Fossil fuels are underpriced by a whopping $5.2 trillion

The world’s top climate scientists calculated in a startling report last year that if we want to limit global warming to 1.5 degrees Celsius this century to avoid devastating social and economic consequences, we need to reach net-zero emissions by 2050.

One big reason that goal is tough to hit is that we’re still heavily dependent on coal, oil, and natural gas — and governments support these forms of energy far more than clean energy.

The International Monetary Fund periodically assesses global subsidies for fossil fuels as part of its work on climate, and it found in a recent working paper that the fossil fuel industry got a whopping $5.2 trillion in subsidies in 2017. This amounts to 6.4 percent of the global gross domestic product .

Its last assessment in 2015 tabulated a value of $5.3 trillion — so not much has changed since then, despite growing alarm about rising temperatures and plummeting prices for alternatives like solar and wind energy. And it’s now clearer than ever that the political will to take on fossil fuels still hasn’t materialized.

So why don’t governments just pull the subsidies, save a ton of money, and fight climate change at the same time?

Well, as former Vox reporter Brad Plumer explained at length in 2015, the IMF is using a, let’s say, unconventional definition of the word “subsidy.”

Fossil fuels do get preferential support from governments, and it’s been critical in keeping some mining and drilling operations running far longer than they would have otherwise.

But the IMF’s calculation is intended to help us grapple with other, hidden advantages we give to fossil fuels. Undoing these cryptic subsidies will not be as simple as zeroing out a line item in a budget. However, confronting them could actually lead to reductions in greenhouse gas emissions while also addressing economic inequalities.

Here are some key takeaways from the new IMF paper.

Carbon polluters are dumping their waste in the atmosphere for free

Fossil fuel companies receive a significant quantity of what we might think of as conventional subsidies — government funding to reduce the retail price of fuel. The IMF describes these as “pre-tax” subsidies, and they amount to roughly $500 billion a year.

Countries like Malaysia , Nigeria , and Saudi Arabia are facing pressure to cut their subsidies for heating and transportation fuel (for budget reasons), but overall, these subsidies are on the rise again around the world.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/16283719/ff_subsidies.png)

Direct pre-tax subsidies to fossil fuels are on the rise again after years of decline. This corresponds to an increase in greenhouse gas emissions. OECD/International Energy Association

But the vast majority of the IMF’s subsidy tally comes from failing to price greenhouse gas emissions, a.k.a. “post-tax subsidies.” In essence, the world’s carbon polluters are dumping their waste into the atmosphere for free. About 87 percent of greenhouse gas emissions don’t face any kind of carbon price at all.

Getting to do something for free that adds a cost to society does confer an advantage, but it’s debatable whether that should be called a subsidy.

And that debate is important. How we sort the factors that drive the ongoing consumption of fossil fuels positions our options to avoid them. The politics is similar across the board for curbing emissions, but the policy tools change depending on whether you view greenhouse gas emissions as a tragedy of the commons or an unfair market advantage, i.e., a tax, a restriction, or an investment in an alternative.

So the $5.2 trillion number might be best understood as a way to signal that the world has grandfathered in a lot of the inherent risks of fossil fuels. Extracting fossil fuels damages and degrades the land and the oceans. Transporting coal can spread dust, pumping oil can spill, and natural gas can explode. When burned, these fuels emit air pollutants like particulates and nitrogen oxides in addition to greenhouse gases.

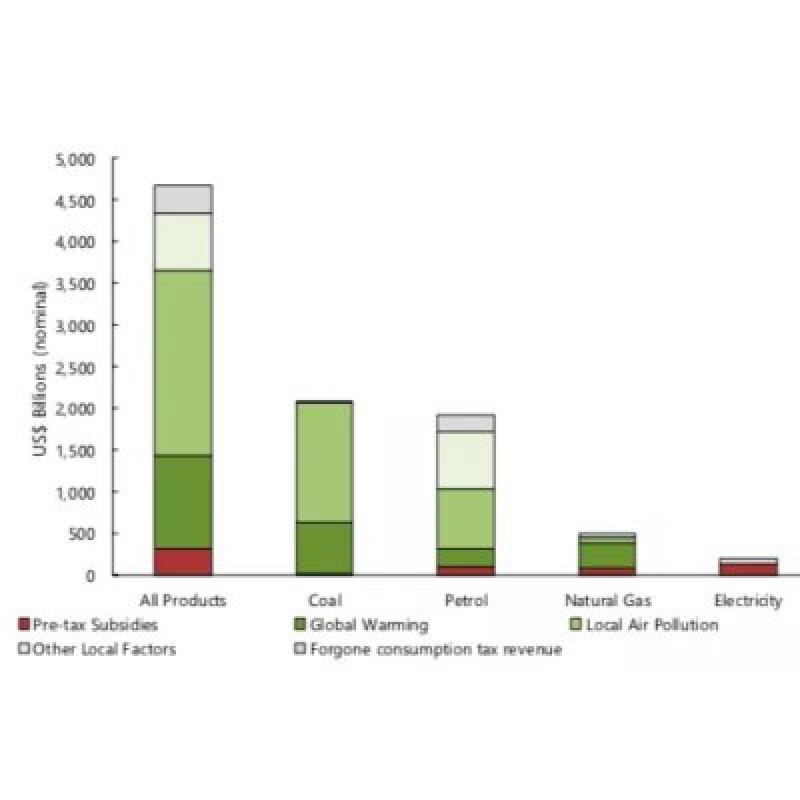

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/16283662/Screen_Shot_2019_05_17_at_11.07.37_AM.png)

The majority of global energy subsidies are indirect, post-tax forms of support, like failing to price greenhouse gas emissions. International Monetary Fund

As my colleague David Roberts has pointed out, there’s also a tremendous security cost. A huge chunk of foreign policy and military strategy for many countries involves protecting shipping lines for fossil fuels. The US military spends at least $81 billion a year protecting oil supplies. Meanwhile, there are no carrier groups defending wind turbine supply chains or a strategic silicon reserve for solar panels.

We as a society pay these costs. Economists have come up with dollar values for how much carbon dioxide harms the world per unit of emission, a value known as the social cost of carbon . But such costs usually aren’t built into the price tag of gasoline, coal-fired electricity, and natural gas heating. As a result, the people most responsible don’t pay directly for their pollution. It also leaves few incentives to limit greenhouse gas emissions, so problems like climate change go unabated.

“It’s much more than just global warming,” said David Coady, an author of the paper and division chief of the fiscal affairs department at the IMF. “A big part of the damage, in fact the biggest, comes from domestic, local pollution, which shows up as really bad health. You just have to look at Beijing and Delhi.”

The IMF’s subsidy value is essentially a way to tally all these factors.

Coady also noted that there are other fossil fuel subsidies the IMF didn’t consider at all, namely subsidies directly to fossil fuel producers, like tax credits or government research and development funding for extraction. “It’s very country-specific and hidden away under laws,” he said. These kinds of support mechanisms for fossil fuels are hard to suss out.

Direct subsidies for fossil fuels do serve a purpose, but they’re really inefficient

Subsidies reduce the retail price of a commodity. That makes the commodity, whether it’s milk, eggs, coal, or oil, cheaper for retail buyers. This can be done to prop up an ailing industry like coal or to boost an emerging sector like renewables .

Subsidies can also be motivated by a desire to help the poor, like keeping lifesaving fuels such as heating oil accessible to low-income households. Leaving out the environmental harms from the price tags for fossil fuels keeps energy affordable as well.

However, the problems that fossil fuels cause, namely air pollution and climate change, remain, and their consequences disproportionately hit the poorest the hardest. And while energy might be cheaper, other constraints for the poor might be more pressing, like food, housing, and child care. So propping up fossil fuels with subsidies often ends up being a counterproductive social welfare program.

“[Subsidies] are very, very inefficient and inequitable approaches to achieving that objective,” said Coady. “It’s not to say that removing these subsidies will not impact heavily on the poor. It will. And so what we argue is that you really need to strengthen social protection systems.”

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/16283671/Screen_Shot_2019_05_17_at_11.10.17_AM.png)

Coal was the most heavily subsidized fossil fuel in the world in 2015, according to the IMF. International Monetary Fund

These social safety nets can be built and reinforced with schemes to price the negative externalities of burning fossil fuels. Coady said that program like a carbon tax and dividend scheme that redistributes money raised from fossil fuel companies to low-income households could be a useful way to do this. It would boost incomes while raising the prices of fossil fuels, creating a stronger incentive to pursue energy efficiency and to consume less overall.

Another model could be a program like Alaska’s Permanent Fund , which is funded by the state’s oil industry and effectively serves as a universal basic income for every resident. Such programs should be scaled up internationally to address the inequities of climate change, namely that the countries that contributed the most emissions are far removed from the countries that stand to suffer the most.

But a global redistribution mechanism like this would be an immense political lift that would have to be driven by a sense of justice and mutual benefits.

“It has to be motivated by more than climate change,” Coady said. “It should be motivated by the fact that it’s a win-win situation. You can get a huge amount of revenue in much more productive areas to address development needs in low-income countries.”

Putting a price on carbon to account for its harm to the climate is one of the easier fixes on the table

Clearly, pricing the negative consequences of fossil fuels, especially carbon dioxide, is critical. “If fuel prices had been set at fully efficient levels in 2015, estimated global CO2 emissions would have been 28 percent lower, fossil fuel air pollution deaths 46 percent lower, tax revenues higher by 3.8 percent of global GDP, and net economic benefits (environmental benefits less economic costs) would have amounted to 1.7 percent of global GDP,” according to the IMF report.

In other words, even without new technologies, restrictions on fossil fuel supplies, and changes in consumption patterns, simply pricing fossil fuels in line with their damage to society would take a massive bite out of global greenhouse gas emissions.

Though it’s necessary, pricing carbon dioxide is not a sufficient means to fight climate change. The problem requires a full-court press across society, from changing how we use and dispose of products to constructing cities more densely to being more conscientious with our food. With the clock running out to act to limit climate change, no option can be ignored.

And so far, no country has achieved what Coady and other economists would consider an optimal price on fossil fuels. The emissions that are priced are often given a value far below their impact on the world.

That said, pricing carbon dioxide is one of the easier fixes in combating climate change. It’s a matter of policy, not inventing a whole new energy system. And in terms of expending political capital, ending handouts to a sector that’s harming the planet might be an easier sell.

Initial image: A natural gas power plant near Ventura, California. Fossil fuels like natural gas get a lot of overt and hidden support in the form of not having to pay for their greenhouse gas emissions. The IMF calculated that this support adds up to $5.2 trillion globally. Shutterstock

Tags

Who is online

55 visitors

we’re still heavily dependent on coal, oil, and natural gas — and governments support these forms of energy far more than clean energy.

And those governments support these forms of energy because that is what the people want. They are still reasonably priced. A large percentage of the world's people are not willing, or even able, to pay the horrendously high costs for improbable solutions to a supposed problem that might occur far into the future, if the scary prognostications turn out to be right.

It would be some much easier and cheaper to invest in the more simple and common sense approach to climate change, which is simply to learn to adapt to it....while attempting to clean the air as much as possible, of course.

Greg...

The world is going to die if we don't act.

I don't know of any way to "adapt" to death

These sorts of phony analyses aren't helpful. 'Social cost of carbon' is a made-up measure used to pad the bill; we see the same thing in the financial, technology, and healthcare sectors. That is nothing more than a way of milking more money from consumers by charging people for something intangible that really has no value.

The prognosticators are trying to keep the money flowing. That's all. Reducing fossil fuel consumption will lower the global GDP and that can't be avoided. But the financial wizards are trying to transform more of the money flow into paying for intangibles with taxes, fees, and other means of padding the bill. If more of the global GDP consists of money paid for nothing then the financial wizards believe they have created economic perpetual motion.

Will solar panel manufacturers be required to pay carbon taxes? Or will those manufacturers be exempted because of some made-up measure of intangible benefit? No matter what method of analysis is utilized there should be little doubt that the purpose will be to keep the money flowing and to convince people to pay something for nothing. That's how finance makes its money.

If your neighbor dumped trash on your lawn every day, what would you do?

Obviously I'd want the neighbor to stop. But I'm not subsidizing the neighbor's trash; that would be a bogus claim. The neighbor could be punished by fining them but that won't do anything about the trash on the lawn. And the neighbor may be willing to continue paying the fines so they can continue to dump trash on my lawn. The fines won't really do anything about the trash on my lawn.

The underlying problem is consumption that generates trash. Forcing the neighbor to reduce consumption would avoid generating trash. But that would reduce the neighbor's contribution to GDP because they would be consuming less. And forcing the neighbor to reduce their consumption without reducing my consumption would be unfair.

The proposed approach (the idea of a carbon tax) is to place fees on consumption. By reducing the neighbor's (and my) consumption the amount of trash is reduced. And the fees would force the neighbor (and myself) to continue spending the same amount of money for less.

IMO the better alternative would be to simply limit consumption. Whatever is not consumed will not generate trash. And the neighbor (and myself) won't have to pay anything to consume less. Rationing consumption would the be fastest and cheapest way to cut the amount of trash being generated. But that means the neighbor (and myself) would be spending less money; not consuming anything won't cost money. But if everyone spends less money then the economy would contract and those scraping a share off of consumption wouldn't make as much money.

I agree, but I'm not sure "simple" is possible.

It's necessary to acknowledge that environmentalism has been about cleaning the environment without giving up anything. Every argument concerning the environment has been premised on ensuring that the money keeps flowing.

Environmentalism hasn't eliminated anything; its always been about using science and technology to provide a replacement and keep the money flowing. But we have only been replacing one environmental problem with another. Environmental problems are sorta like obesity; it's not possible to correct the condition by consuming more.

As long as we're ruled by Big Oil, there's no hope.

Aren't we more dependent upon electric motors and electronic technology than Big Oil? Our dependence on Big Oil is for transportation, not electricity generation. And if Big Oil is the problem then why has coal been the focus of attention?

When I say "ruled by", I mean it literally. Big Oil controls Congress and thus makes the laws. They will burn the world.

No, the financial sector controls Congress. Wall Street controls Big Oil, too.

So perhaps we are ruled by one monster... or perhaps we are ruled by a different monster.

Does it matter?

Post tax subsidies are defined as " differences between actual consumer fuel prices and how much consumers would pay if prices fully reflected supply costs plus the taxes needed to reflect environmental costs and revenue requirements."

So basically another concept fabricated specifically to inflate the headline that is not applied in any other industry or any other human endeavor.

In the United States alone spend well over $250 billion/yr treating health conditions directly related to obesity. We do not attempt to claim that as some sort of "subsidy" for the fast food industry.

Now, would the world be a better place if we all migrated off of fossil fuels? Absolutely.

Will we? Eventually, yes.

Is nonsensical economics yoga like this supportive of that effort? Absolutely not.

Any solution that brings about the end of the fossil fuel era is necessarily going to involve nuclear energy, so we need to start having rational conversations about that.

going to involve nuclear energy

Or hydrogen from sea water.

Which will not be inexpensive either.