The Jobs Recovery: A Longer View

With the monthly job-creation streak continuing to set records, the data shed light both on the rebound from the recession and on what’s left to be desired.

Friday’s jobs report was a blockbuster: Job growth rebounded after a recent dip, and the unemployment rate fell to a nearly two-decade low. But it’s worth taking a step back and putting the latest numbers in some longer-run context.

The United States lost nearly 8.7 million jobs in the Great Recession and its aftermath. It has gained 18.9 million since then — a powerful rebound that belied fears of another “jobless recovery.” (Net growth was needed just to keep pace with the working-age population, which has increased by about 10 million during the same period.)

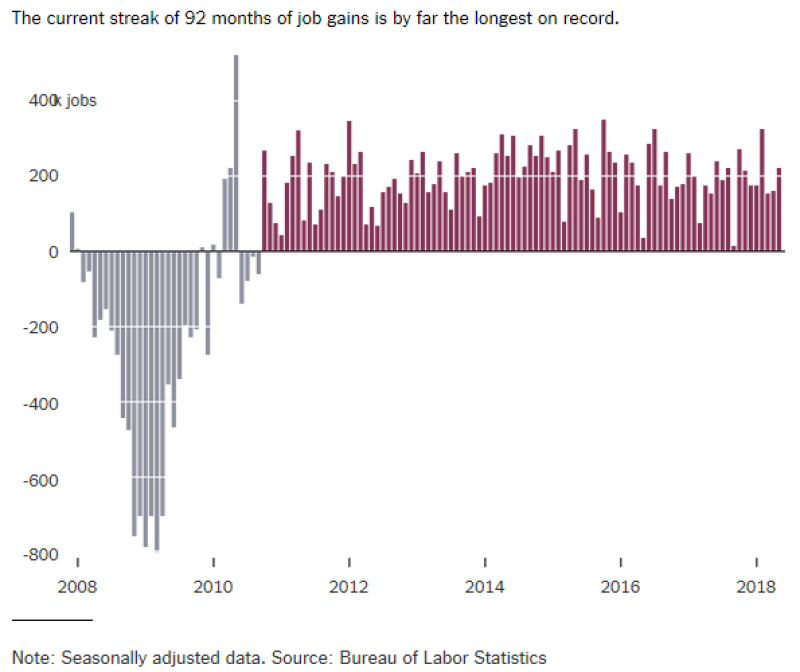

Politicians, investors and, yes, journalists love to obsess over the month-to-month swings in the job numbers. But the true story of the recovery is one of remarkable consistency. American employers have added jobs for 92 straight months — far and away the longest streak on record — and apart from a few blips, the gains have been steady.

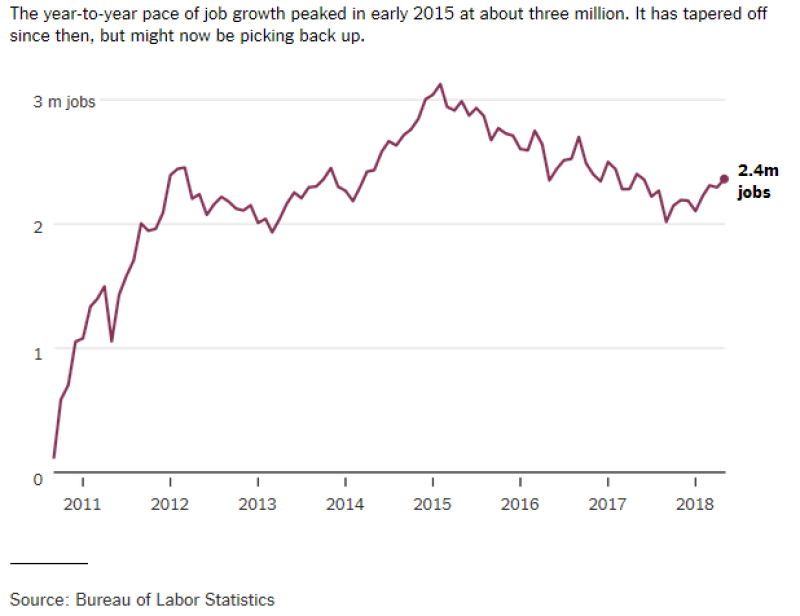

The trend in job growth is easier to see by focusing on the year-over-year growth at any point, rather than the more volatile monthly figures. Looked at this way, hiring accelerated early in the recovery, peaking in early 2015 at a pace of more than three million jobs per year. Growth gradually tapered after that, which isn’t surprising — most economists expected the rate of job creation to keep falling as companies recovered from the downturn and the pool of available workers dried up.

More recently, though, job growth has experienced an unexpected uptick. Employers have added an average of 207,000 jobs per month so far in 2018, up from 172,000 in the same five months a year ago. It’s too soon to say whether that acceleration is the start of a new trend or just a blip. But many economists expect the faster pace of growth to continue because of the tax cuts passed in December and the extra government spending approved by Congress in January.

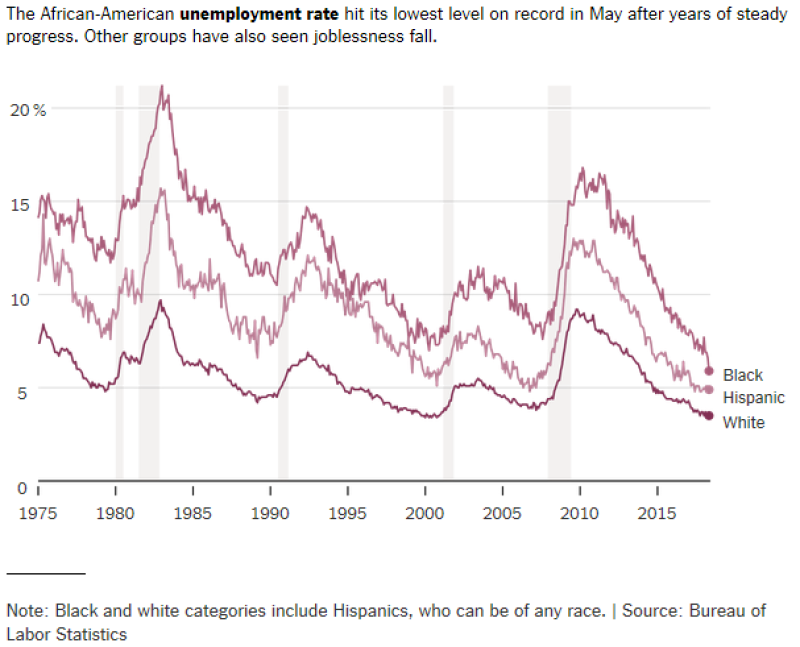

All that hiring has gone a long way toward putting Americans back to work. The unemployment rate, now 3.8 percent, is the lowest since 2000. The progress is increasingly reaching groups that often face discrimination or other disadvantages in the job market: The unemployment rate for African-Americans hit its lowest level on record in May. The jobless rates for Hispanics, teenagers and those with less than a high school education are likewise at or near multidecade lows.

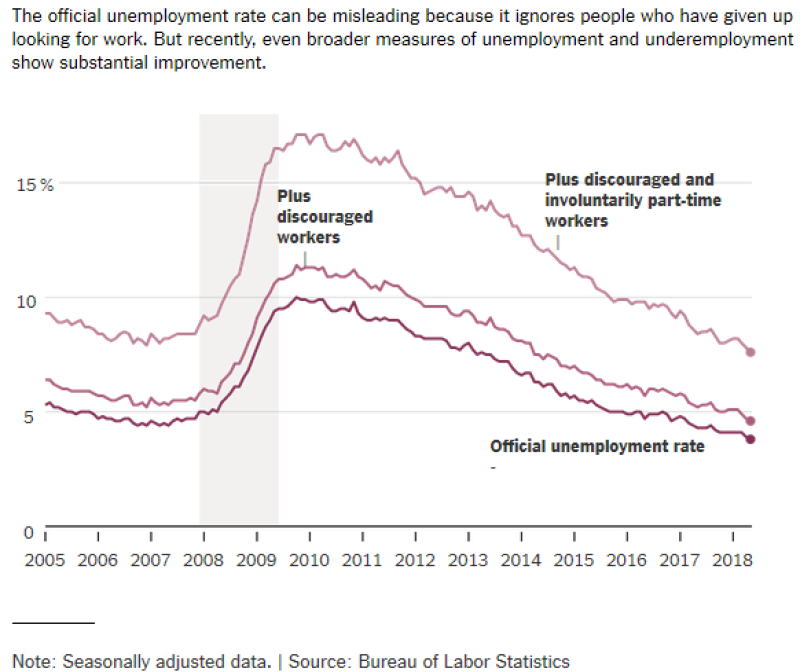

The unemployment rate doesn’t tell the full story, however. Government statistics count people as unemployed only if they are looking for work, a definition that excludes people who are voluntarily or involuntarily out of the labor force entirely. During the recession and recovery, that distinction was crucial: The official unemployment rate ignored millions of people who had abandoned their job searches as hopeless. Eight years of job growth, however, have shrunk the pool of “discouraged” workers, and broader definitions of unemployment all show strong progress.

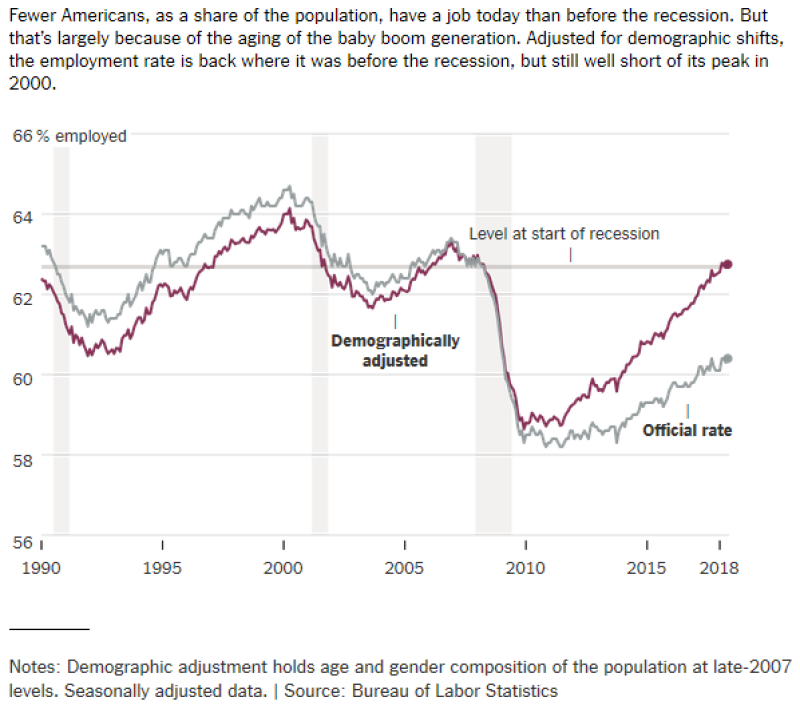

But while the labor market today is healthy, there are signs it still isn’t booming the way it was in 1999 and 2000. The employment rate — the share of adults who have jobs, a measure that avoids tricky questions about who should count as unemployed — still hasn’t returned to its prerecession level. That’s largely because of the retirement of the baby boom generation. But even adjusted for the aging work force, the employment rate is below its peak in 2000.

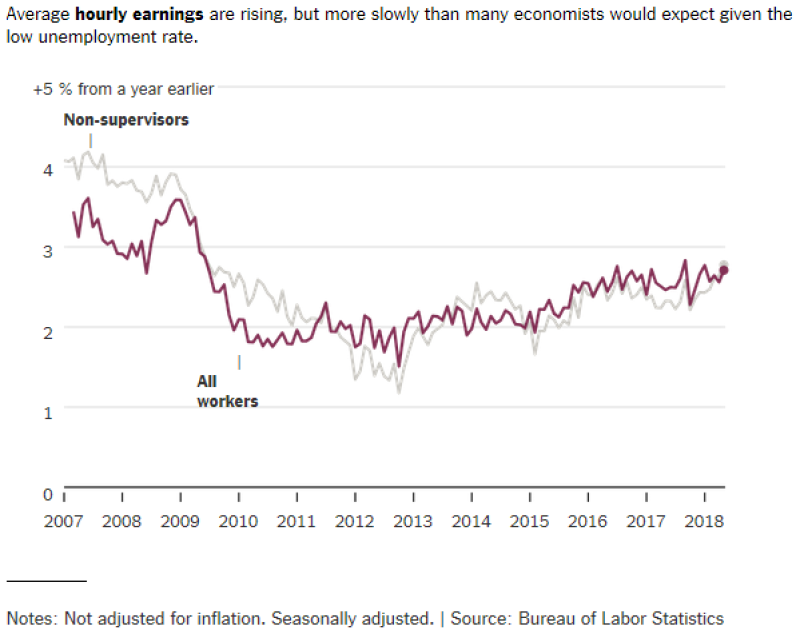

Then there is the mystery that has loomed over the job market in recent years: lackluster wage growth. With unemployment low, companies are increasingly complaining about a shortage of qualified labor. Yet that hasn’t translated into fat raises for workers.

It’s important to note that wages are rising. Average hourly earnings were up 2.7 percent in May from a year earlier, faster than inflation. And while noisy and sometimes conflicting data make it hard to discern a clear trend, there are signs that the pace of growth is accelerating, especially for lower earners.

Still, many economists think wages should be rising faster given the tight labor market. Economists are divided over what explains the disconnect, with some seeing evidence of a long-term, structural shift in the economy, and others arguing that the slow wage growth suggests there is still room for the economy to improve.

Please read the seed before commenting.

Please try to post pertinent to the seed.

If you do not understand, ask questions.

Thank you.

Isn't wage growth a lagging indicator? Remember that most successful businesses will only hire the number of people they need, and will only pay enough for them to stay on. Also, the tendency to hire temps with minimal benefits is becoming more the national norm.

Yes, but not to this degree.

We're seeing record corporate profits, going entirely to shareholders. That's a historical anomaly, particularly intriguing as unemployment falls close to record lows.

"Involuntary part-time" has been dropping. It is down to pre-2008 levels.