China Has Readied a Trade-War Arsenal That Takes Aim at U.S. Companies

In the years since President Trump’s first trade war with China, Beijing has built an arsenal of tools to hit the U.S. where it hurts. Now, it is getting ready to deploy them in full.

On Wednesday, China said it would increase tariffs on all U.S. imports to 84%, a response to new U.S. tariffs on Chinese imports of 104% that went into effect at midnight . It also added six U.S. companies including defense and aerospace-related firms Shield AI and Sierra Nevada to a trade blacklist, and imposed export controls on a dozen American companies including manufacturer American Photonics and BRINC Drones.

While Trump has focused on tariffs as his trade weapon of choice, China’s strategy goes well beyond imposing its own levies, relying on the lure of the Chinese market for U.S. companies. A central thread running through its calculus is how to inflict hardship on companies that bank on their ties with the world’s second-largest economy.

Tools that Beijing has already used and is likely to expand include export controls of critical materials American companies use to make chips and defense-related products, regulatory investigations designed to intimidate and penalize U.S. companies, and blacklists intended to bar U.S. businesses from selling to China. In addition, authorities are preparing new ways to pressure American companies to give up their crown jewels—intellectual property—or lose access to the Chinese market.

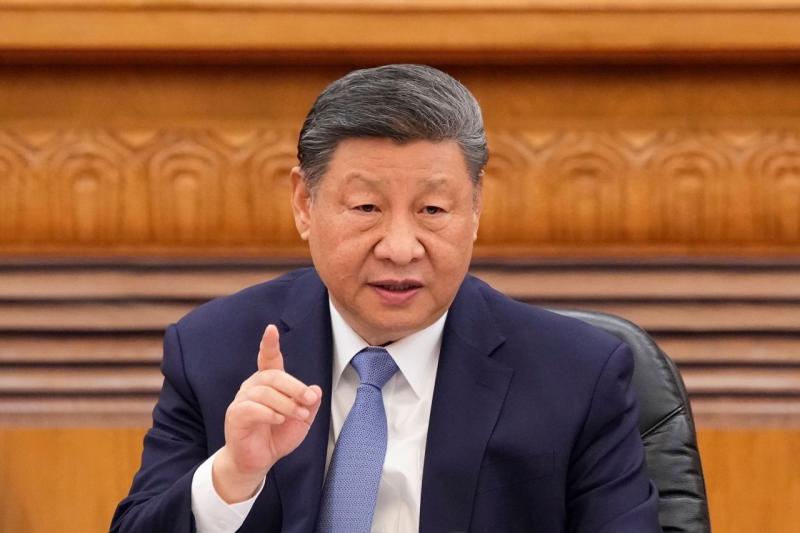

The toolbox underscores leader Xi Jinping’s capacity to engage in a prolonged economic warfare with the U.S. As both capitals appear to move toward decoupling, it also highlights the ever-rising risks for U.S. companies operating or investing in China, or simply trading with the country.

“China has systematically put together a new arsenal of tools that’s intended to minimize the cost to China and maximize the pain on the U.S.,” said Evan Medeiros, a former senior national-security official in the Obama administration and now a professor at Georgetown University. “They’re prepared in a way that gives them an asymmetric advantage in the trade war.”

China’s government and state media have taken a defiant tone, with the Commerce Ministry saying, “If the U.S. insists on its own way, China will fight to the end.”

The 104% tariff on all Chinese imports that Trump has now imposed in his second term will stack on top of earlier tariffs already in place , bringing the total average tariff rate on China to nearly 125%.

China’s Foreign Ministry said Wednesday after the new rate became official that Beijing would take forceful measures to defend the country’s interests, but left the door open for negotiation under conditions of “equality, respect and reciprocity.” China’s Ministry of Commerce noted that the U.S. has long enjoyed a trade surplus with China in services, amounting to $26.6 billion in 2023.

China exports far more to the U.S. than it imports. Still, China is the third-largest buyer of U.S. goods. Soybeans, aircraft and petroleum are among the top U.S. exports to China.

There are some options Beijing will for now be less likely to resort to as the costs to China itself could be high. That includes sharply devaluing the yuan or aggressively selling down its holdings of U.S. Treasurys. Both moves could destabilize China’s own financial market and hurt its strategic goal of bolstering trade relations with other countries.

In recent weeks, for instance, Chinese officials have reached out to some countries in Southeast Asia including Cambodia, Laos and Thailand to try to boost trade with them as well as promoting the use of the Chinese yuan in settling transactions, according to people familiar with the matter.

During those discussions, the people said, Chinese officials have indicated that Beijing is eager to keep the yuan largely stable to advance its “de-dollarization” goal of conducting more trade in yuan.

Tensions between Beijing and Washington have been spiraling, as each round of Trump’s tariff increases on China has led Xi’s government to punch back against the U.S. The Xi leadership’s early hopes of negotiation with the new administration have now morphed into frustration and anger.

The mix of China’s latest countermeasures illustrates its increased focus on targeting U.S. companies, especially those engaged in high-end technology. In its intensifying firefight with Washington, Beijing continues to rely on the lure of the Chinese market for companies, despite China’s recent sluggish growth , as it also seeks to win the race over technology.

One tool Beijing has increasingly used to advance its geopolitical goals is its antimonopoly rules . For instance, some merger deals that could have benefited U.S. companies, such as Intel’s proposed takeover of Israel’s Tower Semiconductor , failed to go through after Chinese authorities dragged their feet on approving them.

In response to Trump’s recent tariff actions, China last week launched an antitrust probe into the China operations of DuPont , which relied on the mainland and Hong Kong for 19% of its revenue last year, without giving much explanation.

China’s antitrust regulator also is reviewing a deal that would shift control of two ports in Panama from CK Hutchison , controlled by the family of Hong Kong billionaire Li Ka-shing, to an investor group led by BlackRock . Even though none of the companies or assets involved are in mainland China, Beijing’s probe threatened to delay the deal, which has become a flashpoint between the U.S. and China . The deal now faces a serious hurdle after Panama’s top auditor said CK Hutchison owes unpaid fees and failed to get necessary clearances for the Panama ports.

Another powerful trade weapon Beijing has developed is the so-called unreliable-entity list, its equivalent to a list the U.S. maintains that restricts foreign companies and individuals deemed harmful to national security from doing business with American companies.

China created the blacklist in 2019, after the U.S. placed Chinese telecommunications giant Huawei Technologies on its list. Companies China identifies as unreliable entities are banned from investing in the country or engaging in trade with Chinese companies and face, among other restrictions, entry bans for their key employees.

A new academic paper by Medeiros of Georgetown and Andrew Polk, co-founder of research firm Trivium China, shows that China’s deployment of the unreliable-entity list has been slow and cautious—until recently.

It started to use the tool in 2023 when it put Lockheed Martin and Raytheon Missiles & Defense on the list for their involvement in arms sales to Taiwan . The move has had limited impact on both companies because neither does much defense-related business in mainland China. The listing hasn’t affected Raytheon-linked commercial subsidiaries in the country.

However, in the fall of 2024 and early 2025 Chinese authorities ramped up use of its entity list, both in frequency and in scope, according to the paper by Medeiros and Polk, published in the Washington Quarterly journal earlier this week.

Most recently, in response to Trump’s tariff assault, Beijing has broadened its blacklisting of U.S. companies from defense-related businesses to companies such as PVH, the U.S. parent company of Calvin Klein and Tommy Hilfiger, and U.S. biotechnology firm Illumina . PVH provoked ire from Beijing after it said it was removing Xinjiang cotton from its production to comply with U.S. law, while Chinese officials believe Illumina has lobbied to exclude its Chinese competitors from parts of the U.S. market.

Until early this week, according to Medeiros and Polk, China has blacklisted 38 U.S. entities and will likely target more American companies as part of its broader competition with the U.S.

China's historical ability to survive all calamities may well place her as the-one-to-beat.

My he has a huge pinky.

The stinky is on the pinky...

does this mean that all that cheap trump and maga merchandise shit for idiots now costs 3x as much today? gee, that's too bad ...

No price is too high for that consumer.

... and apparently, no bar too low.

The Chinese are long term thinkers and planners, Trump on the other hand is shoot from the hip, that is not.a whining formula.

They, and a lot of other people, saw this coming and made contingency plans. I don't think that Trump has a plan beyond weakening the dollar.

trumpski doesn't have a plan for next week, that doesn't involve playing golf ...

The USA has a system where everyone takes care of themselves in a zero-sum game. There is no general direction for the nation, because that would have to be the government, and our government intends to do nothing whatsoever. (Except give money to the already-rich, of course.)

China has a system where everyone takes care of everyone to the benefit of everyone... because the government requires it. The government also determines which industries are to be boosted with cheap loans and such. So China controls the world's rare earths, electronics, automobiles, ...

Why is President Xi smiling?

Because he knows he has the US by the short and curlies. I hope you all bought new wardrobes recently

In China the government doesn't NEED to require it, it's a cultural tradition

The eradication of abject poverty in China is a prime example of it, the cultural tradition that is normal among Chinese families expanded by the government has benefitted millions of people.

I suspect that it's both. Cultural tradition reinforced by state policy. The tradition makes the policy almost invisible, while the policy ensures that the tradition continues.

What Trump imagines...

China unlikely to blink first as Trump’s trade war enters uncharted new territory

Since Trump’s first trade war with China in 2018, Beijing has ramped up trade with other countries, making it less dependent on the US

by Amy Hawkins

The opening shots seem like a distant memory. Back in January, US president Donald Trump threatened to impose a tariff of 10% on Chinese imports. Less than three months later, the rate is now 125% .

China has condemned the tariffs. As well as applying its own reciprocal tariff of 84% on US imports , Beijing has been fighting a war of words.

“When challenged, we will never back down,” said China’s foreign ministry spokesperson, Lin Jian. The commerce ministry said : “China will fight to the end if the US side is bent on going down the wrong path.” Further countermeasures have been promised by Beijing.

The tit-for-tat measures could spark fears of a race to the bottom, with ordinary people suffering as prices rise and a fears of a global recession grow.

But although China’s economy has in recent years been beset by its own challenges , when it comes to tariffs specifically, Beijing is unlikely to blink first.

“For President Xi, there is only one politically viable response to Trump’s latest threat: Bring it on! Having already surprised domestic audiences with a forceful 34% reciprocal tariff, any appearance of backing down would be politically untenable,” says Diana Choyleva, founder and chief economist at Enodo Economics, a forecasting firm.

One of the most helpful factors in Beijing’s favour is the fact that the US is far more dependent on Chinese imports than China is on the US.

The main items that the US imports from China are consumer goods, such as smartphones, computers and toys. Last week, analysts at Rosenblatt Securities predicted that the cost of the cheapest iPhone available in the US could rise from $799 to $1,142 – and that was when Trump’s China tariffs were just 54%. “Trump cannot credibly deflect blame on to China for these economic hardships,” Choyleva says.

In contrast, the goods that China imports from the US are industrial and manufacturing supplies, such as soya beans, fossil fuels and jet engines. It is much easier for price increases in these commodities to be absorbed before a consumer gets their wallet – or in the case of China, their smartphone – out to pay.

Plus, this is not China’s first rodeo. Since Trump’s first trade war with China in 2018, China has ramped up trade with other countries, making it less dependent on the US. Between 2018 and 2020, Brazil’s soya bean exports to China increased by more than 45% compared to the 2015-2017 average, while US exports declined 38% over the same period. China is still the largest market for US agricultural goods, but the market is shrinking, hurting American farmers. In 2024, the US exported $29.25bn of agricultural products to China, down from $42.8bn in 2022.

China has other measures up its sleeve. On Tuesday, two influential nationalist bloggers published identical lists of possible Chinese retaliations , based on sources. China’s foreign ministry declined to comment on the articles but did not deny their content either.

The suggestions included suspending cooperation on fentanyl control , investigating US companies’ intellectual property gains in China, and banning Hollywood films from China. On the final point, a top-down embargo may not be necessary. China has in the past allowed online nationalists to whip up grassroots boycott campaigns. In 2017, Chinese consumers participated in a mass shunning of the South Korean supermarket chain Lotte , in response to the conglomerate’s involvement in a deal that allowed a US missile defence system to be installed in South Korea, which China saw as a security threat. Nearly half of the company’s more than 100 stores in mainland China were forced to close.

China’s strategic advantages do not make it totally immune from a trade war. The stock markets in China and Hong Kong are falling. Beijing has not yet figured out a way to meaningfully boost domestic demand, something that economists say is essential to truly tariff-proof the economy.

The political impact of Trump’s tariffs, coupled with the fear that the US is trying to turn other countries against China, is pushing US-China relations to an all time low. “I do not remember ever being this pessimistic about the trajectory of US-China relations,” wrote China analyst Bill Bishop in a newsletter. “The trade relationship is the linchpin between the two countries, and as it breaks we should probably expect other areas to see more stress.” But as the Trump administration talks of “Chinese peasants” and suggests that China is playing with a weak hand, Beijing is unlikely to back down anytime soon.

"...the fear that the US is trying to turn other countries against China...???

The FEAR? Are you kidding me? The US has not only continuously being doing everything it can to contain China but has been trying also to get other nations to do so for YEARS.

By the way, my wife and I, and my wife's extended family have absolutely no need of anything made in the USA so the tariffs against China are no problem for us, but the tariffs Trump imposed against Canada have the effect of reducing the conversion of my Canada pension to yuan, not enough to be a real concern, but enough to make me damn well hate that asshole Trump.

Oh, yeah!! It's a great time to start a trade war with China...

You could probably do similar illustrations for Africa and The Middle East.

Probably. I stumbled across this one a few days ago.