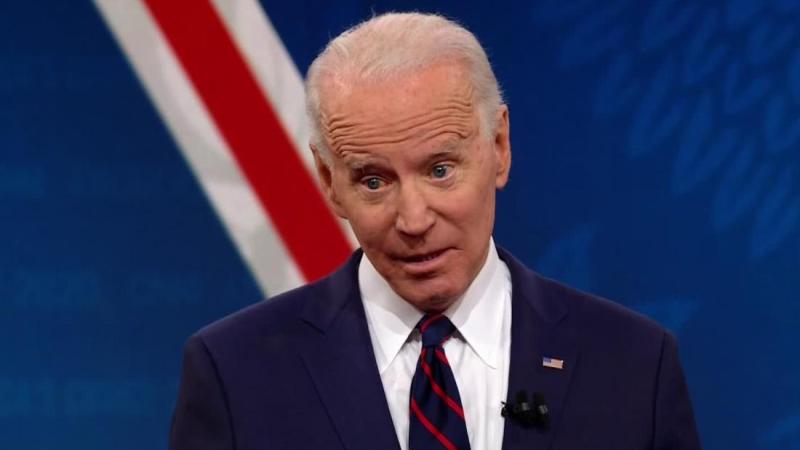

A bad week for Bidenomics

Economically, things were supposedly turning around for President Joe Biden. Unemployment had fallen to 3.8%, GDP was growing, and wages briefly grew faster than inflation for the first time in his presidency.

But then the U.S. Census Bureau and Labor Department combined for a one-two punch that reminded everyone why the public tells pollsters again and again that the Biden economy is terrible. Earlier data from the Congressional Budget Office and Federal Reserve show how awful Bidenomics really is.

The Census Bureau reported that median real household income fell from $76,330 in 2021 to $74,580 in 2022, a decline of 2.3%. This was the biggest drop since 2010, when it fell 2.6%. Even at the height of the pandemic, when government lockdowns put millions out of work, real income only fell 2.2%.

The cause of falling incomes is no mystery: Bidenflation is to blame. Thanks to trillions of dollars in economic stimulus passed by Democrats on a purely partisan basis without even one Republican vote, inflation jumped 7.8% between 2021 and 2022, the largest increase since 1981.

But the new Census Bureau report was looking at data comparing 2021 to 2022. Just the past July, the Labor Department reported that inflation was finally falling to 3.2% a year. Maybe things were about to get better.

No such luck. The Labor Department reported this month that inflation climbed to 3.6% in August, thanks mostly to rising gas and food prices. Maybe Biden now regrets canceling the production of 11 billion barrels of oil in Alaska's National Wildlife Refuge.

Considering that it is low-income households that are hit hardest by inflation, especially when it is driven by household basics such as gas and grocery prices, it isn't a surprise that the Census Bureau also found inequality rising under Bidenomics. So much for the Democratic Party standing up for the little guy.

Struggling families with debt are hit especially hard by Bidenomics. The average interest rate on credit cards has risen from 14.75% when Biden first came to office to 20.68% today. That means people with debt are punched in the mouth twice by Bidenflation: once when they pay higher prices for goods and again when they pay higher interest rates on what they borrowed to make past purchases.

Consumers aren't the only ones suffering from higher interest rates. Taxpayers are getting hosed, too. The federal government will run a $1.7 trillion deficit this fiscal year, including more than $644 billion in interest payments, which, thanks to higher interest rates, is 30% higher than what the government had to pay in interest last year, according to the CBO.

The only reason deficits didn't top $2 trillion this year is because the Supreme Court invalidated Biden's illegal student debt amnesty plan, which would have added hundreds of billions of dollars in deficits for decades to come.

Falling real wages, rising income inequality, higher interest rates, higher government deficits — that's Bidenomics. Those are the facts. No wonder the public continues to tell pollsters the Biden economy is bad.

Tags

Who is online

37 visitors