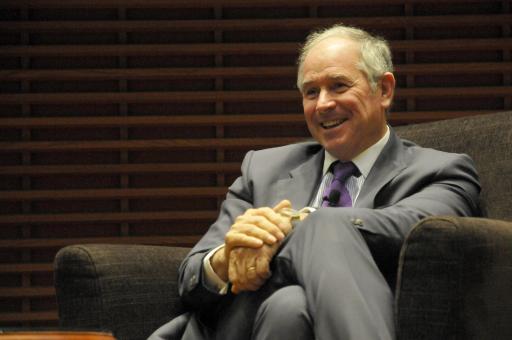

STOCK MARKET: Blackstone CEO Schwarzman Makes $573 Million in One Day as Shares Jump

Photo credit: Lugen Family Office

A plan by the giant U.S. private-equity firm Blackstone Group (BX - Get Report) to convert from a partnership into a stock corporation sent the company's publicly traded units up by 6.9% on Thursday, the biggest single-day rally in almost two years.

The plan is designed to allow ownership in the company by a broader swath of investors -- mainly those who don't want the hassle of filing the extra Schedule K-1 tax filing required by the Internal Revenue Service for partnerships.

But no one benefited more from the price jump than founder and CEO Stephen Schwarzman, 72.

According to the company's annual report for 2018, filed last month with the Securities and Exchange Commission, Schwarzman holds 231.9 million partnership units in Blackstone Holdings, which are exchangeable for the publicly traded units up to four times a year.

The announcement of the conversion plan sent those units up by $2.47 in New York trading on Thursday - translating to a $573 million paper gain for Schwarzman.

Based on the latest price of $38.40 for Blackstone's units, Schwarzman's holdings are now worth roughly $8.9 billion, and over the years he's received additional compensation from generous annual pay packages - $69 million in 2018 alone - and distributions to unitholders. So, for Schwarzman, the extra hundreds of millions are just that: a little extra.

But hey, it's still more than three times the current $175 million jackpot for the 44-state Mega Millions lottery.

Not bad for a day's work.

Related:

1. Here's Why Blackstone Shares Jumped on Thursday

2. Blackstone’s Stephen Schwarzman on Hiring Phenomenal People

Full disclosure: I own shares of Blackstone (BX)

Based on the latest price of $38.40 for Blackstone's units, Schwarzman's holdings are now worth roughly $8.9 billion, and over the years he's received additional compensation from generous annual pay packages - $69 million in 2018 alone - and distributions to unitholders. So, for Schwarzman, the extra hundreds of millions are just that: a little extra.

But hey, it's still more than three times the current $175 million jackpot for the 44-state Mega Millions lottery.

Not bad for a day's work.

I suppose this will make a lot of people hate him!

(Oh well

)

)

Index funds, dollar cost averaging, and reinvesting any dividends

Well, true in many cases.

Although there are also some liberals who have been wise enough to save some money -- some invest in the market.- I've known many who don't hate successful people

Bingo on all counts. I’ve been a regular investor since 1996 and have eight years to planned retirement though if I’m up to it I’ll keep on working.

Index funds, dollar cost averaging, and reinvesting any dividends

For most people that's definitely the smartest way to invest!

(I don't do index funds because I like spending time studying the market-- several hours each day. But I'm thinking of scaling back the time I put into that-- in which case I would sell my higher risk positions and put money into index funds).

After I retired I kept working: I've done some teaching. But for the last few years I'm now self-employed-- as trader! (stock market)

I'm starting to get bored with that though, and may do something else. (To do well as a trader I've found takes a tremendous amount of time, researching things. I liked it, but its getting to be time for a change).

Sounds like the nature of the beast ..... it is what it is.

I once had to get a background check just to contract a build on a casino. Now that is absurd.

I guess they were just checking if i had any Guido associations .... who knows

"But no one benefited more from the price jump than founder and CEO Stephen Schwarzman, 72."

Good for him.

Now I wonder if he's willing to buy me a small 60 ft. yacht.