CPI June 2023: Inflation rose just 0.2%, less than expected as consumers get a break

Published Wed, Jul 12 20238:31 AM EDTUpdated 2 Hours Ago WATCH LIVEKey Points

WATCH LIVEKey Points

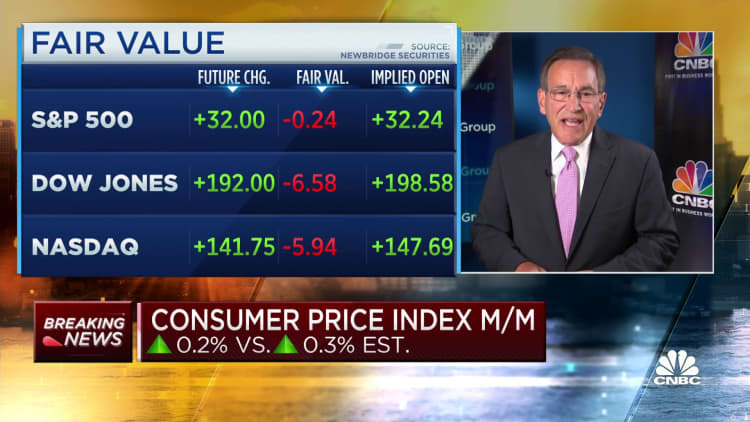

- The consumer price index rose 0.2% in June and was up 3% from a year ago, the lowest level since March 2021.

- Excluding food and energy, core CPI increased 0.2% and 4.8%, respectively.

- Soft gains in food prices and declines in used vehicle and airline prices helped keep inflation down, while shelter prices continued to rise.

- Worker wages adjusted for inflation increased 1.2% from a year ago.

watch nowVIDEO6:1806:18Inflation rose just 0.2% in June, less than expected as consumers get a break from price increasesSquawk Box

watch nowVIDEO6:1806:18Inflation rose just 0.2% in June, less than expected as consumers get a break from price increasesSquawk Box

Inflation fell to its lowest annual rate in more than two years during June, the product both of some deceleration in costs and easy comparisons against a time when price increases were running at a more than 40-year high.

The consumer price index, which measures inflation, increased 3% from a year ago, which is the lowest level since March 2021. On a monthly basis, the index, which measures a broad swath of prices for goods and services, rose 0.2%.

That compared with Dow Jones estimates for respective increases of 3.1% and 0.3%.

Stripping out volatile food and energy prices, core CPI rose 4.8% from a year ago and 0.2% on a monthly basis. Consensus estimates expected respective increases of 5% and 0.3%. The annual rate was the lowest since October 2021.

In sum, the numbers could give the Federal Reserve some breathing room as it looks to bring down inflation that was running around a 9% annual rate at this time in 2022, the highest since November 1981.

"There has been significant progress made on the inflation front, and today's report confirmed that while most of the country is dealing with hotter temperatures outside, inflation is finally cooling," said George Mateyo, chief investment officer at Key Private Bank. "The Fed will embrace this report as validation that their policies are having the desired effect - inflation has fallen while growth has not yet stalled."

However, central bank policymakers tend to look more at core inflation, which is still running well above the Fed's 2% annual target. Mateyo said the report is unlikely to stop the central bank from raising rates again later this month.

Fed officials expect the inflation rate to continue falling, particularly as costs ease for shelter, which makes up about one-third of the weighting in the CPI. However, the shelter index rose 0.4% last month and was up 7.8% on an annual basis. That monthly gain accounted for about 70% of the increase in headline CPI, the Bureau of Labor Statistics said.

"Housing costs, which account for a large share of the inflation picture, are not coming down meaningfully," said Lisa Sturtevant, chief economist at Bright MLS. "Because rates had been pushed so low by the Fed during the pandemic and then increased so quickly, the Federal Reserve's rate increases not only reduced housing demand — as intended — but also severely limited supply by locking homeowners into homes they would have otherwise listed for sale."

Wall Street reacted positively to the report, with futures tied to the Dow Jones Industrial Average up nearly 200 points. Treasury yields were down across the board.

Traders are still pricing in a strong possibility that the Fed will enact a quarter percentage point rate hike when it meets July 25-26. However, market pricing is pointing toward that being the last increase as officials pause to allow the series of hikes to work their way through the economy.

When inflation first began to accelerate in 2021, Fed officials and most Wall Street economists thought it would be "transitory," or likely to fade once factors specific to the Covid pandemic wore off. They included surging demand for goods over services and supply chain clogs that created scarcity for vital items such as semiconductors.

However, when inflation proved more stubborn than anticipated, the Fed began hiking, ultimately raising benchmark rates by 5 percentage points through a series of 10 increases since March 2022.

The muted increase for the headline CPI came even though energy prices increased 0.6% for the month. However, the energy index decreased 16.7% from a year ago, a time when gasoline prices at the pump were running around $5 a gallon.

Food prices rose just 0.1% on the month while used vehicle prices, a primary source for the inflation surge in the early part of 2022, declined 0.5%.

Airline fares fell 3% on the month and now are down 8.1% on an annual basis.

The easing in the CPI helped boost worker paychecks: Real average hourly earnings, adjusted for inflation rose 0.2% from May to June and increased 1.2% on a year-over-year basis. During the inflation surge that peaked last June, worker wages had run consistently behind the cost-of-living increases.

Another BIG WIN for Bidenomics...

"Stripping out volatile food and energy prices, core CPI rose 4.8% from a year ago and 0.2% on a monthly basis." "Housing costs, which account for a large share of the inflation picture, are not coming down meaningfully,"

Food, fuel, home heating, and housing....the major costs for families, have not come down much.