Grocery Inflation is Finally Showing Signs of Cooling | CEA | The White House

Almost immediately after the pandemic began, food processing facilities slowed or paused operations and grocery prices began to climb.

Grocery inflation stayed higher than normal for much of the pandemic thereafter, driven by a variety of factors, including: pandemic-induced shifts in food demand from restaurants to groceries, global supply chain bottlenecks, and unforeseen supply shocks like avian flu, the war in Ukraine, and poor weather. However, in recent months, grocery inflation has finally begun to show signs of cooling. Below, the CEA lays out five facts about grocery prices and their recent dynamics.

Fact 1: Grocery prices matter deeply for families. [1]

According to the Consumer Expenditure Survey, groceries made up around 8 percent of total consumer spending in 2021, and more than 11 percent for people in the bottom fifth of the income distribution. For comparison, gasoline was 3 percent of total consumer spending in 2021, household utilities were 6 percent, and shelter costs—including rent and mortgages—were 20 percent.

Fact 2: Grocery inflation affects households' expectations of overall inflation.

One additional sign of just how salient grocery prices are to families is their effects on household inflation expectations. When groceries become relatively more expensive, households incorporate that experience into their expectations of future overall inflation in the near future. The CEA found that 1 additional percentage point of food inflation is linked to an increase of about 0.11 percentage point in one-year inflation expectations in the University of Michigan survey. For comparison, when gasoline prices—the focus of much of the prior research into the sensitivity of inflation expectations—rise by 1 extra percentage point, near-term expectations tend to increase by around 0.14 percentage point, not much higher than the grocery inflation and expectations relationship.

Fa ct 3: Grocery inflation is cooling.

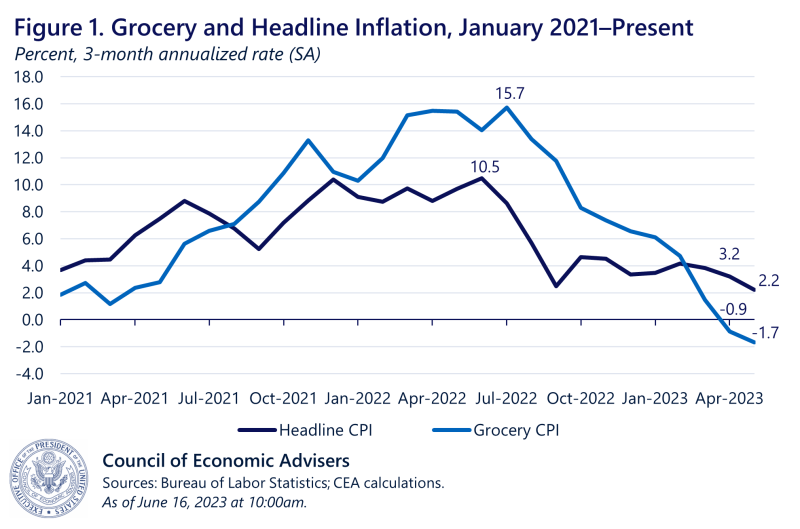

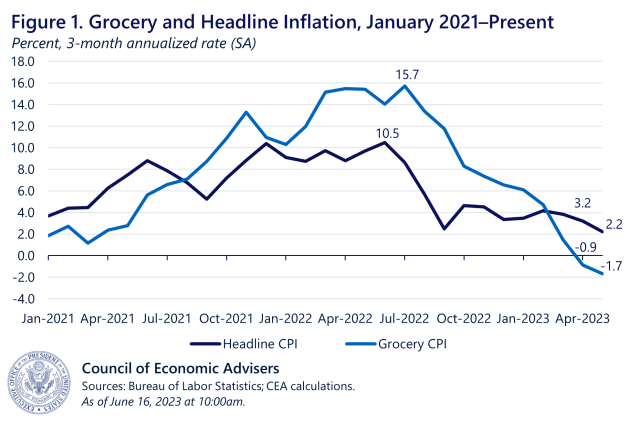

Month-to-month inflation data is timely but can also be noisy. Therefore, the CEA prefers to look at longer averages, such as three-month changes, to better identify recent trends. In May, grocery inflation on a three-month annualized basis was -1.7 percent, down from -0.9 percent in April and a July 2022 peak of 15.7 percent. Accounting for nearly one-tenth of the overall consumer price basket, grocery inflation is now below the headline CPI inflation of 2.2 percent in May on a three-month annualized basis (Figure 1). We will have more information about how recent grocery price trends have evolved with the release of the June CPI on July 12th.

Fact 4: Looking across the components of grocery inflation, a growing share of categories is helping to slow inflation.

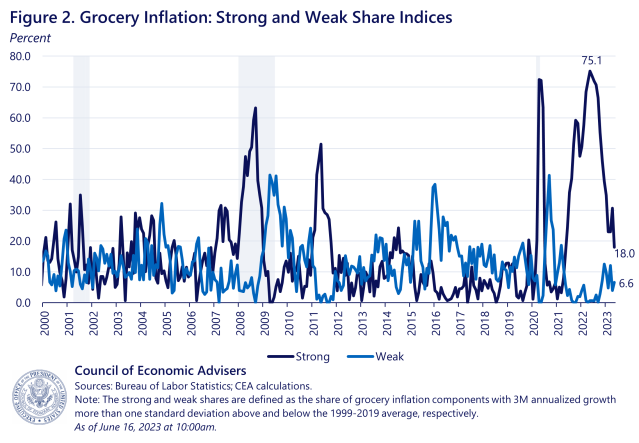

To capture the breadth and intensity of upward or downward pressure on grocery prices, the CEA constructed two measures. The first measure , which we call the Strong Share, is the share of grocery components that have three-month annualized inflation that is more than one standard deviation above their historic means. The second measure, the Weak Share, is the share of components that have three-month annualized inflation that is one standard deviation below their historic means (Figure 2). While still elevated, the Strong Share has dropped to 18 percent from 31 percent last month and its peak of 75 percent in May 2022. Meanwhile, the Weak Share is up slightly to 6.6 percent from 4 percent last month and its low of 0 percent in April 2022. Together, these point to less upward pressure on grocery inflation.

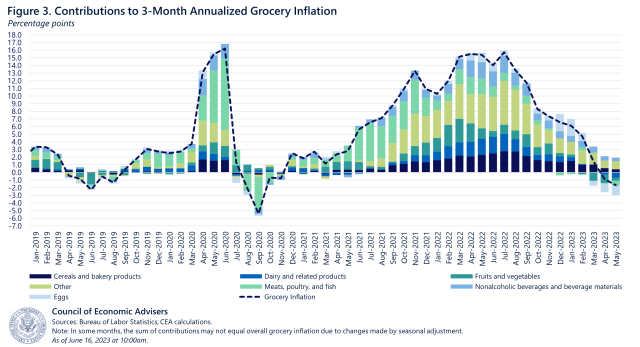

Fact 5: Declines in egg and produce (e.g., fresh fruit) prices are helping drive down grocery inflation (Figure 3).

In addition, the contributions of dairy, cereal and bakery goods, and other goods inflation have declined in recent months. Egg prices, in particular, have been front and center for households in recent months and are now falling. Between January and April 2023, egg prices fell a cumulative 18 percent, and then between April and May alone, they fell another 13.8 percent, the largest month-to-month drop since January 1951. As of May, egg prices are now 20.1 percent above January 2022 levels. Egg purchases account for a relatively small share of the grocery cost basket (1.5 percent) but, due to the highly pathogenic avian influenza (HPAI) virus, egg prices recently experienced amongst the largest annual increases across grocery categories last year. HPAI affected over 40 million egg-laying hens in the United States during 2022 or over 10 percent of the U.S. egg-laying hen population. Measures to address HPAI generated increased costs and supply constraints for producers and wholesale sellers of eggs over the past year. Fortunately, HPAI incidents have declined and the industry has worked to rebuild the flock, which has increased the supply of eggs and resulted in a 65 percent year-on-year decline in the wholesale price of eggs in May 2023. These wholesale prices are, in turn, passing through to falling retail egg prices. The Easter holiday season is also now behind us, further reducing pressure on egg prices. Taking a signal from the wholesale prices, and barring another supply disruption, retail egg prices will likely continue to moderate in the months ahead.

Looking ahead, the CEA staff expect grocery inflation to continue improving alongside headline inflation but remain elevated relative to its prepandemic levels through the rest of 2023.

While agricultural input and commodity prices have fallen, they are still elevated relative to their prepandemic levels. There are also other sources of grocery price pressure, including a robust labor market that is supporting higher wages for workers along the food supply chain. At the end of the day, the goal is to make grocery prices more affordable for households. While the job is not done yet and there is considerable uncertainty around the outlook, we appear to be moving in the right direction.

[1] "Grocery inflation" is also known as "food-at-home inflation."

Tweets by WhiteHouseCEA

You may not feel it yet but inflation is slacking...

Good news but prices are not coming down. They are just inflating slower than they have been.

Which is good.

Inflation is bad but normal while deflation is all bad, rare and is a sign of economic collapse...

Look at prices before your boy blue became POTUS.

Talk amongst yourselves…..

It's good to have successive articles on similar subjects. Figure 1, here, is an excellent demonstration of why economists don't include food and gas in their measure of inflation. If those are included, it appears urgent to relaunch inflation in order to avoid the crash that appears to be coming.