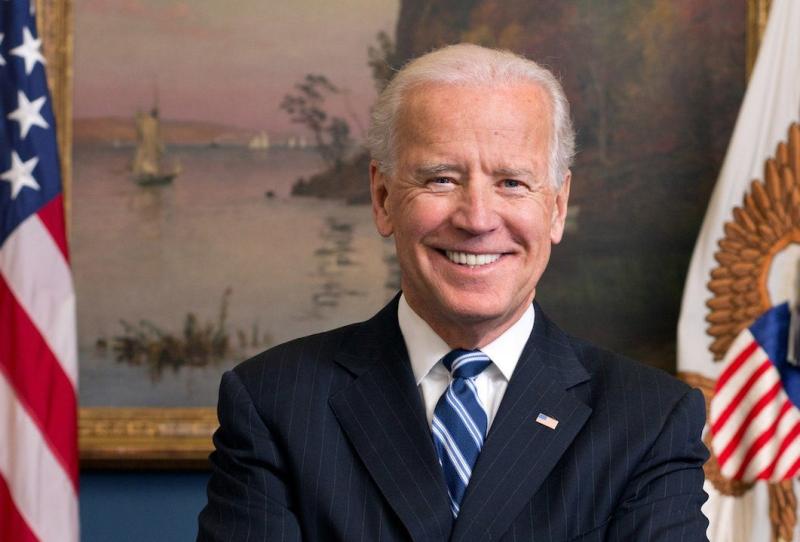

Here's How Much Social Security Income Joe Biden Is Receiving

By: Sean Williams (The Motley Fool)

Yes, Joe and Jill Biden receive Social Security benefits. Both have contributed to the Social Security system and have earned a benefit. It's not free money; it's an earned benefit.

Most of the Biden's Social Security benefit is subject to Federal (and state) income taxes because they have other sizable sources of income. Joe and Jill Biden do not depend upon Social Security benefits. It's true more Social Security recipients are being required to pay income taxes on benefits (401k and IRA disbursements are deferred income) since the caps and tax code does not account for inflation. But the idea of taxing the Social Security benefits of those with other sources of income isn't really a problem.

The real problem is that income tax revenue collected from Social Security benefits are not returned to the system. Politicians have created a tax code that deliberately transfers Social Security revenue to the general revenue fund. It's a backhanded political means of robbing and starving Social Security.

Joe Biden is a Social Security recipient. But will Biden address the problems to protect the Social Security system? Or will Biden adopt political nonsense like the Simpson-Bowles plan to justify robbing Social Security and protecting the general revenue? Joe Biden has been promising to spend a lot of public money so it's unlikely Biden will jeopardize sources of general revenue.

Are you ready for President Joe? Joe Biden has the experience with Federal accounting tricks to rob people blind while making all sorts of claims about fairness and forcing the rich to contribute their share. Taxing the rich is one thing but using accounting tricks to rob Social Security simply wrong.

Social Security is our nation's most prized social program. For more than 80 years, without fail, Social Security has delivered monthly payments to eligible retired workers, some 15 million of whom are single-handedly lifted out of poverty as a result.

Today, Social Security is responsible for providing monthly benefits to more than 64 million people, including nearly 46 million retired workers. Interestingly, one of those roughly 46 million senior beneficiaries just happens to be Democratic Party presidential nominee Joe Biden.

An under-the-hood look at Joe Biden's Social Security benefits

In July 2019, Biden and his wife, Jill Biden, released their tax returns from 2016 to 2018. Joe and Jill file returns jointly. As you can imagine, the couple has many income streams to report.

But one figure that stands out on Joe and Jill Biden's Form 1040 is line 5a, where Social Security benefits received is reported. In 2018 -- the most recent tax filing that Biden made available as part of his presidential campaign -- the couple received $49,545 from Social Security.

This was a drop in the bucket next to the $4.58 million the couple reported in adjusted gross income for 2018. However, the amount the Bidens received in aggregate Social Security benefits is certainly on the upper end of the spectrum. Back in October 2018, the average retired worker was bringing home $1,419.34 a month, which equates to a bit over $17,000 a year in income. Joe and Jill combined were netting well over this average in 2018.

Although Joe Biden's Social Security benefits take a back seat to his other income sources, the former vice president's payout nevertheless tells an interesting story.

There's a cap on benefits for high earners

As you may have already surmised, Joe and Jill Biden's high income is the primary reason their aggregate benefits received are higher than what the average retired worker or couple gets. The Social Security Administration takes an individual's 35 highest-earning, inflation-adjusted years into account when calculating their payout at full retirement age.

Because the Bidens earned far more than the average American worker during their lifetime, they receive a higher aggregate payout.

However, it's worth noting that, at $49,545, the Bidens aren't exactly making bank from Social Security. The level might seem low considering that Joe's annual income ranged from $210,797 and $320,000 between 1998 and 2007, and pushed into the millions of dollars in recent years. No matter how much an individual earns, the Social Security Administration caps monthly payouts at full retirement age each year. In 2020, this cap sits at $3,011 a month.

There's a real possibility that Biden's monthly income from Social Security has been capped.

More and more seniors are going to pay federal tax on their benefits

Another interesting tidbit on Joe and Jill Biden's Form 1040 is line 5b, the taxable amount of Social Security benefits. In 2018, $42,113 of the $49,545 in received benefits was subject to federal taxation at ordinary rates.

In 1983, the Reagan administration introduced the taxation of Social Security benefits as part of a major overhaul of the program officially implemented in 1984. Initially, it allowed up to half of an individual's benefits to be subject to taxation if modified adjusted gross income (MAGI) plus one-half of benefits received topped $25,000 (or $32,000 for couples filing jointly). In 1993, the Clinton administration added another tier of taxation that allowed up to 85% of benefits to be subject to federal income tax if an individual's or couple's MAGI plus one-half of benefits surpassed $34,000 or $44,000, respectively.

With the Bidens earning way above the $44,000 threshold in 2018, 85% of their received benefits ($42,113) became subject to ordinary federal income tax.

It should also be pointed out that these income thresholds have never been adjusted for inflation, despite being signed into law decades ago. Over time, that means more and more seniors are going to have some sort of tax liability on their Social Security benefits received.

Biden may be open to bipartisan reform

The simple fact that Joe Biden is a Social Security recipient could motivate him to seek out real reform for the program, assuming he wins the election in November (Trump could also be receiving Social Security benefits; we just don't know).

Social Security is facing a staggering $16.8 trillion cash shortfall between 2035 and 2094. If lawmakers on Capitol Hill can't find a way to pass reforms that would strengthen Social Security, retired workers could face an across-the-board cut to benefits of up to 24% by 2035.

Between Biden and Donald Trump, the former may actually be better suited to tackle Social Security reform. This is partly because Biden has broken with his party on a handful of occasions and suggested that cost-saving proposals, such as gradually raising the full retirement age, should be on the table. Republicans have long championed the idea of gradually raising the full retirement age to counter increasing longevity.

The point is, Joe Biden is more of a Social Security centrist who may be able to broker a bipartisan fix. Much will depend on the makeup of Congress after November, but Biden likely understands the importance of the Social Security program for the other 64 million-plus recipients.

Are you ready for President Joe? Joe Biden will try to convince you that it's your patriotic duty to allow Congress to rob Social Security and use that money to buy votes.

Really? Explain the republican's and Trump's initiative on the Payroll Tax. How would that work and what would the end result be?

You have to be kidding. He doesn't have to buy votes. He is earning them. It is Trump who wants to screw up SS. Show me one link where Biden plans to do that. If he is getting SS then he has earned it because he worked and had SST taken from his paychecks just like I did. Maybe the money for Trump's bs wall should be put to a better use like shoring up SS.

This is not just a "Trump" thing. Republicans have wanted to privatize SS and the Post Office for years. If you can put enough financial strain on both systems so that failure is imminent, then they can be leveraged as hostages to force Democrats to compromise with the Republicans if the Democrats fail to win the Senate or if they fail to win the Presidency and the Senate.

By the way " compromise " does not mean what you think it means.

Sort of a Leveraged Buy Out of an entire country.

No, the point is, if Democrats can manage to retain the House and gain the presidency and Senate - a bipartisan fix will not be necessary. Sauce for the gander.

Oh - increasing the retirement age is a solution presented by those who define hard work as sitting on their buns. Anyone who has done physical labor knows that the knees and other joints go at about 60.