The Myth of American Inequality

By: Phil Gramm and John F. Early (WSJ)

America is the world's most prosperous large country, but critics often attempt to tarnish that title by claiming income is distributed less equally in the U.S. than in other developed countries. These critics point to data from the Organization for Economic Cooperation and Development, which ranks the U.S. as the least equal of the seven largest developed countries. American progressives often weaponize statistics like these to urge greater redistribution. But the OECD income-distribution comparison is biased because the U.S. underreports its income transfers in comparison to other nations. When the data are adjusted to account for all government programs that transfer income, the U.S. is shown to have an income distribution that aligns closely with its peers.

The OECD measures inequality by determining a country's "Gini coefficient," or the proportion of all income that would have to be redistributed to achieve perfect equality. A nation's Gini coefficient would be 0 if every household had the same amount of disposable income, and it would approach 1 if a single household had all of the disposable income. The current OECD comparison, portrayed by the blue bars in the nearby chart, shows Gini coefficients for the world's most-developed large countries, ranging from 0.29 in Germany to 0.39 in the U.S.

But there are variations in how each nation reports income. The U.S. deviates significantly from the norm by excluding several large government transfers to low-income households. Inexplicably, the Census Bureau excludes Medicare and Medicaid, which redistribute more than $760 billion a year to the bottom 40% of American households. The data also exclude 93 other federal redistribution programs that annually transfer some $520 billion to low-income households. These include the Children’s Health Insurance Program, Temporary Assistance for Needy Families and the Special Supplemental Nutrition Program for Women, Infants and Children. States and localities directly fund another $310 billion in redistribution programs also excluded from the Census Bureau’s submission.

This means current OECD comparisons omit about $1.6 trillion in annual redistributions to low-income Americans—close to 80% of their total redistribution receipts. This significantly skews the U.S. Gini coefficient. The correct Gini should be 0.32—not 0.39. That puts the U.S. income distribution in the middle of the seven largest developed nations—the red bar on the chart.

Gini scores for other countries in the OECD ranking also might shift with better data: The OECD doesn’t publish transfers by income level for other countries. But the change in income distribution for other countries would likely be less drastic. The poorest fifth of U.S. households receive 84.2% of their disposable income from taxpayer-funded transfers, and the second quintile gets 57.8%. U.S. transfer payments constitute 28.5% of Americans’ disposable income—almost double the 15% reported by the Census Bureau. That’s a bigger share than in all large developed countries other than France, which redistributes 33.1% of its disposable income.

The U.S. also has the most progressive income taxes of its peer group. The top 10% of U.S. households earn about 33.5% of all income, but they pay 45.1% of income taxes, including Social Security and Medicare taxes. Their share of all income-related taxes is 1.35 times as large as their share of income. In Germany, the top 10% pay 1.07 times their share of earnings. The top 10% of French pay 1.1 times their share.

If the top earners pay smaller shares of income taxes in other countries, everybody else pays more. The bottom 90% of German earners pay a share of their nation’s taxes on income 77% larger than that paid by the bottom 90% of Americans. The bottom 90% in France pay nearly double the share their American counterparts pay. Even in Sweden—the supposed progressive utopia—the top 10% of earners pay only 5.9% of gross domestic product in income-related taxes, 22% less than their American peers. The bottom 90% of Swedes pay 16.3% of GDP in taxes on income, 77% more than in the U.S.

Even these numbers understate how progressive the total tax burden is in America. The U.S. has no value-added tax and collects only 35.8% of all tax revenues from non-income-tax sources, the smallest share of any OECD country. Most developed countries have large VATs and collect a far larger share of their state revenue through regressive levies.

When all transfer payments and taxes are counted, the U.S. redistributes a larger share of its disposable income than any country other than France. Relative to the share of income they earn, the share of income taxes paid by America’s high earners is greater than the share of income taxes paid by their peers in any other OECD country. The progressive dream of an America with massive income redistribution and a highly progressive tax system has already come true. To make America even more like Europe, these dreamers will have to redefine middle-income Americans as “rich” and then double their taxes.

Mr. Gramm, a former chairman of the Senate Banking Committee, is a visiting scholar at the American Enterprise Institute. Mr. Early served twice as assistant commissioner at the Bureau of Labor Statistics and is president of Vital Few LLC.

The idea of perfect equality is very imperfect. How much should the more productive hand over to the less productive? Here we learn that the US engages in more of this type of transaction than most other countries.

For those interested in hearing the co-authors speak about the book and in their own words:

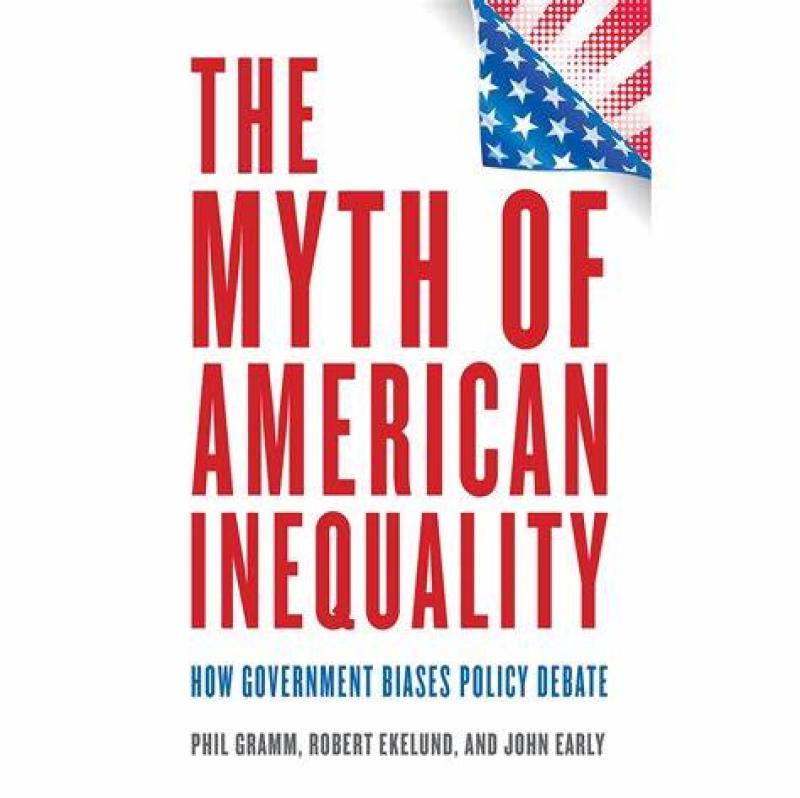

The Book is:

The Myth of American Inequality : How government biases policy debate

Interesting. Thanks

A single statistical measure invented in 1912 feed by incomplete data provides lies, damned lies and Gini Index Statistics.

This is a pretty awkward segue. If the Gini coefficient measures inequalities in disposable income, why even mention Medicaid or especially Medicare (to which all US citizens are entitled on reaching age 65)? Those funds never enter the bank accounts of those families. They go to hospitals and healthcare providers directly. They are in no way disposable income.

The whole screed seems to be bull to me.

Oh course the more you make the more one is going to pay in taxes. Simple logic that seems to escape some people.

This whole piece sounds like nothing more than another poor rich people have all the burden bullshit.

Also how does a government take disposable income? Disposable income is what people have left after paying their bills, not something that is taken in taxes.

It just shows republican priorities of the poor over taxed rich bullshit meme.

Clearly lays that out? So what do you think is the point of this article? That the wealthy pay too much?

Who ever claimed we were like other countries and their tax system?

If you think there is no inequality in the US.....

And once again, of course the rich pay more in taxes. Common logic, the more you make, the more you pay.

Again, what is your point here? Are you espousing that the rich should get a tax cut?

Just because the article makes a comparison doesn't mean everyone else is...

I do go by what you write. If you cannot be clear, not my problem.

Their fair share?

So once again, what is your point? That we should leave the tax system alone? That we should revamp it? That it works fine the way it is?

That people making 25K a year should pay more in taxes?

So your point is really no point at all. So you think the rich pay enough.

Does that mean leave the tax system alone? or....

Finally...

I actually agree about deductions. They can get to be ridiculous, like having a business lunch can qualify as a deduction...

In 2018, the top 1 percent of taxpayers earned 20 percent of all income (AGI) but paid a 40 percent share of income taxes.

Tell you a secret. I may lose my Lib card yet I think they should do away with EIC.

All it is basically is the government buying everyone a new tv or vacation money every year.

Basically giving people money because they somehow managed to pop out a few babies.

EITC was a program instituted with the complete approval and co-operation of corporations. Who wouldnt want to get the government to pay part of your payroll? EITC has always been a "substitute" for paying a living wage, or even raising the minimum wage. If EITC was ended either companies would have to pay better or the poverty rate would rise dramatically. Neither of those are going to happen.

It was established to offset Social Security and Medicare payroll taxes on working poor families and to strengthen work incentives. It got a sizeable number of families aff of welfare.

www.motherjones.com /kevin-drum/2019/10/eitc-or-15-minimum-wage-why-not-both/

EITC or $15 minimum wage? Why not both?

Peter Hannam 4-4 minutes

The Earned-Income Tax Credit is one of the largest social welfare programs run by the federal government. It’s available only to people who work—primarily those with children—and takes the form of a tax refund that generally amounts to a few thousand dollars each year.

Conventional wisdom has long held that the EITC motivates people to work, but a new study suggests this isn’t so. Dylan Matthews says today that this undermines conservative support for the program:

Let’s unpack this a bit. What it means is that the business community likes the EITC because they think it increases the size of the labor force. This in turn pushes wages down. In other words, part of the EITC is captured by corporations: they get to cut wages, which are are then made up by the EITC.

As you can imagine, this is a black mark against the EITC among liberals. Why should corporations end up getting a piece of a program meant to help the poor? If, instead, it turns out that the EITC has little impact on labor force participation, that’s a good thing. It means that the poor are getting 100 percent of the benefit.

Back in the days of old, this would probably be a net political negative: maintaining bipartisan support is a good thing even if it costs a bit in terms of help for the working poor. But these are not the olden days, and there hasn’t been bipartisan support for the EITC in ages. So I’d call this unalloyed good news if it’s true. It means the EITC’s benefits are going exactly where we want them, and we could even sever the connection to work if we wanted to. Republicans wouldn’t support this, but so what? They wouldn’t support it anyway.

Bottom line: it appears that both the EITC and the $15 minimum wage are pretty good programs for helping the working poor. What’s more, both have different pluses and minuses and they complement each other pretty well. Given what we know, progressives ought to support them both.

[deleted]

prospect.org /economy/like-eitc-plenty-turns-out./

What’s Not to Like About the EITC? Plenty, It Turns Out.

Teresa Ghilarducci, Aida Farmand 10-12 minutes 6/28/2019

...there is an important economic effect of the EITC that enthusiasts tend to miss. The EITC is effectively a subsidy to low-wage employers, who are able to attract workers at lower wages than they otherwise would have to pay. Though some workers are partly compensated by the government via the EITC, workers who don't qualify end up with reduced wages

. The heavy reliance on the EITC, rather than the minimum wage and the strength of trade unions, is one major reason why the U.S. leads the OECD in the share of jobs that pay poverty wages —a full 25.3 percent of jobs are poverty jobs, compared to 3 percent of jobs in Norway.

The EITC, in sum, puts downward pressure on wages. That pressure is worse in sectors where many workers are not covered. The EITC excludes older workers and many workers without children, as well as undocumented migrants. The EITC available to workers without children and to noncustodial parents is small and phases out at very low incomes: The income limit for single individuals is just $15,270, and for married couples filing jointly it is only $20,950. The effects are especially pronounced in the rapidly increasing personal and home health-care sector and the non-EITC workers in that sector.

The two complementary policies we need are a higher minimum wage and stronger unions. Merely expanding the EITC will continue to subsidize low-wage employers and drive down market wages. Indeed, there is no bigger supporter of the EITC than low-wage employers. For instance, the Walmart Foundation funds nonprofit organizations such as the United Way and One Economy to expand EITC outreach.

The EITC ostensibly goes to low-paid workers' households, but low-wage employers capture significant economic benefits. The logic is easy to understand: If farmers are subsidized by the government to grow green beans, there will be more green beans. If the government subsidizes low-paid jobs, there will be more low-paid jobs. The EITC benefits employers who pay low wages because they can pay lower wages but still attract and retain the same number and quality of workers.

I just entered single head of household with 2 children and $50,000 in income and qualifie d.

Yep, that old liberal yarn.

Are you saying they don't? In your opinion, what is a "fair share"?

Ha. I was being a little of a jerk.

That law is just a weird quirk of mine. We pay people just because they have children...

Disposable income is income remaining after deduction of taxes and other mandatory charges, available to be spent or saved as one wishes.

My Medicare and Tricare for Life payments represents a very substantial transfer of taxpayer dollars for my direct benefit. Had they not paid those bills, I wouldn't have much disposable income.

In the case of Medicare, the same applies to the rich. A point conveniently forgotten by the author, it seems.

Neither program provides direct income to those benefitting from it, as the author seems to imply. The funds are NOT transferred to low-income households.

The point isn't whether these programs provides direct income to anyone. The point is that the individuals don't have to spend their income or, at least, nearly as much as they would have to if they didn't have those programs. Imagine someone with an annual income of $30,000 with access to Medicare and Medicaid compared to someone with the same income but no access to Medicare and Medicaid. It should be obvious that this greatly affects where a person falls on the poverty scale.

The article doesn't intend that it should be counted as disposable income. Remember, according to the article...

What the article is saying is that by not including the factors left out by the OECD, it makes the redistributed income seem less than what is truly being redistributed. In other words, the higher the Gini coefficient, the more people as a whole should be without disposable income, not specific individuals. The article is stating that this number is skewed because of the way OECD produces the numbers. If it accounted for all redistributed income, which seems to make sense, there are actually less people without some level of disposable income than OECD's numbers suggest.

I wonder if the references used in this 4-year-old article make any mention of non-cash benefits to citizens of other countries, such as universal healthcare coverage (most closely approximated in the US by Medicare)? After all, that's redistributed income, yes? Comparable, yes? I find monetary benefits, such as maternity allowances, housing allowances, old age pensions, etc., all listed for Germany (as an example) as income used for the OECD's calculation of its Gini index, but not healthcare. Maybe the US's exclusion of this data isn't so inexplicable, after all.

Interestingly, income redistributed by government in the form of government-paid sick leave is also not included as income for such calculations.

Now, if the author wants to compare apples to apples, I'm willing to say that omitting data on cash benefits like food stamps and TANF skews the data unfairly against the US when it comes to calculating income inequality. But to exclude programs paying for healthcare from being counted as income, when other countries also exclude programs paying for healthcare from being counted as income, does not.

I couldn't find any information on it in the link you provided, which seems odd, considering that they answer "yes" or "no" to whether other similar programs are included. I tried to find out specific information as to how OECD considers programs like universal health care but could not find any mention of it one way or the other. They do seem to track universal health care programs in the same way they track income equality, but they don't seem to connect the two as far as I can tell. If they are leaving such things out, it would be nice to know why they exclude it, at least in Germany's case. Was it because Germany didn't include it in what they reported, as the article states our government did not? Is that the case for every country? The more I look at this the more questions I have. Both about this article and OECD's methodology.

One reason I think that such should be included is having medical insurance certainly can impact the amount of disposable income a person has. For countries that don't have it, I would think the income inequality would be greater than those that don't. And what would income equality look like between two families, one with universal health care and one without, both having equally high medical expenses? Presumably, one would need a lot more disposable income than the other. Would that be equality?

newrepublic.com /article/167811/texas-senator-phil-gramm-inequality-myth

Phil Gramm Thinks Poor People Have It Too Easy

Timothy Noah 9-11 minutes 9/20/2022

“We’ve sort of become a nation of whiners. You just hear this constant whining, complaining about a loss of competitiveness, America in decline.… You’ve heard of mental depression; this is a mental recession.”

—UBS vice chairman Phil Gramm in July 2008, seven months into the worst recession since the Great Depression and nine days before Gramm withdrew as co-chairman of fellow Republican John McCain’s presidential campaign

“Income inequality is not rising.”

—U.S. Policy Metrics senior adviser Phil Gramm, along with co-authors Robert Ekelund, professor of economics emeritus at Auburn University, and John Early, former assistant commissioner for the Bureau of Labor Statistics, in The Myth of American Inequality: How Government Biases Policy Debate , published September 15

I’ve always had a soft spot for Phil Gramm. The former senator and onetime economist at Texas A&M amassed a fearsome campaign war chest to run for the Republican presidential nomination in 1995, only to quit the race in February 1996 after suffering humiliating defeats in Iowa and New Hampshire. That year’s Republican nominee, Bob Dole, would later lose to President Bill Clinton. Twelve years later, Gramm inadvertently helped Democrat Barack Obama defeat Republican John McCain for president by pooh-poohing the Great Recession.

Gramm is a plainspoken man who would rather piss you off than get your vote. He can’t help himself! But unlike the truth-tellers whom history will remember as Profiles in Courage , Gramm, if he’s remembered at all, will be memorialized as a blunt talker who was always wrong—exuberantly, audaciously wrong, in a Byronic sort of way, but wrong nonetheless.

Gramm’s latest exercise in error is The Myth of American Inequalit y . Gramm and his co-authors, Robert Ekelund and John Early, maintain that America is becoming not more economically unequal but less so. This is a very daring argument, given the mountain of evidence to the contrary. Other conservatives have argued that growing economic inequality doesn’t matter, but not many have argued that economic inequality doesn’t exist. How do you even make such an argument? Here’s how, in four easy steps.

Scramble the timeline. “Income inequality is not rising,” Gramm and his co-authors state. “It has in fact fallen by 3.0 percent since 1947 as compared to the 22.9 percent increase shown in the Census measure.” This is sheer lunacy.

As Gramm well knows, incomes became more equal from the 1930s through the late 1970s. Around 1979, that trend reversed itself and incomes started becoming less equal. They have become steadily less equal ever since, and today, according to Berkeley economist Emmanuel Saez, the top 10 percent’s share of national income exceeds the previous high in 1929 (scroll down to Figure One).

If you start your timeline in 1947, as Gramm and Co. do, you capture a huge chunk of the pre-1979 decline. If you see someone mapping the inequality trend who doesn’t begin around 1979, that’s an immediate tipoff that they’re pulling a fast one.

For the record, though, income inequality by any honest measure has increased almost as much since 1947 as it has since 1979.

Emphasize broad-based inequality. As I explained in my 2012 book, The Great Divergence , there is not one income-inequality trend but two coinciding trends. The starker trend, mapped by Saez and Thomas Piketty, shows huge gains in the pre-tax share of national income by the top 10 percent, the top 1 percent, and the top 0.1 percent, with the gains getting larger the higher you go. (You can make these gains slightly smaller by factoring in taxes and government transfers, but only slightly.) The second, less stark trend is the broad-based post-1979 growth in income inequality as measured by the Gini index and/or by dividing the population into five “quintiles”: the bottom 20 percent, second 20 percent, middle 20 percent, and so on. The gap here, which has mostly stabilized over the past couple of decades, is between college graduates and non–college graduates. Among the reasons you haven’t lately seen the broad-based trend worsening is a weakening in the economic strength of the professional-managerial class (nicely described in 2013 by the late Barbara Ehrenreich and her former husband, the psychologist and author John Ehrenreich).

Gramm and Co. build their book around the Census Bureau’s annual inequality reports, which mostly map broad-based inequality. The latest Census report , which came out last week, showed that 2021 saw the first increase in the Gini index since 2011. But (as the report notes) that’s probably because low-wage workers who dropped out of the workforce at the height of the Covid pandemic in 2020 returned to full-time work in large numbers in 2021 (as documented in monthly jobs reports by the Bureau of Labor Statistics).

Pretend the inequality trend is a poverty story. If you remember nothing else, remember this: The post-1979 income inequality trend is a story about middle-class decline. Average wage growth slowed dramatically in absolute terms after 1979, and the gap between the middle class and the rich became a chasm.

In their book, Gramm and company talk a lot about poverty. That’s a distraction from the inequality story, because while life has been getting steadily worse for the middle class, it’s been getting somewhat better for the poor. The reason life has gotten somewhat better for the poor is that the government has gotten more generous in extending benefits to the poor. The nonprofit Center on Budget and Policy Priorities reported in 2019 that the poverty rate had fallen by nearly half since 1967, thanks mostly to income security programs. More recently, The New York Times ’ Jason DeParle reported that child poverty has fallen 59 percent since 1993, in large part because of expansions in the Earned Income Tax Credit. We still have far to go, but today we are a less desperately poor society than we were in 1979. This is a humanitarian triumph.

Gramm doesn’t see it that way.

In January 1995, Gramm said on Meet the Press : “We have gone too far in creating an entitlement society.… If we stay on the same road we’ve been traveling, in 20 years we’re not going to be living in the same country we grew up in.”

Now it’s 27 years later and Gramm and his co-authors aren’t happy:

T he convergence Gramm describes is real, if exaggerated here, and it helps explain the bitterness of our politics today. As life gets no better for the middle class and government programs make life somewhat better for the poor, the difference between being middle class and being poor becomes … blurry. I don’t doubt that this creates middle-class resentment. But it’s perverse for Gramm to want to resolve this by making the poor poorer. If work is not being rewarded sufficiently in the private sector—and it isn’t—Gramm should favor resolving that by securing workers a living wage (by, for instance, increasing the $7.25 hourly minimum wage and removing government obstacles to unionization).

Reclassify health insurance as welfare. Gramm bellyaches in his new book that the Organization for Economic Cooperation and Development, when it compares levels of income inequality in different nations, doesn’t figure in health insurance, on the grounds that it doesn’t consider health care to be income. Most OECD countries have national health insurance that essentially removes health care from the wage economy. Gramm thinks that’s a scandal.

Gramm takes census data on pretax income and adds in the value of taxes, employee benefits, and government assistance. Fair enough. But if you want to argue that income inequality is a fantasy, that adjustment won’t get you there; you’ll just get a slightly less pronounced inequality trend. If you want to say black is white and up is down, you have to factor in the value of the benefit that OECD excludes: health insurance, funded privately or publicly.

Here’s how Berkeley economist Gabriel Zucman, who hasn’t read Gramm’s book but did read an August Wall Street Journal op-ed summarizing its main points, explained the health insurance problem in an email:

I suppose Gramm would answer that access to health care has market value and therefore must be income. But it isn’t the sort of market value that any of us is eager to realize, because that would entail getting sick. By Gramm’s logic, the sicker you get, the richer you become.

There’s more to say about Gramm’s book. In the next installment—yes, I will write about this twice!—I’ll discuss how Gramm addresses the seemingly insurmountable fact that the rich have gotten much, much richer. He answers, in part, by asserting that Ebenezer Scrooge is actually a very admirable character who’s been widely misunderstood. I kid you not.

If you take the seeded article at face value, the ONLY reason the US does not have the worst income inequality on earth is because we have "welfare" for the poor.

Not because we pay people better for hard work, but because we pay "entitlements".

We're going to rob the economy blind with our rigged game, but since we give entitlement benefits to keep people above the poverty line, we deserve credit, not accusations of "income inequality".

What a thing to have to brag about.

Who was bragging? What process should employers use to determine wages offered?

I'm somewhat puzzled by the fact that "American Inequality" can be considered a myth while it houses billionaires and millionaires and more than half a million homeless people.

[Deleted]