Chinese Consumers Now Rule the World. Get Used to It

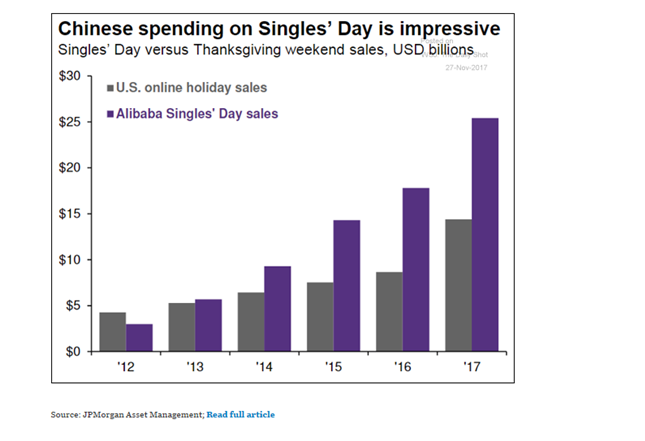

It's no longer the "world's factory" as Singles' Day blows away Black Friday.

It’s way past time to stop calling China the world’s factory.

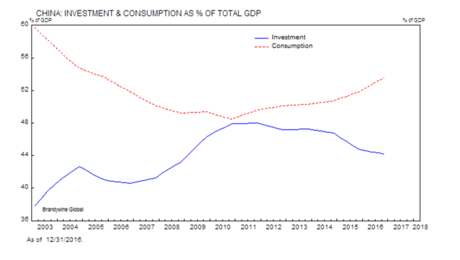

The country is increasingly the world’s consumer. Forget the old investment and export-focused growth model. Even more important is the changing nature of consumption, which no longer revolve around staples: Increasing sums are being plowed into movies, tourism and health care. Investors ignore this seismic shift at their peril.

Moving away from exports.

Moving away from exports.

Qilai Shen/Bloomberg

Chart 1

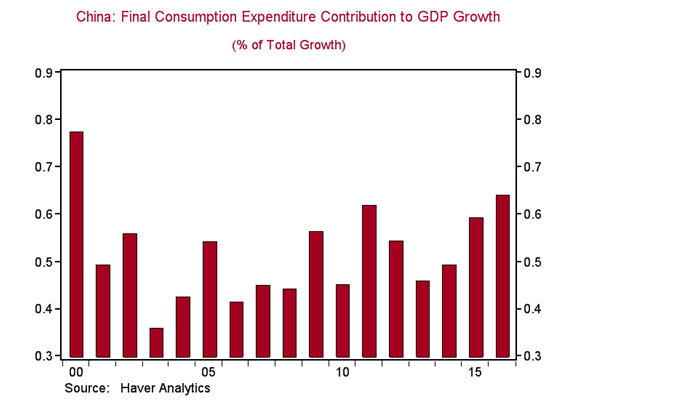

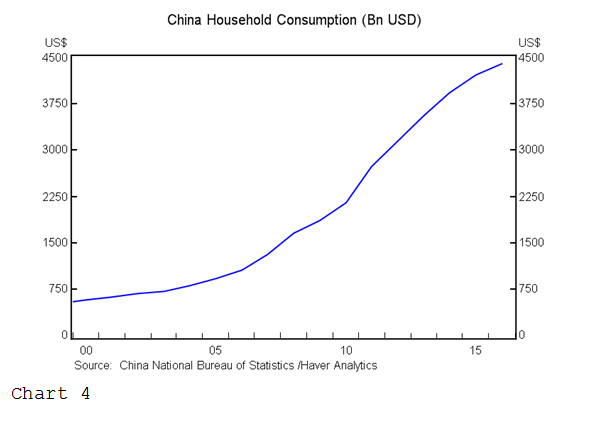

According to the latest official data, China’s final consumption accounted for 63.4 percent of gross domestic product (Chart 2). Household consumption experienced exponential growth and climbed to $4.5 trillion (Chart 3). Retails sales have been growing at healthy pace of about 10 percent. Spending on Singles’ Day this year (Nov. 11), is impressive, registering $25 billion, almost double U.S. Black Friday online sales of $14 billion (Chart 4).

Chart 2

Chart 3

Chart 4

The details are revealing. Chinese consumers are becoming older and richer, generating an upgrade in the products they purchase.

First, there has already been a shift from necessities to choice goods. Apparel and staple foods are declining as a share of consumption, while health and green foods, smartphones and tablets, sporting goods and equipment, trendy and personalized household products, vehicles, and beauty products account for increasing shares of the pie.

Second, low-end mass products are out and high-end premium brands are in. Chinese favor foreign brands, due to a lack of trust in domestic products that are prone to counterfeiting or knockoffs. They regard expensive foreign brands as a symbol of wealth and social status.

And third, consumers will spend less on a relative basis on physical goods and more on experiences and services, including health care, box office, education, concerts, gyms, financial planning and tourism (both domestic and overseas). Chinese are traveling abroad more often, benefiting not only many peripheral Asian countries, but developed countries like Australia, the U.S., Canada, New Zealand and European Union members.

All of this will increasingly take place via omni-channel shopping, including mobile, online and offline shopping. The recent fast adoption of internet and mobile-phone technology leapfrogged some developed countries. Shoppers attach great importance to comparing prices, reading reviews and relying more on recommendations from social media, thanks to a lack of trust in merchants. They are also more demanding and require more hand-holding.

As China’s expansion increasingly depends on consumption, its growth will be not only more internally driven, but also less resource- and credit-intensive. Imports of premium goods and services will increase. This market will be more and more attractive to multinational firms and investors.

One significant byproduct: China’s politically-sensitive trade surplus will continue to shrink and the current account surplus, the broadest measure of capital flows, might contract even more. This, in turn, may exert downward pressure on the yuan.

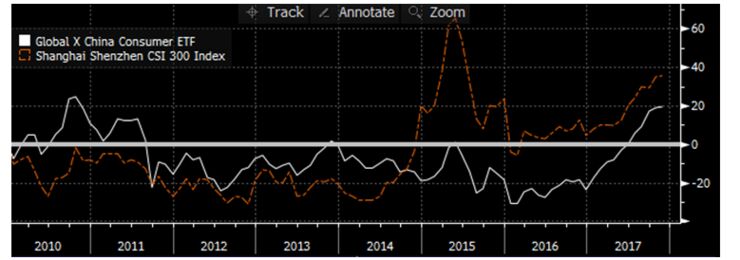

These trends are in their infancy. There is plenty of room to run, especially as China’s population becomes even more urbanized. As the outperformance of the Global X China Consumer ETF shows, investors buy this story.

Chart 5

=============================

by Tracy Chen

There may be links in the Original Article that have not been reproduced here.

For the many on NT who hold to outdated notions about China...

It should be pretty obvious that I don't hold outdated notions about China, and I think the article is pretty well correct.

I most certainly was NOT thinking of you, Buzz!

I just reread my comment and realized why you may have thought that. I just worded it that way to make it emphatic, not accusatory. Your interpretation never crossed my mind. I know you're one of a limited number on NT who are capable of having multiple interests.