Biden pushes massive tax hike on workers as recession begins

July 30, 2022 06:00 AM By Brad Polumbo

The best way to revive an economy as you head into a recession is to slap businesses and workers with a massive tax hike. Said no legitimate economist ever.

Yet that's apparently the best plan President Joe Biden and Democrats in Congress can come up with. Their new so-called "Inflation Reduction Act," which would do almost nothing to reduce inflation , also includes a $315 billion tax on businesses. This comes in the form of a 15% "minimum corporate tax" applied to major U.S. corporations.

Biden says that this tax will allow him to spend huge sums on green energy subsidies and tax credits and "pay for all of this by requiring big corporations to pay their fair share of taxes, with no tax increases at all for families making under $400,000 a year."

Yeah, right.

While this may be literally true in the sense that Biden will levy the tax on corporations, in reality, it will burden everyday people the most. Most economists agree that much of the true burden of corporate taxes is borne by workers through lower wages. There's some dispute about exactly what percentage is ultimately absorbed by workers, but even the most favorable, left-leaning analyses acknowledge that it's a significant chunk. Meanwhile, most research says it's the majority!

As I previously summarized :

"William C. Randolph of the Congressional Budget Office found that for every dollar raised by the corporate tax, approximately 70 cents comes out of workers' wages. Further confirming this finding, research from the Kansas City Federal Reserve concluded that a 10% increase in corporate taxes reduces wages by 7%."

So, Biden's plan to squeeze $315 billion more out of corporations actually means squeezing hundreds of billions out of workers — at the exact time we can least afford it.

Not only are families suffering under the crushing weight of inflation, but we also just crossed into a second consecutive quarter of a shrinking economy, which despite the White House's attempted gaslighting, remains the conventional definition of a recession. (It is even used as the definition in several federal laws .) Raising taxes on businesses and workers is hardly ever a good idea, but in our current situation, it would be a gut punch to the productive sector at the worst possible time.

Tax Foundation Vice President of Federal Tax & Economic Policy William McBride warns that this tax increase would "reduce incentives for … companies to invest, grow, hire, and raise wages."

He adds that in our current economic situation, "it would be extremely unwise to raise taxes, especially the type of taxes advocated by this administration, which would do excessive harm to the economy."

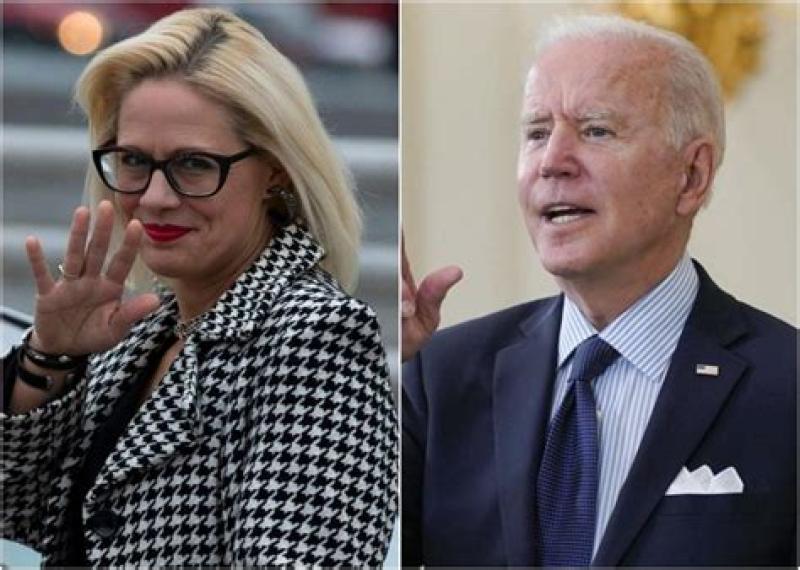

Indeed, it would. If Biden has any sense left in him, he'll heed this warning. But more realistically, swing-vote Sen. Kyrsten Sinema may now be our only hope of killing this terrible bill and sparing the public more economic suffering.

Milton Friedman

Translation: The Green New Deal.

The hell with lower worker wages and higher prices for goods and services.

The current corporate tax rate is 21 pct. So, at least in theory, a minimum tax of 15 pct shouldn't affect businesses. But few of us are naive enough to believe the tax code is applied fairly or that businesses don't game the system to cheat consumers. The sheer number of corporate lawyers should tell us that cheating consumers is part of most business models.

Yes, it's true that consumers provide the money to pay those corporate taxes. And it's also true that businesses cap wages to limit the impact on consumer prices. But that doesn't change the fact that consumers provide the money to pay for business operations, wages, taxes, bonuses, and stock dividends.

Consumers are the magic money tree in the economy. And trying to squeeze more money out of that magic money tree during a time of economic stress is never a good idea. It doesn't matter if the government, corporate lawyers, flimflam financial wizards, or business friendly politicians are doing the squeezing.

The Human Fuck Up Machine rides again; and brings the rest of the Democrat Party with him.

They must feel they have nothing left to lose and might as well throw the US in the rest of the way into the shitter before they lose control in Congress.

Still better than Trump.

Name one thing the Human Fuck Up Machine has done better than Trump- other than screw US citizens over.

One wonders where the ignorance at play in that comment comes from.

Record high inflation, record high food prices, record high gas prices, etc,etc. And he is just as insulting. More even. He just insults a different group of people.

He has continued his unblemished record of fucking things up for nearly 50 years now.

So better how?

He isn’t Trump.

One wonders if one is a moron. Biden is not Trump, that’s it. Trump would end our form of governance, I voted for “not that”.

Not a lot of wondering too be done unless you are retarded.

Stop projecting now and get serious.

A classic case of TDS. A pretty serious one at that.

And that is the ONLY reason why piece of shit is in the WH today.

We see that you can't answer 4.1.1.

Let me answer it for you, as this is probably another reason why you voted for Biden......

No more mean tweets.

Wow, such a sterling endorsement of Biden!

LMAO!

You KNOW you have a losing hand when the very best you can do is play the Trump deflection card!

Naming this the Inflation Reduction Act is Orwellian. Raising taxes to by down the debt might help inflation, but raising taxes to spend more fuels inflation.

A few days ago, the CBO released it's latest forecast, without this bill, federal spending will reach 23.5%of GDP this year and grow to 24.3 percent over the next 10 years, that's WWII levels. Tax total revenue has averaged 17.3% over the last 50 years, Before this bill, tax revenue is expected to reach 19.6% of GDP this year.

Spot on

"...for families making under $400,000 a year."

That's good - sparing the little guy.

You mean the little guy who today has to choose between food and gas?

Except it's becoming more clear that this was just another lie from a politician.

We need opposite Joe.

He needs to decide what he wants to do and then do the total opposite.

We’d be golden then.

I think he would still fuck that up..

To quite what we used to say about some people

" Biden could fuck up a wet dream!"

Pretty sure companies with 1 billion + profits can afford it.

Pretty sure the costs of the taxes will be passed along to their workers in the form of lower wages, reduced workforce, and the customers with increased prices.

"Businesses don't pay taxes" remember?

Lol so it will be more of the same then?

Honestly it never ceases to amaze me when I watch people that will NEVER get a taste of that life fight tooth and nail to defend the pricks born into it, to their own detriment.

I just… I just don’t get it.

Of course you don't.

Liberals are groomed to hate anyone that is successful in life. That includes those that started their own small business, spent thousands of their own money to get it going and countless hours to ensure its success.

Damn, I hate myself? Fuck…

And bugsy, you are obviously NOT one of the people I was talking about and I know for a fact that you do not run a 1 billion dollar business so quit your senseless bitching.

Lol the fucking hubris to think that you are even slightly on congress’s radar with this legislation…

That's because they know that "if you’ve got a business — you didn’t build that. Somebody else made that happen."

Hilarious.

This coming from the guy who claimed to spend time in the military as a "combat veteran", but couldn't say where he served.

You mean nothing to me.

They can afford lawyers and accountants to avoid taxes.

So more of the same. Still not getting what all the bitching and moaning is about.

The culture wars are running out of steam.

The Democrats better hope not, there’s nothing else really for them to run on.

Oh no, are the peas touching your carrots? Different Admin same 4 year old schtick ...

I’m not sure what this means but…. thanks for your comment.

No worries, like inflation about a year ago, it’s only transitionary.

Everything is going to be great. I mean look how much gas has gone down from its peak.

Next is when inflation drops a point or two, Biden will be tooting his horn again and his worker drones will be eating that BS up with a spoon.

The idiocy strikes again. .....