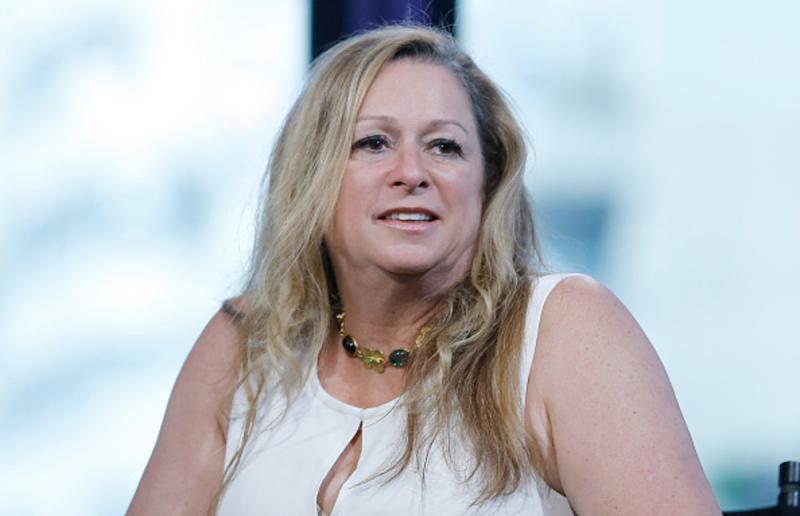

Disney Fortune Heiress Abigail Disney Testifies Before Senate Committee On Income Inequality

Bernie Sanders chaired a hearing on income inequality and the tax code. One of the witnesses was Abigail Disney, grandaughter of Disney Company co-founder Roy Disney

You can skip directly to 17:10 mark on the video. Ms Disney speaks intially for about 5 minutes, and gets very directly to the point.

Tags

Who is online

461 visitors

"It's time to stop rewarding people who make money simply by having money"

Abigail Disney

Yet another Marxist call for the equality of outcomes....

"From each according to his ability, to each according to his needs"

Abigail Disney pays a lesser percent of her (unearned) income in taxes than people who have a 9 to 5 job do.

She understands that isnt right.

That quote does not mean equality of outcomes; it is in reference to a utopian view of Marx of a future society where all needs are provided by technology and where people contribute to society based on their talents. It is Marx' idealistic dream of living to work (doing what one is best at) rather than working to live (working a job in order to survive).

Equality of outcome is both impossible to achieve and would itself be unfair. An architect should not be compensated the same as a laborer on the construction job.

No one in America today, that I know of, is suggesting that an architect should be paid the same as a laborer.

The political right uses that sentence as a boogie man to scare the ignorant.

Aren't you literally demanding equality of result based on race? That's the same thing, except for one's race determines one income, rather than one's job's skill.

Equality of outcome (pure egalitarian society) is an idiotic notion. It is unfair and would be impossible to achieve anyway.

The problem with approaches like a graduated estate tax is that the government will simply waste that income. Rather than give more money for irresponsible politicians to waste in order to further their power, I would like to see these new taxes be legally obligated to go against the national debt.

The problem with that is that a new congress can simply pass legislation to tap into that national debt paydown 'lock box' and spend it.

No matter what we do, our irresponsible politicians will continue to borrow and spend. Short of the electorate getting wise and holding these jokers accountable, the USA seems doomed to borrow and spend itself into oblivion (and the first wave of this will occur when the USD no longer is viewed as viable by the rest of the world).

Let's cut the defense department spending in half. We spend close to a trillion dollars a year on national defense, and we dont need anywhere near that much.

A society decides what values and what laws and rules are needed to enact those values.

People should be taxed on money they are left as an inheritance, period. If it is a relatively small inheritance it should be a relatively small tax, if it is a large inheritance of over 10 million or so the tax should be a larger percentage. Why on earth should we have an aristocracy of wealth that is passed within families from generation to gneration?

Because we have a capitalist economic system in which there will always be a fairly sizable group of poor people, we need to take some of the profit of that capitalist system and use it to provide necessities for the poor. Price of doing business.

I agree. It is unearned income that, as the generations pass, go into less responsible hands (in general). Even with taxation, the inheritances will be a substantial advantage over those who had the misfortune of not being born into money.

Realistically, with the continued advancement of technology, we will start literally running out of productive jobs. We will, at some point (baby boomers may be gone by then), be forced to change our paradigm and that necessarily means reducing the class gaps.

One note though is that we must avoid inadvertently hurting successful, productive people. A prime example are family businesses that are heavily tied into capital investments such as family farms. They can show wealth on paper, but that wealth is not easily liquidated. When the parents die, tax code could easily compromise the business viability to pay for the inheritance tax.

My point here is that the principle makes sense but in practice there are complications.

I miss the days at DL when entry into the park was reasonably priced and you used a coupon for the rides. E tickets were the best. These days I would have to float a loan to go there.

people save money and stuff for their retirement, it is theirs to use and give to their children if they want to. not the government's to take

I agree, plus in most cases it has already been taxed.

Note, however, the impact that increasing capital gains taxes has on retirement (and college savings) assets (mentioned by Sanders). Our system is heavily tied into the stock market (especially now since safe interest yielding instruments are impossible to find) and thus everyone with any kind of savings are affected by capital gains taxes.

Money earned over a lifetime for retirement should be near tax free. The 401k, etc. programs should be expanded. Especially since social security for the working generations is likely to be meaningless.

If people are not allowed to pass on inheritance, they will squander their assets, how will this improve the overall economy?

should a son or daughter who inherits the genes of a parent that is a great athlete also be taxed more? Money is not the only generational advantage passed down

I see a difference between people passing on assets of say $50 million or less vs those passing on assets of $500 million or more. The difference can best be viewed in terms of extremes. There is a point where one simply has more money than they could realistically spend (disregarding just burning money irresponsibly). Somewhere around that point is where more aggressive inheritance tax could be employed (keeping in mind my concern that taxed dollars are wasted by our irresponsible government). In contrast, I think a family with assets of $3 million (just an example) should be able to pass on 100% of that to their children. That amount of money is enough to help the kids expand their wealth by starting companies, etc.