Student Loan Forgiveness

Category: News & Politics

Via: robert-in-ohio • 2 months ago • 147 commentsBy: Story by Jennifer Jacobs and Justin Sink

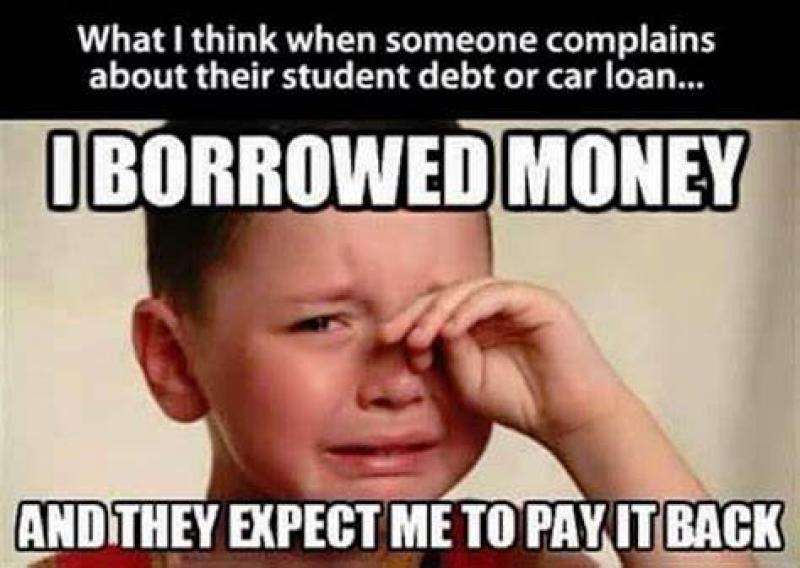

What are we teaching our children and our citizens about the need to be accountable for your actions, to be responsible for the debts they accrue/create and how little people will trust them in the future.

Should a bank look favorably on a person applying for a loan that signed loan papers promising to repay student laoans and then did not do so?

If a person fails to live up to a debt they undertook willingly, why should they be trusted to do anything else they say they will in the future?

Borrowers who had their debt forgiven in the latest round will receive an email from the president letting them know. Biden’s administration gave similar notice in a prior round of debt forgiveness last November.

The moves are reminiscent of 2020, when former President Donald Trump’s name appeared on Covid-19 stimulus checks sent to Americans. Trump is closing in on the 2024 Republican nomination and a rematch with Biden.

The Biden administration announced earlier Wednesday that more than 150,000 borrowers will receive $1.2 billion in student loan forgiveness. The fresh debt relief is part of a program unveiled in January targeting Americans who had been making payments for at least a decade.

“A lot of people can’t even repay and they try - they don’t miss payments, they work like the devil every month to pay the bills,” Biden said.

A plurality of Gen-Z voters – 43% — said Biden was doing too little to address student loans, according to a Bloomberg News/Morning Consult poll of swing-state voters released in December. Yet 46% of swing-state voters overall said they supported the administration’s student loan forgiveness programs, showing divides over the issue.

he move – which benefits those enrolled in the government’s Saving on a Valuable Education (SAVE) plan – wipes out loans for those who borrowed less than $12,000 for their higher education. Other income-driven repayment plans also forgive balances, but only after 20 or 25 years of repayment.

The latest round pushes the total relief approved by the Biden administration to nearly $138 billion, benefiting 3.9 million borrowers. That number could grow as more people become eligible for forgiveness under the SAVE program, which has 6.9 million people enrolled. Administration officials have declined to estimate how many borrowers will eventually see loans forgiven under the program.

Yet the efforts fall short of the president’s proposal for more sweeping student loan cancellation — as much as $20,000 in relief per borrower - that was struck down last year by the US Supreme Court. That forgiveness plan was estimated to cost $400 billion.

The article is about student loan forgiveness - the pluses and minuses.

Please confine comments to that subject

Try and be civil - I know it is hard for so many, but give it a try - real discussions and debates break out when we listen to points of view other than our own.

The answer of course is that the Biden campaign wants their votes.

It is immoral to wipe away the debt of those who will benefit the most in our society via "higher education."

It is unfair to those who did not get such an education and are forced to pay for the debts of those who will.

It is also unfair to those who have paid off their student loans.

Finally, the Supreme Court has already ruled against Biden's scheme. Does the rule of law mean anything anymore?

Get ready for an argument on what the meaning of "is" is from leftists.

The law is what Democrats say it is; and it applies only to who they say.

Interesting word choice - "immoral" and presumptuous of you to broad brush all student loan holders as those who "benefit the most in our society". It's immoral to use predatory loan tactics and for profit schools to prey on those just trying to better themselves. How come you don't talk about that in these diatribes?

Yes, life is unfair. Boo fucking hoo.

I paid mine and I don't really give a shit if others get theirs paid or not. Is it also unfair I paid mine myself when so many others have their parents pay off theirs? Or is it just the way life works? Is it fair I didn't get a business bailout when multiple other businesses, like farmers (many of which are owned by members of Congress) got theirs?

Again you demonstrate you don't know how government and the law works. The SCOTUS ruling was about the mechanism used to fund the school loan bailout. They found piecemeal legal work arounds that won't apply so broadly.

How about you look up the case and explain why you think it's still not legal and the Republican run House is too inept to sue again?

This newest installment in Biden's Loan Forgiveness applies to some folks who have a federal direct loan. Why do you consider the US Dept of Education to be predatory?

Forgiveness isn't restricted to loans for attendance at profit schools.

I was speaking of the term "immoral" Vic used, not this specific round of relief.

It is unfair to those who did not get such an education and are forced to pay for the debts of those who will.

It is also unfair to those who have paid off their student loans.

I agree with these two points

the Supreme Court has already ruled against Biden's scheme. Does the rule of law mean anything anymore?

The executive order took a slightly different path to the forgiveness, relating to total debt which I feel likely will face judicial challenges as well.

Excellent point

Since I also paid for my college costs and those of three children without government assistance perhaps I should be in line for a refund of those costs under this plan.

That's not how life works, but go ahead and file your challenge with the courts. I doubt you will win. I also paid my student loans and my wife is currently paying on hers but doesn't qualify for relief under any of these plans, but neither of us are bitching about it. Sometimes life just isn't fair.

I do not expect life to be fair, but I expect that there be some level of logic in decisions.

We are teaching these young people that they have no obligation to keep their word when they sign a contract.

That is a bad lesson

It is furthering the entitled society

Logical decision making in Washington is the exception rather than the rule.

There are all kinds of lessons good and bad to learn. Are we teaching farmers they can always count on government bailouts too? Both Republican and Democrat Administrations keep bailing them out. There are a litany of government bailouts that often don't make a whole lot of sense like when Congress forgave Covid business loans. Congress members who owned business got millions in loan relief.

Interesting... I'm pretty sure the people served most with school loan debt relief aren't feeling all that entitled when they look at the cost of living vs wages. Housing costs are obscene and grocery prices are resisting inflation reduction.

Sounds more like republicans and Trump with their use of "alternative facts".

Biden continues to ignore the Supreme Court.

Biden Buys Another Round of Votes in Defiance of the Supreme Court (townhall.com)

Fucking hell... Don't any of you conservatives read these rulings? The SCOTUS said the HEROS Act did not authorize the student loan forgiveness plan, not that student loan forgiveness was illegal. It forced the Biden Administration to jump through a dozen other hoops to effect less people.

Jumping through a few hoops seems like a small price to pay to buy a few million votes.

It was something Biden ran on and what his young, more Progressive voters wanted. I don't agree with it and it might be dumb, but it's not illegal, immoral or a surprise.

I think it IS immoral to make taxpayers foot the bills for legal debts incurred by others.

Could a future President forgive mortgage loans because the rates might be too high?

Okay. It's a little harsh, but government makes taxpayers foot the bill for all kinds of things I don't agree with. This is why we have a representative democracy and elections with checks and balances. Specifically this student loan forgiveness program is being done with money that was already allocated so the taxpayers are already on the hook for it anyway. I suppose we all have ideas on how it could be better used though.

I suppose it's possible. I would assume it's legality would depend on how it was done just like these student loans.

O-k-a-y then, I'll just leave that out there.

Great. Now that we've established Biden is acting within the law we can do that.

You realize that this statement is about congress, which did not vote on this, Now there was a Mechanism under the PAYE act that allowed for forgiveness, if you were a responsible human being. this was passed by Congress and signed by the president, unfortunately too many were too lazy or stupid to sign up for it, I guess Biden is rewarding them now?

And you realize you are taking one part of one statement out of context, right? Nothing else you posted there has anything to do with my post.

It absolutely does, it is the difference between a LAW being passed that all parties agree to, to accomplish X and a President acting as if he was a dictator doing what he wants. How about we take money allocated for ACA and redirect it to funding anything else.

... like tax credits for contributions to the religious business.

The President is NOT acting as if he is a dictator. He's doing what he is authorized to do within the scope of his powers on a issue he ran on. It's much like Trump declaring a "national emergency" to divert money allocated for military housing to build sections of border wall.

You don't pay a penny more because a nonprofit gets a tax credit.

And yet Obama acted with-in the confines of the constitution, where the congress controls the purse strings, he passed a LAW that allowed him to put in a mechanism to forgive debt, Now how many future student won't get loans because the funding won't be there from the payments? or what other programs won't get the funding needed because the student loan program will now be short.

bullshit.

All you have to do is simply show me where and how much more you personally paid because someone else got a tax credit.

I have a couple of hours to kill, so take your time and make sure your links work!

not me, as an individual. I didn't pay shit, I took the tax credit, just like anyone that adheres to the 1st amendment in the constitution should, whether they attend a thumper madrasa or not. why stack economic gullibility upon religious gullibility. the IRS proves every sunday that violations of tax exempt status by organized religion is unenforceable, especially with all the dipshit bible thumpers infesting congress.

Well, that is some rapid walk-back.

Here is my post:

And your response:

Now, if you were referencing a different post of mine, please list it here. Otherwise, the only logical conclusion any reader could POSSIBLY get from your "bullshit" comment is that you DO pay more.

You only walked it back when I called you out on it.

You are moving the goal post from illegal to how the programs are run. My major point is not about Biden, but the language we here use to discuss these topics. Biden is an asshole, but this is not illegal, let alone the actions of a dictator. It's simply a policy issue and I get it you don't like it.

not everyone takes the tax credit. all taxpayers make up the difference in the deficit.

If that were true, we wouldn't have a $33 trillion federal debt.

Are your feelings similar for those who take the child credit and often get back many times more than they ever paid in?

Thank you for that.

I had hoped the logic would be obvious, but sadly, it was not.

To ME, it doesn't sound at all credible that you donated anything to any organizations evenly remotely related to any church.

Nope, not buying it

About 37% of all filers use the short form, which does not allow for such deductions.

No where did i use the term illegal, right and wrong isn't always a matter of law but of morality and precedent.

No victim no crime, right Greg?

You see, that's where you are wrong. The crime is against the taxpayer who has to pay the debt for Traitor Joe to buy votes.

That is a very interesting question, hopefully it will be posed to the President perhaps in a non-teleprompter situation where he would actually have to come up with a thought on the subject.

His team would rush in to save Biden from saying something stupid.

Because all debt,

can be discharged in bankruptcy, with the exception of alimony, child support, tax obligations and since 1978, student loans!

Without the ugly option of bankruptcy which has it's own punishments, student loans are permanent.

Even alimony and child support are "term limited", making student loans lethal to many peoples FICO scores.

On top of that, many of these loans were guaranteed by a parent under various programs

because who in their right mind is going to lend teenagers tens of thousands of dollars with no collateral?

Haven't been forgiven but am sure my university has forgotten me.

You could look at bankruptcy in the same light. Promised to repay a loan, declared bankruptcy and the loan was forgiven (so to speak) and the person is off the hook and can do the same thing I believe in another 5 to 7 years. The same goes for corporations.

Will their credit scores be lowered as a result, like when declaring bankruptcy?

In my experience with Disability, the forgiven amount is counted as income and taxed accordingly when filing with the IRS.

Then those who took out loans should declare bankruptcy and have their debts resolved in court, not paid for by other taxpayers.

And there is the problem Student loans were designed to NOT be discharged in bankruptcy, the only way they are suppose to go away is in death, or if you actually have the integrity to pay them off, there are some instances where they will be forgiven for X amount of years of public service. Biden has just given everyoen who actually did what they were suppose to the finger.

But student loans can be forgiven thru bankruptcy, they just need to take an additional step.

Biden seems to favor that approach, just like with immigrants.

I agree.

However, the banks want their money.

With a little investigation and honesty, this is probably similar to the S&L bailout and the Wall Street bailout with the taxpayers on the hook for the financiers' love of gambling and never losing.

Edit: It appears the federal government is the largest lender. Which means, the entire loan process must be re-worked with new rules on how any public money is spent to fund higher education.

Some info at the link below.

Not true, It was a change virtually snuck into the 1978 Omnibus bill changing the bankruptcy code

that no one will take credit for

That is an interesting point - perhaps all those wishing to have all or part of their student loans forgiven should have to go through this legal process and ask a judge to make it so and then have the weight of a bankruptcy on their credit rating.

follow the money on who that change benefits the most and... surprise!

Ergo, more than 98% are locked into the loans even in bankruptcy because they lack the funds to hire a lawyer

to jump through the undue hardship requirements.

Its almost a perfect "catch 22".

Maybe the holders of US federal debt will forgive us.

Yeah right,

Judgements should be issued and assets seized and sold at auction

And colleges will raise tuitions because the money will keep pouring in as students take out loans with the expectation that they will be forgiven. Biden’s just ensuring the problem keeps getting worse.

I think you nailed it quite nicely.

And colleges will raise tuitions because the money will keep pouring in as students take out loans with the expectation that they will be forgiven. Biden’s just ensuring the problem keeps getting worse.

Or perhaps the ability to get a student loan will be so difficult and onerous - that the process will disappear

Biden using taxpayer money to buy votes. Does he have any integrity left?

He had integrity to begin with?

Sorry, he's a politician. Of course he's going to do everything he can to buy votes. And as the President, he's in a good position to be able to use public funds to do so. That's life.

The poor kids shouldn’t be expected to pay back money squandered on Spring Break since there was no long-term, educational benefit.

Loan forgiveness is misguided. If we are going to help with education then that money should be used to help talented, motivated kids to get higher education and then use their enhanced talents to better the nation. To wit, apply the money for students who need it now to get higher education.

Hard to see this as anything more than buying votes and doing so with a very bad message of encouraging government handouts (and bailouts).

I concur. What we should be doing is encouraging people into doctor and nursing programs with an incentive to pay off their student debt after a specific period of time working on the job.

That said, others here using terms like unfair and illegal are also misguided in their bias.

Yes, I am in favor of helping needy, talented, motivated people secure higher skills that will in turn help the nation.

I believe that already exists, or used to. My daughter is having a student loan forgiven because she is a public school teacher and has paid her student loan back for 120 months(she is currently at 116 months)

And this is an excellent program for teachers, and doctors who agree to serve under serviced areas.

Yes, I am in favor of helping needy, talented, motivated people secure higher skills that will in turn help the nation.

But what if the person wants a degree in Tahitian Art History or the effects of Rap Music on Urban Development, or Country Music and its Effects on Political Viewpoints

—and originally—

???

The answer to your question is that I explicitly included the condition that their enhanced talents / education would be used to help/better the nation.

To wit, my position is that the legislation would not fund any education but rather education that reasonably would help the nation. Thus things like "a degree in Tahitian Art History" would most likely not be covered.

I agree with your point, but "who" would decide what benefits the nation? The D's when they are in power and the R's when they are in power?

I have long hair thought that whatever is good for DotW, is good for the country.

It would be a decision like every other decision that makes its way into legislation. There will always be some minority of officials who are in control and making such decisions.

This is true in the private sector too. Everything from deciding features in a smartphone to determining what medical procedures are covered by insurance and by how much.

In short, there is no avoiding that some minority of officials will make decisions affecting the majority.

I envisioned a plan where money was made available to those motivated, talented students who wanted to go into STEM fields. When it becomes saturated...shift the money to another field, like possibly education. But the money needs to go to individuals who will be able to earn a decent salary upon graduation. I'm not talking giving money to someone who is going to end up at Starbucks for 20 years after graduation because they wanted to study "art"

How does this bandaid for existing student loans help if college costs are still through the roof and people are still taking out exorbitant student loans that they will claim they can't pay back? And worse yet they will be taking out the loans with the expectation tax payers will come to their rescue.

Oh that's right, but then the votes will already be bought so Joe doesn't really care that he is not solving a problem but actually making it worse down the road.

It's what politicians do, kick the can down the road. This brings a positive light on him from some people, might even get him a few more votes. But it does nothing to help fix the underlying issue. Politicians don't want to try to fix the underlying issue because it's harder and messy and doesn't bring an immediate return in the way of votes.

I think you are close. In my opinion solutions must come from consensus in Congress, but the populism infecting Congress today refuses to compromise.

Biden is attempting to buy votes--period.

Everyone should remember that Biden has no qualms about making YOU pay for someone's education loans when you go to vote.

Think Biden will stop there on buying votes?

I want the government to reimburse me for all the education money I spent that came out of my own savings. I mean, at this point, why fucking not?

Yeah, and I would like the government to pay to house, feed, educate, and medicate me as we do with aliens!

I want the government to reimburse me for all the education money I spent that came out of my own savings. I mean, at this point, why f***ing not?

A lot of people feel the same way.

How much of this loan forgiveness is going to people who borrowed money and never finished a degree?

Even with a degree there is no guarantee of income sufficient to pay back astronomical college loans, but without a degree, it is highly likely the income is insufficient to even make the payments and pay their basic bills. Which means that these people are a drag on the economy because they could qualify for food stamps and other public assistance rather than have disposable income to pay exorbitant housing costs, buy disposable goods to add to the mountains of rubbish in landfills, and whatever else it takes to make it appear like the economy is healthy and working for the majority of US citizens.

I believe that two-year community colleges should be free to everyone who carries a minimum 2.5 and maybe even 2.0 GPA. Two more years of education and maturity would probably benefit most people as they make the transition from high school to the work force. If so, our entire country will benefit. We might even see the end of the need to forgive student loans.

People seem to think that the education you get at Penn State is more valuable or better than IUP** where I went to school. The degree I got at IUP was just as valuable if I were to spend the same amount of time at PSU....only it was a lot cheaper at IUP.

**Indiana University of Pennsylvania

I agree.

I also wonder if it doesn't have to do with networking as much as education?

Possibly

Yes, absolutely it does.

Thanks to all that have contributed to this point - I had hoped for a good discussion and this has been one so far.

I worked summers in a hot smelly rayon factory and winters in a cold truck stop to go to college.

Letting these people get out of paying college loans back while me and other people worked cheats us and is insulting. Make them pay up.

what years?

my tuition was $3K a year at a Catholic University

My first new car was also $3k

It was also long before someone slipped into the 1980 spending Bill a clause that excluded student loans from being discharged in bankruptcy.

Now tuitions are almost $100K

For cheaper public institutions add travel or room and board.

These are loans to teen aged students without collateral or cosigners.

Either the loans or the bankruptcy laws need to change, probably retroactively.

This country willingly gave rich businesses and their owners, sometimes our own Senators & Reps, PPP loans during COVID

with no expectation of repayment to the tune of $400 Billion and no one said Trump was buying votes.

Studies and criminal cases indicate as much as 15% of those loans were fraudulent waste. ($ 60Billion )

Why should those businesses have gotten off the hook when no one escaped other Great Recessions and Depressions?

But we just have to fuck the less fortunate eh? The kids that will probably never own a house or get out from under this individual,

permanent mountain of debt because there were really no jobs in their majors just promises from the institutions that helped them

(and their parents) fill out the paperwork.

Among other things I sell life insurance and I still issue the occasional policy to help cover outstanding student loans for

the parents or the students, now adults with kids.

That, I think is damn shame.

1973-77. AVTEX factory job was Union and paid very good with lots of overtime. At Truckstop was about $1 above minimum because I could do shift check and park truck I got a little more and got to be Assistant Foreman.

My father was foreman at AVTEX and made good money but paying for most of college meant he didn't get another car for 4 years and other things.

My first used Roadrunner was $700. First year my college rent was $10 a week for a rattly motel shared with 4 others and I made my rent back by doing work there.

I worked and didn't get in on all the college fun things and my parents didn't get to do things to pay for expenses.

My schooling got paid for, sacrifices were made, there were opportunity costs and things were done to get future benefits.

Inflation and rising costs are a problem for everybody. For example, my $700 Roadrunner if I still had it would be worth over $70,000

I don't like doing things the right way and paying my bills and seeing others getting away without paying what they borrowed back and that cost coming out of my taxes.

If I did not pay loans I took out Judgements would be made and my stuff repossessed. I want them treated that way.

We rescued the banks when they failed

We rescued the oil industry when Enron collapsed

We bail out businesses and other countries all the time.

With the national debt at 20 trillion we took the Bush tax surpluses $$ not once but twice.

Now there' s a class of people 43.2 million strong carrying 2 trillion in debt

and people "like us" are whining because 10% of those people might get 5% relief ?

Sorry, I appreciate where you are coming from, but until the government makes

student loans dischargeable in bankruptcy and levels the playing field, I won't agree.

All of that debt is hold back a good economy from becoming a great economy.

As pointed out in post 2.2.2, the debts may be wiped out in bankruptcy. Some efforts on the part of the defaulter may well be necessary, and it may not be easy.

People are free to donate or outright pay off someone else's student loans, but I don't see how ramming it up the taxpayer's ass is fair.

Amen.

If you take out a loan, pay it back.

Seems logical.

Where?

I don't know about all states, but there should be more affordable options than $100K tuition for the majority of people seeking a higher education.

How did we rescue the oil industry when Enron collapsed?

I remember a lot of Congressional investigations and some corporate leaders going to prison, should we do the same with Universities?

Maybe we need tuition reform and real transparency in costs. Perhaps schools should be financially responsible for loans that they encourage students to take. We need to protect students from predatory universities across the land.

Perhaps schools should be financially responsible for loans that they encourage students to take.

That's ridiculous - should Chase be responsible for the credit debt you run up or WalMart or Target

People need to own and repay their decisions on loans and other debts.

How did we rescue the oil industry when Enron collapsed?

We didn't

KEY TAKEAWAYS

What Was Enron? What Happened and Who Was Responsible (investopedia.com)

I see your point. Real competition between WalMart and Target is a curb on raising prices. Apparently there are no curbs on raising tuition/books/fees.

Availability of loans, grants, tiered pricing based on family finances seem to make it easy to raise rates.

Colleges charge more now for any number of reasons:

Tenured professors who may only teach two or three times a week while making large salaries.

Lavish accommodations for students.

Huge sports complexes.

Tons of curriculum programs that really don't prepare students for a decent paying job.

Administrative costs which skyrocketed and some colleges having an extravagant number of administrators compared to undergrads At Harvard, there are 2,600 more administrators than undergrads | The College Fix

Many universities have become more like all-inclusive resorts than focusing on education. A five year all inclusive resort vacation.

Like anything else, it will only change when people refuse to pay more than they should for the product.

I still support free two-year degrees at community college to give people an opportunity to pursue a profession instead of a piece of paper saying they attended classes for 4 years.

and answered at 2.2.28

Only a few percent can afford the extra steps, remember, they are already in the bankruptcy policy and remaining funds are divided between current creditors, ergo it is almost financially impossible.

just over 1% are discharged from bankruptcy.

So, the real fact is that student loans CAN be discharged in bankruptcy, as I stated and as stated in post 2.2.2 and as you just admitted, although your earlier post claimed otherwise.

People who take out loans should repay them.

According to the Bankruptcy codes, they cannot.

you first claimed they couldn't be discharged, then said 1% are discharged, now you are back to claiming they can't be.

which is It?

If 1% are, how is it being done?

“The vast majority of borrowers seeking discharge have received full or partial discharges,” according to the department. “In 99% of cases where courts have entered orders or judgments to date, the government recommended, and the court agreed to, a full discharge or partial discharge” of the borrower’s applicable federal student loan debt.“

Great news for the current administration. What happens during the next Administration if it isn't Biden.

Typical political speech?

So 99% of 632 is 625 cases out of 40.3 million.

Saying that's a remedy rings very, very hollow.

But thanks for finding that article

Albert Einstein Medical is in the news again.

I thought student loan debt could not be discharged in bankruptcy?

Sincerely, I don't know why you are directing the costs of medical college to me. I feel that anyone carrying a 3.5 grade average should have free college education.

I completely support free two-year college for anyone with a 3.0 average, maybe 2.5.

The issues, that I am seeing, are that people are either dropping out for various reasons or earning degrees that don't make them choice candidates for available jobs.

When I worked at Wally World headquarters, they were hiring college grads as hourly workers with little to no prospect of advancing into higher paying positions. Because I have not worked corporate jobs for close to 20 years, I don't know the current status of hiring college graduates for hourly wages.

This HAS to be more fake conservative news because we have been told that student loan debt can not be discharged in bankruptcy.

Yes it can if I remember correctly. You just have to jump through a couple extra hoops.

.

Oh, you and those far-right fascist "news" sites at it again!

if it can not be, then it simply can not be!

Isn't that the ultimate form of "loan forgiveness"?

While admirable who is going to pay for that?

The same ones who are footing the bill for Biden's "forgiveness" of legal debt.

Actually I addressed that as more liberal speak by the Biden Administration

They claim full or partial relief to 625 people out of the 40.3 million debtors with student loans.

Well, that is a pretty neat trick seeing as how you say that NO STUDENT LOANS can be discharged in bankruptcy, how did they manage it?

Did the Biden Admin break the law?

Like many stats, kind of meaningless.

What would be relevant would be the number who applied and then received relief.

https://www.investopedia.com/more-student-loan-borrowers-are-getting-debt-discharged-through-bankruptcy-8403729#:~:text=Key%20Takeaways,discharging%20student%20loan%20debt%20easier.

Not if structured correctly.

I would hope that our government would engineer a corporate sponorship program like many businesses currently have for their employees except this would involve a potential employee base.

I know I am probably expecting too much from a government that would rather spend trillions of dollars waging war rather than take care of our own citizens.

I can repost it for you if that helps; per the Forbes article

632 applied, 99% = 625 were granted some sort of unspecified relief.

They also had to already be enrolled in "SAVE" and on an income adjusted repayment plan for those who qualified.

Good to know, loans can be handled through bankruptcy!

If it had been free with a 3.0 average I would have done what it took to make that grade rather than pumping fuel into 18 wheelers in cold weather.

It would not have made a difference for me. I was a straight A student.

My homelife was such a mess that I quit school and got married at 17 to escape physical and mental abuse by my adoptive parents.

A year later, I got my GED. In 1980 - 81, I took computer accounting on a Pell Grant, but did not finish because my husband was transferred from TN to HI. I never explored further education opportunities on Oahu.

While employed at Wal-Mart, my department was given free courses on computer programs, communication and negotiation skills (which were required). I took every class Wal-Mart would pay for whether it was required or not. I don't have a degree, but I loved learning new things. Now I struggle to comprehend information that used to come so easily. This is why I usually post links and videos to information that I am not sure I am conveying accurately.

So those willing to put in the time and effort win the vast majority of time.

Sounds a whole lot different THAT way than 625 people out of the 40.3 million debtors with student loans.

Apparently a lot of borrowers just don’t want to be bothered with paperwork.

Might be too much work for people unwilling or incapable of paying their legal debts.

Where is the money to pay for this debt forgiveness coming from?

Biden might say it is forgiven but it is still owed somewhere.

The Magic Money Fairy delivery is expected any year now.

Check your wallet

and let them laugh at you

Student loan debt should not be able to be gotten out of in bankruptcy because they supposedly spent the loan money for knowledge and without hurting the person that can not be taken.

The knowledge they borrowed to obtain should have allowed them to make enough money to pay it back.

Interesting perspective thanks for sharing

Wonder how the people who went into the military for the educational benefits feel seeing some not having to pay their loans while they went off to war to get education?

In HS, my father and I argued about college. He wanted me to live at home and commute the first year and then, depending on my grades, perhaps transfer to a better state school for my sophomore year. I want to go out of state right away.

He said you’ll be 18 and can go wherever you can afford, I am just describing what I’ll pay for.

I then applied for a ROTC scholarship and didn’t tell him until I had to go for a military physical out of state. He put me on a Grayhound.

DotW

I had a somewhat similar conversation back in the day - my father had a rule, he called it the "Rule of 18" - at age 18, after graduating from high school (or not) his children had choices - (1) get a job, (2) get a job and go to college on their own dime, (3) go into the military or (4) just go.

I chose #3 and was able to get my college degree while on active duty (at night and on weekends when not deployed) - I didn't always work in the field of my degree, but I was glad to have it and very proud to have accomplished it (it took many more than four years to get it done).

And it was paid for when I reached out and accepted the diploma.

Working one's way through college, paying for it yourself, what a concept.

What student loans pay for by allowing universities to inflate tuition:

Administrators now outnumber students on some campuses, fulfilling the vital role of telling adults what are unacceptable lyrics and inappropriate clothing.