The Brass Tax, The Tax Debate

Do you support Tax cuts? Are you Opposed to Tax Cuts?

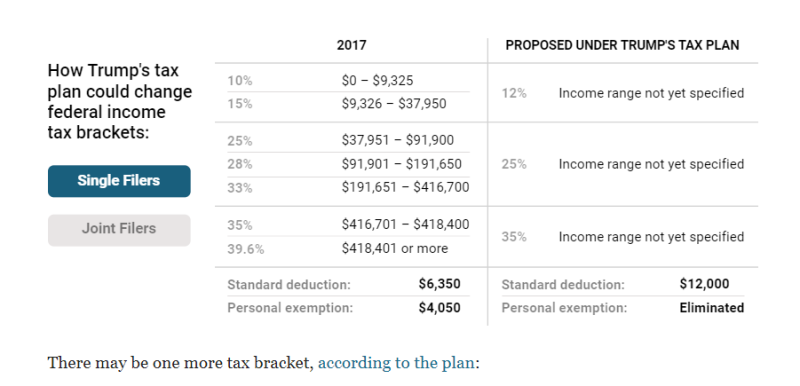

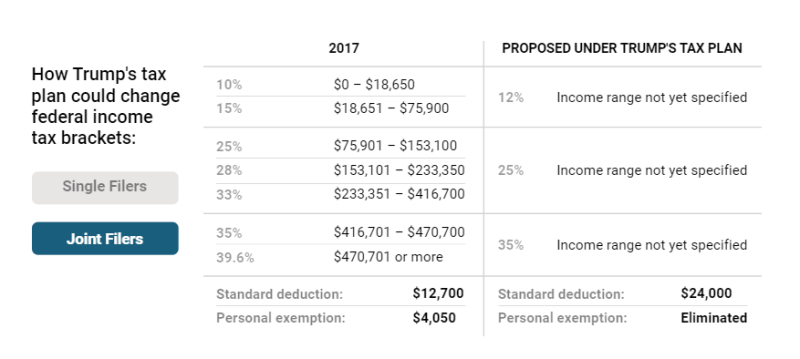

Below you will find what we know about the Trump Tax Plan Vs the current Tax structure.

Charts

http://www.businessinsider.com/tax-brackets-trump-tax-plan-chart-2017-9

Let's try to have an actual discussion about the pros and cons of tax cuts specific to our current tax structure and the proposed tax structure.

Most reports state the Estate tax will be eliminated and the 401k will continue as it is.

I'd like to see taxes lowered, between State and Federal (N.Y. is pretty heavily taxed). I do believe more money in pocket is more money eventually spent, generating additional tax revenue. I believe more spending drives industry and that hires more people, once again, driving more tax revenue. Currently the middle class is squeezed.

So far it doesn't sound to good to me and I still keep my adage that it is nothing but a tax break for corporations and wealthy. Of course it almost sounds like a 'pass it to see whats in it' kind of deal.

I have also heard that now they want four tax brackets instead of three, one for the very well off.

I guess we will all see soon enough as it will most likely pass.

Based on the information that is available, I would end up paying a higher amount in federal taxes. So I not in favor of this so called ''tax cut''.

Trump's shiny tax cut plan has a $1.5 trillion problem

Relying on growth to cover lost revenue is a crock. It will never come to fruition.

You cannot increase spending and decrease taxes. It doesn't work, it never has and it never will. But here we are again with a republican president claiming that is exactly what we should do. Trump has proposed that we decrease the federal income by 60%, that's a BIG number and those of us wanting lower taxes, (and who doesn't), think that is great, but here is the rub....he also wants to INCREASE spending by 55%. Nukes, the military, his wall??? Those fund have to come from somewhere....but he wants to decrease the income by 60%.... Get it?

.

For the last 8 years, we have heard the fiscal conservatives whine and cry that Obama increased the debt.... Where are the fiscal conservatives now? Hey, if you thought Obama increased the debt? You ain't seen nothing yet... Historically republicans ALWAYS increase the debt more than dems do...

Those who pay the most taxes are The Biggest Winners under our system. I wish I paid more taxes than Warren Buffett, T. Boone Pickens, Mark Zuckerberg and Bill Gates Combined. Not paying taxes means one is poor. The working poor pay a higher total percentage of their incomes in taxes than most really rich folks due including local, city and state taxes plus Social Security, Medicaid and other inbedded taxes. Any contention that the poor and middle classes are not paying their fair share of taxes is bunk. When the top 1% owns 99% of all our wealth things are already out of whack. Cutting taxes on corporations and the wealthy just means that more of our tax burden is shifted to the poor and middle classes. It you want to get rich you have got to pay your fair share, too...

For !!!!!!