Income Inequality Grows

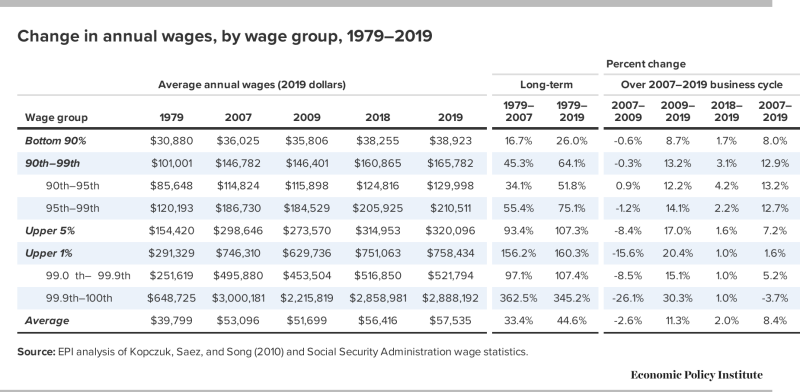

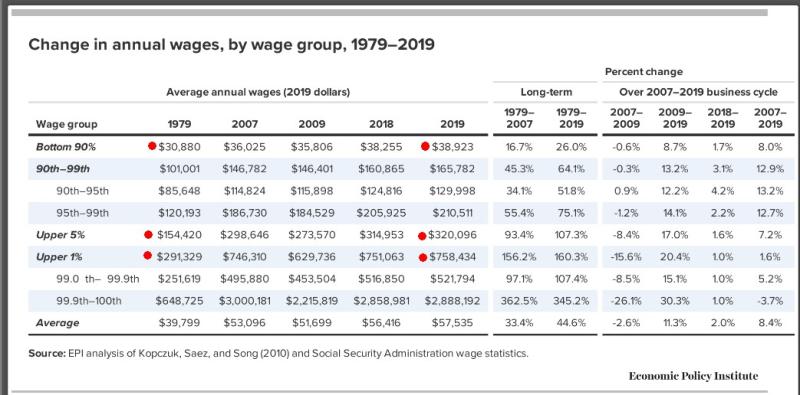

This is a chart indicating average wages of various wage groups over the past 40 years.

If we first look at the line for the bottom 90% of earners we see that from 1979 to 2019 their average salary went from 31,000 to 39,000, an increase of 26%.

The average salary or earnings of the upper 5% of earners went from 154,000 to 320,000, an increase of over 100%.

The average salary or earnings of the upper 1% of earners went from 291,000 to 758,000, an increase of 160% .

----------------------------------------------------------------------------------------------------------------------

Phrased another way , in 1979 the average upper 5% earner made 5 times as much as the average lower 90% worker. In 2019 that has grown to 8 times more.

In 1979 the average upper 1% earner made about 10 times more than the average 90% earner. In 2019 that difference has grown to 20 times more, or doubled.

----------------------------------------------------------------------------------------------------------------------------------------------------------

THIS is why we have so much discontent in the working class. The gains of the economy have been inexorably directed upwards over the course of decades.

Until we go back to a better distribution of the proceeds of business success there will always be the sense that the economy is unfair.

Now of course some will say the high earners "earned" it by being more educated or working harder or having more responsibility. This is of course true in general but it still doesnt explain why today the share of the high earners has increased so much.

The reason is because it was decided , by the people at the top of the economic pyramid, that those who worked with "tech" would make much more money than those who don't.

And this will end, where?

People who work in creating innovations will make more money , it is natural. But why is the gap between the upper 10% and the lower 90% always increasing now ?

related

https://www.fastcompany.com/90584449/eye-popping-wage-report-charts-40-years-of-worsening-income-inequality-as-the-top-1-thrive

Newly available wage data tell a familiar story: In every period since 1979, wages for the bottom 90% were continuously redistributed upward to the top 10% and frequently to the very highest 1.0% and 0.1%. This unceasing growth of wage inequality that undercuts wage growth for the bottom 90% reaffirms the need to place generating robust wage growth for the vast majority and worker power at the center of economic policymaking.

For last year, 2019, the data show a continuation of the trend of annual wages rising fastest for those in the top 10% while those in the bottom 90% saw below-average wage growth. However, within the top 10%, wages rose faster for those in the 90th–99th percentiles than for those in the top 1%.

A similar pattern as in 2019 prevailed over the entire 2007–2019 business cycle as wages were redistributed in two ways, up from the bottom 90% to the top 10% and within the top 10% downward from the top 1% to those in the 90th–99th percentiles. Still, the top 1% has done far better in the 2009–2019 recovery (wages rose 20.4%) than did those in the bottom 90% (wages rose only 8.7%).

As Figure A shows, the top 1% and the very tippy top, those in the top 0.1%, were the clear winners over the longer-term 1979–2019 period:

This disparity in wage growth reflects a sharp long-term rise in the share of total wages earned by those in the top 1.0% and 0.1%.

These are the results of EPI’s updated series on wages by earning group, which is developed from published Social Security Administration (SSA) data and updates the wage series from 1947–2004 originally published by Kopczuk, Saez and Song (2010) . These data, unlike the usual source of our other wage analyses ( the Current Population Survey ), allow us to estimate wage trends for the top 1.0% and top 0.1% of earners, as well as those for the bottom 90% and other categories among the top 10% of earners. These wage data are not top-coded , meaning the underlying earnings reported are actual earnings and not “capped” or “top-coded” for confidentiality. These SSA wage data are W-2 earnings, which include realized stock options and vested stock awards.

Cumulative percent change in real annual wages, by wage group, 1979–2019

Source: EPI analysis of Kopczuk, Saez, and Song (2010, Table A3) and Social Security Administration wage statistics

Copy the code below to embed this chart on your website.

Over the longer term, since 1979, there was far faster wage growth at the top (highest 1.0%) and tippy top (upper 0.1%), signaling a major redistribution upward from the bottom 90%. As Figure A shows, the top 1.0% of earners are now paid 160.3% more than they were in 1979. Even more impressive is that those in the top 0.1% had more than double that wage growth, up 345.2% since 1979 ( Table 1 ). In contrast, wages for the bottom 90% grew only 26.0% in that time. The other segments of the top 10% (those in the 90th–95th percentiles and 95th–99th percentiles) also had faster-than-average wage growth since 1979, up 51.8% and 75.1%, but nowhere near as fast as the wage growth at the top. Thus, wages have been redistributed upward since 1979 from the bottom 90% to the top 10% and within the top 10% to the top 1% and especially to the top 0.1%.

This pattern of upward wage distribution also prevailed over the recent recovery (since 2009): The bottom 90% experienced modest annual wage growth—reflecting growing annual hours as well as higher hourly wages—up 8.7% from 2009 to 2019. In contrast, the wages of the top 1.0% and top 0.1% grew, respectively, 20.4% and 30.3% in the last 10 years.

In the most recent year, however, wages grew fastest for the bottom 9% of the top 10% (up 4.2% for 90th–95th percentiles, up 2.2% for 95th–99th percentiles) and slower than average for the bottom 90% (up 1.7%) and the top 0.1% and top 1% (both up 1.0%).

One key characteristic of the Great Recession downturn was the big hit on the very highest earners, with the top 1% and top 0.1% seeing 15.6% and 26.1% declines over the two years from 2007 to 2009. Even by 2019 the top 0.1% had not recovered from this sharp fall at the start of the business cycle as the top 1% as a whole earned only 1.6% above their 2007 earnings. Thus, the business cycle from 2007 to 2019 was one in which wages were redistributed from the bottom 90% to the top 10% and within the top 10% from the top 1% to the remainder of the top 10% (the 90th–99th percentiles). The one constant wage dynamic in every period since 1979 has been that the wages for the bottom 90% are continuously redistributed upward.

It is worth noting that our series on the wage growth of the bottom 90% corresponds closely to the Social Security Administration’s series on median annual earnings : Between 1991 and 2019 the real median annual wage grew 23.8%, very close to the 26.0% growth for the bottom 90% over that same time period.

It is also noteworthy that the wage growth for the bottom 90% was almost entirely concentrated in the two periods of sustained low unemployment representing 11 of the 40 years: The bottom 90%’s wage growth in the 1995–2000 and 2013–2019 periods represented 90% of all the wage growth ($7,230 of $8,043) over the entire 1979–2019 period. The shift of wages away from the bottom 90% meant that their wages rose 26.0% rather than the 44.6% increase obtained on average over the 1979–2019 period, some 18.6 percentage points faster growth.

Change in annual wages, by wage group, 1979–2019

Source: EPI analysis of Kopczuk, Saez, and Song (2010) and Social Security Administration wage statistics.

Copy the code below to embed this chart on your website.

These disparities in long-term wage growth reflect a major redistribution upward of wages since 1979, as noted earlier. The bottom 90% earned 69.8% of all earnings in 1979 but only 60.9% in 2019 ( Table 2 ). In contrast, the top 1.0% nearly doubled its share of earnings from 7.3% in 1979 to 13.2% in 2019. The growth of wages for the top 0.1% is the major dynamic driving the top 1.0% earnings as the top 0.1% more than tripled its earnings share, from 1.6% in 1979 to 5.0% in 2019.

I was born and raised in the US; and have lived in France for much of my adult life. I have both passports.

When I first arrived in France in the early 70s, the material standard of living (as measured very unscientifically in terms of color TVs per household) was moderately behind the American.

I was more deeply surprised by the lack of multi-lane highways. America was just finishing the Interstate system (so there were almost no pot-holes... yet...), while in France a five hundred mile trip from our home in Lorraine to my mother-in-law's home in Brittany was a twelve-to-fourteen-hour over-night drive... despite 90 mph out-of-town speeds -- no speed limits back then!.

For forty-five years, every year, the newspapers said that America's GDP grew by a point or two more than France's GDP. I'm no mathematician... but the little calculator program that lives on one corner of my computer desktop says that 1,5% compounded over forty-five years should just about raise the American economy to the double of the French.

Today, France's material standard of living (as measured very unscientifically in terms of big flat-screen TVs) is, still, moderately behind the American. Same as forty-five years ago.

And during these forty-five years... France has built -- and maintained (cough, cough) -- its highway network. And also built a high-speed rail network. And also built nuclear power plants that cover 80% of needs. And... and... and...

Basically, it seems to me that France has done better, fundamentally, than the US. Contrary to the numbers.

I tried to understand. For some years, I imagined that perhaps "socially stimulative investments" such as highways, bullet trains, health-care, unemployment benefits, and so on (which are indisputably better in Europe than in the US) carry some sort of "social return on investment" that augmented French/European competitivity without appearing in those "manifestly misleading" GDP numbers.

Then, a number of years ago, an excellent article ( ) by an economist named Eric Zencey gave me a better explanation: GDP is simply... false. GDP measures turnover, not added value. If I sell you my house for a million dollars, and then you sell it back to me for exactly the same amount, GDP has gone up by two million dollars, despite there being no added value at all.

... All those gazillion dollars sloshing around Wall Street, for no added value at all... While China actually makes stuff, and Germany actually makes stuff... and even France actually makes stuff! You know: those bullet trains, and Airbus, and those nuclear plants, and......

Using GDP to measure a nation's progress is like using a ship's wake to measure its progress. More "churn" does not necessarily mean more speed...

If GDP is not a valid instrument... then what? Well... let's go back to the beginning: "life, liberty and the pursuit of happiness". To me "life" in an advanced society means far more than "birth". "Life" means things like a minimum wage... whether employed or not. "Life" is good health-care, accessible for everyone. "Life" is leisure time, with family and friends or just by myself... but my time, not some boss's! "Life" is each person being able to fulfill whatever their capabilities may be, through good education opportunities at all ages.

Or we could put all these same items in the category "the pursuit of happiness". Indeed, there are quite a few attempts these days to quantify "happiness".

America never leads the "happiness" indexes...

More recently, I asked the same question ("Where did the difference in GDP growth between the US and France go?") of Brad DeLong, a leading Keynesian economist and professor at UCal Berkeley.

He answered that it was almost entirely captured by the 1%, and thus never appeared in any average American's life.

Inequality in the United States has been quantified in many ways before, but a recent study from the Rand Corp. has put hard numbers to just how severe that inequality is for average wage-earners in the U.S.

“Trends in Income From 1975 to 2018” looked at inequality in two ways: income distribution over a 45-year period and income growth in relation to broader economic growth, to see if a rising overall tide did indeed lift all boats.

After 1975, the study suggests that’s far from the case, according to Carter Price, senior mathematician at RAND and co-author of the study.

“The gains of economic growth have been primarily going to the top,” Price told “Marketplace Morning Report” host David Brancaccio. “And for some segments of the population, there have been no gains whatsoever.”

The Rand study suggests that has cost the bottom 90% of the workers about $2.5 trillion, according to Price.

Price also said that, controlling for inflation, per capita GDP more or less doubled from 1975 to 2018. Incomes, on the other hand, did not — “at least not at the median and really at any point below the top 95th or even higher percentile.”

“And so the economy doubled, but people’s incomes didn’t double,” Price said.

Click the audio player here to listen to more of Price’s interview on the “Marketplace Morning Report.”

Nick Hanauer, a venture capitalist and host of the podcast “Pitchfork Economics,” suggested the original idea of the study to Rand along with David Rolf, president of the Fair Work Center , and helped fund it. He believes the results could be some of the most important socioeconomic work of our time.

“ The median full-time worker in America today earns about $50,000 a year. If they had been held harmless by the last 45 years of neoliberal economic policy … instead of earning $50,000 a year, they would earn between $92,000 and $100,000 a year,” Hanauer told Brancaccio in a separate interview.

This difference, Hanauer said, “explains not every pathology in our society, but a huge proportion of them, from our budget deficits to our surreally polarized politics.”

This isn't rocket science.

The American economy doubled. Revenue did not... except for the very richest... who captured almost all the nation's added value.

Trickle up working as intended.

I also blame the demonization of unions. I read an article that showed the decline in unions corelating with flat wages.

Of course. Big Business's tame media hammered "corruption" while ignoring the real advantages won for workers.