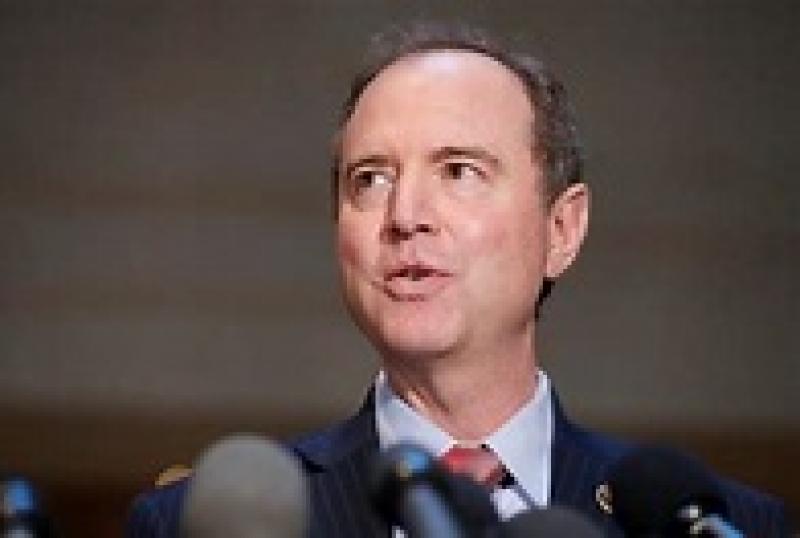

Adam Schiff looking for one more bite of the apple

The most partisan member of congress, our very own master of embellishment and kangaroo courts, Adam Schiff is proposing the creation of a 9/11 style commission to investigate "our response and how we can better prepare for the next pandemic.”

Our response?

We know from the Russia/collusion hoax what he means by "our." He's not talking about the CDC being totally unprepared or the expert task force being less concerned about the spread of the virus because they believed China's false numbers or even some of the nation's governors being woefully unprepared. No, Schiff, just like James Comey, is really talking about one man and one man only - the President. Schiff has dedicated much of his time and the House Intelligence Committee's time, along with considerable tax payer money to removing the President from office. As a matter of fact the administration was bogged down with the faux impeachment proceedings when the China virus first made headlines. Will Schiff consider the impeachment hearings and subsequent Senate trial a hindrance to the administration's response?

No, Schiff was just serving his constituency - that nasty group of haters we have to hear from every day.

For now Schiff will have to wait. Speaker Pelosi just created a new committee on Thursday to look at the recently passed relief bill. She is holding off the dogs for now. The Speaker is playing a different game right now. The current game involves using the crisis to legislate an agenda, which has little public support. Stay tuned for the next "Coronavirus Relief Bill."

Article is LOCKED by author/seeder

Article is LOCKED by author/seeder

So, far Pelosi isn't buying it.

Still licking her wounds?

She's too busy setting up a Stimulus Package to buy votes in her district. You know, the one that removes the SALT from their tax diet...

Yes indeed and here it is:

Pelosi pushes 'SALT shakeup' stimulus that could reduce her tax bill and enrich her wealthy district

Get all the latest news on coronavirus and more delivered daily to your inbox. Sign up here.

House Speaker Nancy Pelosi, D-Calif., is pushing for a new stimulus bill that would roll back the state and local tax deduction (SALT) cap, a proposal that would predominantly help wealthy individuals — including most residents in Pelosi's district and perhaps even Pelosi herself.

A 2019 report from the Joint Committee on Taxation projected that of those who would face lower tax liability from the elimination of the SALT cap – which only affects those who itemize tax deductions – 94 percent earn at least $100,000. The government would lose out on $77.4 billion in tax dollars, with more than half of that amount being saved by taxpayers earning $1 million or more. Those earning more than $200,000 would reap most of the balance.

California's 12th congressional district, which Pelosi represents, is among the wealthiest in the U.S., with a median income of $113,919, according to census data. The average household income is $168,456 -- meaning most residents would benefit from any significant cut to SALT.

Pelosi and her husband have a property tax liability of approximately $198,337.62 considering their two homes, a winery and two commercial properties, public records show, indicating that the couple could reap substantial benefits in the event of a full SALT repeal.

Pelosi's 2020 property taxes in Washington, D.C. totaled $13,997.20 on her Georgetown condo and garage, valued at $1,646,730. Her San Francisco property taxes totaled $51,480.02 -- plus $47,631.98 from her Napa winery, $64,874.66 from a San Francisco commercial property, and $20,353.76 for another building. Property taxes for businesses and other commercial ventures generally have not been affected by SALT provisions.

MYTHS OF THE SALT DEDUCTION, AND WHY CAPPING IT IS GOOD POLICY: READ MORE AT THE NATIONAL REVIEW

Just days after taking heat for successfully demanding $25 million in stimulus funds for the John F. Kennedy Center for the Performing Arts in Washington, D.C., Pelosi specifically declared this week that it might be wise to “retroactively undo SALT,” which was enacted as part of the 2017 tax cuts and prevents households from deducting more than $10,000 per year of their state and local tax expenditures from federal tax bills.

A Pelosi spokesperson said that a SALT drawdown would be “tailored to focus on middle-class earners and include limitations on the higher end.”

However, it was unclear exactly what the limitations would be in the proposed SALT shakeup. House Democrats voted last year to mostly repeal the SALT cap, and haven't hidden their desires to try again should control of the Senate change in November.

Chairman of the House Ways and Means Committee, Rep. Kevin Brady, R-Texas, and House Speaker Paul Ryan, R-Wis., on Capitol Hill introducing the House tax bill in 2017. (AP)

The cap has been particularly unpopular in high-tax blue states. New York, New Jersey, Maryland and Connecticut have even sued to repeal the SALT cap; that lawsuit was dismissed by a federal judge, and the states are appealing. The SALT cap is set to expire in 2025.

Roughly 13 million households nationally would benefit from slashing SALT, with the vast majority of them earning six-figure incomes and located in New York and California, The New York Times reported this week. Even a limited SALT reduction would predominately benefit wealthier Americans.

Pelosi's idea comes as House and Senate Republicans have sought to claw back the $25 million that the previous stimulus bill allocated to the Kennedy Center. President Trump called the payout a necessary compromise to win over Democratic support for the coronavirus relief package, but a chorus of lawmakers have said the spending was irresponsible in the wake of the newly announced layoffs at the opera house.

DEMS CHANGE TUNE ON TRUMP'S CHINA TRAVEL BAN

Rep. Bryan Steil, R-Wisconsin – who on Tuesday introduced the bill to retract the funding, along with numerous cosponsors, including Rep. Steve Scalise, R-La. – said the bailout was always a "mistake," layoffs or not.

“Families and workers are struggling to pay rent, pay their mortgage and buy groceries," Steil said in a statement. "Americans need relief and assistance now, which is why I supported the CARES Act. However, some in Washington felt it was important to spend $25 million of taxpayer dollars on the Kennedy Center when there are obviously bigger needs right now. This is frivolous spending in the midst of a national emergency."

“The ink is hardly dry on a $2 trillion-plus emergency package,” Sen. Patrick J. Toomey, R-Penn., told the Times. “It’s far too soon to know whether and of what nature additional legislation is needed. If we determine that another measure is necessary, it should not be the vehicle for Speaker Pelosi’s partisan, parochial wish list.”

GOP SEEKS TO CLAW BACK $25M ALLOCATED TO KENNEDY CENTER, AS OPERA HOUSE ANNOUNCES LAYOFFS

Senate Finance Committee Chairman Chuck Grassley, R-Iowa, has echoed that complaint.

"This is a nonstarter. Millionaires don’t need a new tax break as the federal government spends trillions of dollars to fight a pandemic," a spokesperson for Grassley said.

"Mrs. Pelosi’s remarks underscore the potential for further political mischief and long-term damage as the government intervenes to stimulate the economy," The Wall Street Journal editorial board wrote Tuesday. "When Democrats next complain that Republicans want to cut taxes 'for the rich,' remember that Mrs. Pelosi wants to cut them too—but mainly for the progressive rich in Democratic states."

Fox Business Network's Brittany De Lea, and Fox News' Jason Donner and Ronn Blitzer, contributed to this report.

The caps on SALT deductions needs to be made permanent. There is no way we should be subsidizing rich people in high tax states. Tax payers living in high tax states should not get a bailout from federal tax payers everywhere else.

Wit a minute. I thought it was only Trump that allegedly riches himself from EOs or passed legislature.

I wonder if any of them will have the balls to call her out if her agenda goes through.

Somehow I doubt it.

Schiff knows he can tweak the emotions of the TDS sufferers by giving them hope of blaming everything on President Trump.

"9/11 style commission to investigate "our response and how we can better prepare for the next pandemic.”

He is one Big Shit Dump !

Let's "tax payer FUND" a group of people to "Scheme" together on the " Unknowable" !

That'll work !

We should definitely review what has gone right and what has gone wrong so that we can be better prepared in the future. But it seems a little early, doesn't it?

Also, is he suggesting that this is a matter to be taken up by the House Intelligence Committee?

They should investigate their own committees failures regarding this event and how it happened and what they were wasting their time on instead of our security

As chairman of the House Intelligence Committee, Adam Schiff had to have known about the rapid spread of the Hunan Virus (COVID-19) in December and January. Why didn't he share what he learned with the WH and Congress? Oh, wait, his only focus at that time was "impeaching" Trump.

It's tucked away in his "Soon to be Released" folder.

When "Soon" is....is anyone's guess !