'Adam Smith's America' Review: Wealth of a Nation

By: Barton Swaim (WSJ)

Admirers of Adam Smith may be surprised to learn that there is an entire academic industry dedicated to the proposition that the great Scottish economist was not a proponent of free-market capitalism. Scholarly articles on Smith and the economic ideas of the Scottish Enlightenment frequently contain lengthy explanations of how he really didn't promote amoral capitalism and unfettered markets but believed rather in a virtuous society that placed moral concerns above the market.

Academic debates aside, the basic point about Smith's economic views isn't in doubt. His magnum opus, "An Inquiry Into the Nature and Causes of the Wealth of Nations" (1776), made the case that economic growth is not the result of governmental planning but the natural outcome of many people pursuing their own self-interest in the confines of an ordered polity. The problem, for academic historians and economists over the last 60 years, is that from the 1950s to the 1980s a few well-known free-market economists overtly applied the chief contentions of "Wealth of Nations" to the major political and economic questions of the postwar liberal order. They recruited Smith, in other words, to make the case against central planning and high taxation. His metaphor of an invisible hand, in their view—the self-interested merchant going about his business is "led by an invisible hand to promote an end which was no part of his intention"—exploded the fantasy that faraway planners were best equipped to create widespread prosperity.

That put Smith, one of the great thinkers of the 18th century, on the side of Ronald Reagan, William F. Buckley Jr. and this newspaper’s editorial page. There was, if I could say it plainly, no possibility that modern academics would let that association stand.

Now to be fair, “Wealth of Nations” was far more than a paean to open markets. The ideas associated with 20th-century classical liberalism were fashioned in opposition to the collectivist ideologies of fascism and communism; Smith had no notion of such things. And although Smith attacked most forms of governmental intervention in economic matters, he advanced some views that free-market economists anathematize—most notably the labor theory of value (the notion that a thing’s worth arises from the labor put into its creation). Odd, too, is the fact that Smith, the first great proponent of free trade and the scourge of protectionism, took a position in 1778 as commissioner of customs in Edinburgh—a tariff inspector.

The scholarly argument that Smith was no proponent of free-market capitalism, however, can get pretty abstruse. It generally incorporates his only other major work, “The Theory of Moral Sentiments” (1759). In that book, he argued that man’s sense of right and wrong derives from a capacity for “sympathy”: Seeing good or bad behavior, or seeing a person experience fortune or misfortune, enables one to put oneself in the place of another and thus think and act morally.

That “The Theory of Moral Sentiments” and “Wealth of Nations” appear to be in conflict—one an exploration of sympathy, the other, seemingly, a defense of selfishness—is commonly referred to as the “Adam Smith problem.” But academic discourse has settled on a solution. It goes something like this: “The Theory of Moral Sentiments” sets the moral premises for “Wealth of Nations” and shows us that the latter, more famous book doesn’t promote atomistic capitalism and unregulated markets at all. In this view, Smith in “Wealth of Nations” defended capitalism, yes, but with a lot of purportedly “moral” regulation. The academic consensus somehow perfectly matches the center-left consensus—amazing!

There is one small glitch: “The Theory of Moral Sentiments” isn’t very good. It is not a great work of philosophy. It’s mostly unreadable, to my mind. What’s more important, its thesis lacks cogency. Sympathy as Smith defines it is far too weak a foundation on which to build an elaborate theory of morality. If he had died after writing “Moral Sentiments,” Smith would be forgotten outside philosophy departments, and likely inside them.

The allegedly vital connection between “The Theory of Moral Sentiments” and “Wealth of Nations” has become a kind of orthodoxy, even so. Even politicians know the formula. “I have come to understand that his ‘Wealth of Nations’ was underpinned by his ‘Theory of Moral Sentiments,’ his invisible hand dependent upon the existence of a helping hand,” remarked Gordon Brown, then U.K. chancellor, in a 2005 lecture.

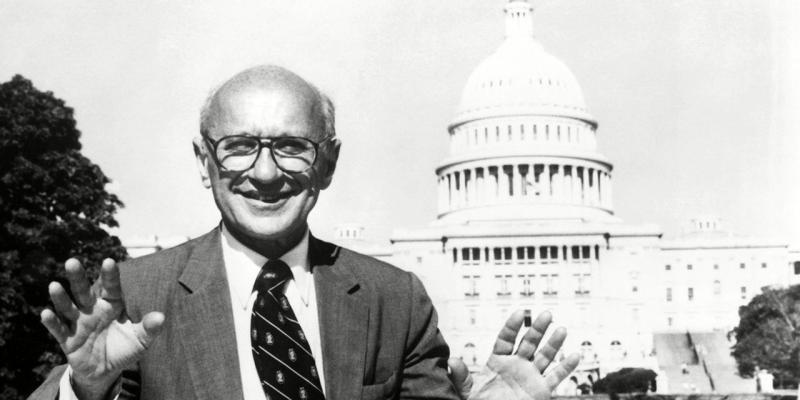

And yet the idea of Adam Smith as a proto-capitalist won’t go away. It is, Glory Liu contends in “Adam Smith’s America,” a false understanding of Smith propounded by figures associated with the University of Chicago Department of Economics, particularly Friedrich Hayek, George Stigler and Milton Friedman. The “complexity and pluralism” of older interpretations of Smith, Ms. Liu writes, have been “overshadowed by the influence of the so-called Chicago School’s distillation of Smith’s ideas into a popular and powerful myth: that rational self-interest is the only valid premise for the analysis of human behavior, and that only the invisible hand of the market, not the heavy hand of government, could guarantee personal and political freedom.”

A “distillation” turned into a “myth”—those are strong words. In the same paragraph Ms. Liu, a lecturer in social studies at Harvard, calls the myth “a deliberate construction.” That sounds close to a fabrication, or lie. But she quickly backs away from that suggestion by saying she is “less interested in providing a definitive account of what Smith originally intended or meant than . . . in elucidating the demands that his readers have brought to his works and how that colored the lessons they have extracted from them.” I am not sure what that means, but I gather from it that Ms. Liu knows she doesn’t have the goods to claim that the Chicago School got any part of Adam Smith wrong.

The book bears the subtitle “How a Scottish Philosopher Became an Icon of American Capitalism,” but you don’t get to the bit where Smith becomes the capitalistic icon until the penultimate chapter. What lies in the middle is basically a history of Adam Smith’s reception in Europe and America. As a work of history the book has its virtues. I had not appreciated how influential “Wealth of Nations” was on the American Founders—Thomas Jefferson read it with care; Alexander Hamilton did likewise but forcefully disagreed with parts of it; John Adams owned two copies, one in French translation.

But a curious thing happens when Ms. Liu gets to the Chicago School. We learn that a pair of earlier Chicago School economists—Frank Knight and Jacob Viner, who taught and wrote mainly from the 1920s to the ’40s—faulted Smith for failing to grasp the function of prices in a free economy. This would seem to contradict Ms. Liu’s thesis that the Chicago economists falsely turned Adam Smith into a free-market hero: Knight and Viner were pointing out that Smith didn’t grasp an essential reality of markets. Yet somehow, according to Ms. Liu’s analysis, they were wrong to do so. “By framing Smith’s contribution and legacy in the pure, objective language of economics,” she writes, “his Chicago exponents constructed the social-scientific bases of their political outlook which privileged free enterprise over central planning, and market rationality over moral reasoning.”

Forgive me, but Smith, for all his greatness as an economist, was wrong about value and pricing. To say so isn’t to “privilege” free enterprise over central planning but to state what is the case. You get the feeling that no one, according to Ms. Liu, can write accurately about any one thing in Adam Smith’s oeuvre without also, at the same time, considering every other thing he ever wrote and so smothering any potential insight with a thousand qualifications.

This high-minded disapproval becomes absurd when Ms. Liu gets to Hayek, Stigler and Friedman. These scholars, concerned as they were about the advance of collectivism over much of the globe, emphasized Smith’s perception that the self-interest of merchants tends to promote the interests of society as a whole. Alas, says Ms. Liu, this “often entailed a flattening of Smith’s ideas in ways that smoothed over, or altogether obscured, the complexities, tensions, and other problematic aspects characteristic of earlier readings of Smith.” Thus did the Chicagoans give us “an invented Smithian tradition” bereft of complexities and tensions.

For all the talk of obscuring complexities and inventing traditions, one looks in vain in Ms. Liu’s treatment for any instance of Hayek, Stigler or Friedman misunderstanding or distorting a passage or idea in Smith’s writing. “Though Hayek’s readings of Smith may have been opportunistic,” Ms. Liu writes after quoting a passage from the Austrian economist’s lecture on Smith, “they were not inaccurate.” As for Stigler, the consequence of his work on Smith “was that certain aspects of Smith’s ideas were amplified and glorified, while others deemed irrelevant or unsatisfactory.” Oh, no!

Ms. Liu’s complaint seems to be that Hayek, Stigler and especially Friedman were, for lack of a less pretentious term, intellectuals. Friedman “mastered the art of distilling and repackaging abstract and complex academic theories into more palatable, usable language for a wider audience.” That phrase “mastered the art” sounds vaguely sinister, but this is a description of what intellectuals do.

We reach the point of comedy when Ms. Liu quotes the socialist agitator Michael Harrington’s criticism of Friedman’s use of the invisible-hand metaphor. “The problem with Friedman’s version of the invisible hand as a right-wing political agenda,” she concludes, “was not that it was a complete misinterpretation of Smith’s text.” (That word “complete” is sly.) “The problem, as Michael Harrington put it, was that it was ‘essentially a mythic, non-historical presentation of an abstract solution taken out of time which does not look to the tremendous evolution of capitalist society.’ ” This is preposterous. If we were to take Harrington’s complaint seriously, we would never again draw on an old book to illuminate a modern problem.

Free marketeers haven’t won many arguments lately, but they have won the argument over Adam Smith. No number of academic monographs and journal articles will persuade the ordinary reader that he doesn’t understand the defense of free enterprise and free trade in “Wealth of Nations” until he has first made his way through “The Theory of Moral Sentiments.” If Ms. Liu and her likeminded academic peers think I’m wrong about that, they’ll need to master the dark art of intellectual debate.

Capitalism may not be perfect, but it still is, by far the best of economic systems.

It simply provides the means & oppurtunities for individuals to succeed.

There should never be guarantees.

I think the essence of a great system is one where:

And it should strictly be through legislation and not rules created by unelected bureaucrats.

Really? Is this supposed to be a revival of neoliberal apologists?

Adam Smith viewed labor as capital; not property as capital. Smith's theories of economics were derived from, what we consider, cottage industry and not the functioning of banks, finance, and corporations in an economy. Smith was not a proponent of seeking rents. Smith's views on exploitive mercantilism weren't complimentary. Smith's views on the role of passive investors weren't complimentary. Smith's views on monopolies weren't complimentary.

Smith's 'invisible hand' is nothing more than competition in the marketplace. Competition among producers, competition among consumers, and competition between producers and consumers. Anything that inhibits competition will inhibit free (and fair) trade. When producers cannot compete because of monopolistic inhibitions then trade is not free (or fair). Smith's view of capitalism (a term which was coined later) involved a direct connection between labor and consumer through the marketplace.

The neoliberal perversion of Smith (often labeled as libertarian liberalism) is not a modern refinement of capitalism. Neoliberals (and libertarians) misappropriates Smith to inhibit competition; an anti-Smith take on economics. Neoliberalism is the antithesis of Smith's theories on economics.