One mind-boggling chart shows how government stimulus cut poverty by nearly half during the pandemic

Category: News & Politics

Via: john-russell • 3 years ago • 51 commentsBy: jzeballos@businessinsider.com (Joseph Zeballos-Roig,Madison Hoff) 2 hrs ago (MSN)

- New projections from the Urban Institute find the poverty rate will drop to 7.7% in 2021.

- The New York Times reported that would be a decline of about 45% from 2018.

- Researchers credited stimulus checks, federal unemployment benefits, and bulked-up food stamps.

- See more stories on Insider's business page.

The federal government embarked on a $6 trillion spending spree to keep individuals, businesses, and state governments afloat during the coronavirus pandemic - and it seems to have succeeded in lifting a lot of people out of poverty.

Much of that cash led to the biggest expansion of the social safety net in generations, helping people keep food on the table and make rent payments.

New research from the Urban Institute shows how the emergency relief programs led to one of the biggest major reductions in poverty.

Their analysis finds that without government programs such as stimulus checks and enhanced unemployment insurance, the poverty rate this year would be 23.1%. But these programs caused it to drop to a much lower 7.7% instead. Around 20 million fewer Americans in poverty now compared to 2018.

The Urban Institute's projection represents a 45% decline from previous levels in 2018. That would make it the largest drop in poverty on record, per the New York Times.

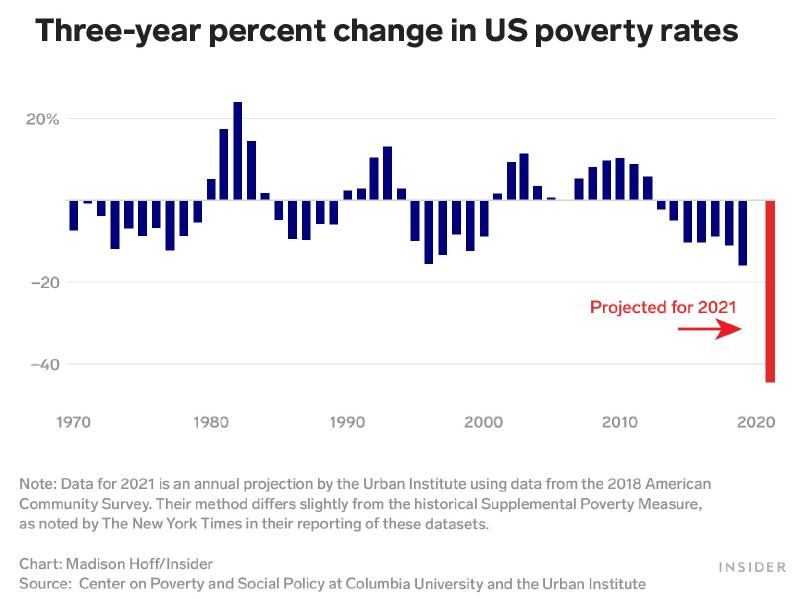

This can be seen by looking at changes in rates from one year compared to three years earlier. The following chart, as replicated from The New York Times' reporting of the historical Supplemental Poverty Measure poverty rates and Urban Institute's projected rate, highlights the percent change in rates from three years prior.

Three-year percent changes have varied over time and have mainly seen declines in the 2010s. But if the Urban Institute's projection is correct, it would mean the biggest drop in poverty rates from three years earlier, as seen in the chart.

Aid during the pandemic has given some Americans much needed assistance to get out of poverty. As Insider's Juliana Kaplan reported, poverty rates fell from December 2020 to January 2021 in part because of stimulus checks and federal unemployment benefits.

Stimulus checks lifted 12 million people out of poverty

Americans used the no-strings-attached checks from the government to pay off debt and cover expenses, and it also seems to play a big role in cutting the poverty rate.

"The federal stimulus checks have a larger antipoverty impact than any of the other programs; if all other programs were in place but the stimulus checks had not been paid, we project 12.4 million more people would be in poverty in 2021," the Urban Institute researchers wrote based on the programs used in their projections.

Programs helped Black Americans the most

The projected poverty rates from the new report for 2021 further vary by race and ethnicity, where the rate for non-Hispanic white Americans is 5.8% and 11.8% for Hispanic Americans. The researchers write that the government programs and benefits have the largest impact on non-Hispanic Black Americans. Without these programs, the projected rate for non-Hispanic Black Americans is 36.0%, but with these programs it is reduced to 9.2%.

Many of these programs ended or are set to expire

Many economists credit the stimulus payments and federal unemployment benefits with playing a major role powering the nation's recovery from the pandemic. The nonpartisan Congressional Budget Office forecasted last month the US would undergo its fastest pace of growth this year since the Reagan administration.

However, the end of these programs are nearing and its unclear whether Democrats will renew them given they were designed as pandemic relief.

Twenty-six states - mostly Republican-led - have already ended $300 weekly federal unemployment benefits for laid-off workers in an effort to encourage more people to head back to work. Early research suggests hiring hasn't picked up in many of those states.

People have largely spent their $1,400 stimulus payments from March, and enhanced unemployment insurance will expire just over a month from now. That's in addition to the end of the temporary 15% increase to food stamp benefits that were part of the stimulus law - those expire on Sept. 30.

Read the original article on Business InsiderContinue ReadingShow full articles without "Continue Reading" button for {0} hours. Microsoft and partners may be compensated if you purchase something through recommended links in this article.

This is a fascinating story.

Government intervention does lower the poverty rate, and helped millions of children not be poor anymore. But these programs have ended or will end by the end of the year.

We will go back to being a society where millions of children struggle through poverty. Somehow, through it all, the rich get richer. A federal minimum wage hike is nowhere in sight.

What do we need, more rich people or less poor children?

Any of the gains are temporary and artificial.

Got any realistic answers and solutions, instead of endless complaints.

I dont think you'd want to hear my answers.

See #3, Greg.

Exactly. That’s the point of stimulus, to get the country and the people through an economic crisis. Most of what was spent in 2020 was justified. Now that the worst of that is over, it’s time to turn the stimulus off and as the eco only grows and recovers back to pre pandemic levels it then becomes time to begin paying back some of the needed excess spending from during the crisis so that we can have the wherewithal to effectively deal with the next one. Massive excess spending now in the face of the recovery beyond maybe the bi partisan infrastructure bill which may pay for itself over time is worse than stupid. It is idiotic lunacy on steroids.

While the stimulus incentives did provide needed relief they are in fact temporary and will not suffice for long term. However, they did prove that an economic boost to the lower economic tiers are good for the economy and the society in general.

Now, what needs to be debated is whether it is past due to dismantle Supply Side Economics and steer the wealth generated by the American economy back into the American economy instead of into the hands/control of an ever decreasing minority of super wealthy.

That's a "duh!"... although a large segment of the population refuses to believe it. Logic and data are inadequate for convincing people of something they do not want to know.

Created value is almost entirely skimmed by the owner class. The ultra-rich leave crumbs for everyone else.

Your comment. Where? When. How?

It's past time for that debate. All of us can see that Supply Side Economics is a sham and a failure

This is a good time to remind everyone who actually pays for the US government..

For those who don't know Federal Income tax is the single biggest revenue source that funds the US government. Last time i checked it was over 50% of the revenue followed by payroll taxes at about 35% and then corporate tax and other miscellaneous taxes. So who pays Federal income taxes? The top 1% very much over-funds it in comparison to their percentage of AGI and the bottom 50% very much under-funds it in comparison to their percentage of AGI.

See attached:

Now one can debate whether one or the other pays enough but one CAN NOT debate who pays the most. The top 1% clearly does pay the most and has for a long, long time.

The important topic is the tax burden.

If Mr A has $10 in revenue, while paying $5 in taxes, his burden is 50%. If Ms B has $100 in revenue, while paying $25 in taxes, her burden is 25%.

So while Ms B pays a lot more, her burden is far less.

I wish I had to pay billions in taxes...

In your opinion.

I'm simply putting out the ever present fire coming from the left that the rich don't pay their fair share. By any "reasonable" analysis a group of people who make 20% of the money but pay 40% of the taxes is paying a fair share. Especially when the that group is only 1% of the people. Fair share? What a ridiculously subjective term when used by the left.

The thing that always cracks me up with the "rich need to pay more taxes" debate is why rich people who jump on this bandwagon don't try to set an example and pay more voluntarily. Like you Bob. Why don't you pay more than is mandated?

Or even tens of thousands.

The people who have all the money have to pay all the income taxes, wealth taxes, and everything else.

The sad part is you could take 95% of the richest Americans wealth and they would still not have to work another day in their lives and could live off whats left very comfortably. Elizabeth Warren's 2 or 3 % wealth tax, which so many whined about, would not reduce a single rich person to the mere upper middle class.

The "47 percent" that Mitt Romney so famously whined about in 2012 is made up of the retired living off social security, stay at home mothers (or fathers) raising kids, students, the disabled, and children. Able bodied people who dont work lose eligibility for cash welfare very soon after they get it.

People dont pay income tax because THEY DONT MAKE ENOUGH MONEY. What is so hard to understand about that for conservatives?

The people who gain benefit from the government should pay something for it and since Federal Income tax is the main revenue source. So they should pay some Federal Income tax.

Why is that so hard for liberals to understand?

In 2019, 154 million people paid income tax.

In 2019, there were 74 million children age 17 and under in the United States. There were 45 million people collecting social security retirement. Another 20 million were college students. I dont know how many stay at home spouses but I'm sure it is many millions. Then you add in the disabled and people (with families) at low wage jobs whose income doesnt get them above the poverty level and you have your "47 percent".

Low wage individuals without families do pay income tax.

Low income individuals do not get very much help from the government at all. Low income people with families do not have to pay income tax because they are also eligible for government assistance. Do you think it makes sense to extract income tax from families who need food stamps to eat?

Taxes are paid by the people with the money. What is so hard for conservatives to understand about that?

WTF? Government assistance programs are designed for low income people.

SNAP, Medicaid, CHIP, TANF, SSI, subsidized housing and energy assistance just to name a few.

Honestly John, sometimes you are really, really out there ......

The vast majority of government benefits for low income people are for those with dependents. If you are poor without any dependents you will get little if anything unless your income is below 10,000 a year or so. You will get medicaid but thats about it. Housing assistance is not given to anyone who is alone, according to what I am seeing on the websites.

They pay payroll tax.

You forgot the welfare-for-farmers subsidies that are necessary to keep farmers afloat, since Trump started his "easy to win" tariff war with China.

If they are working, which many aren't and if they are the first 10k or so is exempt from the Fed Income tax and most State income taxes.

That said i clearly wasn't talking about Payroll taxes but rather Federal Income taxes. As pointed out, the single biggest revenue source for the Federal budget.

I didn't forget about it, i wasn't talking about it but since you bring it up. Farmer subsidies have been supported by many, many Presidents going back to FDR but since the POTUS doesn't make such laws, the really substantial component of such action is Congress. Who does promulgate such laws. So many, many congresses have support farm subsidies as well.

Pointing our Trump only for such actions reeks of TDS ....... nothing more.

Obviously a reduction in poverty is good news. But the hangover from the handout party may be rather harsh. This isn't sustainable so the hangover really can't be avoided.

The governments stimulus policies show up in the Federal Reserve data as spikes in personal income during 2020. The increased income appearing as spikes means this was not a redistribution of income from the top to the bottom. And the spikes do not suggest a more equitable distribution of national income. The spikes also show that the government stimulus was not about maintaining or protecting income. The government dumped money the country doesn't have into the economy. The decrease in poverty cannot be sustained on a credit card, so there will be a lot of disappointment in our not to distant future.

Do you have any proof of this?

You cannot view the graph? Here's a link: Notice the spikes in personal income during 2020?

The Federal Reserve publishes all sorts of interesting data. Here's one of interest: The Federal budget is larger than national corporate profit; taking all corporate profit in the US wouldn't fund the Federal government. Also note that the pandemic has been very good for corporate profit.

Here's another interesting source of information:

Did you know that Federal/state/local government spending was 46.1 pct of GDP? Did you know there are almost twice as many government workers (at all levels) than workers employed in manufacturing? Did you know that the US debt, public and private, is $85 Trillion?

Let me rephrase. Do you have anything that justifies your explanation? There are spikes in the graph, but no explanation for them.

So?

Numbers without context are pointless.

From the seeded article: "The federal government embarked on a $6 trillion spending spree to keep individuals, businesses, and state governments afloat during the coronavirus pandemic - and it seems to have succeeded in lifting a lot of people out of poverty."

Lifting a lot of people out of poverty means their income has increased. That increase in income is shown in the Federal Reserve data.

Didn't you know that the relief checks (and government assistance) count as income?

What does your citation have to do with the spikes in the graph? If you want to present data - that's a good intention - you must demonstrate its relevance.

Poverty is a measure of personal income. A large, rapid reduction in poverty requires a large, rapid increase in personal income for those who were in poverty. The seeded article states that a large, rapid reduction in poverty was achieved. The seeded article cites government relief as the source of additional personal income that resulted in a large, rapid reduction in poverty.

The Federal Reserve data provides supporting confirmation for the information presented in the seeded article. That's why the Federal Reserve data is relevant.

The other linked information supports my statement that the large, rapid reduction in poverty is not sustainable. The people lifted out of poverty will very likely fall back into poverty.

I'm not saying you're wrong... I'm saying you haven't proven your case.

You're assuming that two things are linked, but you're not proving it. During that same period, lots of stuff was happening. You've picked out one item. You must justify the selection. You must show why it is more relevant than the other stuff that happened at the same time.

Then it behooves you to show how 'other stuff happening' is more relevant. Are you suggesting that government distribution of money doesn't decrease poverty by increasing personal income?

What I've stated is that the spikes in personal income attributed to government distribution of money is not sustainable. Most of the people lifted out of poverty by government distribution of money will fall back into poverty. The government is incapable of meeting expectations that poverty can be permanently reduced by government distribution of money.

No. That's not how it works. You are making a claim. You must support it. I am making no claim. I have nothing to support.

I have.

The next time, please don't post a graphic if you don't understand it. Thanks.

I do understand the information in the graphic. But this is not a forum for remedial education of those who do not understand the graphic.

Says the guy who calls posters on here fascists with zero proof and only to boost his ego.

NT's fascists identify themselves every day.

Don't you think it would be right to Perrie to let her know who those people are?

Of course, some people would not want to out themselves.

Why? Fascists are welcome on NT.

Well then where the fuck are they? You keep blabbing incessantly about fascist this fascist that, where are your boogeymen?

A fascist is (by definition) an authoritarian and a xenophobe (racist). There are lots of NT members who are authoritarian and racist.

Look around.

There are none.

To a leftist, anyone not toeing the loon leftist line and falling over the feet of socialism is a fascist.

I bet certain leftists wake up every morning and look under their beds for fascists and Russians, just like they did when they were continually accusing Trump of collusion.

Everybody on here that countered them then, in their minds, were Russian.

I dont think we have outright fascists here, but we definitely have a few that would be totally cool with it.

Yep....those that think ANTIFA is really anti-fascist.

Oh yeah, and filling a vacant seat is packing the court. And bezos’s money is not his own. And i care so much about the poor that i want an endless flow of dirt poor immigrants that will need public assistance and gas to cost $10 per gallon. And now, fascists, FASCISTS, they are everywhere, they are among us. Yeah, you have zero credibility due to your endless bs and dumbass beliefs.

"Economics is just math" - Bill Clinton