What’s the Problem with Low Inflation?

The Issue :

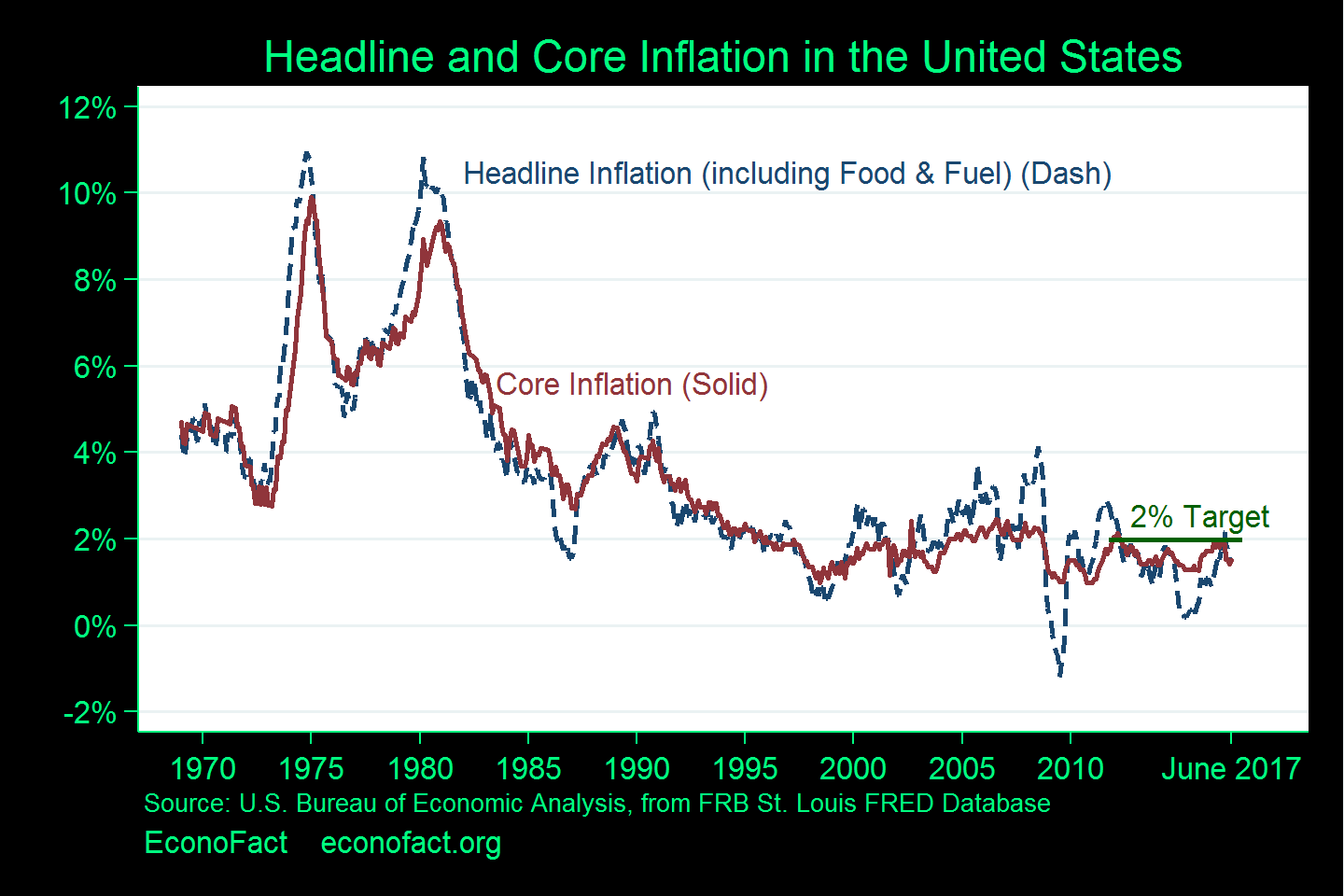

Today's low inflation has some economists puzzled. The Federal Reserve has persistently undershot its inflation target of 2 percent since 2012, when it established this level of inflation as one of its policy goals. Modest inflation has a number of benefits, and some concerns have been raised by the persistence of inflation below this target level. These recent concerns stand in stark contrast to the experience of the 1970s when the inflation rate reached double digits. At that time, President Gerald Ford tried to marshal public support for policies to lower inflation with the slogan “Whip Inflation Now,” and with buttons that had the acronym “WIN.” (People took to wearing the buttons upside down, making the acronym NIM which meant “No Immediate Miracles.”) Inflation in the United States was eventually brought down by the recession of the early 1980s, and continued to stay low during the period called The Great Moderation of the 1990s and early 2000s.

High inflation in the late 1970s was widely viewed as the most pressing problem facing the nation at that time. What are the sources of concern today that inflation is too low?

The Facts :

§ The inflation rate in the United States, as measured by the annual rate of change in prices of Personal Consumption Expenditures, peaked at over 10 percent in 1974, and then again reached this point in 1980, but declined during the recession of the early 1980s and has remained low since (see chart). Since the beginning of 2009, in the wake of the Great Recession that began in 2008, headline inflation has averaged 1.5 percent while core inflation, which does not include the prices of foods and fuels, and is therefore less volatile, has averaged 1.3 percent. Part of the recovery from the Great Recession was due to the Federal Reserve’s so-called Quantitative Easing policy in which it increased the money supply by purchasing assets outside of those typically included in its open-market purchases. There were predictions that this would lead to high inflation but, almost a decade after that policy began, there is little evidence of inflation or incipient inflationary pressures.

§ Low inflation can be a signal of economic problems because it may be associated with weakness in the economy. When unemployment is high or consumer confidence low, people and businesses may be less willing to make investments and spend on consumption, and this lower demand keeps them from bidding up prices. Inflation often tends to decrease when the economy softens – for example, the rapid decline in inflation in the early 1980s occurred when the Federal Reserve raised interest rates and caused a sharp downturn in economic activity that raised the unemployment rate, with unemployment eventually reaching 10.8 percent in November and December of 1982. The unemployment rate likewise reached 10 percent in October 2009, but this was despite, rather than because of, efforts by the Federal Reserve since during the Great Recession the Fed was engaged in low-interest rate policies to help the economy recover. Inflation was low during the Great Recession; headline inflation was negative from March through September 2009, and core inflation hovered around 1 percent in that period.

§ The Federal Reserve set an ongoing inflation target of 2 percent “over the medium term” in January 2012, a policy that continues to the present. This is a symmetric target, not a ceiling; that is, Federal Reserve policy is aimed at keeping inflation around 2 percent, with it sometimes being higher and sometimes being lower. But the inflation rate has been almost always below 2 percent since that policy has been in effect and, most recently, headline inflation was 1.4 percent in June, 2017. This has raised doubts about whether the Federal Reserve will raise its benchmark interest rate for a third time this year. There have been calls for the Federal Reserve to raise interest rates because the ongoing recovery from the Great Recession represents the third-longest recovery on record and the current low unemployment rate would usually lead the Federal Reserve to set its policy course towards preventing the economy from overheating. It is striking, however, that this recovery has not been accompanied by increasing inflation, even with unemployment rates of 4.3 percent in June and July, the lowest string of two-month unemployment rates in more than 15 years.

§ A concern that arises with persistently low inflation is that it can limit the scope for monetary policy. Interest rates cannot go below zero (or, at least, not by much), the so-called zero-lower bound. Interest rates decrease as expected inflation declines since the interest rate charged by a lender reflects, in part, a hedge against being paid back in dollars whose value has been eroded by inflation (this is called the Fisher Effect after the early 20th century Yale economist Irving Fisher). Low interest rates, along with the zero lower bound, limit the scope for the Federal Reserve to further lower interest rates when the economy is weak. The current interest rate on one-year Treasury Bills is 1.2 percent, and, at an interest rate this low, the Federal Reserve may not be able to “keep its powder dry” in case the economy weakens.

§ Another potential problem with low inflation is its possible effects on the functioning of the financial system. Banks profit from the spread between their cost of borrowing and their income from lending. This spread tends to compress with the lower interest rates that accompany lower inflation. One could argue that the profitability of the financial sector, while not a policy goal in itself, is important for it to function and, in turn, for the health of the economy. However, banks and other financial institutions profit from other sources as well, such as by charging fees and through their holdings of assets. In fact, with major banks deemed healthy by the Federal Reserve in June, 2017, and with strong bank profitability, the shareholders in these banks are set to receive their biggest dividends in a decade.

§ In the extreme, when an economy's inflation rate turns negative, it raises additional concerns and the prospect that the economy slips into deflation . Deflation means that prices and wages are falling. But the face value of debt already taken on will not decline, nor will scheduled interest payments, and deflation will make the fixed interest payments on the debt more expensive in terms of prices and wages. This can lead to a debt-deflation cycle, an idea developed by Irving Fisher in 1933 as one explanation for the cause of the Great Depression of the 1930s. In a debt-deflation cycle, the higher burden of servicing the debt, in terms of prices and wages, reduces demand in the economy which contributes to further deflation, and so on.

What this Means :

The Federal Reserve has the dual mandate of price stability and low unemployment. It seems to have achieved both of these goals recently, with low inflation and low unemployment. However, the fact that inflation has been below the Federal Reserve's target even as unemployment has reached levels consistent with an economy functioning at full employment is somewhat of a mystery. It may be that inflation is responding slowly to economic circumstances and that as the labor market continues to tighten, wages will start increasing and prices will follow. On the other hand, low inflation could reflect an economy weaker than what the unemployment rate would lead us to believe, perhaps because low unemployment is partly reflecting low labor force participation of both men and women in prime working ages -- which reduces the unemployment rate. While economists do not fully know why inflation has been so quiescent, they do understand some of the potential challenges of this outcome.

-------------------------------

Original article http://econofact.org/whats-the-problem-with-low-inflation by Michael W. Klein, Econofact http://econofact.org/

There may be links in the Original Article that have not been reproduced here.

For policy wonks...

Part of the recovery from the Great Recession was due to the Federal Reserve’s so-called Quantitative Easing policy in which it increased the money supply by purchasing assets outside of those typically included in its open-market purchases. There were predictions that this would lead to high inflation but, almost a decade after that policy began, there is little evidence of inflation or incipient inflationary pressures.

The intent was to reduce rates on treasuries, which would spread to reduced rates on commercial paper. The theory being that as companies reduced their debt service, they would push these savings back into expansion projects, etc. as well as finance new debt at lower rates. That is not exactly what happened, as companies began stock buyback programs, to drive up stock values, as well as increasing dividends, etc. The upshot being a significant portion of so called "earnings" increases have been in reductions in debt service. Certainly these companies have increased their debt at cheaper rates, but where did the savings end up? Again stock buybacks, dividends, etc.

This had led to a host of zombie companies that rely on low interest rates to survive and therefore a drag on any productivity gains.

All of that does not include the 2008 decision to pay banks for both reserves and excess reserves, which now stands at 1.25% . The result being that excess reserves jumped from historical $2B to $2.6T and then to current $2.1T .