50 years of tax cuts for the rich failed to trickle down, economics study says - CBS News

By Aimee Picchi

December 17, 2020 / 12:43 PM / MoneyWatch

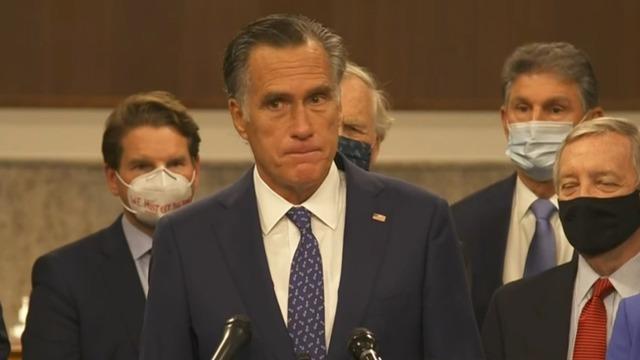

Bipartisan senators unveil COVID relief bills...49:53

Bipartisan senators unveil COVID relief bills...49:53

Tax cuts for the wealthy have long drawn support from conservative lawmakers and economists who argue that such measures will "trickle down" and eventually boost jobs and incomes for everyone else. But a new study from the London School of Economics says 50 years of such tax cuts have only helped one group — the rich.

The new paper, by David Hope of the London School of Economics and Julian Limberg of King's College London, examines 18 developed countries — from Australia to the United States — over a 50-year period from 1965 to 2015. The study compared countries that passed tax cuts in a specific year, such as the U.S. in 1982 when President Ronald Reagan slashed taxes on the wealthy, with those that didn't, and then examined their economic outcomes.

Per capita gross domestic product and unemployment rates were nearly identical after five years in countries that slashed taxes on the rich and in those that didn't, the study found.

But the analysis discovered one major change: The incomes of the rich grew much faster in countries where tax rates were lowered. Instead of trickling down to the middle class, tax cuts for the rich may not accomplish much more than help the rich keep more of their riches and exacerbate income inequality, the research indicates.

"Based on our research, we would argue that the economic rationale for keeping taxes on the rich low is weak," Julian Limberg, a co-author of the study and a lecturer in public policy at King's College London, said in an email to CBS MoneyWatch. "In fact, if we look back into history, the period with the highest taxes on the rich — the postwar period — was also a period with high economic growth and low unemployment."

In our piece for @ConversationUK, David Hope and I argue that governments should not give undue concern to the economic consequences of taxing the rich when deciding how to pay for COVID-19. https://t.co/MRgnX8JfmH

— Julian Limberg (@JulianLimberg) December 16, 2020

Because the analysis ends in 2015, the research doesn't include President Donald Trump's massive tax overhaul, which he signed into law in late 2017 and which slashed taxes for the rich and corporations while providing a moderate cut for the middle class. But Limberg, who co-authored the study with David Hope, a visiting fellow at the London School of Economics' International Inequalities Institute, said that he wouldn't expect the results of that tax cut to be much different.

Already, Mr. Trump's tax cuts have lifted the fortunes of the ultra-rich, according to 2019 research from two prominent economists, Emmanuel Saez and Gabriel Zucman of the University of California at Berkeley. For the first time in a century, the 400 richest American families paid lower taxes in 2018 than people in the middle class, the economists found.

The "careful" new research from the London School Economics "suggests indeed that tax increases on the wealthy should be considered post-COVID," Berkeley's Zucman said in an email to CBS MoneyWatch.

Engine for stronger economic growth?

To be sure, the economy was humming along before the pandemic struck the nation in March, with an unemployment rate that was at its lowest in about half a century. Conservative think tanks such as the American Enterprise Institute pointed to Mr. Trump's tax cuts as an engine for stronger economic growth.

Yet even so, millions of American families struggled to find jobs that paid living wages, while the cost of essentials such as health care, housing and education increased at far faster rates than the typical income. Even before the pandemic, income inequality had reached its highest point in 50 years, according to Census data.

In 2020, the pandemic has worsened inequities across all spectrums, touching racial, gender and educational divides. When the economy shut down in March, workers who couldn't transition to remote work — typically lower-paid employees involved in retail, service and hospitality jobs — were hit the hardest.

At the same time, white-collar workers generally fared better as they were more likely to maintain their jobs as they shifted to remote work. Investors also benefited as the stock market rallied on hopes for an economic recovery — a development that doesn't help most low- and middle-class workers. Only about half the U.S. population is invested in the stock market through their retirement and savings accounts, and even then more than 80% of all stocks are owned by the richest 10%.

BREAKING: U.S. billionaires have grown their collective wealth by $1 trillion since mid-March. That's more than it would cost to send a $3,000 stimulus check to every person in America.

More of our latest research here: https://t.co/wvfXxl92yKpic.twitter.com/sYgDKiuW70

— Americans For Tax Fairness (@4TaxFairness) December 9, 2020

Since the pandemic began, the combined wealth of America's 651 billionaires has jumped by more than $1 trillion, reaching $4 trillion in early December, Americans for Tax Fairness said earlier this month.

Meanwhile, almost 8 million Americans have fallen into poverty since the start of the pandemic through November, according to new data released by the University of Chicago and the University of Notre Dame.

Rebuilding the economy and household wealth for low- and middle-class families are among the issues facing President-elect Joe Biden after he's inaugurated next month. Raising taxes on the rich and corporations could provide trillions of dollars in resources for helping the economic recovery, Zucman told CBS MoneyWatch.

"This is not only a viable option, but also a fair option, because some of the wealthiest taxpayers have benefited from the pandemic — for instance large corporations such as Amazon and their shareholders," he noted. "These taxpayers could reasonably be asked to pay more to make up for pandemic losses."

I could have told you that without the fancy study...

So raising taxes on the few hundred really rich in this country is somehow supposed to help level the playing field. As for corporations, they don't taxes, they only collect them and pass the increases on, and raise prices for their products.

You are being dishonest with that statement. Any raising of taxes on the wealthy would only bring them up to the same taxation as everyone else, which is the definition of "leveling the playing field".

It is a shame then that with lower taxes goods and services didn't see a price cut.

Funny how that works huh. Raise taxes and we will raise prices, meanwhile lower taxes and we will keep prices the same, of course they will still go up a little.

Things are a lot more expensive now than 20 years ago. I used to be able to buy groceries for a family of 4 and walk out of the grocery store with 3 bags and spent 30-45 dollars. Today I buy groceries for 2, walk out of the store with 2 bags and spend at least 50 bucks

Welcome to "Reality 101"

Yep, the reality that 'trickle down' is fabrication.

Funny that, I think I read they don't include things like buying groceries in the living index.

Oh...REALLY????

No wonder some seem to think our standard of living is higher than it was 60 years ago!

Some more of that, "Reality 101"...

You pay more in taxes than most billionaires. That's gotta feel good come April.

The problem is we haven't seen wages rise. Prices have increased, as have investor returns, but wages have remained stagnant and buying power for the average person has reduced. It is not a sustainable system.

Indeed.

However, all too many "do loopholes"!!!

Sometimes, a picture is worth a thousand words.

Nailed it. In my post below I more or less said exactly this using myself as an example. The money I got from the recent tax cuts has gone straight into investment accounts and trust funds for the girls.

Sounds good to me. If not for the financial incentive I never would have put so much effort into climbing the ladder of success.

I see the workers paradise of Cuba has greater income equality but it doesn’t appeal to me.

If you had $10,000 for every day since 1776 it would not equal one billion dollars. Our tax code has made the super richer beyond reason. < 1 percent owning > 90 percent of wealth is unsustainable!

Pretty sure this wasn't about capitalism as a system of economics dude, but rather about government taxation policies that favor the already wealthy.

Quelle surprise!

The standard of living for everyone is much higher than it was 50 years ago.....

Sean, you could not be more wrong. In 1960 the average salary in the US was $5,600. Adjusted for inflation, equals $49,736.60. In 2019 the average salary was $48,672, so we actually lost buying power.

.

.

he standard of living for everyone is much higher than it was 50 years ago.....

Food costs take up less than half as much of the average persons expenses as they did in 1960.

but by all means, you live on 49,000 and spend twice on food, and buy services and products at 1960 standards, and I’ll happily live on 48,000 with 2020 products

heres a good primer of how more discretionary income Americans now have that they didn’t before,.

Your criterion is intrinsically skewed. Revenues in the US are so unequal as to make "average" meaningless. "Median" is somewhat better, but still inadequate.

Those are just charts on what we spend on and no where does it say we have more discretionary income. In fact, it says:

Once again, you have not addressed the fact that real income has not increased at all. In fact, it has gone down.

Bob, my number from the 1960's was the median income. Median income in 2018 was $63,179.

.

Heck, we can do the mode if you want to, which is probably the most accurate, which is where people cluster at.

OK... I misunderstood.

What does "standard of living" have to do with income inequality?

We should have a wealth tax. First 50 million dollars doesn't get this tax. For every dollar above 50 million you pay 3 % per year. Over 1 billion is 4 percent per year.

Capital gains should be taxed as regular income.

There should be a small tax on every Wall St transaction.

All of these changes would provide many billions of dollars to provide needed programs to improve the lives of working people, and would not effect the lifestyles of the wealthy at all.

Investing is not work. People who make their money in a non productive way should be taxed higher.

How about we just charge 1/2 a percent over 50 million and a full percent on 1 billion. We don't need to get greedy. Even with that this country could fund universal health care

And capital gains should be taxed as regular income, I agree with that.

What always makes me shake my head is the people defending the ultra wealthy (like they need it) when they will never be in the same position.

Useful idiots is what I believe they use to call them.

Thats not gonna work. As it is the proposal is only to tax wealth over 50 million. The first 50 million doesnt get taxed. So someone has 51 million. They would be paying 1/2 a percent on one million. That is a skimpy "wealth tax".

You're driving away the incentive to make money, John. What about Jeff Bezos? Imagine how much money he would pay in a wealth tax. You take too much away from him and he's liable to just say fuck it, why bother working to make more or investing to make more?

You are serious?

Someone who has 2 billion dollars would pay 4 percent tax on the second billion. How much of the second billion would be left after the tax ? $960,000,000.

A society is under no obligation to let people accrue unlimited wealth, at least not without taxing it at the highest levels.

I stand corrected. I didn't do my math homework.

I don't know. People like to hold up Jeff Bezos as an example of this. But how would this really work.

Bezos is worth approx $200 Billion based on current stock values. That changes daily so when is it calculated. A 4 percent tax on $200 billion is approx $8 billion. So where is he gonna sell enough stock to raise that kind of money because selling that much stock will devalue the entire worth so that needs to also be calculated in. After all, it's not like he has that $200 billion just stuffed under his mattress in large bills.

Why did countries that tried to tax wealth stop doing so? Because it wasn't working and ending up driving more money out of the country than the country would raise. In 1990 twelve European countries had a wealth tax, today only four counties still do. The others dropped it because it was too easy to avoid the tax by moving your money out of the country. The plans by Warren and Sanders rely more on citizenship than place of residence, but one has to ask why they would put so much energy into a proposal that is easy to avoid, has not proven anywhere in the world to bring in the kind of money envisioned and stands a good 50% chance of being declared unconstitutional by SCOTUS.

I doubt he'd pay anything at all. His lawyers will find loopholes.

Standard of living is much more important than "income inequality." Jealousy doesn't really kill people.

Jeff Bezos "earned" $ 200 000 000 000?

Seriously?

Your Comment was probably a clumsy attempt at "owning a lib", but just in case your understanding is really that poor...

A tax on revenue would be most efficient with a top bracket at about 70%.

A tax on wealth would be most efficient with a top bracket at about 5%.

Do you need clarification on the difference between the two?

Absolutely true. Unless you're among the group that believes the government should care for you from cradle to grave...

You're citing the ideals of the Green New Deal but history shows that it really didn't work that way. While the statutory rates have been that high or higher in the past, the effective tax rate where nowhere close to that. The rich and powerful work with their allies in Congress to get loopholes inserted into tax code which allows them to save on their taxes, or they look to offshore the money and take it out of the reach of the taxman.

In 1990 there were 12 European countries that had a wealth tax, today there are only 4. I believe it would be even harder to set up in the USA as any wealth tax has a better than 50% chance of being found unconstitutional by SCOTUS.

In addition, a lot of that wealth is held in property or stocks. Very few of the rich have millions in cash just lying around. So property would need to be sold to pay the tax man which means you have to find people willing to buy that property. As the people who can afford to purchase that property are other rich people who are having to pay their own "wealth" taxes how willing would they be to increase their "wealth' with property that then needs to be sold again to pay taxes. So unless your plan is for the government to take the property and own it themselves not sure where this will go.

And IMO government has never proven trustworthy with managing money. How much money is taken in annually and wasted? Increasing the cash flow to government has seldom resulted in the same large cash flow to the people.

I'll tell you how much I earn when Donald Trump volunteers his tax returns.

Actually... that was the rate during WWII, when the American economy was doing the best it has ever done.

... which proves that the wealthy can buy political clout. It proves nothing about the efficacity of the tax.

yes, 70% was the statutory rate but was not the effective rate. The effective rate was between 35% & 37% and there were loads of loopholes and exemptions that everybody could use. As Congress changed tax code they eliminated a lot of loopholes as they brought the statutory rate down. I don't believe the statutory rate could go back up to 70% again. One thing these plans never identify is what about state and local taxes. Raise the federal rates up to 70% and all the sudden you are taxing people at 99%. I don't know of anybody who is willing to stand for that.

From actual experience in Europe, it wasn't that the wealthy were buying their way out of it, the tax just didn't work as they planned.

From If a Wealth Tax is Such a Good Idea, Why Did Europe Kill Theirs? : Planet Money : NPR

As I said before, most rich do not have millions in cash lying around. The assets are in property, stock, etc. To raise money to pay a wealth tax would require that assets be sold. You have to find buyers for such. There's no easy way to do that with the value you are talking here. And once the physical asset is sold and the tax paid, what is to stop the person from taking the reminder of the money and putting it offshore and out of reach of the tax man? As France found out, when faced with taxes like that most wealthy will leave the country and move to other countries that are more friendly to the rich. So the original country loses out both with a loss of the citizen and the loss of what that money can do.

A wealth tax sounds nice for some on the progressive side as it seems like a simple way to reduce the wealth inequality but from history it doesn't really work out that well. Coupled with the very possible SCOTUS ruling as unconstitutional, I don't really see a wealth tax taking shape here in the US.

No, it wouldn't. My opinions are based on what's good for society, not on what's good for me.

No.

Perhaps we'll finally get "trickle down".....

C'mon! You know how brackets work.

The loopholes are still there, and nearly as effective, reducing the theoretical rate by half.

No, a lot of the loopholes from years past are gone having been closed. There are still some but not as many and not s open. And brackets have nothing to do with combined federal / state / local taxes when you combine them. When you raise the federal tax rates, it doesn't cause state and local taxes to go down. So if you live in NYC and your effective federal tax rate is 14.3%, you combine in FICA, State, (no local tax in NYC) for a combined effective tax rate of 27.22%. But if you raise the federal tax rate to 70%, then your total tax rate climbs to 82.91%.

I believe it's more likely we'll have more of the 1%'ers just leaving the country and taking their money with them.

I believe a wealth tax is just a bad idea. I also don't think it will stand much of a chance of passage and if it somehow does get passed it will face years of court challenges before ending up in front of SCOTUS where I believe they will find it unconstitutional.

This country has much more serious issues that need solutions, I would strongly suggest to Washington that they drop any pretense of push for a wealth tax and get to work on the needs of the American people. But considering how they have been conducting business for the past 40 years I don't expect them to start acting for the good of the country.

I assume that a wealth tax law would include dispositions to prevent that.

I agree entirely! Personally, I feel neither.

Then we just disagree. I feel you are looking at an idealistic situation. Washington has proven over the years to be in the pocket of big money, I don't see any way that will change unless we completely change who we send to represent us. Secondly, in a free society such that we have, once the tax has been paid for that year how can the government tell a person what he can now do with his money? If the person gives up his citizenship and moves to another country with friendly tax laws what is to stop them? What recourse does the government have at that point? About the only way I can see is for the government to enact laws that take away from the personal liberties to prevent a person from giving up his citizenship or investing his money in other countries. If the country has to enact such laws to reduce or eliminate personal freedoms to prevent such action, then isn't the country at risk of becoming that very dictatorship the left has warned the country about for the past four years?

I'm not a lawyer but the wealthy have been stashing wealth overseas for years. All these years of government and they couldn't prevent people and businesses from doing that.

For what it's worth I can agree with you. In an idealistic world we would be mostly equal, have equal access for our wants and needs and people would help to take care of people. But that's not reality.

Citizenship is of no importance. Residency may or may not be.

As someone here pointed out, even the richest don't have a swimming pool filled with gold coins - Scrooge McDuck is fiction. Great wealth is in the form of stocks, bonds, real estate, ... Not very liquid. If an ultra-rich leaves the country, just put a lien on their property. They'll come back.

Of course not. I was asked about my opinions. I answered.

Wrong. 50 years ago a married couple with only one spouse working could afford a car payment, house payment and put 4 kids through college without being, "wealthy" and STILL have money to put into savings.. That shit simply doesn't exist anymore.

Excellent post!

USELESS idiots, better suits those who defend outrageous profiteering via the United States, carefully set up, totally slanted, straight up JOKE of a LOOPHOLE designed taxation, for those, in who's powder rooms is found, Menstruation Crustacean Stations, asz they're so bloody rich, and ain't life just a BITCH, when you can afford to have scratched, ANY a frckn itch ? A lobster doling out women's feminine products, who'd of thought, cause i'd guess, what else would you buy when the limit is the sky, and a school teacher pays 10 times that of the alleged Billionaire head Donald Ducking his taxes and shorting his vendors Trump. It just amazes me that righties wearing obviously far too tiighty whiteys , have no problem getting squeezed just so as to appease persons screwing over a Country that helped enable their massive wealth abundance, as they fund the lobbyists who help push the laws oh so complex, so as not too many can follow and comprehend , the laws written to bend just for them. As they hire only those that aspire to great heights, to help shelter fortunes, that their lobbyist investments do create, and it's not out of sheer envy or hate, but WTF is even a small percentage fair, cause it is not, and it is ridiculous, how bottom feeders defend these fckers as they screw over all of US, as their money decides so much as to what our pols pursue and due, and change is way OVER ! We need to reform our lobbyist bought and paid pol bribery schemes that pay and pave the way for individuals to outweigh the masses of true constituents concerns, against the ones that by who the pols do from, greatly profit and earn that which never should have been that much of a return, to sender our country further in debt, to be paid for by our childrens children, as no sweat off the backs of those who decide where it does, the monies flow, as rapid pay day loans borrow almost all from those stuck with a jones, and they defend and moan, as their fine with the company and money they're keeping, cause a loan isn't of interest to them, unless someones gonna bleed and be in need of a Menstruation Crustacean Station, that is bleeding our country to Death, do US A part !

BTW, that Menstruation Crustacean Station, is an actual thing. What the hell will they think of next///...

Damn, this big fucking surprise! You mean to tell me that when you enact policies that funnel more and more of a nation's wealth into the hands of the already wealthy they DON'T turn right around and have that wealth flow back out into broader society? What the fuck, history has shown us repeatedly that THAT is exactly what happens! I mean, it is not like there are any of examples of rich people just getting richer while giving little to nothing back to the community as a whole (or at least nothing even remotely in proportion to their wealth).

I donate to charities sure, but it sure as hell is not any significant percentage of my family's overall wealth and I don't plan on doing that either. If the government lowers my taxes, that is going straight into either one of the kid's trust funds, or one of our investment accounts. I want to make sure my kids and future grandkids will have everything they need and set them up as well as I can financially. Now if the government were to raise my taxes, so be it. But that really is the only way you are going to get anything meaningful out of me to put towards other uses.