Layoffs Arrive in Brexit Britain, and Auto Workers Are Up First

In his 50 years working in Britain’s car industry, John Cooper has survived plenty of upheavals. None is scarier than the prospect of Brexit.

Being split off from their biggest market means the job cuts and production slowdown U.K. carmakers have imposed the past few months could be just a prelude to wholesale shutdowns.

Photographer: Simon Dawson/Bloomber

Photographer: Simon Dawson/Bloomber

The shock is only beginning to hit. Since October, 650 of Cooper’s colleagues have lost their jobs at the factory where Vauxhall Motors churns out Astra hatchbacks. The remaining 1,200 staff worry the plant may close if the U.K. loses tariff-free access to Europe. Across the River Mersey from Vauxhall’s factory, Jaguar Land Rover is planning production cuts.

“People shouldn’t underestimate the dangers that Brexit’s bringing,” Cooper, a union representative, said outside the sprawling factory in the town of Ellesmere Port, near Liverpool, where he’s worked since he was 18. “Why would Nissan continue to invest in the north east when it’s got a plant in Spain where it can build the same car without a 10 percent tariff?”

If Prime Minister Theresa May gets her way, by next year Britain will start severing ties with the bloc after a transition period, including quitting the customs union it’s been part of since 1973. Whether duties are imposed after that is still up in the air as London and Brussels wrangle over the terms of their divorce.

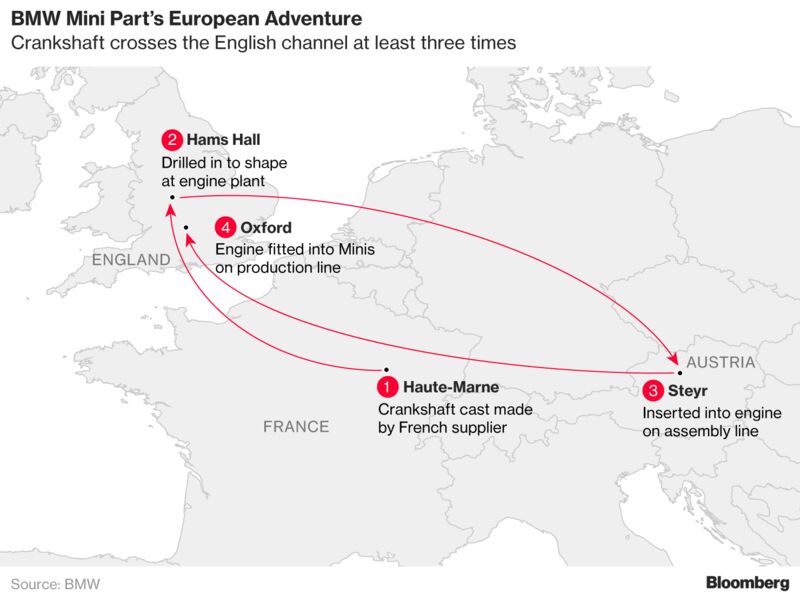

Tariffs and other hurdles to trade could be disastrous for the automotive industry since parts routinely move across borders several times during the manufacturing process. Take the BMW Mini, manufactured in Oxford. Before reaching the production line, each engine crankshaft is made in France, shipped to BMW’s U.K. engine plant in Hams Hall near Birmingham and then to Steyr, Austria for assembly.

The fate of the Vauxhall plant depends on whether its French parent company, PSA Group, decides to build the next Astra, a 2021 model, there. PSA, which bought Vauxhall from General Motors Co. last summer, has other options: it designs Peugeots and Citroens in France and Opels in Germany and could ship those to Britain with Astra logos.

Foreseeing these risks, Cooper had ardently campaigned against Brexit by canvassing workers at the plant, yet the leave vote still prevailed in the neighboring area—along with most of the other towns where U.K. carmakers operate factories.

Peter Southwood

Peter Southwood

Matthew Lloyd/Bloomberg

“It’s hard to see how anybody could sanely vote for anything that would make the business more difficult,” said Peter Southwood, 44, who’s worked at Vauxhall for 21 years. “They see the cars coming down the line, they see how many are going abroad, they see where the parts come from.”

Southwood’s grandfather and two uncles worked at Ellesmere Port and he hopes his son or daughter might uphold the tradition. But, Brexit or not, employment in Britain’s automobile industry isn’t what it used to be. In the heyday of the 1970s, 12,500 people worked at the Vauxhall plant. Headcount has since fallen 90 percent, largely due to automation.

The EU departure is dealing the industry an additional blow just as it scrambles to adjust to the transition into electric cars and government plans to phase out gas and diesel engines in the coming two decades. After touching a record in 2016, U.K. car sales suffered their biggest annual decline since 2009 last year as Brexit and the Volkswagen diesel emissions scandal tarnished buyer confidence.

The cost of assembling a car in Britain could increase by 2,372 pounds ($3,337) under a so-called Hard Brexit, where a 10 percent tariff is imposed, according to estimates of London-based PA Consulting. Plant closures are most likely at Japanese-owned Honda Motor Co. and Toyota Motor Corp. since they export most of the cars they make in Britain, it said.

Foreign companies won’t stay “if there is no profitability of continuing operations in the U.K.,” Japan’s ambassador to the U.K., Koji Tsuruoka, said in an interview carried by BBC News this month. “It’s as simple as that. These are high stakes that I think all of us need to keep in mind.”

It will probably be too risky for both sides to let negotiations fall apart without a deal that allows goods to move between borders with few or no tariffs, according to Tim Lawrence, head of manufacturing at PA Consulting. “Britain is Europe’s second-biggest car market and it’s hugely important for EU companies like the German premium manufacturers,” he said.

But talks on trade haven’t even started—and the EU doesn’t expect a full detailed trade deal to be completed until after the U.K. has left.

In and around Ellesmere Port, a nerve center for the industry, workers are understandably anxious.

An Astra hatchback automobile sits in the lot at the Vauxhall Motors plant in Ellesmere Port.

An Astra hatchback automobile sits in the lot at the Vauxhall Motors plant in Ellesmere Port.

Matthew Lloyd/Bloomberg

On a snowy day this month outside Jaguar’s Halewood plant where it makes Range Rover Evoque and Land Rover Discovery Sport SUVs, several workers wearing green sweaters and trousers bearing the signature Jaguar cat logo said they’d been warned not to comment. One man said he’d voted to leave the EU because migrant workers crossing the bloc’s open borders had depressed U.K. wages. “I’m happy to get out of Europe, just not with the way the government have gone about it,” he said.

Another, 50-year-old Brian, was hopeful demand would pick up: “Rich people are still going to buy high-end cars,” he said. Owned by India’s Tata Motors, JLR is more shielded from Brexit because it exports a lot to the U.S. and China and a spokeswoman said new investments are planned at Halewood.

John Cooper

John Cooper

Matthew Lloyd/Bloomberg

Vauxhall’s Ellesmere Port site, by contrast, ships eight out of 10 cars to Europe, according to Cooper. He’s lobbying management for new production along with Len McCluskey, the general secretary of Britain’s national Unite union and an ally of opposition Labour Party leader Jeremy Corbyn.

The pair went to Paris last month to try to convince PSA Chief Executive Officer Carlos Tavares to grant two new models to Ellesmere Port. That’s the deal Cooper says is needed to guarantee survival, and both should include electric versions. Tavares hasn’t yet obliged. A Vauxhall spokesman said he couldn’t speculate.

After half a century at the plant, Cooper won’t give up without a fight. Vauxhall is an iconic brand in the U.K., appealing to Britons who want to support local industry and local jobs—something that, ironically, Brexit campaigners said leaving the EU would help safeguard.

“I don’t believe if you put a Vauxhall badge on a Peugeot 308 it would sell it in the same volume,” Cooper said. “I don’t want my legacy to be we didn’t get a car.”

=============================

by Suzi Ring and Christopher Jasper

There may be links in the Original Article that have not been reproduced here.

Tags

Who is online

49 visitors

But hey!

Britain could always fall back on its own domestic auto industry...

... oh, wait...