Eleven million families in the US at risk of losing their homes as CDC eviction moratorium set to expire

One might be forgiven for recalling these words:

'And thus be it ever

When free men shall stand

Between their loved homes

And the war's desolation.

And the rockets red glare

The bombs bursting in air

Gave proof through the night

That our flag was still there.'

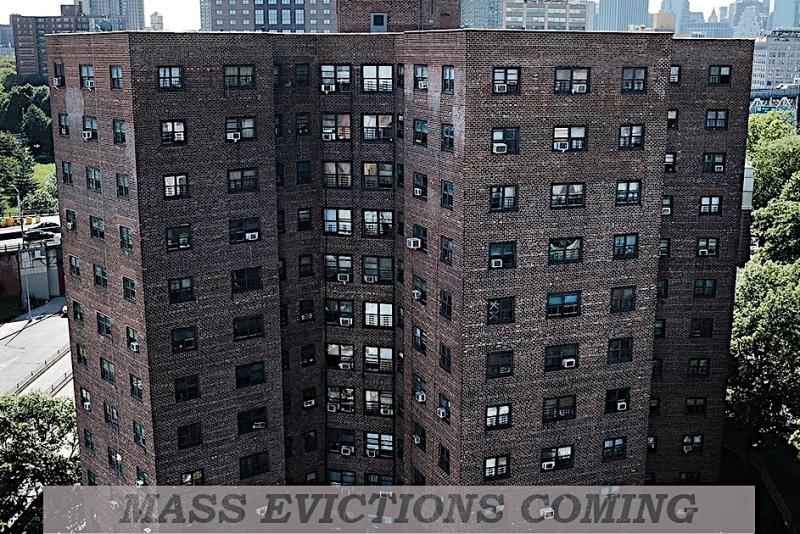

An historic and devastating wave of evictions and foreclosures looms, with the Centers for Disease Control and Prevention’s (CDC) federal eviction moratorium set to expire at the end of this week, on July 31.

With just days to go, there is no indication the Biden administration is going to extend it. White House Press Secretary Jen Psaki boasted in a press conference on Friday about vague efforts by the Biden administration to “help people with government-backed mortgages stay in their homes through monthly payment reductions and potential loan modifications.” Noticeably absent was any reference to the end of the moratorium or relief for renters.

At his CNN town hall event on Wednesday, President Biden did not even speak about the housing crisis. Nor did he say anything about it on Friday when he spoke at a campaign rally in Arlington in support of Democrat Terry McAuliffe’s run for governor of Virginia.

Last year exceeded the $10 trillion mark in housing debt for the first time in history, according to the New York Fed’s Household Debt and Credit Report, reaching levels higher than those seen in the third quarter of 2008, which reached just under $10 trillion. This creates the obvious preconditions, paired with job losses, attacks on workers' wages and a new surge in the pandemic, for an immense foreclosure crisis.

Despite the CDC’s moratorium, which was issued on September 4, 2020 as state-level moratoriums expired, over 444,000 evictions have been ordered during the pandemic, with over 6,600 in the week preceding July 17, according to Princeton University’s Eviction Lab. According to the Eviction Lab, neighborhoods with the highest eviction filing rates have the lowest COVID-19 vaccination rates.

The housing crisis presents an immediate danger to public health, especially given the spread of COVID-19 among the homeless population, which many of those being evicted or foreclosed on will join.

A UCLA-led study published in the American Journal of Epidemiology released Monday found that COVID-19 death rates increased significantly following the lifting of eviction moratoriums, resulting in 433,700 excess infections and an estimated 10,700 excess deaths in the summer of 2020. The study’s senior author, Frederick Zimmerman, professor of health policy and management at UCLA Fielding School of Public Health, concluded, “Evictions may have accelerated COVID-19 transmission by decreasing individuals’ ability to socially distance.”

Much of the $47 billion in federal aid for renters provided under pandemic stimulus programs is being held up by state governments, with the end of the moratorium expected to create a surge in evictions the money was ostensibly intended to prevent.

According to figures released in March by the Consumer Financial Protection Bureau, 11 million families are at risk of losing housing, with 2.1 million being at least three months behind on mortgage payments, while 8.8 million are behind on rent.

At the time, homeowners were estimated to owe almost $90 billion, with the news release noting that “the last time this many families were behind on their mortgages was during the Great Recession.” Once the federal assistance programs and moratorium are ended, renters and homeowners will be left with a mass of overdue bills, payments on mortgages, and late rents.

According to the US Census Bureau’s June 23-July 5 Household Pulse Survey, 7.4 million households are not caught up on rent payments, constituting almost 15 percent of the total 50.9 million renter-occupied housing units in the US. Of these, households with four or more people constituted 3.6 million, or almost 50 percent of households not caught up on rent payments, with almost 4 million, or around 53 percent, being households with children.

The overwhelming share of households that are behind on rent are poor and working class, with 73 percent of those behind on rent making less than $50,000 a year, and over half (57 percent) making under $35,000 a year.

Speaking to the economic crisis facing broad swathes of the working class and middle class in the US, among all renters 13.7 million have seen the respondent or a household member experience a loss of employment income, with almost half of those not caught up on rent payments reporting a loss of employment income. Even worse, among respondents, 20 million were not currently employed, constituting nearly two in five households.

Even as millions struggle to make their payments and keep a roof over their families’ heads, rents are skyrocketing, with the median national rent reaching $1,527 per month, a 5.5 percent increase from the previous year, according to Realtor.com. Of the 50 largest metropolitan areas, 43 saw their median rent increase in that same period.

A recent report by the National Low Income Housing Coalition found that in 45 states and Washington D.C., median gross rents grew faster than median renter household income between 2001 and 2018. There is no state, city or county in the US where a worker earning the minimum wage at 40 hours a week can afford to rent a two-bedroom house.

Median existing home prices have risen, with the Wall Street Journal documenting a median price rise to $363,300, a record increase of 23.4 percent from the year earlier, according to the National Association of Realtors.

Compounding the pressure on households that have lost employment and income, putting them on the verge of eviction, is raging inflation. The Consumer Price Index (CPI) increase in June was the highest seen since 2008, at 5.4 percent.

While virtually nothing is being provided for the overwhelming majority of the population, unlimited money is being provided to enrich the oligarchy and prepare for world war.

The Federal Reserve is spending $120 billion on bonds and securities every month to pump money into the financial markets. US banks have posted record profits for the second quarter, exceeding analysts’ expectations, with just six banks making a combined $42 billion in profits in only three months. One of the largest asset managers, BlackRock, which posted a profit of $1.38 billion, manages $9.49 trillion, up from $7.32 trillion last year.

As this catastrophe plays out, Biden’s budget calls for a record annual military budget of $753 billion, in preparation for war against China, Russia and other countries.

Biden has presented a watered-down bipartisan infrastructure plan, which, in its present state, constitutes $579 billion in new funding over eight years. Neither this nor Biden’s “American Jobs Plan” or “American Families Plan” has actually been drawn up in the form of legislation.

Under conditions where there has already been a sharp increase in poverty globally, and in the US as well, there has been an rise in the wealth of billionaires. Globally, billionaire wealth surged 60 percent in the first year of the pandemic, from $8 trillion to $13.1 trillion.

The housing and eviction crisis, which has been exacerbated by the COVID-19 pandemic, shows in no uncertain terms the absolute bankruptcy of capitalism, which is unable to provide for the needs of society. It makes clear the objective need for the overthrow of capitalism and its replacement by socialism, where the working class will make the necessary arrangements for housing for all of society on the basis of human need, rather than the drive of the capitalist oligarchs to make profits.

Quote the paragraph or sentence to which you wish to reply. Then respond with supporting reasons when possible. Ex:

'While virtually nothing is being provided for the overwhelming majority of the population, unlimited money is being provided to enrich the oligarchy and prepare for world war.'

The contrast between 'virtually nothing' and 'unlimited money' could not be more stark.

When governance exists to enforce the will of an oligarchy on the overwhelming majority of the population, when societal resources are applied not to life-sustaining policies but scorched earth policies, when billionaires globally increase their wealth massively as the working class falls into deprivation, when 'law and order' becomes a shibboleth meaning the coerced maintenance of these social relations -- that is called 'class struggle.'

Kapital affords no alternatives. Neither Capitalist party offers alternatives because there are none. When the Federal Reserve pumps billions into fiscal markets each month, it is doing what Kapital does. When mass evictions occur, that is Kapital doing what Kapital does.

The meaning of Lawrence' article is that for all its extortion/trading of worker-created wealth, Kapital as a social system is bankrupt. It is unable to ensure even basic life necessities to millions. And the Biden administration is silent on the end of moratoriums as rising inflation and a wave of evictions and home foreclosures loom.

As Kapital uses up and discards proletarians in ever-increasing numbers, cries for a worker-led social system will grow. Class struggle unfolds before your watching eyes.

Under Republican or Democratic governance, the struggle will only intensify -- violence, courts, incarceration, threats of death. The state will reply by turning guns on the population.

The state has nothing else left.

So the US should go straight to Socialism or Communism- which have worked where again?

We can try those systems; but they will just concentrate the wealth and power in the hands of even individuals. At least the rest of us will be exceedingly poor together.

Seems like that is the way it is now.

It hasn't been implemented period.

Intelligent Capitalists know this and argue that there must be a reason for that. Less so Capitalists try to cast Stalinism, a petty-bourgeoisie tendency, as a version of socialism.

Sure Stalin wasn't a socialist. It's like a Methodist claiming an Baptist isn't a "real Christian".

It is amusing to watch religious sects quibble.

'It is amusing to watch religious sects quibble.'

We know the policies of Stalin. We know of his reliance on an promotion of the more prosperous elements in the new society. We know of the allowances he made for possessing private farms and other properties. We know about his allowance of capital accumulation and the establishment of privilege in a thousand different ways. If that isn't implementing Capitalism, feel free to explain the difference.

Soviet Thermidor, the emergence of a ruling caste and the inequality, social contradictions and antagonisms which always accompany it are also known to us. We know of the bureaucracy's efforts to silence and repress youth and their education. To his last days Lenin, though unable to speak, denounced these tendencies which he saw in incipient form. Only several years after the October Revolution, what would become known as the left opposition was already active.

I could go on, but why should I. If you read one text -- say Trotsky's 'Revolution Betrayed,' you would perceive the silliness of the analogy you propose. The attempt to use sectarianism to overturn socialist theory and Marxian analysis falls short of the mark.

If you are using those terms as Marx would use them then the abrupt and chosen change you describe is essentially impossible. For the USA, as it stands right now, to 'go to' socialism (as per Marx) the people would have to dismantle capitalism. There is no way on the planet that would happen as an event.

If capitalism eventually stops being our economic system here in the USA it will be a process of very gradual evolution (unless, of course, the USA simply implodes or is conquered by a foreign power). None of us living today will likely see any substantial move from capitalism.

The key point is this. These concepts, as Marx defined them, represent the people having democratic control over the productive resources of the nation. Not the state / government but the actual people. There would be no stock market, no uber wealthy (e.g. Musk), and the people would necessarily be informed and actively involved in the workings of their business and regional/local social decisions.

What you are referring to, at a national level, is unlike anything that has existed in history and might likely will never happen in the future.

I don't see how people can afford to rent. My mortgage payment is less than that.

Luckily you don't have to since it's a lie. The median national rent is only $997.68 which is still expensive but just two thirds of the claimed rate. Only two states have a median rental rate higher than 1500 and they are California and Hawaii, Maryland and New Jersey come in third and forth with a median rate of 1392 and 1334 respectively. I believe the $1,527 number may have come from the average from the fifty biggest metro areas in the USA. June 2021 data: In the 50 largest metros, the median rent was $1,575, up 8.1% year-over-year.

The rental rates are going to be lower when you take in every state and every town. The reality of it is that in larger cities the rents are going to be higher, that's where the work is.

I live in a town/city of 62,000 (2021 population) the average rent for a one-bedroom apt is $1224.

The average rate in Tampa, an hour and a half southwest of us is $1557 a 15% increase from the previous year.

The average rent in Bumfuck MO is $665.

Location, location, location.

They want 1200 for this area.

I know how it works, I was speaking about the claimed median rate in the article being wrong which it was. The median national rent is not $1527 as the article claims. Since the median national rent is $997 obviously 50% of rents cost more and 50% cost less and Location plays a big part in how high or low it is.

I understood what you were trying to clarify. My point is that depending on the location the prices are going to vary greatly, thus Location, location, location.

Maybe it's time we started calling it...trickle up.

It has always been that.

Except when moving up, it seems more a flood than a trickle...

I feel for those who are losing their homes right now (I've been there). I also hope that scammy landlords that are raising rents will get the kind of karma they deserve. That said many landlords can't be stiffed on rent money forever. Eventually COVID grant money will run out and then how are some of the landlords supposed to provide for their families with no income?

Kind of a cuts both ways thing.

This is just me thinking weird thoughts out loud but...it seems that markets are just being manipulated instead of rising and falling naturally.

You may not be wrong. Especially in housing markets where investors are buying up houses and properties faster than they can be made jacking up the values AND then renting them at astronomical prices. My mortgage payment is less than half what my rent payment was 15 years ago.

And there's this ...

The oligarchy rules: Amazon and corporations veto Seattle homelessness tax

Seems like that would have been a drop in the bucket for them.

Funny how quickly they folded.

The measure would have taxed large corporations with an annual revenue of more than $20 million beginning in 2019 at a rate of $0.14 for every hour worked by each employee in the city. First if it was such a good idea why only tax corps making 20m + why not everyone ? Second most business owners big and small probably realized it would eventually be everyone so they all fought against it. How many working people in Seattle really want to coddle the homeless after last summers free for all ?

It would not have hurt their bottom line.

A drop in the bucket indeed. One suspects that it is the principle which matters.

'...buying up houses and properties faster than they can be made jacking up the values AND then renting them at astronomical prices.'

Thus the economy can 'boom' for some while others struggle to survive . It is telling that circumstances which are best for the oligarchy are also most dangerous and stressful for the working class. Under Kapital, crises often create the best conditions for the ultra-wealthy. It's a wonder more people don't question that.

Depends on who we're talking about.

If you have a high labor business like a restaurant or a daycare, a tax like that gets expensive pretty quickly.

It also taxes certain industries disproportionately and then provides a free ride for companies that outsource labor.

I think a lot of people forget this.

So economic growth that builds wealth for 2/3 of American families is somehow reason to abolish capitalism? Are we sure about that?

I just worry about artificially inflated value. People buying homes at a peak. If something happens and prices fall a lot of people could be underwater again.

I've lived through numerous RE ups and downs in a number of states. It's the way of RE and it isn't going to change, Ender. There will always be those that get caught in the ''underwater'' portion.

I purchased a townhouse in Huntington Beach CA new in 1983 for $165,000. Today it is worth $1.3 million. there was a time in the '90s when the price dropped and again in 2008 but even with the large drops if you held on it escalated in price.

That's probably a valid concern. It's happened many times in the past.

But it certainly doesn't warrant a move to socialism.

That will never happen. What could hurt though is the loosening of regulations.

Taking the 2/3 stat at face value, 1/3 is a substantial minority for whom capitalism does not work. Yet clearly, Capitalism works very well for some. I would say that it works very well for the 1%, and well for the Next 9%. The 90% experience varying degrees of socio-economic stress. Those at risk of homelessness are well down the scale, while the homeless near the bottom.

The ruling class is well able to broaden and deepen social attack. Plenty of people in the second third have reason for concern, and for the 20% after the top 10% -- their fortunes can turn also.

Not addressed in Lawrence' article -- rising class consciousness and with it the emergence of global class unity can change many things.

It's the home ownership rate in the US.

I'm not sure it's accurate to say that "renting an apartment" means that "capitalism does not work".

Most.

Again, I'm not sure it's realistic to say that "economic stress" means the entire economic system isn't working.

Also not addressed is the failure of our educational system to teach people how to make the system work for them, which is the underlying issue.

People want to own buildings in the most desirable places where they can charge the highest rents, because, well, capitalism. This is also what drives gentrification. You might call it greed.

People will have to live in shitty neighborhoods in rundown apartments because that is all they can afford.

Again, the fruits of capitalism.

Everyone on earth needs housing. What happens when "the market" prices you out of a place to stay ?

Therein lies the problem, one of the major components of the price increases is a lack of supply and the number of new units being built is far less than what is needed. When it comes to affordable housing it is even worse and apartment construction is far below what is needed.

i don't have an answer to the problem and it is a problem that is going to get worse.

Kavika, we have to have government programs to provide (including building units if necessary) affordable housing to everyone who needs it.

The private sector (capitalism) is neither equipped or willing to do this.

I don't disagree with that JR, will they? I don't know some states have started on small projects to meet this end.

Most of those government program units are built, run and maintained by those awful capitalists.

Kapital is what Kapital does.

'What happens when "the market" prices you out of a place to stay?'

And leaves you with too little to pay the rent on the ground on which you stand...

There aren't many shitty apartments left because HUD and Section 8 has driven up the prices even in the shitty neighborhoods. The Government pays to much in shitty neighborhoods and all the other Landlords see what they're paying and fix up their apartments and raise their rates to match. It used to be you could rent a decent apartment that was very outdated for cheap and you could do a little work and paint and have a tidy but old fashioned place for a good price but they a few and far between now.

Just tell me, if the government is not going to be the provider of consistent affordable housing, just who is going to do it? It can't be a capitalist approach because capitalism dictates that every housing unit have its rental price maximized. That approach is not compatible with "affordable".

That's the key. The Maximum should be and would be what people can afford but Government subsidizes it and makes the unaffordable affordable for those who qualify for the subsidies. The subsidies actually drive up the prices by paying prices the real market would never bear. Plus we have unfettered Illegal Immigration that is causing a housing shortage that's also driving up prices (I'm sure they qualify for section 8 though).

So it's the illegal immigrants that are buying up all the houses. Here I thought it was mostly hedge fund managers.