December Inflation Report: Consumer Price Gains Continue to Cool - The New York Times

Inflation slowed last month thanks to cheaper fuel and airfares.

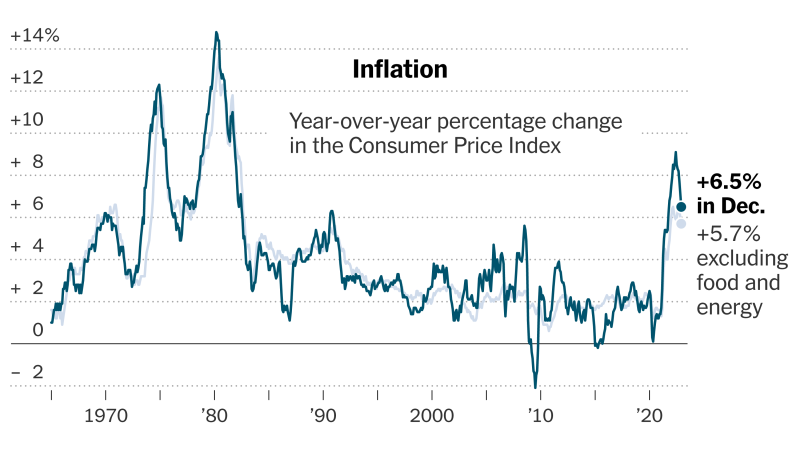

Inflation continued to slow on an annual basis in December, welcome relief for American households and a positive development for policymakers at the Federal Reserve and the White House.

The Consumer Price Index climbed 6.5 percent in the year through last month, down from 7.1 percent in the November reading, as prices declined slightly on a monthly basis. The annual inflation rate was the slowest since October 2021, a pullback that came as gas prices dropped and airfares declined.

Economists and Fed officials are more acutely focused on a so-called core inflation measure, which removes food and fuel prices to get a sense of underlying price trends. That measure climbed 5.7 percent in December from a year earlier, compared with 6 percent previously and in line with what forecasters had expected.

The takeaway is that inflation is moderating meaningfully. But the key question now is how quickly and how completely it will return to normal after a year and a half of unusually rapid increases, and policymakers are wary that a full deceleration could be a long process.

Several factors should help to slow price increases this year. A pullback in goods price inflation is expected to help cool overall inflation this year as supply chains heal. Climbing rental costs bolstered inflation in December and could continue to push inflation higher for a while, but that is expected to reverse by mid-2023. Rents for newly leased apartments have begun to climb much more slowly, private data suggests, which will feed into the government's official inflation measure over time.

But Fed officials are closely watching what is happening with prices for other services, which include things like hotel rooms, sporting event tickets and health care. They worry that services inflation — which is unusually rapid — could keep prices increasing faster than the central bank's target. The Fed aims for 2 percent inflation on average, using a price measure that is different from but related to the Consumer Price Index.

To cool conditions, central bankers have been raising interest rates, making borrowing more expensive for companies and households in a bid to slow demand and the broader economy.

— Jeanna Smialek

What Fed officials are saying about inflation and interest rates.

For the Federal Reserve, the inflation report on Thursday confirmed that the slowdown in price gains that officials have been expecting is coming to fruition.

Given that, the figures could help policymakers feel comfortable downshifting the pace of interest rate increases. Officials slowed their rate moves in December and have made it clear that they may dial them back further in February — adjusting policy a quarter point (also referred to as 25 basis points) at a time, instead of continuing with the more aggressive adjustments they made in 2022.

"I expect that we will raise rates a few more times this year, though, to my mind, the days of us raising them 75 basis points at a time have surely passed," Patrick Harker, the president of the Federal Reserve Bank of Philadelphia, said in a speech on Thursday. "In my view, hikes of 25 basis points will be appropriate going forward."

But the fresh inflation data does little to suggest that the problem of rapid price increases has been fully solved, so central bankers are likely to raise borrowing costs slightly more over the coming months and then leave the rates elevated for some time to fully wrestle inflation under control.

Core services prices excluding housing costs, a measure that both the Fed and economists are watching closely, picked up 0.3 percent in December on a monthly basis. That was up from 0.1 percent in November, according to calculations by Omair Sharif, founder of Inflation Insights.

"What we've done is made a pivot from goods inflation," Mr. Harker said in a question-and-answer session following his speech. "Service inflation ex-shelter is still running really high."

Many central bankers think that to get services inflation under control, they need to slow the job market and tamp down wage gains. Otherwise, companies facing larger labor bills are likely to continue passing along those costs to consumers.

"The biggest cost, by far, in that sector is labor," Jerome H. Powell, the Fed chair, said at his latest news conference in December. "And we do see a very, very strong labor market, one where we haven't seen much softening, where job growth is very high, where wages are very high."

Fed policymakers first slowed interest rates increases in December after a series of rapid moves earlier in the year, and seem poised to slow them further at their next meeting on Feb. 1. But they still expect to raise rates at least slightly more and then keep them high until they see convincing evidence that price increases are moderating, even if that inflicts some economic damage.

"We're really moving into an era of higher nominal interest rates for quite a while," James Bullard, the president of the St. Louis Fed, said at an event on Thursday. He said that the inflation report was encouraging, but that markets were too optimistic that inflation would swiftly slow.

— Jeanna Smialek

Understand Inflation and How It Affects You

- Inflation Chickens: As a spike in egg prices spooks consumers, some are taking steps to secure their own future supply by snapping up chicks that will grow into egg-laying chickens.

- Social Security: The cost-of-living adjustment, which helps the benefit keep pace with inflation, is set for 8.7 percent in 2023. Here is what that means.

- Tax Rates: The I.R.S. has made inflation adjustments for 2023, which could push many people into a lower tax bracket and reduce tax bills.

- Your Paycheck: Inflation is taking a bigger and bigger bite out of your wallet. Now, it's going to affect the size of your paycheck in 2023.

Continue reading the main story

Takeaways from the latest inflation report.

Monthly changes in December

Piped utility gas service

+3.0

%

Hospital services

+1.7

Meats, poultry, fish, eggs

+1.0

Electricity

+1.0

Motor vehicle maintenance

+1.0

Rent of primary residence

+0.8

Motor vehicle insurance

+0.6

Apparel

+0.5

Alcoholic beverages

+0.5

All items less food/energy

+0.3

Nonalcoholic beverages

+0.1

Medical care commodities

+0.1

Physicians' services

+0.1

Cereals/bakery products

n.c

-0.1%

All items

-0.1

New vehicles

-0.1

Smoking products

-0.3

Dairy

-0.6

Fruits/vegetables

-2.5

Used cars/trucks

-3.1

Airline fares

-9.4

Gasoline (all types)

-16.6

Fuel oil

Monthly changes in December

Piped utility gas service

+3.0

%

Hospital services

+1.7

Meats, poultry, fish and eggs

+1.0

Electricity

+1.0

Motor vehicle maintenance and repair

+1.0

Rent of primary residence

+0.8

Motor vehicle insurance

+0.6

Apparel

+0.5

Alcoholic beverages

+0.5

All items less food and energy

+0.3

Nonalcoholic beverages

+0.1

Medical care commodities

+0.1

Physicians' services

+0.1

Cereals and bakery products

n.c

-0.1%

All items

-0.1

New vehicles

-0.1

Tobacco and smoking products

-0.3

Dairy and related products

-0.6

Fruits and vegetables

-2.5

Used cars and trucks

-3.1

Airline fares

-9.4

Gasoline (all types)

-16.6

Fuel oil

Lower gas prices helped to pull inflation lower in December, contributing to the Consumer Price Index's slowest annual increase in more than a year. Digging into the numbers, prices for some goods are beginning to pull back as supply chains heal and demand for things wanes — even as gains for many services remain unusually strong.

Here's what to know about the December inflation report:

-

Overall inflation cooled to 6.5 percent in December on a yearly basis, down from 7.1 percent in November.

-

After stripping out food and fuel prices, which are volatile, the core price index was up 5.7 percent over the past year, a moderation from 6 percent in November. On a monthly basis, that core measure picked up, though: It climbed by 0.3 percent compared with November, in line with expectations but quicker than the previous reading. That suggests inflation has some underlying staying power.

-

One of the big categories that dragged down overall inflation was gas , which fell sharply in price in December. Energy prices overall were down 4.5 percent on a monthly basis.

-

Food prices rose 0.3 percent, a slight slowdown from earlier readings, although some products saw huge increases, like eggs, up about 11 percent in December alone.

-

Rent continued to rise, putting upward pressure on inflation. Shelter costs climbed sharply over the month, with rent of primary residences jumping by 0.8 percent. Economists expect those price gains to slow in 2023.

-

Prices for goods are also expected to climb more slowly — or decline outright — as supply chains heal and consumers stop buying so many couches and coffee machines. Used cars and trucks , a big driver of inflation early on, became cheaper last month, and new cars also declined slightly in price. But apparel prices, which many economists had expected to show a marked slowdown in December, instead rose.

-

Services costs could help to keep inflation higher than normal. Wage gains are rapid, and Federal Reserve officials are worried that this will prompt service providers — like hotels and day-care centers — to keep raising prices. December's report showed increases in prices including sporting event admissions and pet services.

— Jeanna Smialek

In another sign of cooling inflation, food price growth slows (eggs excluded).

Food prices, one of the most visible signs of inflation for consumers, continued to rise in December, albeit at a slower pace than recent months.

Food prices rose by 0.3 percent in December versus the previous month, down from monthly gains of 0.5 percent in November and 0.6 percent in October.

Food prices overall were up 10.4 percent over the past year. The cost of food at restaurants rose at an 8.3 percent annual pace, while food at grocery stores became 11.4 percent more expensive.

Rising food prices have weighed heavily on American consumers as they grapple with the high cost of many other goods and services. Some have had to make changes to their grocery shopping routines to accommodate the cost of food, cutting out certain types of meat and switching to lower-priced grocery stores.

An outbreak of avian influenza, also known as the bird flu, has caused the prices of eggs to surge, recording a gain of more than 11 percent in December, versus the month before. In other breakfast staples, the price of cereal rose 1.1 percent, bacon fell 2.9 percent and the cost of biscuits, rolls and muffins was unchanged. The price of oranges dipped 1.7 percent from the previous month as suppliers continued to recover from hurricane damage to Florida crops last fall.

— Isabella Simonetti and Ana Swanson

Continue reading the main story

President Biden says inflation report shows his economic plan is working.

Video The December inflation report showed that consumer prices receded, largely due to cheaper fuel and airfares.CreditCredit...Hiroko Masuike/The New York Times

The December inflation report showed that consumer prices receded, largely due to cheaper fuel and airfares.CreditCredit...Hiroko Masuike/The New York Times

President Biden celebrated Thursday's report showing that consumer prices receded in December, saying inflation is "coming down in America month after month" even as it remains high in major economies around the world.

In remarks that lacked some of his typical cautions about how far the economy still has to go to recover, Mr. Biden cheered falling gasoline prices, slowing food inflation and falling core inflation — which strips out food and energy prices. He claimed progress on the economic issue that has most bedeviled his presidency.

"It all adds up to a real break for consumers, real breathing room for families and more proof that my economic plan is working," Mr. Biden said.

Mr. Biden has expressed increasing optimism in recent months that the economy can achieve a so-called soft landing that avoids a recession — with inflation cooling and growth slowing, as the Federal Reserve continues to raise interest rates to help tame price growth. He has repeatedly pointed to the strength of the job market as a sign that the nation is nowhere near an economic downturn.

Republicans continued to blame Mr. Biden for high inflation, particularly the trillions of dollars in new spending he signed into law for pandemic relief, infrastructure and more. They used the report on Thursday as new fuel for a House Republican push to cut federal spending in the year ahead.

"Out-of-control Washington spending got Americans and our economy into this mess," Representative Jason Smith of Missouri, the chairman of the Ways and Means Committee, said in a news release. "Congress owes it to the American people to confront the crisis head-on."

Mr. Biden took his new Republican opponents head on in his remarks, promising to veto their plans to reduce funding for I.R.S. enforcement and replace the federal income tax with a national sales tax — which Mr. Biden said would cut taxes for the wealthy while raising them for the middle class.

— Jim Tankersley

Markets end the day with gains after fresh inflation data.

The stock market inched higher on Thursday as investors reacted to fresh data that showed price increases slowed in December, but in some corners of the economy, inflation remains stubbornly high.

The S&P 500 stock index fluctuated between small gains and losses in early trading, before a midday surge faded and the index ended the day up just 0.3 percent. The move still added to gains made earlier in the week, taking the S&P's rise so far this year to 3.7 percent.

Despite the latest reading of consumer inflation cooling as expected, investors noted that the numbers were driven by a continued drop in used car prices and a sharp drop in energy costs, while price pressures in some parts of the economy driven by consumer demand remained strong. Buying clothes, drinking alcohol, getting a haircut and staying in a hotel are now more expensive than they were a month ago. Airline prices fell in December but remained nearly 29 percent higher from a year ago.

That's not what the Federal Reserve wants to see because it suggests consumers are still willing to pay higher prices, hinting at the robust jobs market and wage gains that are making the Fed's job of lowering inflation harder. As a result, the Fed may need to continue raising interest rates and keep them at a high level for an extended period of time, increasing costs for companies and weighing on stock markets.

"The risks to inflation remaining resilient mostly stem from wage gains," said Lauren Goodwin, an economist at New York Life Investments. "What we see today is that may be the case. The Fed will be worried about that."

Still, investors have been encouraged in recent months by signs that inflation is moderating and by the Fed's response in December to slow the pace of interest rate increases. The market's musings about inflation have shifted from how high it could go to how long it would take to fall.

Some investors pointed to the high cost of rent, which typically takes a while to catch up with changes in the economy, skewing inflation higher. And housing costs make up a big chunk of the overall Consumer Price Index.

The latest numbers were enough to solidify investors' expectations of a further slowdown in the Fed's next increase in interest rates, to 0.25 percentage points, down from a 0.5 percentage point increase in December. The Fed's key policy rate is currently set in a range of 4.25 percent to 4.5 percent.

The central bank has forecast that interest rates will need to rise above 5 percent this year, but some market watchers are becoming doubtful given slowing inflation. Analysts at Morgan Stanley expect the Fed to raise interest rates in February and then stop, with a peak target rate of 4.75 percent.

The yield on two-year U.S. government bonds, which is sensitive to changes in Fed policy, fell almost 0.1 percentage points on Thursday to 4.12 percent from a peak of 4.72 percent in November, but trading remained choppy. The 10-year Treasury yield, which underpins borrowing costs around the world on everything from mortgages to company loans, dropped below 3.5 percent for the first time this year. The value of the U.S. dollar also declined compared with a basket of other currencies that represent the country's major trading partners.

Yet worries remain in markets over how long the Fed will need to keep interest rates elevated to slow inflation, even after it has stopped raising rates. The longer interest rates stay high, the more pressure they put on company costs, and the higher the risk that the economy could slip into a recession.

"We think any rally here based on the C.P.I. report will be temporary," said Mary Ann Bartels, chief investment strategist at Sanctuary Wealth. "We have months if not quarters ahead of us where we need to see much lower levels of inflation, and we think we will get there but it's going to take time."

Isabella Simonetti contributed reporting.

— Joe Rennison

Unemployment is negligible, wages are growing, business is profitable, the markets are booming.

Because Inflation is waning the FED only raised rates by a quarter point. The economy has grown each of the last two quarter. Recession avoided!

Mark down a win for Biden's good management.

Of course the nattering nabobs of negativity will try to put a bad spin on good economic news...

Good news for America is bad news for MAGA!

What actions did the Biden administration take to improve the economy?

Timely seed from 3 weeks ago. Maybe you should seed another article to respond why posting stories from last month is relevant.

Unemployment rate is lowest since 1969.

Post pandemic bounce

So...inflation is still up from when the Human Fuck Up took office and tore down what was working.