After the disease, the debt

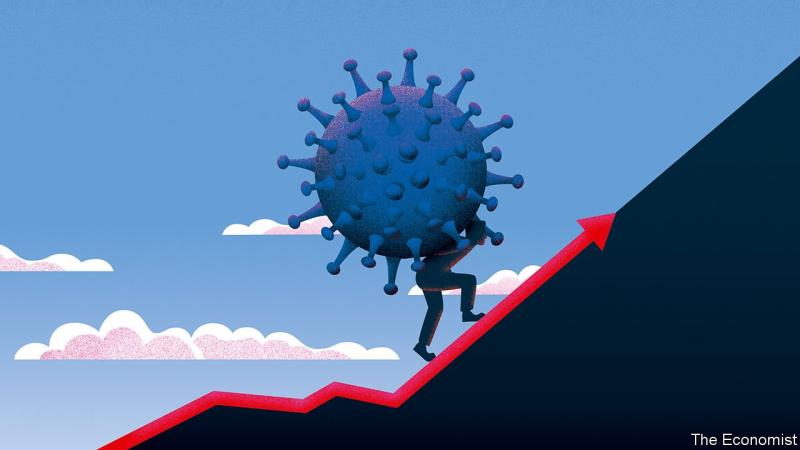

N ATIONAL LEADERS like to talk about the struggle against covid-19 as a war. Mostly this is a figure of speech, but in one respect they are right. Public borrowing in the rich world is set to soar to levels last seen amid the rubble and smoke of 1945. As the economy falls into ruins, governments are writing millions of cheques to households and firms in order to help them survive lockdowns. At the same time, with factories, shops and offices shut, tax revenues are collapsing. Long after the covid-19 wards have emptied, countries will be living with the consequences.

An astonishing deterioration in the public finances is unfolding (see article ). America’s government is set to run a deficit of 15% of GDP this year—a figure that will go up if more stimulus is needed. Across the rich world, the IMF says gross government debt will rise by $6trn, to $66trn at the end of this year, or from 105% of GDP to 122%—a greater increase than was seen in any year during the global financial crisis. If the lockdowns last longer, the load will be greater. Managing such colossal debts will burden Western societies for decades to come.

Few subjects in economics attract more scaremongering than government borrowing. The national-debt clock ticking near Times Square in New York has warned of imminent fiscal Armageddon since 1989. In fact a country’s public debt is not like a household’s credit-card balance. When the national debt is owned by its citizens, a country in effect owes money to itself. Debt may be high, but what matters is the cost of servicing it and, as long as interest rates are low, this is still cheap. In 2019 America spent 1.8% of GDP on debt interest, less than it did 20 years ago. In 2019 Japan’s gross public debt was already almost 240% of GDP, but there were few signs that it could not be sustained. In countries that print their own money, central banks can hold down interest rates by buying bonds, as they have in recent weeks on an unprecedented scale (the Federal Reserve has bought more Treasuries in five weeks than were issued, on net, in the year to March). Just now there is no risk of inflation, particularly since oil prices have collapsed. Most economists worry less that governments will borrow recklessly, than that they will be too timid because of an irrational fear of rising public debt. Inadequate fiscal support today risks pushing the economy into a spiral of decline.

The clean up after the storm .....

Pretty much... at least McConnell is beginning the resistance to any more stimulus spending and hopefully we can keep interest rates down to make the load a bit more bearable. Trump will have to spend his 2nd term bringing the budget into balance and begin a. Plan to reduce the debt.

Since the economy has already been trashed, a government default on debt wouldn't cause that much more harm.

I would propose defaulting on any government debt owned by China. Let Xi Jinping have the haircut.