Donald, what have you done?!

First quarter GDP is looking alarmingly flat, and way down from where it was.

It seems clear that Trump's minions wanted "shock and awe", so they moved fast and hard. DOGE kids rampaged through one government sector after another breaking everything they found.

Kinda like a bull in a china shop. Ya know what? All that smashed china is really, really hard to put back together...

There are links in the seed.

We won't see the first estimate of 2025Q1 GDP for five days, and I'll be sure to write it up shortly after its 8:30AM ET release. But much of the data that is used to compute how the economy grew over the quarter—or didn't—is already out, and so we can examine the forecasts from various shops that track this measure.

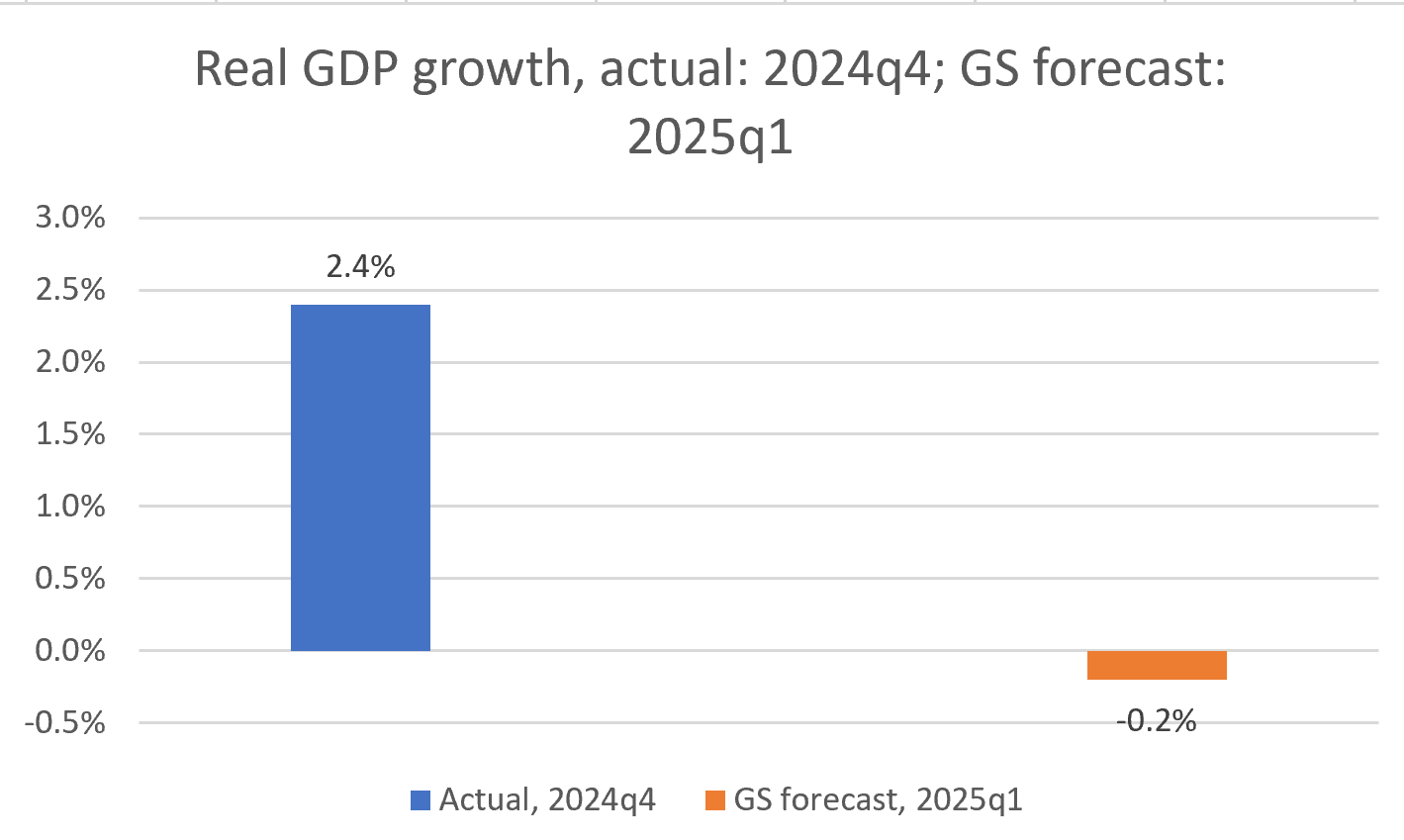

The figure below, from Goldman Sachs (GS) researchers, predicts a sharp deceleration in real GDP growth, from 2.4% in 2024q4 to -0.2% in 2025q1. If they're right—and GS has been both more bullish and more accurate than most—this will represent a remarkable shock, fully attributable to the actions of the Trump administration.

It's often hard for analysts to cleanly figure out what drove a particular result in empirical economics. But not this time. It's their trade war, attacks on Fed independence, slash-and-burn DOGE cuts, and the uncertainty generated by policy whiplash.

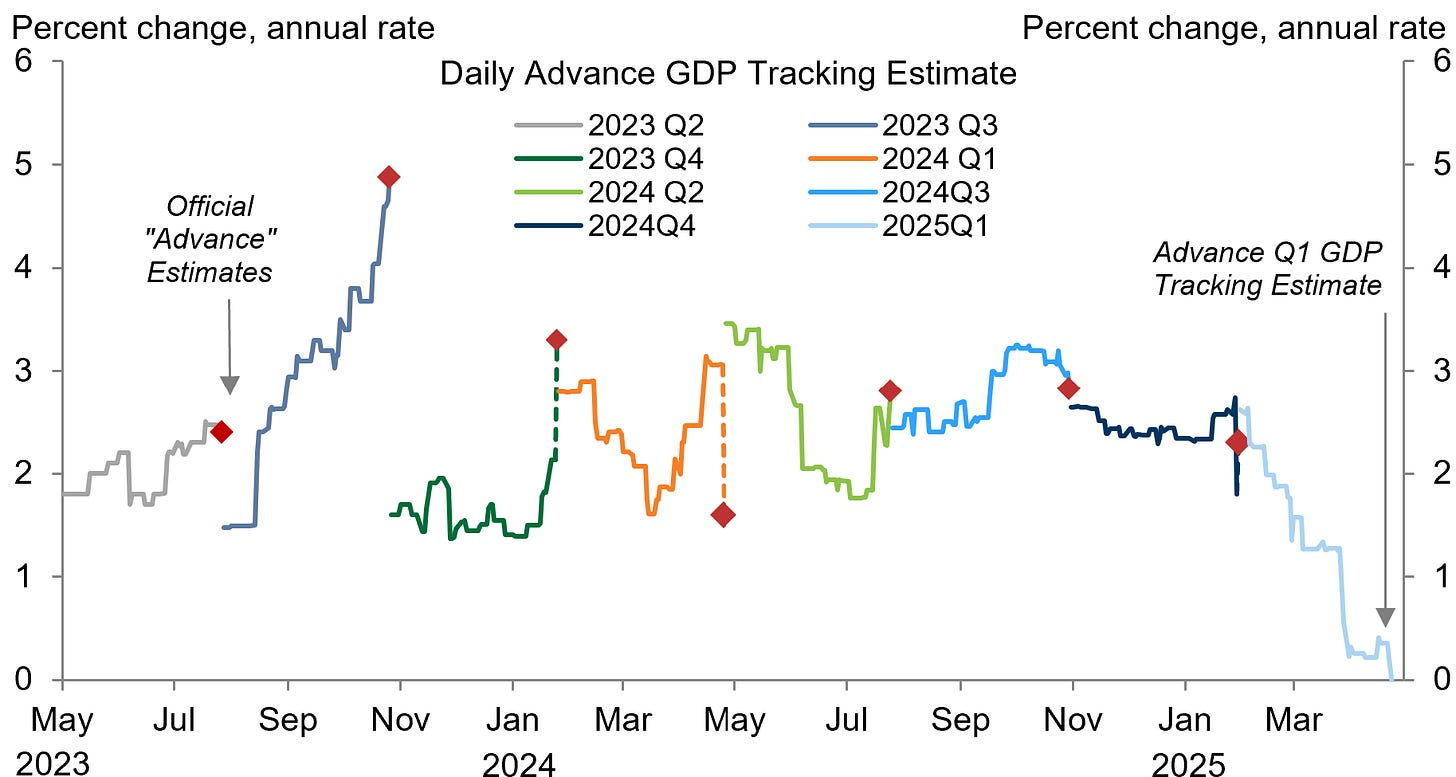

Now, before we go much further, of course GS might be wrong. But they're not alone in forecasting this sharp deceleration: the Atlanta Fed GDPNow is at -0.4%.1 GS also has a decent record on this sort of thing, as shown in the figure below: with 2 exceptions, they pretty much hit it.

Source: Goldman Sachs Research

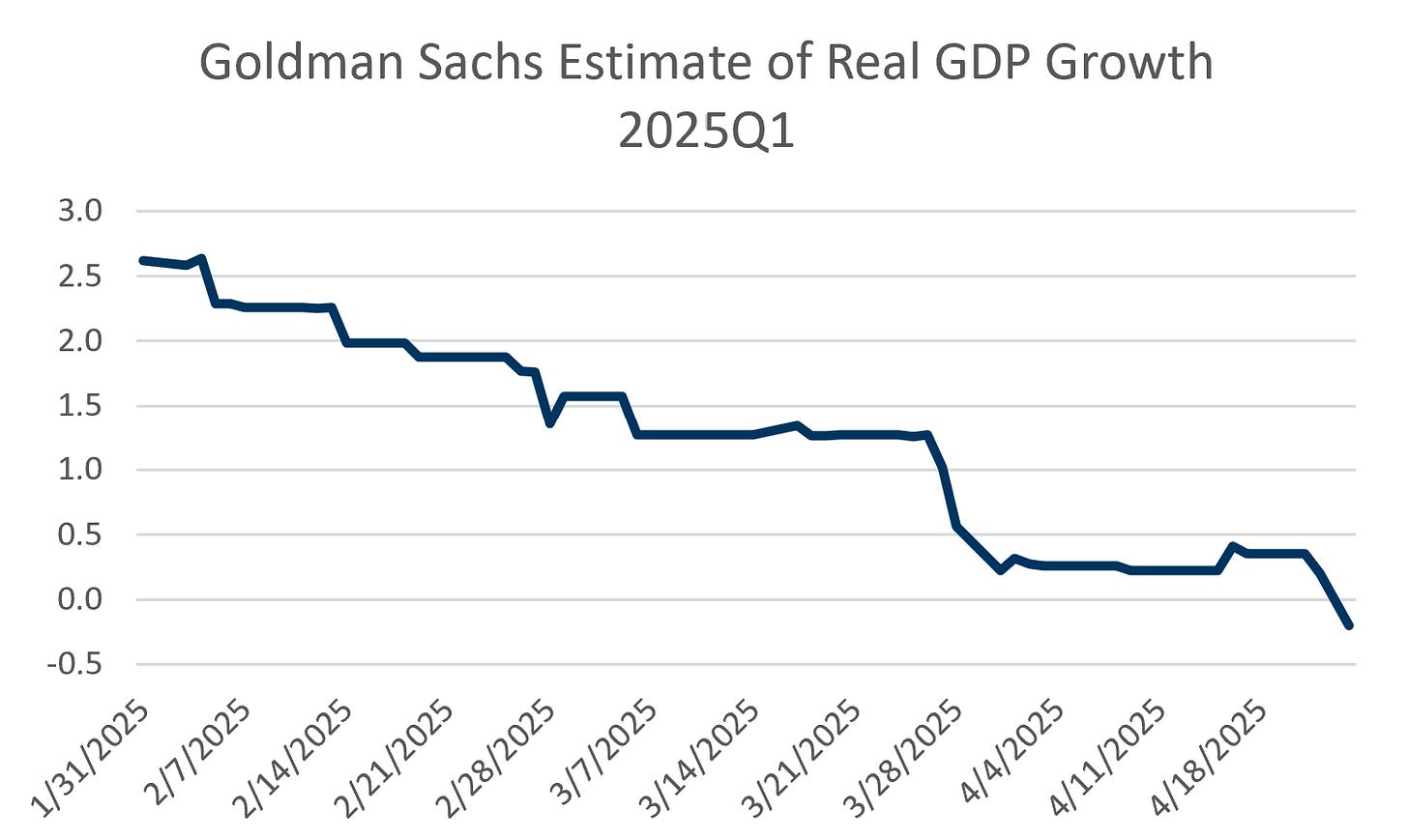

In this next figure, I'm isolating (and updating) the '25Q1 part of the figure above. When Trump took office, GS's opening bid for the quarter was a continuation of steady, strong growth. But with the arrival of Liquidation Liberation Day, the markdowns started. BTW, that big dip at the end of March is interesting. I've often said we're seeing weak soft data (surveys, plans for expansions) and good hard data (jobs, spending, growth), but that markdown was largely a function of weaker hard data, specifically consumer spending in the first two months of the quarter.

If real GDP growth does come in negative for Q1, it will trigger a lot of recession talk. That's understandable—when it comes to GDP growth, crossing zero is a big deal (an informal definition of recession is two consecutive quarters below zero). But for regular folks, this is going to hurt whether growth is 0.2% or -0.2% . That's because there's a negative correlation between GDP growth and unemployment, based on the simple fact that less demand for goods and services translates into less demand for workers.

Roughly speaking, for every point of real growth below around 2%, the unemployment rate tends to rise half-a-percentage point. So, if we stick around zero growth—whichever side of zero we're on—the jobless rate should rise.

"Stick around" is important. In numerous recent pieces, I've started reflecting on what happens if Trump continues to dial back the tariffs and Fed attacks, which may be as simple as he sees more of Bessent than Navarro. There's a good chance that GDP would pick up some strength under this scenario. After all, if Trump's awful economic policies are the problem, then dialing them back should help (this assumes he dials them back far enough to make a difference).

But the problem, of course, is not just the policies. It's the guy. Businesses will still worry about investing with Trump, unconstrained by the R majority, in the White House. The "sell America" trade may be less in the financial headlines, but global investors will surely be a lot more wary of investing here (and require a higher interest rate to do so).

But those are longer-term concerns. My point this morning is that if GS and others are in the right ballpark, as I believe they are, it will provide unequivocal evidence that having inherited a strong economy, President Trump squandered that inheritance.

1 I'm citing their "alternative model forecast," which adjusts for imports and exports of gold as these flows can distort such estimates.

Whatever

From what the polls are telling us, Americans didn't really want their government destroyed...