The Fed Must Mind Expectations

Markets are expecting more rate cuts. His Royal Orangeness is demanding them.

The Fed, however, isn't necessarily there.

Will Trump fire Powell? (Of course I know he doesn't have any legal right to do that... but does anyone think he gives a flying fuck about the law?)

Will Trump appoint himself Chairman of the Fed? Will the Senate approve?

I've got a longer piece on this topic over at msnbc.com , but for here, let me start with this NY Times quote from the Yuriy Gorodnichenko. Yuriy, a Berkeley econ prof, is an authority on inflation expectations, which he partly derives from a original survey of wage and price setters:

"There is enormous disagreement about what inflation can be, and what this means in practice is that inflation expectations are not anchored. It's very easy to change the beliefs of people from one number to another, because everybody is so uncertain and so confused."

Now, consider that Yuriy said this back on March 17th , i.e., well in advance of the current sh—show.

I raise this because the sweeping tariff agenda puts the Fed in a tough box. In a nutshell, Trump has already starting raging for the Powell Put (defined below) to kick in, but Powell's explicitly not quite there. From a speech he gave last Friday:

"While tariffs are highly likely to generate at least a temporary rise in inflation, it is also possible that the effects could be more persistent…Our obligation is to keep longer-term inflation expectations well anchored and to make certain that a one-time increase in the price level does not become an ongoing inflation problem."

Unpacking, there are two tariff-driven problems the Fed faces here. One is that stagflation—slow growth at higher prices—is by definition a challenge as their rate tool doesn't work like that: slower growth==>cut rates; higher inflation==>raise rates.

Two, tariffs are, in theory and practice, a one-time hit to the price level, and every central banker is raised from youth to "look through" one-time inflationary hits. But, as Powell said, the effects could be more persistent.

EG, if tariffs just keep coming, so they're not a one-time-thing that Fed officials can "look through." Or, if in the sense that I suspect Yuriy is referencing, wage and price setters don't have a clear sense as to the limits of Trump's tariffing project. The Fed believes that such dynamics could de-anchor inflationary expectations, which is a true back-to-the-1970s nightmare for them.

Which means the Powell Put, where the Fed cuts rates in reaction to stock market declines as insurance against a spreading sell-off, may not be forthcoming. As I get into in the MSNBC piece, Trump will not like that one bit.

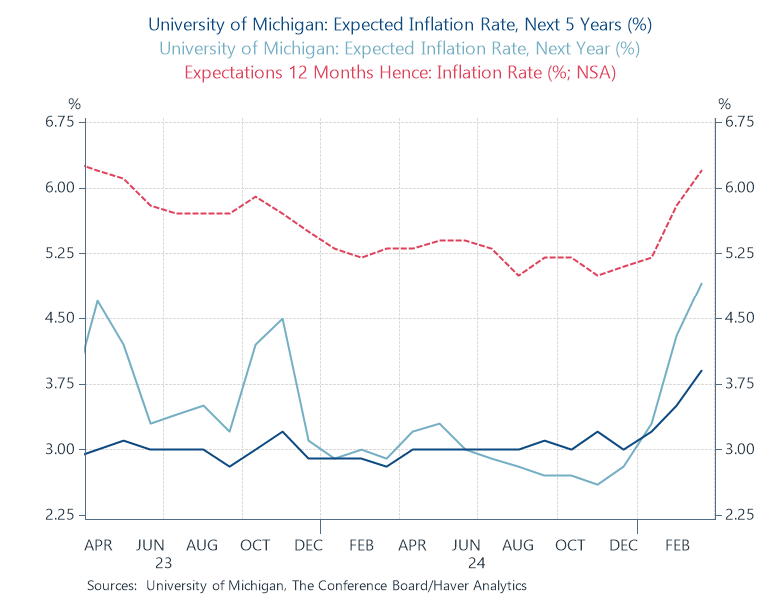

What do the inflation expectations indicators show? Well, that depends on where you look. Consumers, appropriately freaked out about price effects of the tariffs, have jacked up both their short- and longer-term inflationary expectations, as shown in the figure below (sources are UMich and Conference Board).

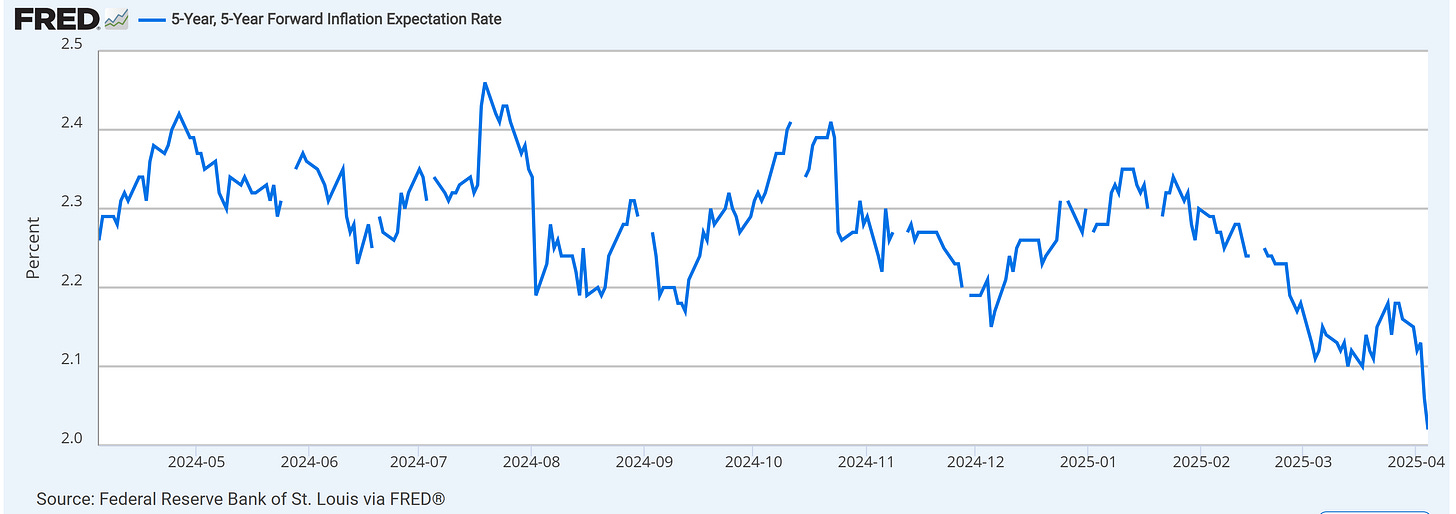

Market-based formulas, however, are not even flashing yellow. To the contrary, the one below of long-term expectations ticked down sharply in recent days. That should be heavily discounted, as it's reflecting more of the recent market stress and expectations of future rate cuts than the status of anchoring conditions.

But the broader, simple point is that tariffs and the stagflation they create, along with their potential for de-anchoring expectations, could lead the Fed to be reluctant to intervene with rate cuts. And remember also that numerous Fed peeps are already antsy about whether inflation is reliably heading back down to their target.

This happens to be the opposite of what markets are expecting: Fed futures are now pricing in more Fed rate cuts based on the tariffs' impact on markets and future growth. And, sure, if the economy's bottom really falls out, the Fed will jump in to help.

But they're still—and if I can help it, always will be—independent from the chaos-generating White House and will act in ways to best meet their dual mandate of full employment at stable prices. Even when it gets really hard to do so.

Whatever

Nota to NT MAGAs: There have now been a couple dozen seeds about how stupid and destructive Trump's tariffs are. I continue to hope (far America's sake) that all those analyses are wrong.

I continue to hope that you will seed articles explaining how these tariffs were determined, and why they are a good idea.

Note to NT liberals. Tit for Tat seems to be "Do your own fucking research" if you honestly want to find it. There has been plenty of comments posted here (not novel-length commentary) doing just that.

Does that, in your opinion, also apply to NT conservatives as well?

(Is it possible you have somewhat of a " double standard " here?)

Nope. No double here. Conservatives, more times than not, will comply. Lefties it seems, not so much and some get all pompous assed arrogant about it and opine "do your own research. I'm not your mom" bullshit

What color is the sky where you live? Right wingers on NT are widely known to bail from comment threads when they are asked to support their claims. When they actually do reply to the request for supporting their claims, they either claim to have done it already or that the requester should do their own research. See example ...

Not a very good example at that...................I think your cherry picker of commentary must have gotten deported.

I've found that's usually an indicator that they can't back up their claim.

That will be a challenging tast-- because the actual fact is-- those tariffs are a terrible idea!

Just to be perfectly clear-- I'm speaking here about actual facts (AKA "true facts")--- not "alternative facts"!

Anyone remember this?

Kellyanne Conway: Press Secretary Sean Spicer Gave 'Alternative Facts'

The right and alternative facts are a match made in heaven.

Mark Cuban: "My Money Is on Donald Trump Winning"