Florida Housing Market Rocked by Insurance Crisis, Inflation Woes

By: Giulia Carbonaro (Newsweek)

NewsCrisisInflationFloridaHousing

It's not a great time to be a homeowner in Florida—and things are even worse for aspiring homebuyers. The Sunshine State has experienced an exodus of property insurance companies which has left both homeowners and homebuyers facing likely higher costs while lingering high inflation gives them no respite.

Earlier this month, Farmers Insurance announced it was pulling out of the state, stating that it will discontinue new coverage of home policies, among others.

It was the fourth major insurer to announce leaving Florida in the past year, with most saying they were doing so because of the increased risk posed by hurricanes and other extreme weather events, which have become more common or more severe due to climate change.

They aren't baseless concerns either: at least six insurance companies went insolvent in the state last year, according to the Associated Press.

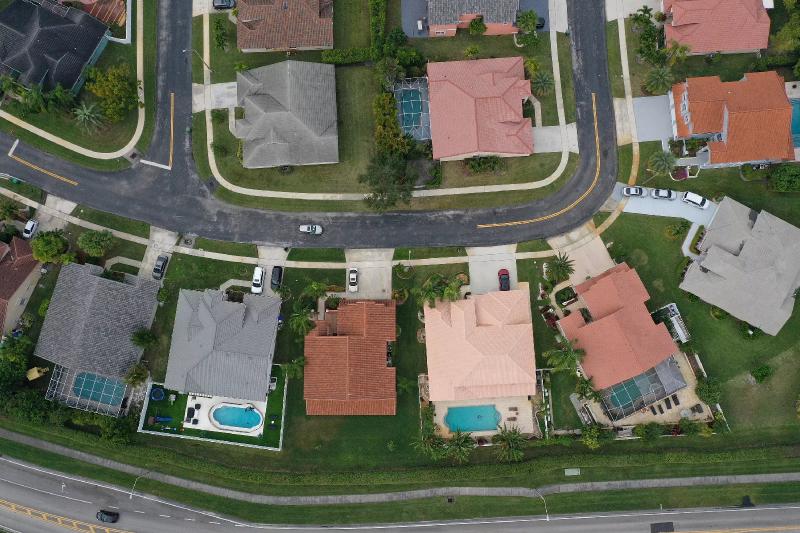

In an aerial view, homes sit on lots in a neighborhood on January 26, 2023, in Boca Raton, Florida. has experienced an exodus of property insurance companies which has left both homeowners and homebuyers facing likely higher costs while lingering high inflation gives them no respite.Joe Raedle/Getty Images

Exodus of Insurance Companies

Farmers' announcement exacerbated the unfolding insurance crisis in the state, which experts say is likely to put significant pressure on homeowners and homebuyers—in addition to high inflation.

"The rising risk of property damage due to hurricanes as well as high inflation is putting financial pressure on insurance companies and homeowners," Cristian deRitis, deputy chief economist at the financial intelligence firm Moody's Analytics, told Newsweek.

"Greater frequency and intensity of storms are causing annual insurance premiums to rise. In addition, higher costs for building materials and increasing wages for construction workers are putting upward pressure on the premiums needed to cover insured losses."

Florida has become the country's inflation hotspot, with more than 2.5 million residents of the Miami-Fort Lauderdale-West Palm Beach area living with a 9 percent inflation rate for the 12 months ending in April, according to new data from the Bureau of Labor Statistics cited by CNN.

The U.S. annual core inflation rate for the 12 months ending in June was 4.8 percent, while in May it was 5.3 percent, according to a BLS report. The high inflation in Florida, due to the influx of people to the state in recent years—including remote workers and retirees—and its growing population, has been pushing up home prices which are now expected to be impacted by the insurance crisis.

Jeff Tucker, senior economist at real estate company Zillow, said that "the withdrawal of insurance companies from Florida means fewer options for insurance for residents." Tucker said this "will most likely raise the cost of insurance, further pushing up the total cost of homeownership in the state."

"Buyers are now going to have to factor in increasing rates when it comes to their monthly payments," Lisa Hill, President of Orlando Regional REALTOR Association, told Newsweek.

"For example, if a buyer was looking at paying about $150 a month for homeowners insurance, they should now factor in closer to $400 of their budget to account for those rising costs. While I think we'll keep seeing a steady stream of home sales throughout Central Florida, buyers will need to rethink their budget."

A woman walks past a closed shop in Miami, Florida on January 12, 2022. Florida has become the country's inflation hotspot.CHANDAN KHANNA/AFP via Getty Images

The impact could be felt by Florida homeowners and homebuyers in the long term.

Moody's Analytics expects home prices in Florida to fall or grow more slowly than they otherwise would as homebuyers consider this additional expense. "Along with higher premiums, homeowners will face rising costs to harden their homes against future storms," deRitis said. "This will add to the total user cost of housing and further limit home price growth."

Tucker believes that "in the long run, if enough insurers pull out, it could seriously diminish the ability of buyers to obtain mortgages or have the confidence to buy a home in Florida."

The Zillow economist said that, at least for now, demand to buy in Florida has remained "very strong, in spite of having fewer options for home insurance"—a positive indicator that the housing market in the state is not falling apart.

Christopher Grimes, senior director at the finance and insurance company Fitch Ratings, said that Florida "remains a desirable place to live and the demand for housing has remained strong," but "the realities of the rising cost of living is becoming increasingly challenging."

What Can Homebuyers Do?

In addition to property insurance companies leaving the state amid high inflation, insurance premiums in Florida have reportedly surged by over 200 percent since Ron DeSantis won the governor's office in 2018.

Florida homeowners pay an average of more than $4,200 per year for home insurance, triple the national average of $1,700, according to data from the Insurance Information Institute (Triple I).

The high premiums are likely to put even more pressure on the Florida governor to fix the insurance crisis in the state, with many already blaming him for failing to shore up the volatile market.

But what can Florida homebuyers and homeowners do to navigate this increasingly complex scenario?

While securing insurance coverage in Florida might have become a little more challenging, James Eck, vice president and senior credit officer at Moody's Investors Service, says struggling homeowners have options.

"A number of states along the Atlantic and Gulf coasts, including Florida, have state-sponsored insurance plans that serve as insurers of last resort," he told Newsweek.

"Additionally, since mortgage lenders require borrowers to have homeowner's insurance on the mortgaged property, if the policy lapses or is canceled, the lender will purchase an insurance policy on the customer's behalf, in what is known as 'lender-placed' coverage."

This kind of state-sponsored insurance plans and lender-placed coverage often have higher premiums and more restrictive coverages than what is typically available in the private market, Eck said.

"To the extent traditional insurers decline to write policies in these high-risk areas, the additional costs associated with more expensive insurance options could negatively impact home prices, as buyers would have to factor in higher insurance costs just as they would other recurring expenses, such as servicing mortgage debts and paying property taxes."

Read more

- Florida insurance crisis explained: Why multiple insurers are leaving state

- Florida insurance crisis sparks fears for housing market

- Ron DeSantis suffers another tough week

Trolling, taunting, spamming, and off topic comments may be removed at the discretion of group mods. NT members that vote up their own comments, repeat comments, or continue to disrupt the conversation risk having all of their comments deleted. Please remember to quote the person(s) to whom you are replying to preserve continuity of this seed. Any use of the phrase "Trump Derangement Syndrome" or the TDS acronym in a comment will be deleted.

To add to the misery of home insurance a few days ago AAA will no longer renew existing policies.

Florida has just gained the number-one spot in the country for the highest Auto insurance rates.

But our politicans are much more interested in banning ''woke'' than items that are really hurting Florida.

My son was having a difficult time last year because of the increase cost of insurance. He's now in the process of selling his house. I hope it goes well for him

I wonder which state duhsantis will flee to when his term is over...

Probably Alabama, he and Tommy Tuberville will make a great pair.

I don't know about that. tuberville is old school kkk and they hate mediterranean mackerel snappers too ...

I'm sure that the military stationed in any of the five military facilities in Alabama are overjoyed with Tuberville and his white nationalist BS. /s

That was sarcasm, right?

Yes, I forgot to insert the sarcasm sign. It's there now.

I'm sure a few of those MENSA candidates you have in the FL legislature will cook up a plot for a state backed insurance plan administrated by one of their donor cronies for profit. Years from now they'll find it full of corruption and self dealing at the expense of policy holders.

We have one already, it's named Citizens Insurance and is the insurer of last resort. In Florida, if the policy premiums don't cover the cost they are allowed to hit the existing policy holders from other insurance companies with payment to keep them afloat.

How long will it be before Citizens Ins is the only choice?

At the rate we are losing insurance companies, it could be very soon.

Sorry to hear that, Trout. It is happening to a lot of people add to that the inflation and the price of auto insurance it's getting impossible for a family to survive here.

Yet Florida Governor Ron DeSantis is in South Carolina campaigning for President blaming all of Florida's problems on, "Woke Mind Virus"...

WTAF?

The only virus we have in Florida is him.