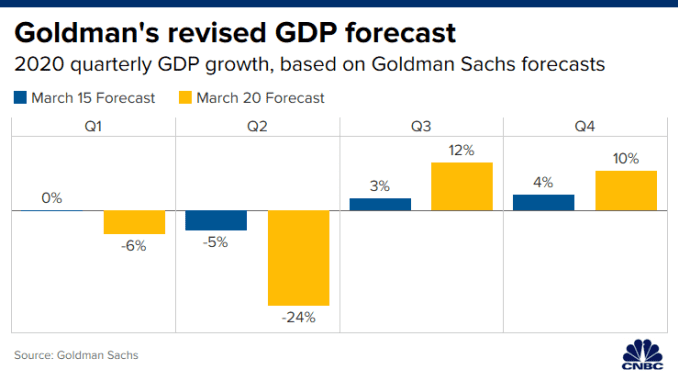

Goldman sees unprecedented stop in economic activity, with 2nd quarter GDP contracting 24%

Goldman Sachs economists on Friday forecast an unprecedented 24% decline in second quarter gross domestic product, following a 6% decline in the first quarter, based on the economy’s sudden and historic shutdown as the country responds to the coronavirus pandemic.

The economists then expect a bounce back of 12% in the third quarter and 10% in the fourth quarter, but unemployment will surge to 9%. They also expect GDP to contract by 3.8% for the full year on an annual average basis, and 3.1% on a fourth quarter over fourth quarter basis.

“Over the last few days social distancing measures have shut down normal life in much of the U.S. News reports point to a sudden surge in layoffs and a collapse in spending, both historic in size and speed, as well as shutdowns of many schools, stores, offices, manufacturing plants and construction sites,” the economists said. “These developments argue for a much sharper drop in GDP in Q1 and Q2.”

In the past week, schools, public buildings, restaurants and stores across the country have shut down.

The state of California issued a stay at home order for its 40 million residents, and on Friday morning, New York state said it was mandating 100% of the workforce to stay home , excluding essential services.

President Donald Trump has told Americans to stay away from bars and restaurants, and a number of states have ordered those businesses to close, resulting in the layoff of millions of workers.

Article is LOCKED by author/seeder

Article is LOCKED by author/seeder

And to think it all could have been easily avoided but for the government of China!

A recession is inevitable!

We can't do this. Most of the country lives paycheck to paycheck. Are we going to stop banks from sending out credit card bills and mortgage notes? Are car loan payments going to be halted? Insurance payments? Light bills? Gas bills? All of our other bills so we can afford to buy two months of groceries and sit on our asses at home?

Most people can't even afford two weeks of groceries with their last paycheck and god knows that Unemployment Insurance won't cover everything--if they even qualify for it!

We are about to spend over a $Trillion dollars to prevent all of that:

Going to take more than that to pay the bills of all of those put out of work.

That might cover some people for a couple of months, but not all. Seriously, I pay out over $4k a month just in bills easy. The extra money they were talking about and the income from UI wouldn't pay them all, much less put food on the table for 4 people and gas in our car so we can still go grocery shopping or to the doctor if we get sick or injured.

Yup, they are all in on this. Huge spending packages are favored by both parties now. The cure may very well be worse than the sickness!

I have a agree with you. Once the "curve" has flattened and trending downward and it looks like all the preventive measures like social distancing have been factored in and infections are decreasing, I believe the rebound will progress quickly. So much of this has been produced by an "abundance of caution" overreaction to this viral threat because of the glut of worse case scenarios put out by the usual culprits.

This is the core of what is killing the jobs right now. We will have to find a way to eliminate that requirement either through vaccination or elimination of the at-risk segment of the population co-mingling with the low risk segment. Locally we have stores that are setting aside times of operation strictly for the elderly and infirm to shop to lessen their risk of exposure.

I really hope so but let's be honest. While most individuals are smart people are dumb and will usually find ways to shoot themselves in the foot.

Ummm ... I think that sharp decline in GDP is going to be global. Goldman Sachs is only stating the obvious.

It seems the financial wizards are experiencing depression. The economy is working according to Maynard Keynes rather than according to Milton Friedman. The supply-side monetarists have been dead wrong and now we pay for their hubris.

This isn't a recession. And we won't know if this will become a recession (or depression) until the pandemic recedes. You know, Goldman Sachs and the rest of the supply-side monetarists are in the business of managing risk. How are they doing? Their monetary theories collapsed in less than four weeks. I don't believe taking advice from those who have proven themselves to be so very incompetent would be wise at this moment.

Right now, we can't afford the luxury of listening to incompetents like Goldman Sachs.

Keynesian economics is more a government option for the bad times. The economics of Milton Friedman is what produces the good times. What is happening to the economy (a prosperous one only a month ago) is because of a government ordered shutdown - not due to any form of economic policy.

This isn't a recession.

Not at the moment, but we are well on the way. As I say, it is inevitable at this point.

Well, it seems obvious that the monetarists are hoping for run away inflation caused by shortages. The central banks are already preparing to become artesian wells of cash to drive more money chasing short supplies. The monetary actions being taken now is devaluing the cash realized from the market sell off.

The DOW has lost $10 trillion in value. How much actual cash was realized from the sell off? I wouldn't be surprised if much less than $1 trillion was actually extracted from that record high market. Dimes for dollars is how monetary policy works.

Monetarists fear the value of money. That's why monetary policy employs such strenuous efforts to devalue money. But monetary policy falls apart when confronted with the water/diamond paradox of the real economy. Under current conditions cash is king. And that means Keynes is king, too.

If John Maynard Keynes were alive today he'd be stunned by it all.

No doubt. I really don't know how Keynes would react but I wouldn't be surprised if he would be appalled by how much the real economy has deteriorated.

Oh big surprise! I don't think we need economic experts to tell us it's going to be an insane year for the economy and the numbers that measure it.