Ten years on, the Fed’s failings on Lehman Brothers are all too clear

The key policymakers have always maintained they had no choice but to let Lehman collapse. That’s simply not true.

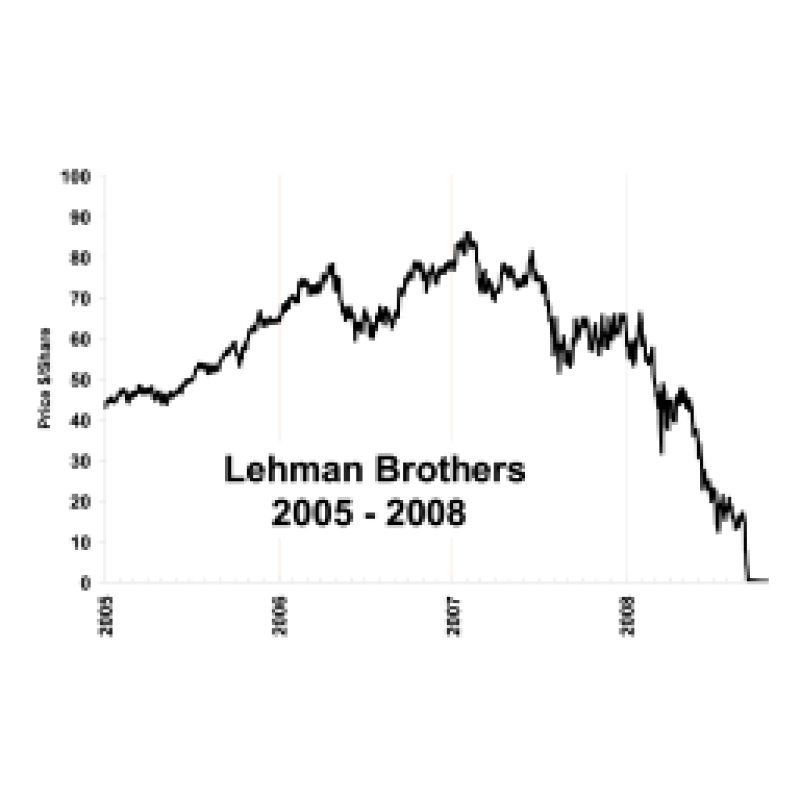

In 2007 Fortune magazine ranked Lehman Brothers investment bank number 1 on its list of “most admired securities firms” . Just a year later, on 15 September 2008, the financial world was shocked when Lehman, with $600bn (£463bn) of assets, filed for bankruptcy, causing chaos in financial markets: stock prices plummeted, credit flows froze, and markets feared that even larger financial institutions – from Morgan Stanley to Goldman Sachs and Citigroup – might fail.

Linda Nylind/Guardian

The Lehman bankruptcy was shocking, in part, because it was unique. Other financial institutions, such as Bear Stearns and AIG, also experienced crises in 2008 and surely would have failed if not for emergency loans from the US Federal Reserve. On the eve of its bankruptcy, Lehman urgently sought similar aid from the Fed, but the policymakers at the time – Fed chair Ben Bernanke, Treasury secretary Henry Paulson, and Timothy Geithner, president of the Federal Reserve Bank of New York – said no.

Ever since, Bernanke, Paulson and Geithner have given a consistent rationale for their decision, one they are now reiterating at media events commemorating the 10th anniversary of the financial crisis: the trio wanted Lehman to survive, but rescuing it would have been illegal, and they were unwilling to break the law. As Paulson put it in July, “we didn’t believe then and we don’t believe now that there was a single authority we had” that would have allowed a Lehman rescue.

How could it be legal to rescue Bear Stearns and AIG, but not to rescue Lehman? The 2008 decision-makers point out that the Federal Reserve Act requires that Fed loans be secured by collateral, which protects the Fed and taxpayers from losses if the loans are not repaid. According to Paulson and colleagues, the firms rescued by the Fed had enough collateral for the loans they needed, and Lehman Brothers did not.

Lehman executives have bitterly contested this story, saying their firm could have survived if only the Fed had treated it the same way it treated other financial institutions. Some disinterested observers accept the policymakers’ explanation for their decision, but others do not. As Paulson ruefully put it in July, when he and his colleagues were asked the question of why they let Lehman fail, “we answer it and most people still don’t believe us” (a statement that elicited chuckles from an audience of sympathetic journalists).

There is a vast amount of publicly available information on the Lehman bankruptcy, much of it gathered by the Congressionally appointed Financial Crisis Inquiry Commission and by the examiner appointed by the court. These and other public records provide good reason for people not to believe Paulson, Bernanke and Geithner: their story isn’t true.

by the Fed had enough collateral

for the loans they needed,

and Lehman Brothers did not.’

Alex Wong/Getty Images

Many emails and memos document the discussions among Fed and Treasury officials in the days before the bankruptcy, and they make it clear that the discussions had nothing to do with the Fed’s legal authority or Lehman’s collateral. Instead, Lehman’s fate was determined by officials’ views of the political and economic consequences of a Lehman rescue or a Lehman bankruptcy.

The deciding factor was politics: the decision-makers, especially Paulson, were unwilling to endure the intense criticism that would have followed a Lehman rescue. Having experienced the backlash from politicians and the media against the Fed’s loan to Bear Stearns in March 2008 and the government takeovers of Fannie Mae and Freddie Mac in early September, Paulson told the others: “I can’t do it again. I can’t be Mr Bailout.” Paulson’s chief of staff put the point bluntly in an email to Paulson’s press secretary: “I just can’t stomach us bailing out Lehman … will look horrible in the press, don’t u think?”

Another factor was that policymakers did not fully anticipate the severe damage that the Lehman bankruptcy would inflict on the financial system and economy. Today, Paulson, Bernanke and Geithner claim they knew in advance that the event would be a “catastrophe”, a “calamity”, and an “epic disaster”. But, once again, their claims are contradicted by the real-time record. As Lehman faced bankruptcy, policymakers hoped that they could calm financial markets with measures including increased lending to Morgan Stanley and Goldman Sachs.

But what about the collateral issue that is central to the official Lehman narrative? If one examines Lehman’s finances on the eve of its bankruptcy, it is clear that the firm did have ample collateral to borrow the cash it needed to stay in business, a fact that officials would have discovered had they actually looked.

Because Lehman had ample collateral, a short-term loan from the Fed would clearly have been legal, and would have created very little risk for the Fed or taxpayers. With help from the Fed, Lehman might have weathered the financial crisis and be a healthy firm today. Even if Lehman had proved to be unviable in the long run, temporary assistance would have given it time to wind down its business in an orderly way, which would have lessened the disruption of the financial system, the severity of the recession and the loss of jobs.

The events of 2008 will not be the last financial crisis in US history. Sooner or later, another major financial institution will find itself in trouble, and policymakers will have to decide whether to rescue it. We can hope that the Fed’s officials have learned the lessons of 2008, so that they stand ready to rescue the next Lehman Brothers.

There is reason for worry on this score. The “bailouts” of 2008 were highly unpopular across the political spectrum: Bernie Sanders derided them as “socialism for the rich”, and conservatives were also distressed by government intervention in banking. These views led Congress, as part of the Dodd-Frank Wall Street Reform Act of 2010, to restrict the Fed’s authority to lend to distressed financial institutions. The details are complex, but one upshot is that a rescue of Lehman Brothers might truly be illegal under current law.

The opposition to Fed rescues arises largely from a misconception that they transfer money from taxpayers to bankers who have lost risky bets. In fact, many of the Fed rescues in 2008 – and certainly the rescue of Lehman Brothers that could have occurred – were short-term loans that were very likely to be paid back with interest. Even if loans had not been repaid, collateral protected the taxpayers from significant losses. If members of Congress wish to reduce the dangers of future financial crises, the first thing they can do is repeal the Dodd-Frank restrictions on Fed lending.

Laurence M Ball is the writer of The Fed and Lehman Brothers: Setting the Record Straight (Cambridge University Press)

Tags

Who is online

55 visitors

Ball never asks the basic question: "Why should anyone have saved any of these crooks?"