Data prove it: The Trump tax cuts soaked the rich

By: nypost (New York Post)

The latest IRS data on who bears the income tax burden demonstrate yet again the benefits of lower tax rates over higher rates.

Bernie Sanders should pay attention.

When President Donald Trump entered office, the richest 1% of tax filers ($675,000 income and above) paid a little more than 40% of the income taxes collected.

The 2017 Trump tax cut reduced the effective highest federal tax rate to 37% from 42%.

Both Joe Biden and Bernie Sanders, then as now, condemned this a giveaway to the rich.

But the most recent IRS tax return data (for 2021) confirm that even as these rates were lowered — not to mention the corporate tax rate cut from 35% to 21% — the share of the tax burden shouldered by the 1% rose to almost 46%.

Why is everyone always caught by surprise when this happens?

High-income earners shelter less and earn more when top tax rates fall.

That shouldn't astonish anyone.

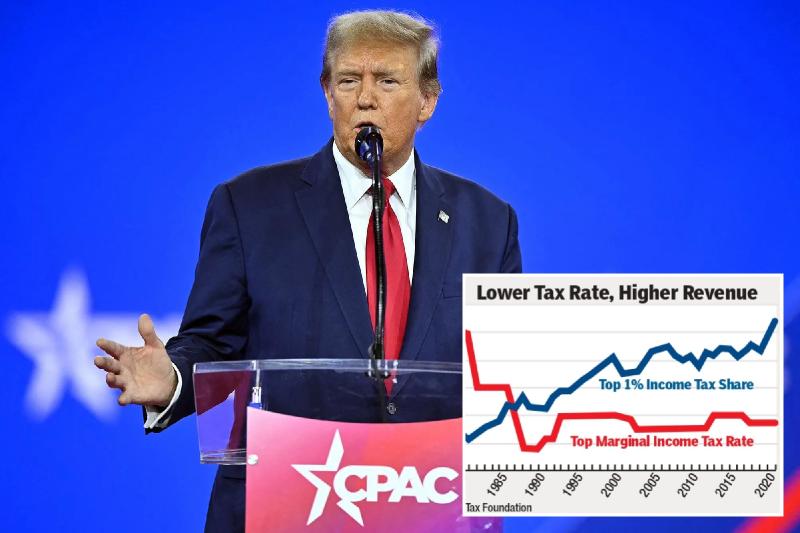

The chart below shows the inverse relationship between the highest tax rate applied and the share of taxes paid by the rich.

When Ronald Reagan was elected president, the top income tax rate in the United States was at 70%.

When Ronald Reagan was elected president, for example, the top income tax rate in the United States stood at 70%.

The wealthiest 1% of tax filers paid roughly 19% of the income tax.

When Reagan cut that rate to 50% and then all the way down to 28% in 1987 (a tax reform that nearly every senator — including Al Gore, Ted Kennedy and Joe Biden — voted for), the share of taxes paid by the rich rose to 25%.

Think about that: When the highest tax rate was 70%, the rich paid less than 20% of the tax burden.

With today's tax rate of 37%, the top 1% pay almost half of all income taxes.

And our data show that when the top tax rate stood at 91% in the early 1960s, before the Kennedy tax cuts, the top 1% paid only 15% of the taxes.

This inverse relationship between tax rates and taxes paid seems counterintuitive and almost mathematically impossible, but there are several explanations why high tax rates don't raise much revenue from the rich.

First, when tax rates are high, deductions to avoid paying those high rates become far more attractive to high-income earners, and they creep into the system as sure as crumbs on the kitchen floor attract mice.

We find it highly ironic that the same Democrats who want to raise the federal tax rate to 50% or 60% and even 70% to force the rich to "pay their fair share" are also the loudest voices in Congress for bringing back the biggest tax favor for the super-rich ever devised: the deductibility of state and local taxes.

Green-energy tax write-offs provide massive shelters for the rich too.

High tax rates also send economic activity and taxable income offshore to lower-tax nations.

This is how Ireland has become one of Europe's highest-performing economies.

And finally, high tax rates act as a financial penalty on economic activity and investment, which slows growth.

When that happens, there are fewer rich people with smaller income gains to siphon off.

This election is almost a referendum on whether America should keep our lower tax rates in place (the Trump plan) or raise rates on investment to 50% or more, as President Biden has endorsed.

It's a pretty solid bet that if the latter happens, the economy will underperform.

And if history is any guide, Bill Gates, Elon Musk, Jeff Bezos and Taylor Swift will end up paying less, not more, in taxes.

Arthur Laffer is president of Laffer Associates. Stephen Moore is a senior fellow at the Heritage Foundation. They are co-founders of the Committee to Unleash Prosperity and co-authors of the book "Trumponomics."

Trolling, taunting, spamming, and off topic comments may be removed at the discretion of group mods. NT members that vote up their own comments, repeat comments, or continue to disrupt the conversation risk having all of their comments deleted. Please remember to quote the person(s) to whom you are replying to preserve continuity of this seed.

No Fascism References, Memes, Source Dissing.

So there you have it. Figures don't lie but liars figure.

Yet we are told that Trump's tax cuts were a favor to the rich. Seems that was bullshit............again

Do expect to see lots of posts all bemoaning how those tax cuts didn't give some individuals any relief or how their taxes didn't go down at all.. sigh

You know people are going to bitch and whine just for the sake of doing it.

The most common complaint will be "But Trump (insert idiotic and unfounded complaint here)".

Oh, boy, more 'job creator' BS. You know, these tax cuts (and tax increases) are usually accompanied by changes in deductions. The way the tax code has been screwed up with handouts, bailouts, and giveaways it's possible to lower the tax rate while increasing the effective tax rate. It's a warm, fuzzy way of making a tax increase look like a tax cut. Trump's tax cuts did that by imposing a limit on SALT deductions. The net effect of the Trump tax cuts didn't cut the overall Federal tax revenue. Trump's tax cuts may have slowed the rate that Federal revenue collections increased but tax revenue still increased after the tax cuts.

The bottom line is that over 97 pct of the Federal debt was created after Ronald Reagan was inaugurated. The so called fiscal conservatives have overseen the largest increase in national debt in the history of the country. And that astounding increase in nation debt means money just ain't worth what it was. Neoliberal prosperity created with inflation has, in reality, bankrupted the country. Today the 1 pct are big fish in a much smaller pond. That's because the fiscal conservatives have actually created many, many more jobs in China than in the United States.

I forgot to include the link: You can check the numbers yourself.

Our tax and spend friends on the left:

DOH!