Dollar's Decline Laid Bare in Real Rates

Dollar's Decline Laid Bare in Real Rate One thing that could reverse the greenback's drop is if the Fed's doves acknowledge the need to boost interest rates.

The dollar is depreciating.

The dollar is depreciating.

Andrew Harrer/Bloomberg

You can make a career as a currency strategist talking about the influence that nominal interest-rate differentials have on exchange rates and no one will call you out. You only get caught when it doesn’t work and you have to figure out a clever explanation for why not. This is one of those periods.

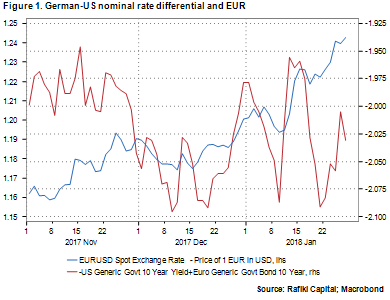

That's especially true when it comes to the dollar, which has fallen steadily over the past 12 months despite the increase in rates and bond yields in the U.S. It’s hard to look at the chart below and make the case that the red line (nominal 10-year rate differentials between Germany and the U.S.) is heavily influencing the blue line (the euro-dollar exchange rate) or even heavily correlated with it.

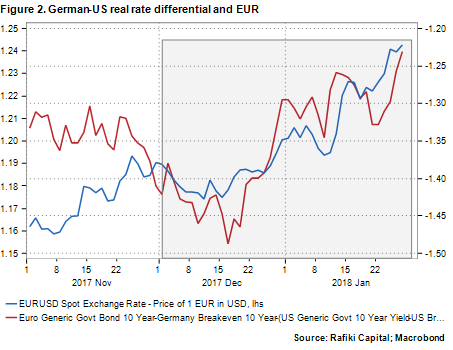

So, what is behind the dollar's weakness? Has it disconnected from the fundamentals, and does it represent some sort of referendum on the current state of the political environment? Before going down that path, consider real, or inflation-adjusted, interest rates, which have been strongly correlated with the dollar's movements since early December, especially against the euro.

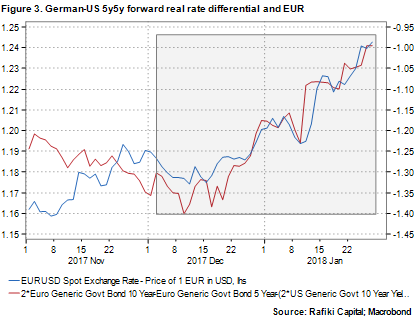

For good measure, take a look at where the market expects five-year rates to be five years from now in the U.S. and Europe, and subtract where real rates are expected to head. When graphing that difference against the euro-dollar exchange rate, the fit is as good or better than looking at 10-year real rates alone. It is rare for something so far in the far in future like the market's expectations for inflation in five years to matter in the here and now, but when it does it's meaningful and marks a major shift. For many years, the mantra was that two-year nominal differentials were all that mattered.

Inflation expectations can really have a big influence on exchange rates if the expected monetary policy response to inflation changes. In recent decades, central banks were expected to follow some variation of a Taylor rule. In that world, an increase in inflation rates and expectations should lead to an increase in nominal and real interest rates. Your currency would tend to appreciate as a result.

In the old days, when central banks were less committed to fighting inflation, higher rates of inflation would lead to currency depreciation on the view that inflation would be accommodated and the price level would widen between the two countries. This is simply the purchasing power parity model that all economists are taught at birth. We are so accustomed to thinking in terms of aggressive central bank reaction functions to deviations in inflation that it has become standard to associate faster inflation with a stronger currency.

The timing of this refocus on real rates and inflation differentials corresponds closely to the timing of the announcement that Jerome Powell would replace Janet Yellen as head of the Federal Reserve. The perception is that Powell is somewhat more dovish than Yellen. Although Powell at times has sounded somewhat skeptical that long-term inflation would pick up, that is not quite the same as saying that he would not act if inflation did pick up.

The buzz going around Washington is that the Fed will be taking a serious look at alternatives to the 2 percent core inflation target. These include nominal GDP, price level targets and adjustable core inflation targets, among others. Investors see this discussion as posing dovish, rather than hawkish, risks.

The European Central Bank, by contrast, has reiterated two key points, one by omission and one directly. ECB doves and hawks both tie future policy to how close and how fast inflation gets to the just under 2 percent target. No one on the ECB has suggested that the target be 2.5 percent for a period of time to make up for all the months that it undershot the target. You can say that Governing Council members differ on their forecasts but not on their reaction functions. What is not said, except by implication, is that policy is so loose now that there is no real easing option. How high would the euro have to go for them to cut policy rates by another 20 basis points or extend quantitative easing purchases for another six months?

The fact that there is a discernible relationship between euro-dollar exchange rate and five-year, five-year real rate differentials suggests that the market is worried about a major shift in policy framework. Those fears are overstated. Most likely the Fed reiterates that a 2 percent target is a 2 percent target, even if policy makers tolerate a slight overshoot. I suspect this is also ECB policy, although its policy makers would prefer not to admit it. No central bank wants to be remembered for premature excessive tightening.

For the dollar to firm, we need 1) a major Fed official to indicate that the central bank is not rolling over on inflation, and 2) for investors to be convinced that the new Board of Governors is not that different than previous boards, or for inflation to firm sufficiently that even the doves on the board acknowledge the need to hike. It will take a while for 1) and 2) to be established, but 3) could emerge more quickly.

=============================

by Steven Englander

There may be links in the Original Article that have not been reproduced here.

So Treasury Secretary Mnuchin, shown above in a tasteful photo-op with his equally tasteful wife... will probably be getting his wish for a weaker dollar.