The trouble with sunsets

By: By Paul Krugman

One thing I didn't quote was the rest of Sen. Rick Scott's proposal , which asserted that sunsetting can't possibly do any harm: "If a law is worth keeping, Congress can pass it again."

Sorry, but that's not how things work. Especially not now.

Even in our personal lives, everyone knows that it's much harder to start doing something good than it is to continue a good routine. I don't decide every morning whether I feel like working out; I've made morning workouts my baseline, to be canceled only in exceptional circumstances. (For younger readers: Staying in halfway decent shape later in life isn't easy. Also, you kids, get off my lawn.)

In much the same way, the Senate doesn't have to decide every five years to actively continue these programs that many older Americans deeply rely on. For decades they've been our baseline, without the periodic meltdowns engendered by the debt ceiling and other recurring deadlines that require our legislators to actually come together and do something.

One of the most famous results in behavioral economics is that workers are far more likely to make use of financially advantageous retirement plans when they must opt out in order not to be enrolled, as opposed to having to opt in, even though the cost of opting in is trivial.

So even if politics weren't a factor, someone who actually wanted to preserve Medicare and Social Security wouldn't require that Congress opt back in to those programs every five years.

But of course politics is a factor, and political motivations lie behind the widespread use of sunsets in U.S. legislation. Unfortunately, most of those motivations are malign.

Now, it's true that much of what the government does can't, as a practical matter, be made legislatively permanent. We can't, or at least shouldn't, establish permanent funding for the military, because America's military needs are constantly changing in the face of events, like Russia's invasion of Ukraine. Also, national security at least used to be an area in which partisanship was muted and politicians were relatively likely to act in the national interest.

But we have a lot of other areas — especially tax policy — in which you might think there were major advantages to stability: It's easier to make long-term financial plans if you have a pretty good idea what tax rates you will face in the future. Yet much of modern tax legislation has been full of sunsets.

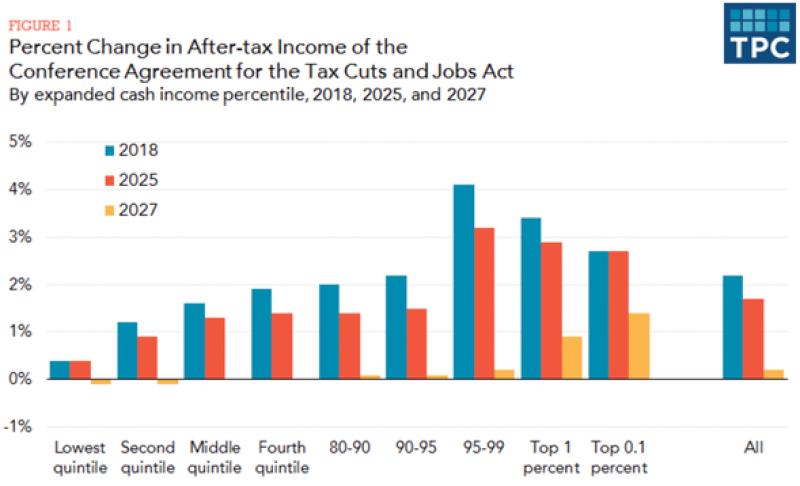

The 2001 Bush tax cut, for example, was written so that the whole thing would expire at the end of 2010 — with, among other things, a sudden jump in taxes on large estates, creating a clear incentive for wealthy heirs to find a way to hasten their elders' deaths. The 2017 Trump tax cut was written so that many of the cuts that benefit the middle class would expire after a few years, so that on paper the tax cut became much more regressive over time. Here's the Tax Policy Center's picture:

A tax cut that got more regressive over time.

Tax Policy Center

Why do such silly things? One answer involves the peculiar institution of the filibuster, which means that in many cases legislation can't be enacted unless one party controls 60 Senate seats — which is to say, in a deeply divided nation, basically never. Fiscal bills, however, can be enacted through reconciliation, which only requires a simple Senate majority — but normally can't increase the deficit for more than 10 years. Hence the abrupt cutoff at the end of a decade.

Another reason for sunsets is to hide the true cost of legislation. Donald Trump's Tax Cuts and Jobs Act was written with middle-class tax cuts that expired after a few years in the belief that Congress would feel politically compelled to extend these cuts; meanwhile, the official revenue loss from the bill would be held down because, at least on paper, many of its tax cuts were only temporary.

Finally, we have what I suspect is the reason behind Rick Scott's thinking: to create sunsets that would affect legislation you don't like but don't have the votes to repeal. In terms of sheer political calculus, this increases the possible ways to kill a program: All you need is control of either house of Congress or the White House. And there's always the possibility that Congress will fail to opt in, even if it would never have considered opting out. Think of it as being like a company that makes its retirement plan opt-in in the hope that some workers will fail to take advantage of a good deal.

These are all pretty bad reasons for legislative sunsets!

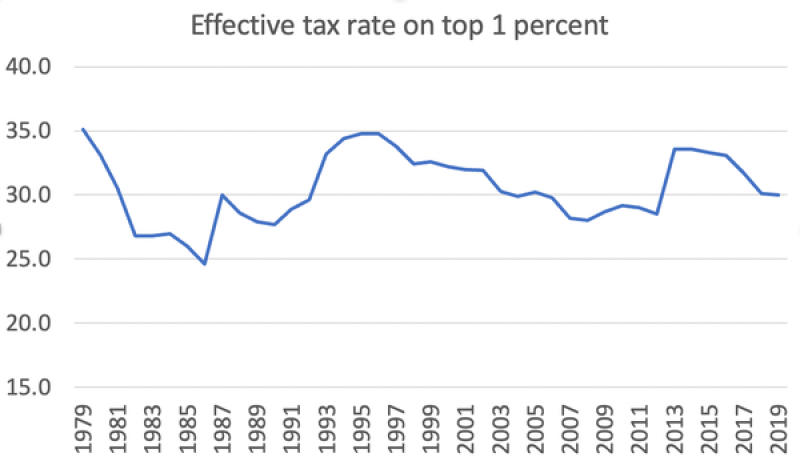

And here's the thing: Sunsets do matter. One of the lesser-known facts about President Barack Obama is that he managed to achieve a surprisingly large increase in effective tax rates on the top 1 percent. Here's the Congressional Budget Office estimate of the average effective tax rate on the top percentile:

What it looks like when high-end tax cuts expire.

Congressional Budget Office

How did Obama manage that when his party controlled Congress for only two years? Part of it was new taxes on high incomes imposed to help pay for the Affordable Care Act. But another important factor was that Obama was able, in effect, to raise taxes on high incomes simply by not extending some of Bush's tax cuts.

I like that particular outcome (although it raised my own taxes). But in general, sunsets are a bad thing, and any politician who tries to make them sound innocuous is probably trying to pull a fast one.

Tags

Who is online

50 visitors

By posting to this seed, you are agreeing to abide by the Group's Rules .