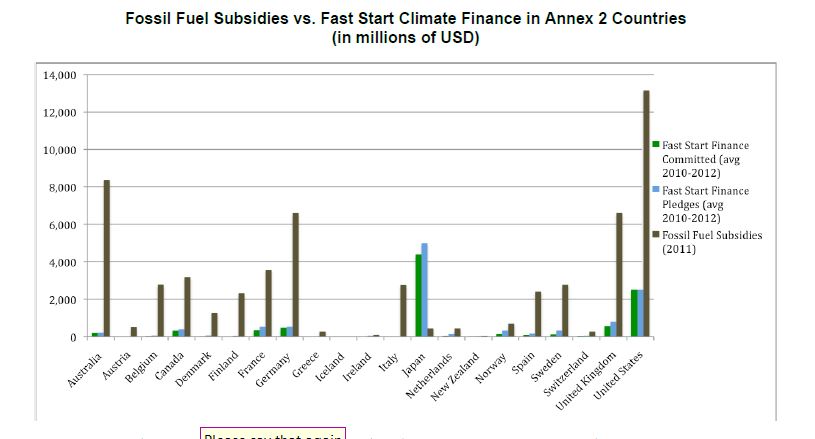

It is understandable that some countries may still need to subsidize fossil fuel companies, but fossil fuel companies receive about six times as much in subsidies as sustainable energy sources. The International Energy Agency reports that subsidies to oil companies in developing countries could reach as much as $630 billion in 2012, with those in developed countries adding about $58 billion. Below is a breakdown of the subsidies in developed countries along with the amount of money they have committed to help develop the worlds sustainable energy resources.

The United States yearly subsidies to the fossil fuel industries amounts to about $13.6 billion. As Washington struggles to balance the U.S. budget, that is certainly one of the cuts that should be considered. The Institute for Policy Integrity lists links to laws giving tax breaks to energy companies. It lists 38 for the fossil fuel industries, 25 for all the renewable energy sources together , and one break for nuclear power. While it is the national interest to subsidize sustainable fuels, a much larger share of tax breaks go to well established and profitable energy companies. But thats not the whole story.

Some of the tax breaks and subsidies meant to promote the development of renewable energy sources end up with the fossil fuel companies. For example, the Georgia Pacific paper company, a subsidiary of Koch oil, mixes a byproduct of paper production, called black liquor, with diesel to make a product they call biofuel. This fuel cannot be used in transportation, and can only be burned as fuel in their plants. However, Koch has somehow managed to qualify the black liquor mixture to take advantage of the biomass fuel assistance program and has received $5 billion in subsidies for the process. Though Koch is on the record as being against green energy, funds meant for green energy projects are subsidizing the fuel for Kochs paper mills. Congress tried to close this loophole, but the effort was ultimately defeated.

The fossil fuel companies have become so large and so adept at lobbying, that they often distort U.S. policies for their own benefit. For instance, Exxon pays a lower tax rate than the average American . Between 2008-2010, Exxon Mobil registered an average 17.6 percent federal effective corporate tax rate, while the average American paid a higher rate of 20.4 percent. In spite of that, the company complains about its high taxation and is currently running ads against the Obama administrations efforts to cut $36 billion in tax loopholes and subsidies to help balance the budget. Large oil companies are now multinational companies which have little allegiance to the United States. According to a Mother Jones article, Exxon has 20 wholly owned subsidiaries domiciled in the Bahamas, Bermuda and the Cayman Islands that (legally) shelter the cash flow from operations in the likes of Angola, Azerbaijan and Abu Dhabi. Of the $15 billion in income taxes it paid in 2009, Exxon paid none of it to the United States , and it has tens of billions in earnings permanently reinvested overseas. We should ask why our government is providing subsidies and tax breaks to companies that have little legitimate need for them and apparently little allegiance to the United States.