House flippers triggered the US housing market crash, not poor subprime borrowers

The grim tale of America’s “ subprime mortgage crisis ” delivers one of those stinging moral slaps that Americans seem to favor in their histories. Poor people were reckless and stupid, banks got greedy. Layer in some Wall Street dark arts, and there you have it: a global financial crisis.

Mounting evidence suggests that the notion that the 2007 crash happened because people with shoddy credit borrowed to buy houses they couldn’t afford is just plain wrong. The latest comes in a new NBER working paper arguing that it was wealthy or middle-class house-flipping speculators who blew up the bubble to cataclysmic proportions, and then wrecked local housing markets when they defaulted en masse.

Analyzing a huge data set of anonymous credit scores from Equifax, a credit reporting bureau, the economists — Stefania Albanesi of the University of Pittsburgh, the University of Geneva’s Giacomo De Giorgi, and Jaromir Nosal of Boston College—found that the biggest growth of mortgage debt during the housing boom came from those with credit scores in the middle and top of the credit score distribution—and that these borrowers accounted for a disproportionate share of defaults.

As for those with low credit scores—the “subprime” borrowers who supposedly caused the crisis—their borrowing stayed virtually constant throughout the boom. And while it’s true that these types of borrowers usually default at relatively higher rates, they didn’t after the 2007 housing collapse. The lowest quartile in the credit score distribution accounted for 70% of foreclosures during the boom years, falling to just 35% during the crisis.

So why were relatively wealthier folks borrowing so much?

Recall that back then the mantra was that housing prices would keep rising forever. Since owning a home is one of the best ways to build wealth in America, most of those with sterling credit already did. Low rates encouraged some of them to parlay their credit pedigree and growing existing home value into mortgages for additional homes. Some of these were long-term purchases (e.g. vacation homes, homes held for rental income). But as a Federal Reserve Bank of New York report from 2011 reveals (pdf, p.26), an increasing share bought with the aim to “flip” the home a few months or years later for a tidy profit.

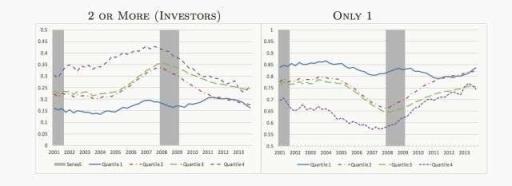

Share of mortgage balances held by borrowers with two or more mortgages (left panel) and only one mortgage (right panel) by quartile of the 8Q lagged Equifax Risk Score.

In early 2004, a little more than 10% of borrowers in the top three quartiles of the credit score distribution had two or more mortgages. By 2007, that had jumped to around 16% for borrowers in the middle half of the credit-score distribution, and around 13% among that top quartile. However, for the lowest quartile (i.e. subprime), only around 6% had more than one mortgage, rising to around 8% by 2007.

Clearly, richer borrowers were driving the trend. For instance, among prime borrowers, the growth in per capita mortgage balances held by investors was around 20 percentage points higher for those with the highest credit scores than those with the lowest.

Come 2007, investors accounted for 43% of the total mortgage balance for the top credit-score quartile. For the middle two quartiles, speculators were responsible for around 35% in 2007.

This set up a dangerous dynamic. The mortgages these prime borrowers were able to secure were much bigger than those taken out by poor homebuyers. Worse, speculators have less incentive to hold onto their extra homes than those who only own one home. So when the housing market started tumbling and the economy soon followed, they were much more willing to default and foreclose, as you can see in the chart below.

Investor share of 90+ days delinquencies (left panel) and foreclosures (right panel) by quartile of the 8Q lagged Equifax Risk Score.

This would explain why, as the researchers put it, “the rise in mortgage delinquencies is virtually exclusively accounted for by real estate investors.” The share of single-mortgage borrowers who couldn’t keep up on their loan payments barely budged between 2005 and 2008.

Recent research—particularly that by Antoinette Schoar , a finance professor at MIT Sloan—has been helping rewrite the received wisdom of the “subprime crisis” that has blamed the crisis on poor, reckless borrowers for the better part of a decade. Shoar’s work reveals that borrowing and defaults had risen proportionally across income levels and credit score, but that those with sounder credit ratings drove the rise in delinquencies. This new paper’s investigation into the habits of middle- and upper-income real estate speculators in the run-up to the crisis marks yet another chapter of the history books in desperate need of revision.

Shoar’s work reveals that borrowing and defaults had risen proportionally across income levels and credit score, but that those with sounder credit ratings drove the rise in delinquencies. This new paper’s investigation into the habits of middle- and upper-income real estate speculators in the run-up to the crisis marks yet another chapter of the history books in desperate need of revision.

Interesting facts presented in this article...

Good find.

I was sitting on my precious sister's patio in CA listening to the tale a young man was laughing about. His job was to secure buyers of houses whether they could qualify or not. They, in turn, would sell the paper to mortgage companies. He said he didn't care as long as he had a signature!

Predatory lending isn't funny, but this is even less funny:

those with sounder credit ratings drove the rise in delinquencies

Speculators cause every crash, don't they?

Speculators cause every crash, don't they?

True enough John, @ least since the 1600's. (smile)

In hindsight the Tulip bubble seems truly nuts but the sheer ridiculousness of that craze always tickled my affinity for the many bazaar spikes in human behavior throughout time.

Tulip mania

Tulip mania, tulipmania, or tulipomania (Dutch names include: tulpenmanie, tulpomanie, tulpenwoede, tulpengekte and bollengekte) was a period in the Dutch Golden Age during which contract prices for bulbs of the recently introduced tulip reached extraordinarily high levels and then dramatically collapsed in February 1637.[2] It is generally considered the first recorded speculative bubble (or economic bubble),[3]