America's Growing Debt Mountain in 5 Charts

By: Jennifer Sor (Markets Insider)

Looks like Biden won't be bragging about Bidenomics much longer. Of course the problem with these analyses is that near term behavior is not a trend. The indicators look mighty troublesome but it's too early to tell if the train is only going to stall or fly off the tracks.

And there's not much Biden can do to prop up Bidenomics. The cost of deficits has risen through the roof.

- There's a storm of private and public debt troubles that's headed for the market.

- Warning signs have sprung up in rising credit card balances, delinquencies, and other indicators.

- Here are the signs that the US is dealing with troubles stemming from its mountain of debt.

A storm of public and private debt is brewing in the US - and the troubles are already beginning to show on the surface as loans pile up and borrower confidence falters.

At a broad level, Fitch Ratings' downgrade of the US credit rating and Moody's downgrade of 10 US banks this summer points to issues for both US sovereign credit (political polarization hampering the US's ability to meet debt obligations) and debt originated out of the banking sector (structural pressures stemming from tighter credit conditions and Fed policy).

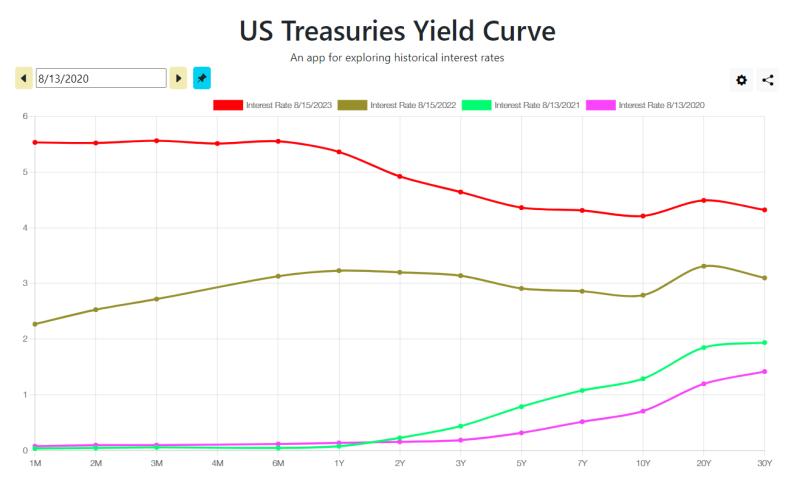

But there are more granular problems mounting across debt markets as well, as both private and public sectors face a drastically different environment than they did in the previous decade when interest rates were at historic lows coming out of the 2008 crisis. If low rates spurred the sugar rush of heavy borrowing, rising interest rates may be setting the stage for the sugar crash.

This was on full display earlier this year as Silicon Valley Bank imploded, driven by mismanagement of its balance sheet which was weighed down by a bond portfolio that was rapidly depreciating as interest rates climbed. SVB, Signature Bank, and First Republic all fell in quick succession.

The fallout from that event was relatively contained, but that hasn't stopped market pundits and investing icons from sounding the alarm on high debt levels in the era of rising rates. Hedge fund legend Ray Dalio and top economist Nouriel Roubini are among those who have warned a full-blown debt crisis could be on the way.

Here are five charts that point to the warning signs flashing in US debt markets.

1. Private debt levels are rising at a staggering pace

Private debt levels are building fast, and hit new records this year. Credit card debt just passed $1 trillion for the first time ever, according to Federal Reserve data.

Credit card debt hit $1 trillion for the first time ever. DataTrek Research

Personal unsecured loans also hit a new record, notching an unprecedented $225 billion in 2023, according to TransUnion. Ditto for corporate debt, which saw volumes grow 6.2% over the last year to hit $7.8 trillion, per Janus Henderson.

The public debt picture looks even worse. The national debt balance blew past $32 trillion for first time this year, with the potential for $5 billion to be added each day for the next 10 years, according to Bank of America.

Federal Reserve

2. Corporate defaults are surging

Companies have begun to buckle under their debt burdens as rates rise, with the volume of defaults among US companies in 2023 already surpassing last year's total. 55 US firms defaulted on their debt in the first six months of the year - a 53% increase from the 36 companies that defaulted in 2022, Moody's Investors Service data shows.

Up to $1 trillion of corporate debt could default if the US faces a full-blown recession, Bank of America strategists warned, though the bank no longer sees a recession as likely in 2023.

3. Late payments are piling up

People and companies are increasingly falling behind on their loan payments.

In the commercial real estate sector, the percentage of commercial property owners that were late on payment for 30 days or more-or have already defaulted on their mortgages-rose to 3% in the first quarter this year, according to data from the Mortgage Bankers Association, reversing a preexisting downward trend. This is reflected in the rising rate of delinquencies on loans securing commercial mortgage bonds, which have been on the rise this year.

The delinquency rate for commercial property owners rose to 3% in the first quarter of 2023. Mortgage Bankers Association

Meanwhile, the delinquency rate for all personal loans rose to 2.23% in the first quarter this year, up from just 1.7% in the first quarter of 2021, Fed data shows.

The delinquency for all personal loans rose to 2.23% this year. Federal Reserve

4. Banks want to dump risky debt

Banks are already trying to dump loans that have a greater risk of default, even if it means selling those assets at a discount. JPMorgan, Goldman Sachs, and Capital One are among those on Wall Street who are trying to get rid of large commercial real estate assets, Bloomberg reported this week.

Banks are also pulling back on debt-dealing altogether as financial conditions tighten. That spells trouble for the commercial real estate industry, as there's around $1.5 trillion of CRE debt that's set to reach maturity in the coming years, and will need to be refinanced.

Property owners could run into trouble when they go to refinance their mortgages as rates are higher and property valuations have been falling. A wave of commercial mortgage defaults could be on the horizon, according to some veteran investors, and banks have already started to rein in lending activity after the spasm of bank failures earlier this year sparked a brief banking crisis.

Earlier this year, Morgan Stanley noted that the credit crunch had arrived as banks recorded the sharpest decline in lending on record.

Banks pulled back on lending the most they have on record. Federal Reserve

The national debt in 2008 was $10 trillion. Today the national debt stands at over $32 trillion. Only three Presidents (Obama, Trump, and Biden) are responsible for two thirds of the national debt. And Biden certainly isn't doing anything to slow growth of the national debt.

Expect a lot of noise about the need to cut Social Security. But SoSec isn't what is driving the increases in national debt. The debt has gotten so large that taxing the rich and cutting SoSec won't solve the problem any longer. That's thanks to Bidenomics.

Back here in reality, Bill Clinton passed off a big budget surplus to Bush Jr which he and the gop blew up with all of their irresponsible tax cuts, unfunded foreign wars, military and stimulus spending which resulted in The Great Recession!

Back here in reality, Bill Clinton passed off a big budget surplus to Bush Jr

Yes between a tax increase and a spending decrease, deficits were controlled. He also re-appointed Greenspan. He also benefited from the luck of timing. The internet invented by Al Gore was exploited by business for a decade of productivity growth. Also OPEC had problems and oil prices fell.

In March 21, weeks after Bush entered office, the economy went into recession.

Because it was all creative accounting............short memories abound with some but they know what they are fed.

The reality is that the Federal debt increased from $10 trillion to $32 trillion under three Presidents; Obama, Trump, and Biden.

The first 43 Presidents are responsible for $10 trillion of the national debt. The last three Presidents are responsible for an additional $22 trillion in national debt. Obama's and Biden's contributions to the national debt weren't caused by tax cuts.

Trump has been blamed for adding $7 trillion to the national debt. But that means Obama and Biden are responsible for adding $15 trillion to the national debt.

No, because of voodoo economics and the misguided tax policies passed by the gop which resulted in huge deficits...

Clinton was forced to the middle by Congress and benefited greatly in that regard on this topic. Left to his own devices it likely wouldn’t have happened. Certainly not like it did when he was for forced to the middle.

How fast my friends on the left forget.

You’re too young to understand the stagflation and the economic hole Reaganomics brought us out of. I on the other hands remember 18% mortgage rates, high unemployment rate and record low disposable income.

Younger generations have experienced nothing like it. Even under Biden.

It's just asinine people now pretend the 70s was some sort of economic golden era because of some sort of compulsion to attack Reagan.

Obama and Brandon are now GOP?

Hillarycare alone would have killed it.

Yep, I remember but let’s see.

That was probably Bush 1’s fault

I know.

Obtuse as hell.

The article is actually about private debt. That is indeed a looming problem.

Recent Presidents (notably Democrats) have solved private debt problems by nationalizing that private debt. Government bailouts and debt relief means private debt becomes a national debt problem.

My take is that the article is trying to prime the pump for another government bailout. But government debt ain't cheap any longer so a bailout would be much more costly.

Definitely a possibility.

Received this link in an email from Forbes this morning.

and this information in another email from Forbes.....

Skyrocketing debt costs and trillions in unfunded liabilities for entitlement programs that will start coming due in the next decade. Rough seas ahead.

But better not talk about doing something..

Problem is, no politician will grow a pair and push not kicking the can even further down the road. Meanwhile the younger generations complain about the mess but keep electing people who will make it worse and ask for more. Free college, etc.

It’s a death spiral …..

This is the NewsTalkers!

It's very exciting!

Maybe you didn’t read it. The seed is about both private and public debt.

Now... re-read your article. Observe the text concerned with public debt. Observe the text concerned with private debt.

Yes, both are included in the seed. Not sure how you missed it the first time.

The article lays out information and facts that indicate growing problems concerning debt in the private sector. But the article does not propose any remedies to address those growing problems. The author of the article is relying on the reader's understanding of economics to understand the significance of the problems and risks. What is the private sector going to do to address those growing problems?

The private sector will address the problems of too much debt, late payments, and defaults by simply shutting down access to credit. Interest rates on available credit will increase to mitigate the risks of default. The economy will contract because our modern economy has been erected on a foundation of credit.

Is the Federal Reserve in the private sector or the public sector? Who regulates bank lending and bank exposure to risk? Who sets interest rates and how do they do that? Who manages access to credit and the cost of credit in our economy? Who is responsible for managing a recession and recovery from recession?

The article may be highlighting problems associated with private debt but in our modern (neoliberal) economy only the government can remedy those private sector problems. Is the government still capable of remedying credit problems in the private sector? In the recent past, the government nationalized private debt because the cost of government debt was very low. Can the government afford to do that now? Or will the tax burden to service the national debt become a drag on the economy?