Russia’s Ukraine war and Biden’s oil import ban affects gas prices, but drilling isn’t the answer -The four myths Republicans have been spreading about oil and gas prices, explained.

www.vox.com /22959903/russia-ukraine-oil-gas-price-europe-us-exports-climate-change

Russia’s Ukraine war and Biden’s oil import ban affects gas prices, but drilling isn’t the answer

Rebecca Leber 10-13 minutes 3/5/2022

Editor’s note: On March 8, 2022, President Joe Biden announced a ban on Russian oil imports, as oil and gas prices have surged.

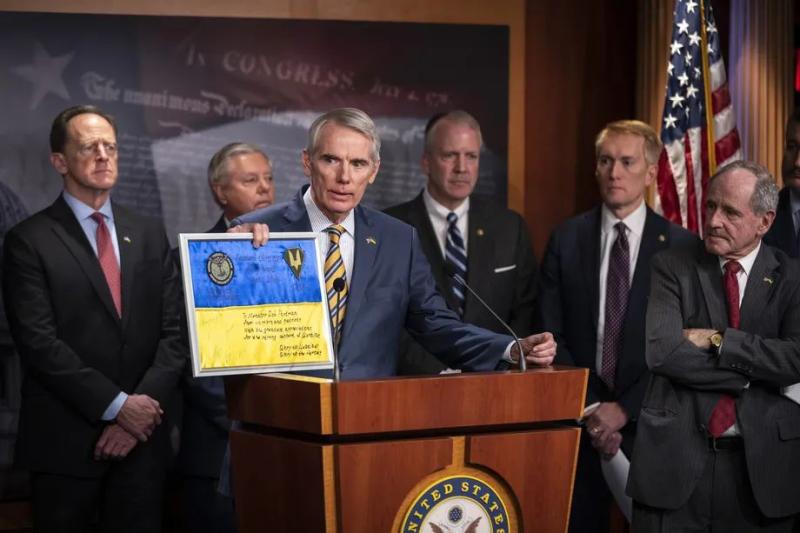

Republicans and conservative commentators have had a field day using Russia’s invasion of Ukraine as an opportunity to bemoan US energy policy and champion fossil fuel reserves. They’ve pointed fingers at the Biden administration , environmentalists , and even Swedish teenager Greta Thunberg, alleging that climate priorities are what have kept America from its “energy independence.” If only oil and gas companies were allowed to drill or frack more, we’d have a quick fix to rising energy prices in the US and Europe and to Putin’s influence, they’ve said.

There are many problems with these claims, and the stakes of this conversation are very high: The way western Europe and the US respond to this crisis could determine the course on climate change and energy costs in the long run.

Let’s walk through the myths currently circulating and how to avoid falling for them.

Myth No. 1: Biden killed oil production

Republicans on the Senate Natural Resources Committee recently sent a letter to Biden claiming that he has shut down leasing for oil and gas and is holding back more production. “There has not been one lease sale on federal lands since you imposed a ban in violation of federal law,” the letter said. “No other major oil-producing nation shuts off its own reserves to production.” Sen. Joe Manchin echoed the myth at a recent hearing : “The time for leasing pauses has come & gone.”

Biden has done nothing to halt oil leasing. In fact, the Biden administration has outpaced Trump in issuing drilling permits on public lands and water in its first year, according to federal data analyzed by the Center for Biological Diversity. His administration set a record for the largest offshore lease sale ever in the Gulf of Mexico last year, before a federal court blocked the lease sale for not considering climate impacts.

There was a temporary pause on new federal leases in the first few months of Biden’s administration when he placed a moratorium on them while the administration reviewed how to better integrate climate costs in lease sales. Meanwhile, the president has done nothing to prevent the vast amount of gas production that occurs on private lands or halt existing oil leases on federal lands. The moratorium is now irrelevant, anyway, because a Louisiana federal judge ruled against it last June. (There’s a second, temporary pause on new lease sales because another court invalidated the administration’s use of a social cost of carbon.) The US also became the world’s largest exporter of liquified natural gas (LNG) for the first time in 2021.

Clark Williams-Derry, an energy analyst with the Institute for Energy Economics and Financial Analysis, offered a reality check to those complaining that climate regulations have changed the fate of oil and gas. “The idea that the tiny marginal changes in US policy have anything to do with the big shifts we’ve seen in prices is just preposterous,” he told Vox. The marginal Biden measures — like reversing Trump-era environmental rollbacks — haven’t made any kind of dent in the global oil market.

Myth No. 2: The oil and gas industry can quickly ramp up production to make a dent in prices

According to an op-ed in the Hill from Rep. Gus Bilirakis (R-FL), increasing oil and gas production is as easy as “flipping the switch.”

The White House would probably be pulling those levers if it could because Biden advisers have said they’d like to see more production. “Prices are quite high, the price signal is strong,” White House National Economic Council Deputy Director Bharat Ramamurti said in an interview . “If folks want to produce more, they can and they should.”

But oil companies have made it clear in earnings calls with shareholders that they don’t plan to produce much more, anyway. Remember that just two years ago the industry was in a complete free fall when demand crashed because of the pandemic. Banks sought government bailouts for oil investments that went under, and oil prices actually hit negative levels as producers grew desperate for oil to be taken off their hands.

Oil and gas prices have climbed in the US because demand during the pandemic has bounced back faster than supply, and with instability caused by factors that include Russia’s war in Ukraine. In the past decade, Americans have gotten used to cheap fuel, but crude oil is now well over $100 a barrel , as of March 8.

It’s possible prices will still climb, but at least in recent weeks, that hadn’t changed companies’ calculations on production levels. “Whether it’s $150 oil, $200 oil, or $100 oil, we’re not going to change our growth plans,’’ Pioneer CEO Scott Sheffield told Bloomberg Television in February. “If the president wants us to grow, I just don’t think the industry can grow anyway.’’ The largest US fracking companies reiterated in earnings calls in February that they intend to keep output roughly flat, according to reporting from the Wall Street Journal.

In other words, now that companies are making handsome profits, they’re using that extra cash to reward investors and pay down debts, not invest in new production.

Myth No. 3: LNG exports will fix Europe’s problems and help US gas prices

Lawmakers and pundits have offered an overly simplified solution that the US can just make up that difference in exports. Columnist Karl Smith at Bloomberg Opinion argued, “Fracking may be America’s most powerful weapon against Russian aggression.”

But LNG exports don’t solve Europe’s or America’s energy challenges. In some ways, they exacerbate them.

To export gas to Europe, a facility first needs to convert it to liquified natural gas, which cools and pressurizes the methane so it can be shipped across continents. On the other end of the ocean, another facility must turn it back into gas for shipment via pipeline.

That’s a lot of infrastructure, which is impossible to scale up in enough time to make an impact on current prices. There’s one new LNG terminal that opened this year in Louisiana. On the European side, the LNG terminals are already at capacity . This isn’t going to help make up Russia’s supply of 40 percent of Europe’s gas either.

So it’s not particularly helpful or possible to boost exports to Europe, but it also wouldn’t help prices in the US.

Williams-Derry says that US exports of liquified natural gas have been the primary reason for climbing prices. In 2016, the US completed its first LNG export terminal in decades, which the gas industry hoped would alleviate a glut of natural gas that was keeping US gas prices too low for the industry’s liking.

“The reason we’re experiencing higher natural gas prices right now is we’re exporting more,” Williams-Derry said last week. “It’s not that we’re consuming more. It’s not that we’re producing less. It’s that we’re exporting.” The chart shows how LNG exports have grown since 2016.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/23287972/ieefa_on_gas_exports.jpeg)

Gas exports have been since the expansion of liquified natural gas terminals in the US since 2016. The move was intended to boost profits, and now is responsible for rising methane gas prices. IEEFA

There’s a reason the fossil fuel industry has been pushing so aggressively for new infrastructure. Jack Fusco, president and CEO of the largest LNG company in the US, Cheniere, welcomed the instability because of how it would boost the industry’s profits. In recent comments highlighted by Kate Aronoff at the New Republic , Fusco said, “But if anything, these high prices, the volatility, drive even more energy security and long-term contracting.”

Fusco’s argument underscores the real reason the industry is drumming the message about energy security. The more government investment in new infrastructure, the more multi-year contracts the industry can get, and the better the prospects are in the long term. Exports aren’t the simple fix for the US or Europe, but they are the best thing that can happen to the oil industry in the long run.

Myth No. 4: We can ignore climate concerns because boosting gas will counter dependence on Russia

In an op-ed for Fortune, American Petroleum Institute CEO Mike Sommers suggested the oil industry is ramping up production for patriotic reasons: “U.S. natural gas producers and exporters have mobilized to help ease Europe’s ongoing energy crisis,” he wrote, adding “as in World War II and other crises, America has Europe’s back.”

None of the suggestions Sommers suggest, like boosting LNG capacity, actually help in the immediate crisis. Sommers says himself this is a lesson for the long run.

In the long run, investing in fossil fuel infrastructure can seriously backfire by raising energy costs for Europeans and increasing reliance on Russian gas. LNG will always be the more expensive option because of its processing and transport. “By locking yourself into a gas-powered future, you’re locking in higher costs for the long haul,” Williams-Derry said. “There’s not a good alternative to Russian gas if you want to have inexpensive gas in Europe.”

“If you’re going to double down on gas, essentially, you’re doubling down on Russia,” Williams-Derry added.

Skyrocketing energy prices during periods of global instability is nothing new, but countries have still not learned that “part of what we’re seeing here is the cost of reliance on fossil fuels,” said Sam Ori, executive director of the Energy Policy Institute at the University of Chicago.

Clean energy isn’t a panacea either. “Once you’re in the [energy] crisis, it’s too late,” Ori noted. But Ori noted that the world will have to make choices anyway of how to respond to Russia. Countries will invest in new energy infrastructure. They will have to make a choice what kind of energy future to support. And there’s a real opportunity to break the cycle of instability.

But the US risks learning the wrong lessons. Sen. Manchin, who has voiced support for historic funding for climate and clean energy investments but blocked the passage of the original Build Back Better bill, has rallied for an all-of-the-above energy approach that boosts fossil fuels. “To continue to ask other countries to do what we can do for ourselves in a cleaner way is hypocritical,” Manchin said in a recent statement . Lobbyists from the US Chamber of Commerce and American Petroleum Institute are beating the same drum.

The biggest risk is if the US and Europe respond to this crisis by over-investing in the future of fossil fuels. Actions like building LNG terminals and approving new leasing don’t help in the short term when people are struggling to pay high bills. It doesn’t achieve energy independence. But it would lock the world onto a dangerous path for climate change.

Correction, March 7, 2022, 11:45 am : A previous version of this article incorrectly stated that a US oil export ban lifted in 2015 affected gas exports.

reality check -

www.msnbc.com /opinion/msnbc-opinion/record-high-gas-prices-are-not-joe-biden-s-fault-n1291238

Opinion | The GOP is lying to you about gas prices

By Hayes Brown, MSNBC Opinion Columnist 6-7 minutes

On Tuesday, the day the average gas price in the U.S. beat a record set in 2008, President Joe Biden announced that the United States will halt imports of Russian oil in response to Moscow’s invasion of Ukraine. But the Republican Party would prefer you focus on the record-high price to fill your tank than on any bipartisan support for cutting off Russia.

“Joe Biden caused this and doesn’t seem to care,” Nathan Brand, the Republican National Committee’s deputy communications director, tweeted Tuesday about the new record . The party’s rapid response director, Tommy Pigott, captioned a 2019 video of Biden pledging to end fossil fuel with, “The pain at the pump is the point.” Sen. John Barrasso, R-Wyo., who co-sponsored a GOP bill to cut off Russian oil, was one of several elected Republicans demanding that Biden “take the shackles off American energy.”

In the race to politically exploit the high cost of gas, Republicans are banking on voters not caring that they’re lying through their teeth about how much of this is Biden’s fault. The president does not, as they would have you believe, have a dial in the Oval Office that he uses to set gas prices. Meanwhile, suggested fixes the GOP has offered up would do nothing to shrink Americans’ costs, which suits them just fine for now.

Vox’s Rebecca Leber put together a great roundup of the myths that Republicans have been touting, including their claim that Biden choked off oil production and that it’s Democrats who aren’t “flipping the switch” on more production. As Leber noted, oil companies are the ones who won’t be ramping up production anytime soon. The industry is still trying to recover its losses from during the pandemic, when demand for oil cratered and prices briefly plunged to negative levels . Likewise, while the number of active rigs in the U.S. continues to rise after that 2020 crash, oil companies, like most other industries, are struggling to hire workers and procure equipment amid the ongoing supply chain backlog.

Nobody likes to be in charge when Americans’ costs go up.

The demand for oil is back to pre-pandemic levels, potentially increasing the price of products across the board — and nobody likes to be in charge when Americans’ costs go up. That was true during the George W. Bush administration when the price of crude oil hit $145 per barrel in June 2008 as worried investors looked for a safe haven. (It didn't work .) And it was true under former President Barack Obama when demand recovered after the 2008 financial crash and the ensuing Great Recession.

More from MSNBC Daily

Must reads from Today's list

Crude oil was trading around $126 per barrel Tuesday, 58 percent higher than the roughly $80 per barrel it was at before Russia’s aggression against Ukraine roiled the market. That price, which makes up over half the total cost per gallon of gas, is based on global demand — something Biden has even less control over than how much your local Exxon station charges.

The U.S. Energy Information Administration shows American production of petroleum to be near its pre-pandemic high, while crude oil production specifically should hit that benchmark next year. And it's worth noting that the U.S. spent the last two years as a net exporter of petroleum — but is forecast to increase its crude oil imports . So while America pumping more oil could help meet domestic consumption needs, global demand is something the U.S. can do little about, absent asking OPEC countries to pump more crude.

But is there anything to the idea that Biden’s policies so far have blocked the U.S. from producing and importing even more oil? Well, not really. The death of the Keystone XL pipeline from Canada is a favorite talking point for Republicans, but that pipeline wasn’t even scheduled to be operational until next year, which would have no impact on today’s gas prices. Likewise, Biden’s pause on licensing new federal lands for drilling, which was overturned in court, didn’t stop those licenses already issued from being used; there are also 9,000 approved permits that haven’t been used yet.

As for some of the steps that Republicans are suggesting Biden take to lower prices, none would have much short-term impact. But all of them just happen to fit within the same set of energy policies the GOP is constantly pushing. Even if the Biden administration were to announce today that it would subsidize every new oil well in America, it’s not like sticking a straw into a milkshake. The time that elapses between initial drilling to a completed well that can deliver hydrocarbons can span from a few months to a few years.

Even if the Biden administration were to announce today that it would subsidize every new oil well in America, it’s not like sticking a straw into a milkshake.

Democrats scrambling for a quick fix — like a proposed gas tax holiday — will find that they’re also out of luck. The biggest issue isn’t the domestic supply of oil or the taxes being paid. It’s how much Americans love and expect cheap gas, a problem the U.S. has only encouraged as an automobile-centric society . In the rural areas and suburbs where the GOP is already poised to do well, there are no mass transit options to replace the family car, leaving people there to spend more of their paycheck on gas than urban dwellers and meaning they are more ready to find someone to blame.

That’s perfectly fine for the GOP, whose members now get to have their cake and eat it, too . Biden has done just what Republicans who wanted to look tough on Russia wanted. As a token of their appreciation, they’ll spend the coming weeks and months working to convince Americans that it’s Biden — and not Russian President Vladimir Putin — who’s draining their wallets at the gas pump.

I wonder if the oil companies want gas prices to go down.

They should have listened to the CEO of Hess Oil being interviewed. He told the interviewer that the government should be talking to Wall Street if they want more production since they will crush his stock prices and shareholders will be very angry if their dividends are cut which increased production would mean.

This is an excellent graph showing the number of operating well as of Feb 2022 vs pre pandemic.

Drilling isn’t a short term solution is what they said in 2008. As they’ve fought tooth and nail against every domestic energy initiative this century. if they had drilled then..

you drill now to help with tomorrow’s problems.

.

Here in Denver the price of gas at Kroger pumps was $3.29 a bit over a week ago. Yesterday it had risen to $3.99. Who has been trying to make the use of fossil fuels painful fort the American people? Certainly not the Republicans or Trump.

How is using fossil fuels painful? Specific examples please.

Oh, the high prices....perhaps having to choose among gas, medicine, or food

How is that painful? Expensive yes, painful????

So you feel that we should continue to import Russian oil after their invasion? Is that what you are promoting?

The gop in Oklahoma is unrelentingly in the pocket of the oil and gas industry so they were mad as Hell at Biden for low oil prices until they became mad as Hell about high oil prices when it fit their anti-Biden anti-American agenda!

So if they are "unrelentingly in the pocket of the oil and gas industry", why would they be mad about high gas prices?

Mad as hell at Biden for low oil prices? Where do you get stupid shit like that? If they were mad at Biden for low oil prices, don't you think they would be mad as hell at the previous administration?

Primary is being mad as hell about Biden, secondary is trying to figure out why they are mad as hell about him.

been hauling barley for a major beer maker the past couple days , ironically for "beer money ".

Ran the truck pretty close to empty on a set of tanks that hold about 190 gals , cost to fill up a couple days ago was just a little less than $700.

I can make 3 trips on a full set of tanks .

Normally the cost of fill up would be just a little less than $400. or that was the norm in the past .

cost of fuel is going to raise the price of everything is my point .

In the US, he did.

Reading is fundamental.