When MAGA Meets Minsky

Laying the foundations for the next financial crisis

Even Krugman seems to balk at the simplest explanation for what Musk/Trump is doing.

Preparing America for crony kleptocracy on the model of Putin's Russia.

It's hard, for example, to see whose interests Trump is serving by trying to kill New York's congestion pricing scheme, which is already showing clear positive results, including a noticeable decline in traffic accidents. If you think he cares deeply about the relatively small number of people who commute into lower Manhattan by car (many of whom seem to like the policy!), I have a Melania coin you might want to buy.

This behavior may in part reflect the right-wing insistence, going back to Reagan, that government can never be a force for good, a doctrine right-wingers try to validate when they're in power. Part of it may reflect jealousy: Trump, and only Trump, is allowed to have policy successes.

But it's also surely part of the effort to flood the zone — to do so many bad things at the same time that it's hard to focus on any one outrage. And I'm sorry to say that this strategy often works. In a week in which Trump has firmly allied himself with Russian aggression while falsely claiming that millions of dead people receive Social Security, how many people noticed Tuesday's executive order that appears to be an effort to strip the Federal Reserve of its ability to oversee and regulate Wall Street?

This is, however, important. The Musk/Trump administration has been weakening financial regulation across the board. The Consumer Financial Protection Bureau, which aims to shield Americans from fraud, has been shut down. All of the agencies that try to supervise and regulate financial institutions, other than the Fed, are now being run by people hostile to the very idea of regulation. Cryptocurrency, which is rife with fraud and scams — indeed, the whole thing may be a scam — is now being actively promoted by the executive branch.

And all of this couldn't be happening at a worse moment. MAGA may well be laying the foundations for the next financial crisis.

Economists have known for a long time — more than 250 years — that financial institutions should be regulated. Libertarians often invoke Adam Smith's The Wealth of Nations for its advocacy of laissez-faire economic policies. But even Smith, who had witnessed the Panic of 1772 that hit Scotland, London and Amsterdam — arguably the first modern banking crisis — called for significant restrictions on banks,

The 21 st -century financial system is, of course, far more complex than that of the 18 th century, although there are some echoes. Notably, "stablecoins," crypto tokens that can supposedly be redeemed at will for actual dollars, are a lot like the privately issued bank notes of the 18 th and 19 th centuries, which could supposedly be redeemed at will for gold and silver coins. The main difference is that while bank notes were clearly useful for legitimate business, cryptocurrencies still don't seem to have any real use case other than money-laundering.

Did I mention that Howard Lutnick is now the Commerce Secretary? Lutnick has had close financial ties to Tether, which Bloomberg describes as

the stablecoin used by drug traffickers, terrorists and scammers to move money around the world.

And crypto aside, the complexity of modern finance makes it even harder for both consumers and investors to assess banking risks, so we need effective financial regulation to avoid or at least limit financial crises.

Yet the Musk/Trump administration is moving to loosen if not eviscerate financial regulation. And it's doing so at an especially dangerous time.

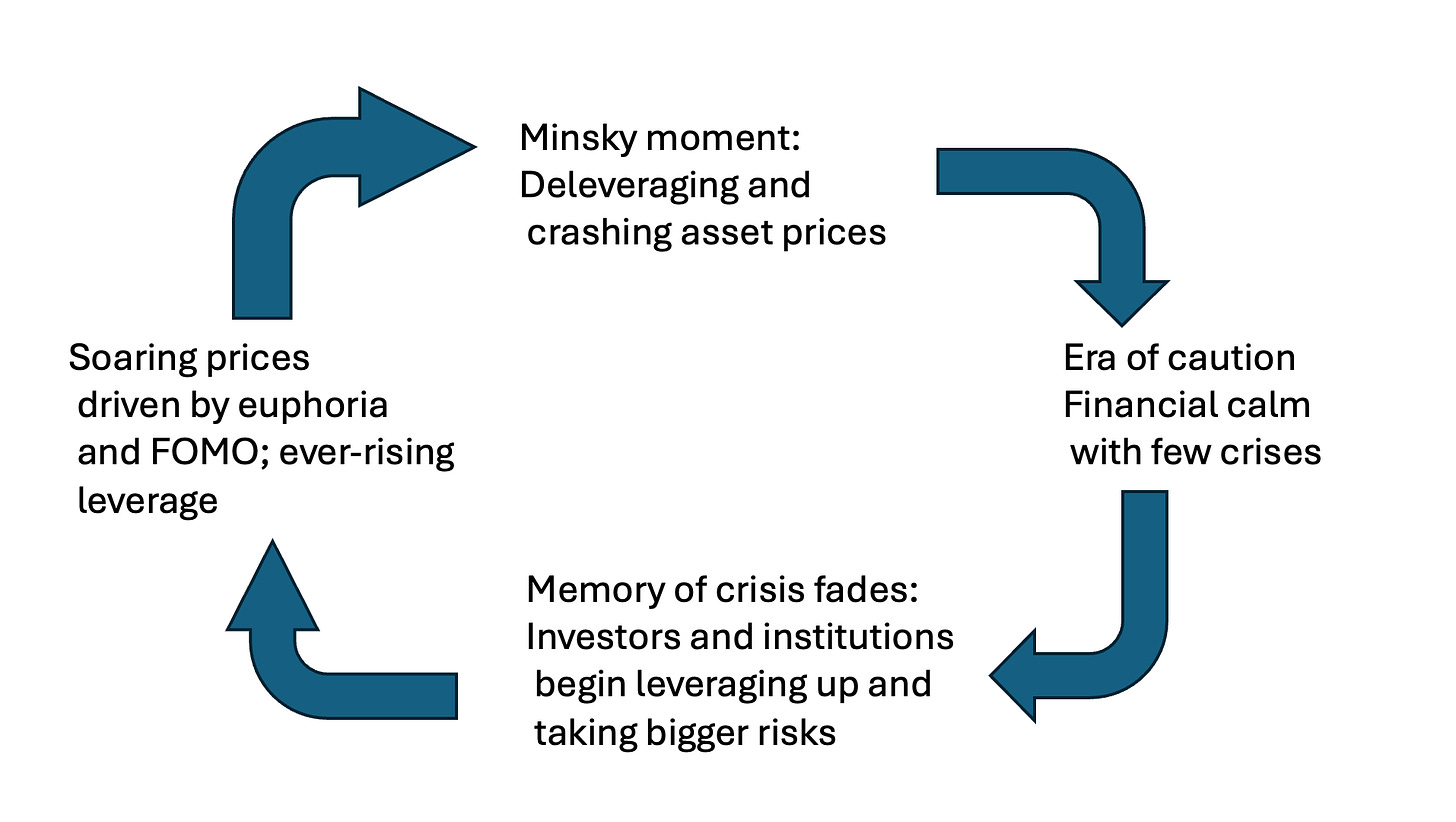

In the aftermath of the 2008 financial crisis I, like many economists, became a fan of Hyman Minsky's "financial instability hypothesis." At a time when many economists were arguing that financial markets are generally efficient in the sense that asset prices reflect the best information available, Minsky argued instead that they are driven by cycles of greed and fear. A Minsky cycle looks something like this:

In the aftermath of a financial crisis, investors are well aware that markets can go down as well as up. They are cautious about taking risks, and especially about leveraging up — investing with borrowed money. And as a result of this caution, financial markets are calm with relatively few crises.

Over time, however, memories of past disasters fade, in part because those who remember bad things retire or move on, replaced by younger traders who have never experienced a major crisis. This eventually produces markets in which prices seem to go in only one direction — up — and whoever is most willing to take leveraged risks wins. Even those who intellectually know better get sucked in because of FOMO: fear of missing out.

This manic phase doesn't just induce many people to take on risks they don't understand. It also creates what the famed investor James Chanos calls a "golden age of fraud." (I'll be posting a long talk with Chanos this weekend.) When it seems as if fortune favors the brave, con men or, sometimes, con women find it especially easy to attract suckers, especially if they can hang their promises on a narrative — say, the wonders of crypto or the limitless potential of AI.

The New York Times recently ran a heartbreaking story about how the president of a community-owned bank in Elkhart, Kansas fell for a crypto scam, destroying the bank and quite a few people's life savings in the process. You can be sure that we'll hear many more such stories once we reach the final stage of the cycle — the Minsky moment, when euphoria-driven asset price surges give way to fire sales as highly leveraged investors desperately try to raise cash.

Where do regulators fit into all of this? They can't completely eliminate the Minsky cycle, which is deeply rooted in human psychology. But they can dampen it and limit the damage when the Minsky moment arrives. Yale's Gary Gorton has shown that the extensive financial regulations introduced in the 1930s produced a 50-year "quiet period" in which there were plenty of stock market ups and downs — notably the "go-go years" of the 1960s followed by the very depressed market of the 1970s — but there weren't any serious banking crises.

But politicians are subject to the same mood swings as investors, so they tend to push regulators to loosen up precisely when they should be trying to rein in irrational exuberance. The Fed, which is somewhat insulated from politics and has a relatively long institutional memory — which has traditionally seen its role as being to take away the punch bowl just as the party really gets going (the original quote isn't quite that snappy, but never mind) — has historically been the main exception.

But now the Trump administration wants to cut the Fed out of the loop.

Most observers believe that when — not if — the reckoning comes, it won't be as bad as 2008. That's probably true. It doesn't look as if banks and quasi-banks are as exposed as they were back then, so there may be less disruption to the financial system. But one lesson from 2008 is that an ever-changing financial system sometimes creates risks that nobody realized were there until things fall apart.

Furthermore, a crisis doesn't have to be as bad as 2008 to be very bad indeed.

And let's not ignore the fact that if a crisis comes any time in the next few years, the Musk/Trump Administration will be in charge of handling the response. If that thought makes you feel confident, maybe you want to buy some more Melania coins?

Whatever

Plutocratic kleptocracy. America's future...