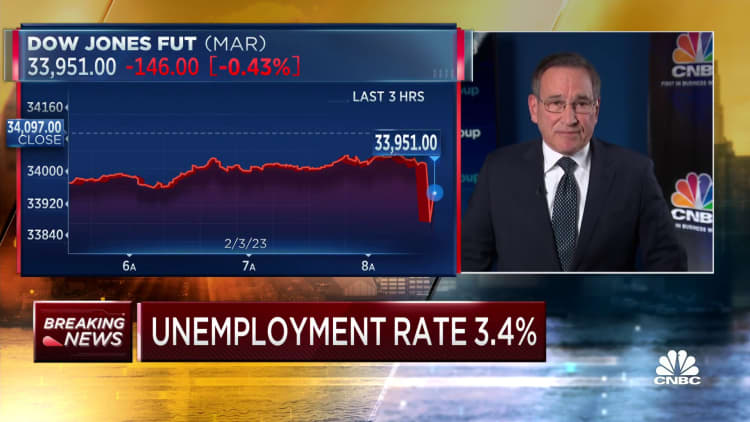

Jobs report January 2023: Payrolls increased by 517,000, unemployment rate at 53-year low

Published Fri, Feb 3 20238:31 AM ESTUpdated 1 Min Ago  WATCH LIVE Key Points

WATCH LIVE Key Points

- The January jobs report showed nonfarm payrolls increased by 517,000, far higher than the 187,000 market estimate.

- The unemployment rate fell to 3.4% versus the estimate for 3.6%. That is the lowest jobless level since May 1969.

- Leisure and hospitality added 128,000 jobs to lead all sectors. Other significant gainers were professional and business services (82,000), government (74,000) and health care (58,000).

watch nowVIDEO3:3303:33 Nonfarm payrolls increased by 517,000 in January; strongest gain since July 2022 Squawk Box

watch nowVIDEO3:3303:33 Nonfarm payrolls increased by 517,000 in January; strongest gain since July 2022 Squawk Box

The employment picture started off 2023 on a stunningly strong note, with nonfarm payrolls posting their biggest gain since July 2022.

Nonfarm payrolls increased by 517,000 for January, above the Dow Jones estimate of 187,000 and December's gain of 260,000, according to a Labor Department report Friday.

"It was a phenomenal report," said Michelle Meyer, chief U.S. economist at the Mastercard Economics Institute. "This brings into question how we're able to see that level of job growth despite some of the other rumblings in the economy. The reality is it shows there's still a lot of pent-up demand for workers were companies have really struggled to staff appropriately."

The unemployment rate fell to 3.4% versus the estimate for 3.6%. That is the lowest jobless level since May 1969. The labor force participation rate edged higher to 62.4%.

A broader measure of unemployment that includes discouraged workers and those holding part-time jobs for economic reasons also edged higher to 6.6%. The household survey, which the Labor Department uses to compute the unemployment rate, showed an even bigger increase of 894,000.

"Today's jobs report is almost too good to be true," wrote Julia Pollak, chief economist at ZipRecruiter. "Like $20 bills on the sidewalk and free lunches, falling inflation paired with falling unemployment is the stuff of economics fiction."

Markets, however, dropped following the report, with the Dow Jones Industrial Average down about 100 points in early trading.

Growth across a multitude of sectors helped propel the massive beat against the estimate.

Leisure and hospitality added 128,000 jobs to lead all sectors. Other significant gainers were professional and business services (82,000), government (74,000) and health care (58,000). Retail was up 30,000 and construction added 25,000.

Wages also posted solid gains for the month. Average hourly earnings increased 0.3%, in line with the estimate, and 4.4% from a year ago, 0.1 percentage point higher than expectations though a bit below the December gain of 4.6%.

The unemployment rate for Blacks fell to 5.4%, while the rate for women was 3.1%.

"When you look at this, it's pretty hard to shoot any holes in this report," said Dan North, senior economist at Allianz Trade North America.

The surge in job creation comes despite the Federal Reserve's efforts to slow the economy and bring down inflation from its highest level since the early 1980s. The Fed has raised its benchmark interest rate eight times since March 2022.

In its latest assessment of the jobs picture, the Fed on Wednesday dropped previous language saying gains have been "robust" and noted only that the "unemployment rate has remained low."

However, Chairman Jerome Powell, in his post-meeting news conference, noted the labor market "remains extremely tight" and is still "out of balance." As of December, there were about 11 million job openings, or just shy of two for every available worker.

"Today's report is an echo of 2022's surprisingly resilient job market, beating back recession fears," said Daniel Zhao, lead economist for job review site Glassdoor. "The Fed has a New Year's resolution to cool down the labor market, and so far, the labor market is pushing back."

Though Fed officials have expressed their intention to keep rates elevated for as long as it takes to bring down inflation, markets are betting the central bank starts cutting before the end of 2023. Traders increased their bets that the Fed would approve a quarter percentage point interest rate hike at its March meeting, with the probability rising to 94.5%, according to CME Group data.

The Fed is hoping to engineer a "soft landing" for an economy that is pressured by inflation and geopolitical factors that held back growth in 2022.

Most economists still expect this year to see at least a shallow recession, though the labor market's resilience could cause some rethinking of that.

"Our base case is still recession likely toward the latter part of the year," said Andrew Patterson, senior economist at Vanguard. "One report is not indicative of a trend, but certainly if we continue to see upside surprises, our baseline is up for discussion. This does increase the marginal probability of a soft landing."

Gross domestic product grew at a 2.9% pace in the fourth quarter of 2022. The Atlanta Fed's GDPNow tracker is pointing toward a 0.7% increase for the first quarter of 2023, though that's off an incomplete data set.

Bloop!

Now, if only wages could keep pace with inflation.

According to some, wage growth is negligible!

remind us again, which party always votes against increases in the minimum wage?

probably the party smart enough to know what the damn topic is.

States have taken that over as it should be. Don't need a federal minimum wage. The labor market will and should be the driver. $10.00 an hour in Podunk, Missouri will not even get close to a living in New York City.

So you bring up wages, someone comments on what you said and you say it was off topic....

Alright then.....

[deleted]

Who says that wage growth is "Negligible"?

Oh by all means, do explain...

I am just using your vaunted logic here.

you claim inflation is negligible, and wages are not keeping up with it, thus rendering wage growth negligible

That is not only dishonest, but also wrong...

But, the topic, unemployment, is negligible.

what is dishonest? do you believe inflation is somehow not outpacing wages despite your very own source confirming it?

be specific!

Do you know what two consecutive quarters of economic growth and record low unemployment means? It means we are not in a recession. Inflation is waning and was minus .1% in December. The annual rates is going down each month. I know. You cannot accept that Biden is succeeding economically. The damn MAGAs wish he was not. BIDENOMICS FOR THE WIN!

your post is unrelated to what I wrote.

you said I was dishonest and wrong.

prove it!

You already did...

Remind me again, who has been at the helm for current record high inflation and consumer prices?

That’s right ..... Goober and his Bidenettes.

of you think for even one second you have proved me wrong, I gave some Enron stock I can sell you!

[deleted]

[deleted]

Can i bundle some FTX with that?

[deleted]

[deleted]

what is wrong or dishonest? if you are willing to say that why not back it up with FACTS?

The reality of the economy is that the price of groceries has not even topped out yet here.

The price of gas went back up a dollar in Colorado due to supposed damage to the local refinery during the cold snap.

What kind of jobs were added and in what sectors?.

Bullshit, that data has to be cooked. Empirical evidence says otherwise.

SPLAT!

Can you see pyramids from that river you're on?

Stop projecting, it’s very unseemly.

I am not the one who is in fool on denial...

And no, I didn't mean full on. But, that too!

actually you have argued that inflation is negligible and have touted wage growth that hasn't even kept pace!

Weak sauce there buddy and no, unlike you I won’t tag your sophomoric taunt.

Because you don't like it???

And the election must have been rigged because you don like the results.....

Lol .... you’d have to be completely deaf, dumb and dull to not see it in the real world.

Large corps all over laying off thousands, small businesses cutting back hours/days due to lack of staffing, prices increasing because of lack of staffing, etc.

I swear, some of you folks are getting more obtuse by the minute.

Your argument is limited to, "NUNT UH!"

Fox News and The WSJ reported it too...

So what? What’s happening out in the real world tells a different story.

As previously noted, you’d have to be a complete dimbulb to not see it.

So, in other words, do NOT believe all the verifiable facts and numbers that every reputable news organization is citing, believe what you and only you can see?

No other words required.

Only eyes, ears and the ability to believe them without bias.

Duh!

Makin' the Fed's job harder...

Oh look.

Somebody gets it.