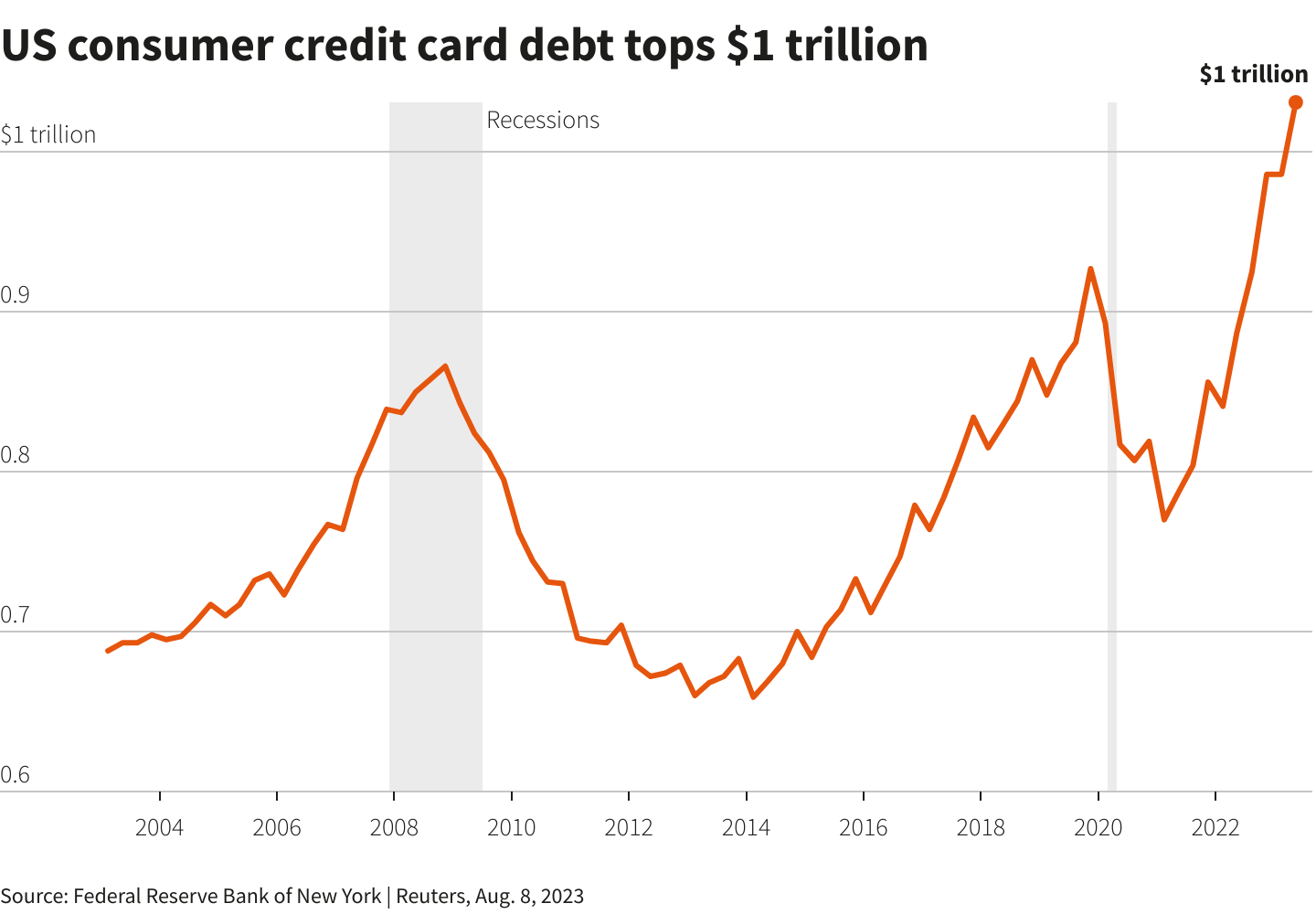

Credit card debt in US hits record high

Category: News & Politics

Via: sparty-on • last year • 44 commentsBy: Emir Yildirim ( httpstwitter. comanadoluagency)

Persistent inflation, rising interest rates spur US consumers to resort to taking out loans, say experts - Anadolu Ajans

Article is LOCKED by author/seeder

Article is LOCKED by author/seeder

The fetcher is acting up but the link works if you want to read it.

Hooray Bidenomics!

Buying food via credit cards is part of the Biden economy.

Or a SNAP card.

If you claim you're an illegal you will get more SNAP benefits than if you claim you're a citizen.

It shouldn't even be happening there but yet, here we are.

Yep pretty sad. Even worse is that many of the folks getting screwed by that reality are still supporting the people screwing them.

Amazing

It's far beyond pathetic. And they don't even realize where the problem is. They just keep drinking the Kool-aid.

Persistent inflation, rising interest rates spur US consumers to resort to taking out loans, say experts

OMG-- that's terrible!

(Totally unprecedented in our entire history! )

)

I pay mine off every month. It's usually about 1500 or so. 0 mortgage, 0 car payments, 0 debt. Life is good.

Where was this sourced? Turkey?

Well, it certainly wasn’t sourced in a “Resist” boiler room that’s for sure.

No, this is Tokyo Rose level anti-American propaganda, from Turkey! Americans hit new credit card records every year, except when we are in another gop recession! Americans spending more is a sign of Consumer Confidence and of our growing economy, not of hard bad times...

lol ….yeah, data coming from the Federal Reserve Bank is like Tokyo Rose propaganda.

Hilarious!

I said what I meant, and I was correct...

Yes you did and no you are not. Not even close actually.

It is not you ….. not remotely

Then explain this...

See Bush's Recession and Covid?

That is a longwinded way to say that you can't dispute a single thing in the article.

Evidently a concept lost on a lot of people.

lol Bush’s recession? It was Bush’s recession but this isn’t Biden’s record credit card debt? One wonders if you are really serious or just playing the normal silly NTer mafia games.

And the key words here are “record credit card debt.” Higher than “Bush’s” recession and COVID. You do comprehend that from the chart you linked, right?

That is opposite what the graph shows...

Alrighty then …… thank God you aren’t an Engineer.

My chart proves that the only times credit card debt declined was in very bad times...

Unlike Now!

It is bad for the economy if we spend less!

So your supposition is that record debt is good?

Was growth credit card debt so bad when it reached new records every year of the Trump administration, until Covid-19?

Answer my question and I’ll be glad to answer yours

Paid my cards off with a home equity loan last year.

Maybe we need "Credit Card and Loan Debt Forgiveness" to pay off the credit cards and loans people have to rely on because of Bidenomics.

Damn it, don’t give goober and his Bidenettes any ideas ….

Oh, if they do that, I'm going on a Democrat level spending spree. But then again, with they way they let criminals go with no repercussions, we could walk into any store and do a snatch and run this afternoon. If arrested I'll talk jibberish claiming I'm "seeking asylum" and they'll give me transportation to where ever I want to go and SNAP benefits.

A large portion of the people being forced to do this are the poor. The folks Biden says he is fighting for. Wakey wakey people. Bidenomics is killing you.

My father's philosophy was, and how he lived his life, If you don't have the cash in your pocket, you can't afford it. He ended up being a very financially successful man. When I came to China I had only an Amex card that I used primarily for travel, such as making hotel reservations, etc, and I paid it up on every due date. I eventually allowed it to expire because we no longer travel so I don't need it and I live with my father's philosophy - not a single concern about debt. Actually, my Amex card expired with them owing ME a bit of money, but not worth the effort to seek it.