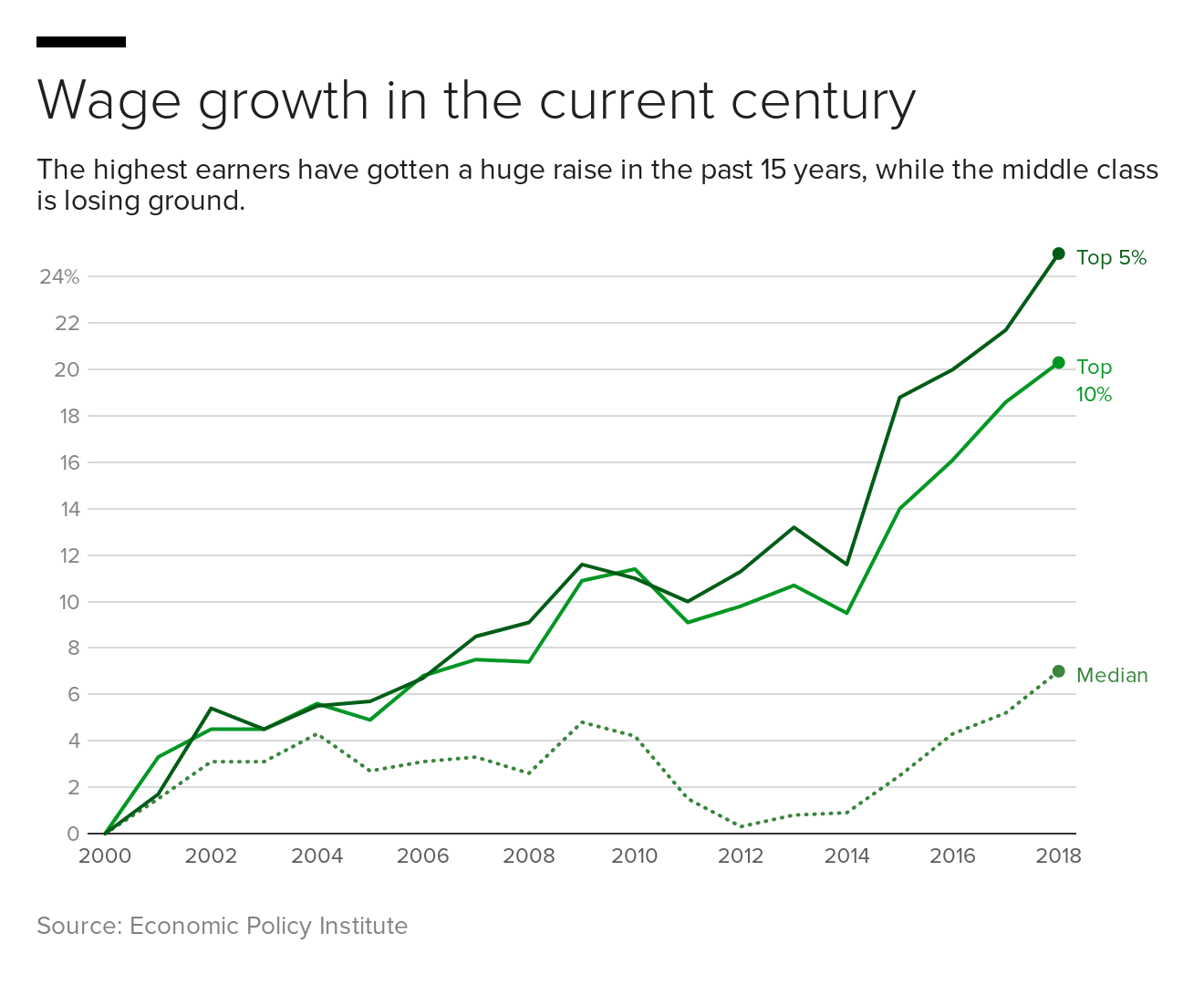

Several factors are widening the gulf between the middle class and the rich in the U.S., the CBO says. Most important, top earners are grabbing a larger share of the nation's overall income, which could be due to "superstar" workers and top executives receiving huge pay packages, according to the non-partisan agency.

Secondly, capital gains — the income earned from property or investments like stocks — have grown much faster than the income from labor. In other words, a rank-and-file worker can't hope to match the income booked by a wealthy investor's portfolio. Income from labor will grow at an average annual rate of 1.3% between 2016 and 2021, while capital gains will increase at an annual rate of 6.3% over the same period, the CBO estimates.

That trend overwhelmingly favors the rich. The CBO notes that capital gains contributed less than 2% of income for the bottom 99% of U.S. income earners, but accounts for 22% of the total income for the country's richest 1% of households.

Stuck in the middle

The Tax Cuts and Jobs Act gave big tax breaks to corporations, lowering the business tax to 21% from 35%. That's allowed corporations to spend hundreds of billions repurchasing their own stock, which helps investors, and boost dividend payments.

The law also gave a valuable tax break to some professionals through what's known as the "pass-through" deduction, which allows them to lop off 20% of their income before paying the IRS.

At the same time, the lowest-earning Americans are seeing higher pay as more states and cities boost the local minimum wage . Labor movements such as the Fight for $15 are also putting pressure on low-wage employers to increase their hourly rates.

That leaves the middle class without visible means of catching up to the top-earning Americans, while also trailing the gains eked out by the poorest workers.

It could take "concerted efforts" to reverse the stagnation that the middle class is likely to see over the next several years, the Brookings experts said. For instance, new policies such as expanded tax credits and help with housing costs could help boost growth for this group, they noted.

Tags

Who is online

48 visitors

Those lazy middle class workers need to stop being deadbeats and work harder.

Funny, this lazy deadbeat middle class person served in the U.S. Navy for 20 years, is service connected 100% disabled, and retired from a second career after the military. I have three different sources of income and I am doing fairly well financially. You can work harder if you want. I am at a point in life where I can work if I choose to, not because I have to.

My guess is you are not middle class then, you are at a minimum top 15%. check this link to know for sure.

Interactive, What % are you.

Nope, I'm just below the top half but I live in rural SE AZ where the cost of living is considerably lower than other parts of the country. Plus all the services I require are within maximum of two hours from me. Therefore, I am comfortable.

As it should be. You've worked hard for it and served your country. You should be comfortable. Thx for everything you did for us Devil Doc.

You've clearly earned your Stand Easy ...... enjoy!

This topic is SO much more complicated than just the data being used for this article. Speaking only for my little sphere of influence. I have plenty of high paying jobs available right now that i can't find qualified and/or willing applicants for. Wages that far outpace the average middle class wage. I know many other employers here in the exact same boat.

Is this the tax cuts fault John?

Amazing! The economy has been on the wrong track since Bill Clinton was President and everyone expects that to be corrected in less than two years. It was the economic policies of the Clinton administration that transformed the economy into vulture capitalism and abandoned the idea of building equity.

Who creates jobs if not businesses? Consumers, alone, creating jobs only results in day labor and freelance work. Gig work isn't a sustainable means of converting labor into wealth. At best, a gig economy pays the bills and often is inadequate for that. We must have businesses for the economy to create and distribute wealth. Blaming business as the cause is a stupid thing to do since our economy depends upon having businesses.

The bigger problems are the disincentives for building business equity. Incentives for profiteering and quick returns for vulture investors has threatened the resilience of the US economy. What is good for the political donor class has proven to be very bad for the country. Thank Bill Clinton for that.

Consumer spending creates virtually every job, most directly, some indirectly.

Walmart is said to be the largest private employer in the world.

Aren't virtually all of the jobs created through Walmart due to consumer spending ?

Consumers do not maintain a payroll. Consumers only provide an unorganized pool of money. Where do consumers get their money?

Walmart collectivizes unorganized consumer spending to, in essence, become a super consumer. Walmart is one of the largest consumers on the planet. As one of the world's largest consumers, Walmart has tremendous bargaining power over prices. But where does Walmart buy the products it sells at a markup?

The only thing businesses like Walmart and Amazon really do is to collectivize consumer spending. And Walmart and Amazon make money by skimming off a share from transactions between suppliers and consumers. Retailers are middlemen that do not add value to the economy; middlemen make money by introducing inefficiency into the economy. While retailers are a necessary part of the economy; retailers cannot be the economic driver of the economy.

Someone, somewhere, has to produce something. That's an unavoidable requirement for creating and distributing wealth.

A company can produce something, but if consumers don't have money to buy it, no demand, no sales, no more company. If wealth isn't getting to consumers, no way to buy. Its why our current distribution of income/wealth isn't working for most Americans. The gains in the economy are going to the top, and they don't spend it all. Their demands aren't enough to feed the economy long term.

Yes, that's why consumption is the controlling factor for the economy. Where do consumers get the money to consume?

Consumers must also be producers so they can buy things. We can try to create a gig economy to provide income but that is hardly dependable. We must have manufacturing in the economy to provide the money for consumption. Borrowing money to replace manufacturing and production won't be sustainable. At some point the loans will default and borrowing more won't be possible.

I would have to disagree with everything you said, Clinton was on the path to actually start paying off the Debt, which would have slowed real inflation allowing the dollar to get stronger and buy more. Consumers are the only thing that creates jobs, no business goes into business without the consumer in mind.

Without consumers you have no cash flow, hence no profits, hence no business. We have to keep as much money a possible in as many hands as possible in order for the economy to remain strong, the flow of wealth to the top has caused rampant real inflation and a market bubble that is so overvalued and a governmental pocket book that is already stretched so thin that when it does pop we will not be ale to save ourselves and a true depression will hit and hit hard. Hyperinflation is something we may all need to come to terms with in the near future.

Phony measures of inflation have been used far too long to mismanage the economy for the benefit of profiteers and passive investors. The inflation that matters affects what people have to buy. Yet those items are excluded from measures of inflation because they are 'volatile'.

Where do consumers get the money to buy things? Are we depending on planting a forest of magic money trees? Magical thinking got us into this mess and more magical thinking will only make the mess worse.

Consumers do control the economy. However, consumers don't accumulate money from buying things. Consumption is not a source of income for consumers. And when more of consumers' disposable income is spent on goods and services that are not included in measures of inflation then we are flying blind. Consumers have to obtain money from somewhere; if consumers don't then the economy stalls because consumers are the controlling factor for the economy.

Producing something is the only way to create and distribute wealth. Production uses labor and resources to add value to the economy. That's the only source of wealth and money. There aren't any magic money trees. Consumers must also be producers otherwise they cannot consume.

Yes, from people who started a business and got a loan or investment from some other businessman or bank.

Lets go back to the first person to ever have anything of value and what made it of value....someone was willing to exchange a service or good for it....a consumer.. without a consumer that person would still have the trinket a worthless trinket.

Now expand that times infinity and we have the system of buying and selling today, but I cannot start a new business unless I know there is demand for the product or service I wish to provide...starting a business just because you think you will create jobs without having a consumer in mind is a great way to no longer have a business.

For the most part, you are correct. But .... Pet Rocks.

Hmmm, now you have me pondering, I think that with every invention, even pet rocks. The businessman still at least "believes" there will be demand for his product, now some people do not do market research and gamble, but that is why most businesses fail in their first year also.

Go back far enough and we'd find a subsistence economy that wasn't based upon consumers, marketplaces, or trade. The consumer had to be the producer because there wasn't anyplace to buy anything. But the economic principles were the same.

If you start a business to supply what you need then its a viable business. Expanding that subsistence business only requires producing more than you need. If you need what you produce for yourself then it's a fairly safe bet that others need it too; that's a not a high risk business assumption. And if you cannot get what you need without producing it yourself, then that's a business opportunity.

Business is the activity of producing or buying and selling products (such as goods and services). it is "any activity or enterprise entered into for profit.

What you just said "If you start a business to supply what you need then its a viable business. Expanding that subsistence business only requires producing more than you need."

First, only producing for your own consumption is NOT a business, second you need a consumer to purchase what you have over produced otherwise it is trash.

Now where would that consumer get the money to buy your overproduction?

Obviously incorrect. An engine plant operated by General Motors for its own consumption is a business. As you stated, production is a business activity. And profit is not a requirement for business.

A manufacturer can operate separate captive businesses to supply components rather than buy those components on the open market. The purpose is to lower the cost of the components, not to make a profit by supplying components. Calling those separate businesses 'corporate divisions' doesn't change that they are businesses that could sell what they produce on the open market. The reason a manufacturer owns captive businesses is to avoid paying the markup that would provide profit. So, profit is not a requirement for a business. A captive business would be all cost without any profit.

Yes, consumption is the controlling economic factor in a market economy. Consumers do need a source of money so they can consume.

Consumption relies upon converting labor to cash just as production does. Consumers must be producers and producers must be consumers. Modern phony baloney economics tries to separate the two but the reality is that producers are consumers. In a market economy there can't be one without the other.

So, what you're saying is: everybody's wages are increasing.