IMF Strikes Out in Projecting Unemployment as Badly As the Fed

Those of us pushing the Federal Reserve Board to hold off on raising interest rates have pointed out that the members of the Fed's Open Market Committee, like other economists, have repeatedly over-estimated the non-accelerating inflation rate of unemployment (NAIRU), the unemployment rate at which inflation would start spiraling upward. In 2014, they had put it at 5.4 percent. Today the unemployment rate stands at 4.1 percent, with no evidence of acceleration in the inflation rate.

If the Fed's inflation hawks had their way, there would have been sharper increases in interest rates over the last four years. These would have slowed growth and prevented millions of workers from getting jobs and tens of millions from getting pay hikes. For this reason, we have argued for caution in raising rates until there is clear evidence that inflation is becoming a problem.

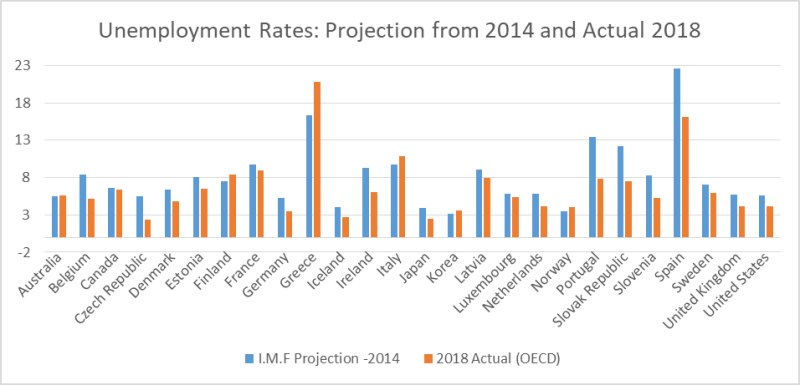

It turns out that the United States is not the only place where economists have trouble projecting floors to the unemployment rate. The figure below shows the IMF's projection of unemployment rates from April of 2014 for the calendar year 2018. It also shows the most recent measure from the OECD.

Source: IMF and OECD.

In the vast majority of cases, the most recent month's unemployment measure is well below the 2014 projection. For example, Belgium would have an unemployment rate of 8.3 percent in 2018. The most recent month's data put the unemployment rate at 5.2 percent. For Germany, the projection was 5.2 percent unemployment; the most recent number was 3.5 percent. For the UK it projected 5.7 percent; the most recent number is 4.2 percent.

In some cases, the gaps are dramatic. The IMF projected an unemployment rate for of 5.5 percent for the Czech Republic; the actual rate is 2.4 percent. For the Slovak Republic, the projection was 12.2 percent; the actual figure is 7.5 percent. In the case of Spain, the projection was 22.6 percent; the most recent figure is 16.1 percent. On the whole, the average projected rate was 8.0 percent, the average current rate is 6.6 percent.

There are six countries in which the actual rate is worse than the projected rate. The actual rate in Finland is 0.9 percentage points higher than the 2014 projection. The rate in Italy is 1.2 percentage points higher. But, Greece is the big winner in this category. Its 20.8 percent unemployment rate is 4.5 percentage points higher than the 16.5 percent rate projected four years ago.

The moral of this story is that economists have a very bad track record in projecting unemployment rates. If a central bank wants to raise interest rates to head off inflation, it would be well-advised to look at what is happening to prices rather than relying on projections of NAIRUs. (The 2014 projections can be seen as NAIRU projections since the IMF assumed that the cyclical component of unemployment would be largely gone by that point.)

Original article by Dean Baker , in Beat the Press .

There's great pressure on the Fed - on all central banks and on the IMF - to raise interest rates... supposedly because

INFLATION IS COMING ! ! ! ! ! ! ! ! ! !

Be afraid!

Ummm............ no....

Higher interest rates are not good for borrowers... which is most ordinary people... but they're really, really nice for lenders... and for all those who have nice big stock and bond portfolios. If I were just e teeny-tiny tad cynical, I might even imagine that the call for higher interest rates has more to do with this than with that...

Off topic [ph]