Trump Media's accounting firm has 100% deficiency rate from watchdog | Fortune

BY Lydia Beyoud, Nicola M. White, Amanda Iacone and Bloomberg

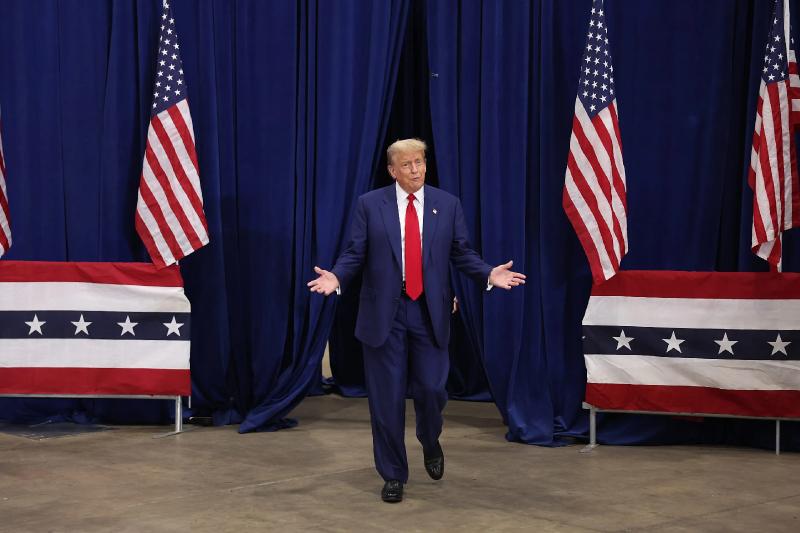

Donald Trump arrives for a rally on April 02 in Green Bay, Wisconsin. Scott Olson—Getty Images

Donald Trump's social-media company just became the most valuable publicly traded client of an accounting firm that has more experience auditing companies traded over-the-counter and has had a string of regulatory issues, including a 100% deficiency rate on audits reviewed by a US watchdog.

Trump Media & Technology Group Corp. said in recent regulatory filings that it will keep BF Borgers, a Lakewood, Colorado-based accounting firm, as its auditor after starting to trade publicly late last month. A Canadian regulator said last year that BF Borgers violated its rules for auditors, while the US's Public Company Accounting Oversight Board found multiple deficiencies in every audit it reviewed from the firm over the past two annual checks.

Closely held companies often retain audit firms after going public through mergers with blank-check companies. But most of BF Borgers's clients, such as Lingerie Fighting Championships Inc., a mixed martial arts league, are significantly smaller than Trump's media business. Its deficiency rate from the PCAOB was worse than the industry rate of 40% in 2022, and the December enforcement action from Canada's audit regulator prevents it from accepting new clients in that country until it makes certain improvements.

A representative for BF Borgers didn't respond to multiple requests for comment.

Trump Media said in a statement that articles about BF Borgers's record were partisan and "preemptively attacking our auditors before they've even begun their work for us as a public company."

TMTG has used the firm since 2022 as it sought to go public by merging with Digital World Acquisition Corp., a special purpose acquisition company. PCAOB inspections haven't yet covered BF Borgers's audits of Trump Media.

Read more: Trump Media Is Now the Most Expensive US Stock to Bet Against

Trump owns most of TMTG's stock, and its listing on the Nasdaq netted the former president a multibillion-dollar windfall. After a surge in its share price the company is now valued at roughly $5 billion. Shares in the company fell 10% to $36.52 at 1:04 p.m. in New York on Monday.

Audit Report Card

Small or foreign audit firms often have high deficiency rates, and are typically only examined every three years by PCAOB inspectors. However, BF Borgers is a prolific auditor with more frequent examinations. Last year, it ranked No. 8 on a list of audit firms with the most publicly traded clients, with just nine fewer clients than midtier firm BDO USA, according to research firm Ideagen Audit Analytics. Among the 10 busiest auditing firms, Withum Smith+Brown had an 80% deficiency rate and BDO had a 66% rate in 2022, according to the audit regulator.

About 84% of BF Borgers's clients were traded over-the-counter, meaning they don't meet the listing requirements of large exchanges. Less than 30 traded on either the Nasdaq or the New York Stock Exchange, according to Ideagen.

The PCAOB said that BF Borgers more than doubled its clients between 2019 and 2021. But the company didn't add more staff to handle the additional workload, the PCAOB said in an expanded inspection report, noting that just one person was responsible for 147 audits.

Deficiencies Found

Congress created the PCAOB to oversee the work of auditors and restore investor confidence in corporate accounting, tapping the Securities and Exchange Commission to appoint its members. The regulator's inspections look at a small sample of client audits. Theymeasure whether auditors had sufficient evidence to back up their assessments of companies' financial statements, providing a performance gauge for corporate directors and investors.

Negative findings from the regulator indicate flawed processes or technical violations of the board's rules.

The Washington-based audit regulator found problems with the firm's testing procedures for bedrock measures such as revenue and accounts receivable, among other issues.

In 2022, the PCAOB placed a two-year ban on one of BF Borgers' audit directors for failures on the audits of Chineseinvestors.com Inc., United Cannabis Corp. and China Pharma Holdings Inc. China Pharma's shares are down 99% in the past three years.

BWAHAHAHAHA...

I suspect the vast majority of Trump’s base has no understanding why this stock should be avoided.

So many will lose their shirts on this. They are likely buying this shit stock thinking they are investing in a sure thing because of Trump’s involvement. They likely do not know that Trump, unlike them, did not buy his shares and that the fundamentals of the company are that of penny stocks.

As of close yesterday the stock has already lost half it's value from it's start up high. I expect by the time Trump is able to access his shares in September it will worth pennies.

If you shorted Trump's stock big time on the margins when you called it you'd be rich today

Only about one week later!

T,G what you are missing is that Trump is such a brilliant businessman it is a sure thing for investors. Why people would not invest in it is beyond me....

Stop me before my head explodes.

IMO some people are making the assumption that Trump's MAGA crowd bought the stock because ithey felt they'd make money on it (because they think Trump is a genius)>

And I'm sure many did for that reason.

But I think its also possible that many don't care if they lose money-- rather than seeing it as an investment (as a way for them to make money) some people probably just looked at it as a way to "contribute" to Trump-- a way to donate $$$ that they don't care if they never see it again.

So whether or not they make money is irrelevant to some of these people.

Some certainly gave little thought to the downside and invested just because it is a Trump stock.

But if they really wanted to directly help Trump they already had campaign contributions.

I think most of them are operating on blind trust. An exercise of naivety, ignorance, and arguably stupidity. Not much of a stretch given that supporting Trump (talking about his MAGA base here) is based on blind trust.

Figures lie and liars figure.

... his entire worthless life has been a financial shell game.

Not hard to believe at all