President Biden's Economic Performance Has Proved Unbeatable - Bloomberg

By: Bloomberg. com

This seed will make the White-wing knuckle draggers shit in their collective pants!

In 1992, James Carville said: "It's the economy, stupid." That catch phrase lead to Bill Clinton's upset over sitting Republican President George Herbert Walker Bush (daddy Bush).

Up until now many Republicans have been assuming that the economy under Biden has been "terrible". They have been talking about how Americans have "suffered" because of Joe Biden. Republicans (except Bloomberg) are stupid about the economy. Maybe now they will wake up and smell the money.

No first-year president going back to Carter comes close to matching the current White House occupant's No. 1 or No. 2 ranking in each of 10 key measures.

By Matthew A. Winkler +Follow December 20, 2021, 5:00 AM EST

President Joe Biden has the economy and markets humming.

Photographer: Mandel Ngan/AFP via Getty Images

U.S. financial markets are outperforming the world by the biggest margin in the 21st century, and with good reason: America's economy improved more in Joe Biden's first 12 months than any president during the past 50 years notwithstanding the contrary media narrative contributing to dour public opinion.

Exceptional returns from dollar-denominated assets, especially the S&P 500 Index in both absolute terms and relative to its global counterparts, can be attributed to record-low debt ratios enabling companies to reap the biggest profit margins since 1950. Corporate America is booming because the Biden administration's Covid-19 vaccination programs and $1.9 trillion American Rescue Plan reduced the jobless rate to 4.2% in November from 6.2% in February, continuing an unprecedented rate of decline during the Covid-19 pandemic

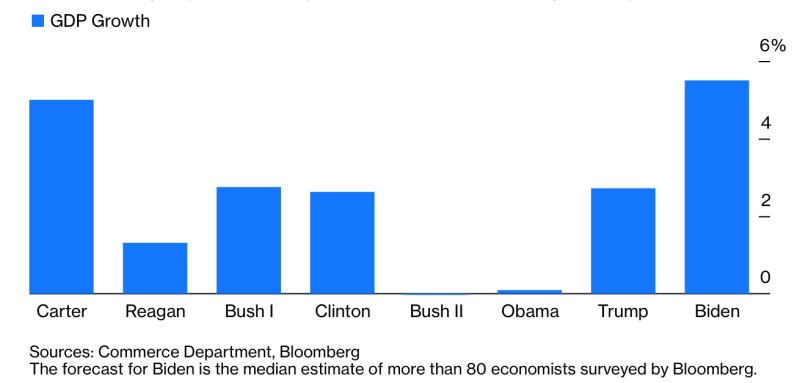

Consider that real, or inflation adjusted, gross domestic product surged at an average annual rate of 5.03% in each of the first three quarters of 2021, and is poised to expand 5.6% for the year based on the average estimate of more than 80 economists surveyed Bloomberg. If that forecast proves accurate, it would be more than 2.8 times the average between 2000 and 2019 and double the average since 1976.

All of which makes Biden's first year in the White House the standout among the seven previous presidents, based on 10 market and economic indicators given equal weight. According to data compiled by Bloomberg, no one comes close to matching Biden's combination of No. 1 and No. 2 rankings for each of the measures:

- Gross domestic product (1)

- Profit growth (1)

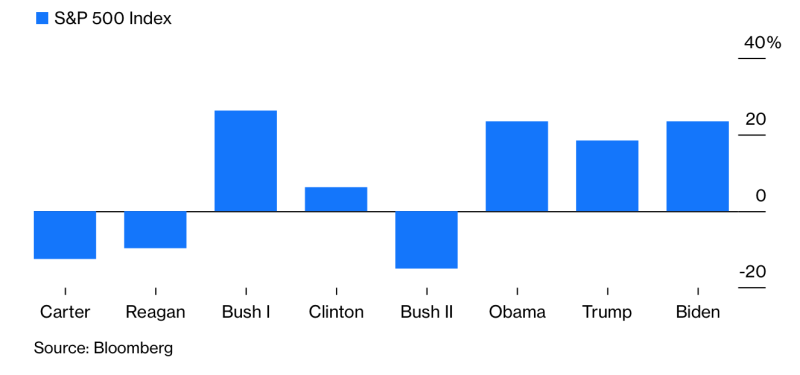

- S&P 500 performance (2)

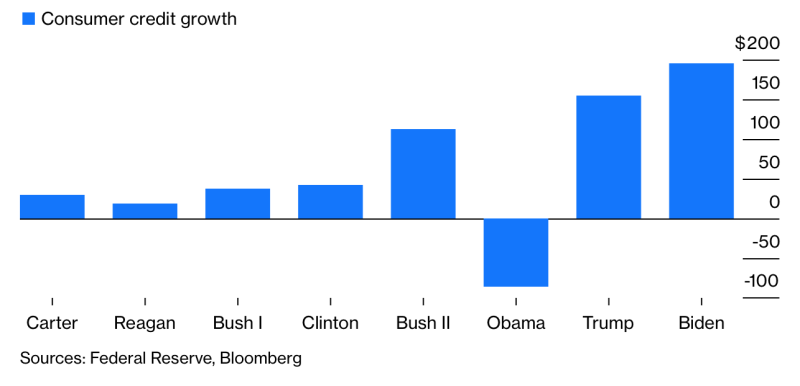

- Consumer credit (1)

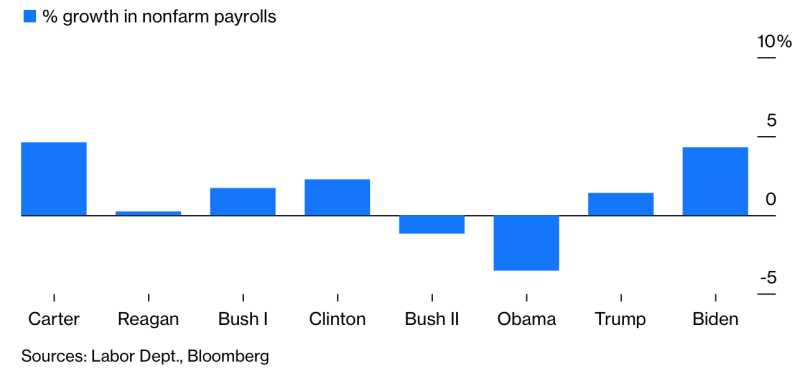

- Non-farm payrolls (2)

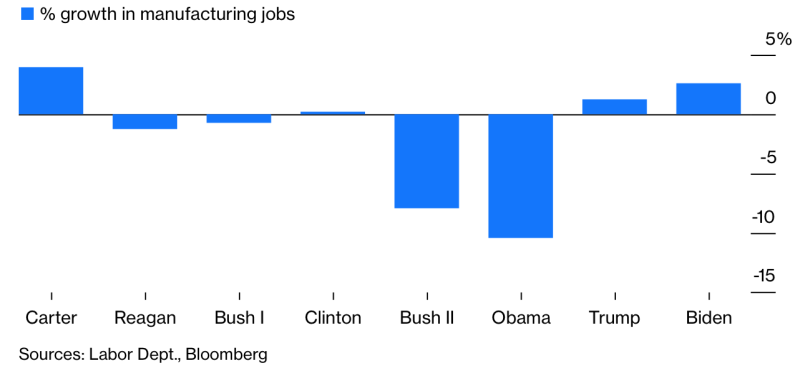

- Manufacturing jobs (2)

- Business productivity (2)

- Dollar appreciation (2)

- S&P 500 relative performance (2)

Per capita disposable income, which rose 1.08% this year, is the only comparable weakness for Biden, trailing Donald Trump’s 2.17%, George W. Bush’s 2.01%, Jimmy Carter’s 1.80% and Ronald Reagan’s 1.42%.

GDP growth in every incoming administration during the past four decades never exceeded 2.74% until 2021. Biden is now positioned to surpass Carter (5.01%) as the GDP champion of presidents since 1976. Much of the credit goes to The American Rescue Plan, which poured $66 billion into 36 million households and reduced the child poverty rate by 50%, helping the U.S. recover faster from the pandemic than most other nations.

Leading the Pack

The economy is poised to expand 5.5% in Biden's first year as president

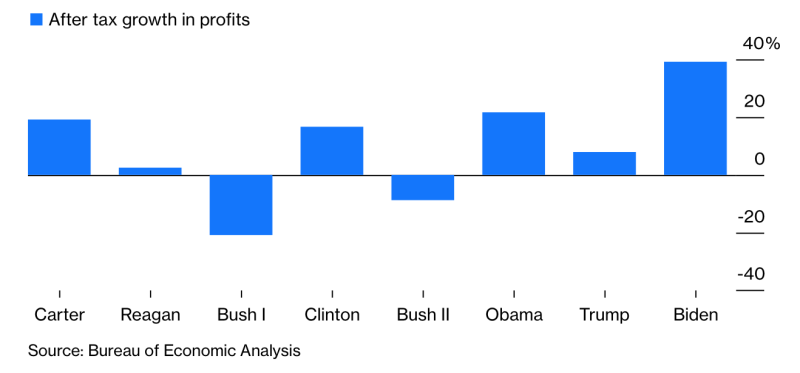

Corporate America was never healthier than under Biden in 2021. Efforts to support consumers flowed through to America’s companies, which are enjoying profit margins of around 15%, the widest since 1950, according to the Bureau of Economic Analysis. Non-financial profit increased 39.3%, making Biden No. 1 among eight presidents with Obama a distant second at 21.6%.

Earnings Bonanza

Corporate profits have boomed in Biden's first year in office

The boom times have allowed companies to reduce net debt as a percentage of earnings before interest, taxes, depreciation and amortization to the lowest since data was compiled in 1990 for companies in the S&P 500. All this helps explain why the stock market under Biden is second only to George H.W. Bush of any incoming president since Carter.

Bull Market

Biden edges Obama for second-best first-year stock performance

Americans are certainly feeling good. Consumer credit surged $196 billion through October, a record under Biden that is 27% more than the increase under No. 2 Donald Trump ($154 billion). Although some of the gains reflect a rebound from 2020 when the pandemic caused many consumers to retrench, they wouldn’t be adding debt if they weren’t feeling confident.

Feeling Flush

A surge in credit borrowing by consumers signals high economic confidence

The way the jobs market is improving, it’s not hard to see why consumers are in such a good mood. Biden is the only president over the past half century with robust increases in non-farm payrolls (4.3%) and manufacturing jobs (2.6%), approaching the gains enjoyed by Carter in general employment (4.6%) and factory workers (3.9%). Trump, who inherited the longest expansion in modern times and said in 2015 he would “be greatest jobs producer that God ever created,” is an also-ran, with non-farm and manufacturing payrolls inching up 1.4% and 1.3%, according to data compiled by Bloomberg.

Jobs Boom

Only Carter tops Biden for best growth in payrolls in their first year in office

Returning to Factories

Manufacturers have added more workers under Biden

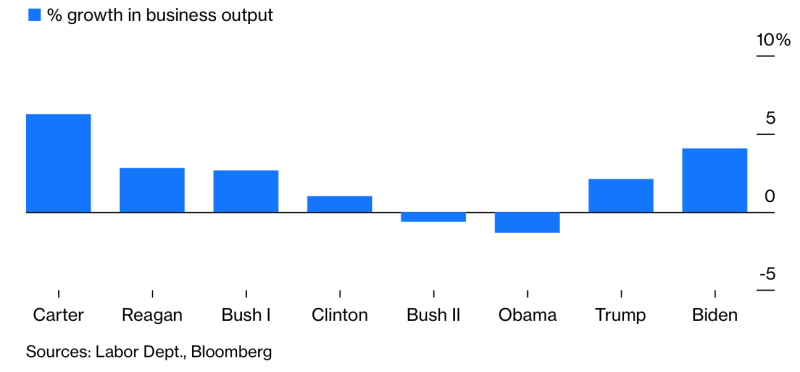

Companies need all the workers they can get. U.S. business output, a measure of productivity, increased 4.4%, putting Biden ahead of every predecessor except Carter, where it gained 6.25%. No wonder confidence among chief executive officers of the largest U.S. companies soared to a record this year as expectations for hiring, capital investment and sales improved. The Business Roundtable's CEO Economic Outlook index, launched in 2004, rose 10 points to 124 in the fourth quarter, the highest in 20 years.

Getting Back to Work

Business output is surging under Biden as the economy recovers

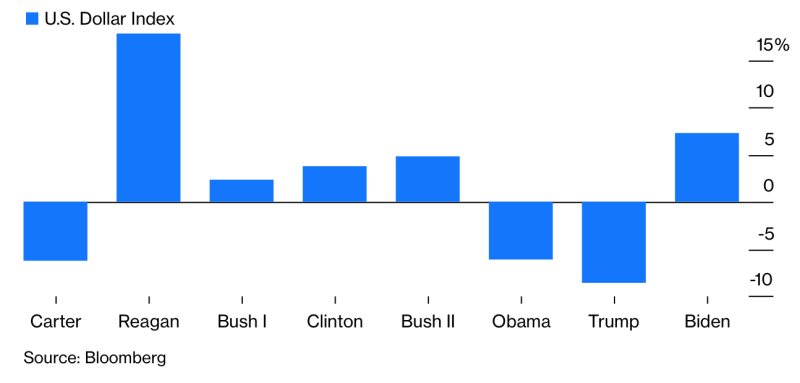

America’s economy is the envy of the world, looking at the foreign-exchange market. The dollar has strengthened 7.37% this year. That is the most under a first-year president since the greenback gained 17.8% for Reagan, according to data compiled by Bloomberg.

The Mighty Greenback

America's currency has gotten stronger under Biden

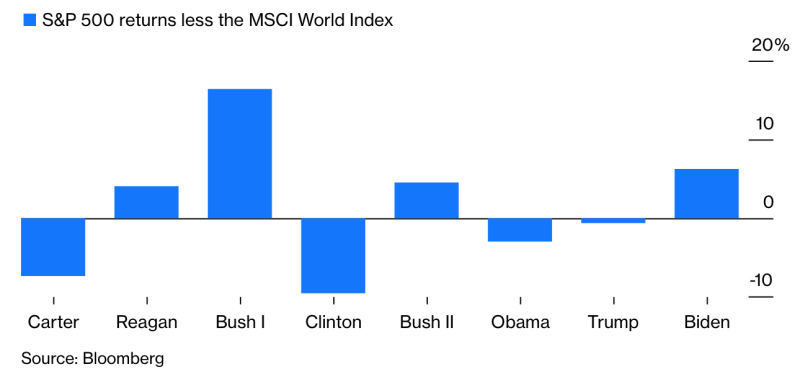

In another sign that the U.S. economy is a global leader under Biden, U.S. stocks outperformed the world equity market by 6.3 percentage points, the widest advantage since 1988, when George H.W. Bush was in the White House, according to data compiled by Bloomberg.

Beating the World

U.S. stocks are generating higher returns than the global equity market

The good times may extend into 2022. Biden's bipartisan $1.2 trillion Infrastructure Investment and Jobs Act bodes well for the economy and American labor because it will rebuild the nation's deteriorating roads and bridges as well as fund climate and broadband initiatives that create jobs. Even Senate Minority Leader Mitch McConnell, who said his priority was preventing the Biden agenda, voted for the law along with 18 fellow Republicans.

Biden, like Carter, now faces the political fallout of the accelerating inflation from global supply chain breakdowns associated with the pandemic even though maintaining stable inflation and interest rates are the primary responsibility of the Federal Reserve, and the Fed said it's prepared to tighten monetary policy in 2022.

It will be fun to see what the Trumpanzees will say.

The last time i presented the numbers, they tried to attack the source (CNN).

Butt CNN was NOT the source of those numbers; CNN merely reported the numbers (accurately).

Your seed is like Kryptonite to the magats here. Job well done. I only wish I could vote it up a hundred times.

Bingo

All I can say is that whoever wrote that article got to smokin some great stuff! Whatever Biden has done has only helped his rich corporate liberal buds. The little people are still suffering financially and economically, and will be for the foreseeable future, as long as Uncle Joe remains in office. The only thing I have for confidence in this administration is that Joe Biden only has four years to totally screw this nation up. That's because he will never get reelected. Okay I've said my piece so now the libs can start roasting me now if they want.

Specifics here would be helpful.

I certainly hope he does not run. The D and R parties should both seek the best possible candidates in terms of competence, energy, convictions, ethics, etc. Now I know that is not what is going to happen, but it should.

Biden clearly is far from the best the Ds have to offer so for the good of the party and the nation, I hope for better. Similarly, Trump is an abysmal candidate especially after he proved this to the world with his Big Lie con-job. The GOP can do better without breaking a sweat.

Will the parties do better? Sadly I cannot confidently state that we will not see Biden v. Trump (although I do not expect to see either of them).

Agreed.

Specifically, stock market and real estate investments have grown at a much, much faster rate than wages. That's great if you have stock market and real estate investments, but not so great if you work for all of your dollars instead of them working for you.

Biden has been able to accomplish large government spending programs, which also historically favor wealthy and affluent people.

High government spending also encourages inflation. Inflation is an interesting academic concept for affluent people, who note that their $15 margaritas are now $22. It's a very painful concept for middle-class and poor people, many of whom were stretched to the limit already.

This is a result of Biden policies?? If Biden has some method for making this (stock market growth) happen I would ask him to bottle it for future administrations. Wages have been stagnant for decades (adjusted for inflation).

I see that as mostly a function of Congress and I see this happening regardless of the party in power. Biden and the current Congress are guilty of this if they pass the BBB legislation. I can see the extant infrastructure legislation (if by some chance it is properly executed) as being a good thing for the nation as a whole. That is, national infrastructure (true, not in name only) is actually something that falls within their purview.

(refer to above)

Our federal government has for decades engaged in egregious spending. So, barring BBB, distinguishing Biden's administration/Congress from other administrations/congresses on these grounds seems unfair. If we want to note that this administration and this Congress continues the trend of past administrations and congresses to favor the rich and powerful, that goes without saying. But it does not show the distinction that I expected to see.

I would note, that while we are going to spend a record amount on Defense under Bidens first budget

we are no longer spending trillions on ME adventures and instead

we are chafing at spending a lesser amount on our own actual citizens and infrastructure

almost strictly on partisan lines after the last Administrations 200 plus Infrastructure weeks

also produced nada.

I do not recall the last administration cutting COLA for active duty personnel living in high cost the of living areas like Biden is doing. Please tell us about record amounts for defense under Biden.

COLA is evaluated every year. Sometimes it increases, sometimes it decreases.

This year it happens to go down in many areas previously seen as "safe" " high cost areas

It is also determined by a third party government contractor by the laws that Congress enacted,

not Mr. Biden.

Frequently Asked Questions about CONUS COLA | Military.com

In spite of many Congressional objections from both sides of the aisle, the 2022 Defense budget

was not only a record number $740 Billion but the House added $28 Billion which the Senate accepted

and Biden signed for $768 Billion.

Which is meaningless when BAS, BAH, COLA and other non taxable stipends are calculated by laws

previously established by Congress not the White House.

Some of it, certainly.

It's not unlike a doctor who comes in for his shift at the hospital, doesn't read the patient's chart accurately, and overmedicates her. He's not responsible for what the previous Dr. did, but he's definitely responsible for making it worse.

Which makes inflation all the more problematic.

The infrastructure improvements are overdue and the infrastructure bill would have been fine had we not already pumped $3 trillion into the economy already through FFCRA and CARES, and another trillion through QE. As much as things may need to be done, they can't all be done at once.

Yes, but not like we have in the last 20 months or so. We're talking about the difference between billions and trillions.

Despite the ridiculous claims in the article, I think it's unfair to blame or credit him exclusively for any part of the current economic situation. That said, he has contributed to a number of current economic problems. He's a career politician who wants it to appear like he's doing "something", and his supporters are perfectly happy to count "spending" as "something".

That basically states that the sitting PotUS will have some influence on matters in the USA. Of course that is true. But that is a far cry from speaking of specific actions by the PotUS that caused a rising stock market or stagnant wages.

I certainly agree that the federal government has irresponsibly overspent and over-borrowed (well before Biden). But if we are going to continue to spend (which clearly they will) then I favor hard infrastructure and related initiatives that are necessary and actually within the constitutional purview of the federal government.

Agreed, they are growing worse. It is as if they gauge reasonable spending/borrowing as a percentage of national debt. COVID relief became an easy excuse for exacerbating the problem.

Not different in fundamentals from any other PotUS. It really is not the PotUS as much as it is political parties who care only about power and will burden our great-grandchildren with debt (and further compromise the value of the USD) to get their way.

The same basic dynamics would have happened with any D PotUS and similar dynamics with any R PotUS. Focusing this discussion strictly on Biden misses the point.

I thought I had effectively communicated that "additional reckless spending" was the specific action in question.

Totally agree.

As would I, but what we prefer is completely immaterial with regard to the consequences. Whether you spend $300k renovating your home or buying a new McClaren, the money is gone.

Absolutely. Combine that with the increasing trend over the last decade or so to value feelings and ignore facts, and they have nearly unlimited carte blanche because people "feel afraid".

The difference in this situation is the quantity of money that had already been spent before he arrived.

I do give him credit for hobbling the extremists in his own party who are still throwing tantrums because they didn't get to spend half as much of other people's money as they wanted.

Money invested wisely can (essentially will) enable revenue growth. Having quality roadways, for example, is critical for commerce. Money spent on handouts, wasted, or stolen via corruption is money gone.

I get that. But you're talking about a decade later, and only then if you're able to actually collect that revenue.

Regardless, you can't force that much money into the economy in such a short span without problems. Those problems will be capitalized upon by the wealthy and will make life very difficult for the working class.

... and effectively execute the legislation. Lots of ifs. And that is the nature of infrastructure. So I support infrastructure (as I defined it). I would think you would support it too and recognize that infrastructure does indeed enable commerce.

Are we still talking about the passed and signed $1.2T infrastructure bill (vs. the BBB legislation)? This is a bill whose actions (and spending) are necessarily executed over time. And if you are hinting at the incompetent execution of same well then we agree because that is my key concern. But the concern for waste and corruption is true of any initiative of the federal government.

And there is nothing that I see that can be done to prevent the wealthy from working conditions to their benefit. That is systemic in our extant implementation of capitalism.

Okay, I admit that I did not check my sources as properly or as thoroughly as I should have and I was wrong. My thanks for the corrections and clarifications and mybapologies as well. I will have to he more careful in the future.

Kudos.

Mr Giggles is a dorm manager and right round this time he had an unsafe stairway that had to be blocked off because there were no funds to repair it. He's also had tons of work orders that go ignored because of lack of funding.

No problem Ed.

Thanks for your service during a difficult time.

Go Navy.

Damn! I missed this?

OMG, we don't need no stinkin' facts.

facts ruin their narrative of a third world country economy, thumpers being crucified daily, our streets filled with roving bands of criminals and commies, and the entire population of central and south america is either camped at 2 border crossings or waiting at every foot of shoreline and mile of desert to invade. is there a world record for how high bullshit can be stacked? how tall is trump?

My dad used to say...."I knew bs could be stacked high, but I didn't know it could also speak."

Yep, Joe Biden is a neoliberal's neoliberal. As the data clearly shows, Biden has overseen a revival of the neoliberal economy based on neoliberal financial measures.

Biden has been very, very good for Wall Street and global profiteers. Neoliberals are basking in the glow of returning to normal. Stock trading Congressmen should be happy; it's been a good year for them.

The other thing that happens is that the incoming president doesn't see the results of their policies until they're into they're second year, their first year is still the previous presidents policies. If it wasn't for the covid19 downturn during Trump, Trump's policies are still in effect.

That's the typical excuse. Don't forget the flurry of Executive Orders Biden issued to overturn the policies of 'he who shall not be named'. Of course, we're supposed to ignore that Biden is walking back on a lot that he rescinded.

No, Biden promised a return to neoliberal normal. And that's what we got. Joe Biden is a neoliberal's neoliberal. Give him credit for what he has accomplished in such a short time.

What walk backs are you pretending to ignore Nerm? Be specific.

You keep using that word, I don't think it means what you think it means.

H/T Inigo Montoya

Thanx for the neowordsalad!

BTW, the performance of the S&P 500 was just one of the economic factors in the article.

Well, yes, the S&P 500 was just one factor listed in the article, twice. Are any of the listed factors NOT supply-side measures of the economy?

Which of the listed factors address safety-net measures of the economy? You know, things like income, housing, and food security. Why aren't factors like CPI, trade deficits, and inflation included? Why isn't measures of poverty in a claimed booming economy mentioned?

According to the article, Joe Biden has been very good for the supply-side of the economy. And the supply-side of the economy is what neoliberals care about. Joe Biden's planned return to normal has really been about returning to preferential treatment for the supply-side of the economy.

I see. You appear to be opposed to "supply-side economics".

Please notice the "three fundamental 'pillars' of the supply-side model" in the article below. Joe Biden hasn't done anything that resembles the supply-side model.

In fact, the "three fundamental 'pillars' of the supply-side model" are what Republicans have promoted since Ronald Reagan. Therefore, according to the article below, you must have hated Donald "supply-side" Trump. It's strange, butt I don't recall you criticizing The Donald.

Supply-side economic theory powers Trump tax plan

By Farrokh Langdana , Director, Executive MBA Program & Professor of Finance and Economics

Faculty Blog:

The Wall Street Journal published a gem in a Nov. 25, 2017 , letter to Treasury Secretary Steven Mnuchin during the tax debate signed by nine economic heavy hitters that included two of the original supply-side theorists, Prof. Robert Barro from Harvard and Prof. John Taylor, from Stanford; Taylor was in the recent running for Fed Chairman.

The WSJ article (A) is vintage supply-side thinking. Below is an overview of the supply-siders followed by analysis of two anti-supply side articles from Paul Krugman (B) of the New York Times and Peter Coy (C), the economics editor for Bloomberg Businessweek, followed by my personal opinion.

There are three fundamental 'pillars' of the supply-side model:

As the "size of the pie" – the national income, denoted as Y---increases, tax revenues (T) are supposed to rise, in T = tY, where t is the % tax rate, Y is National Income (GDP) and T is Tax Revenues in dollars.

So as tax rates, t, fall with Trump's proposal, i f Y (GDP, the size of the pie), increases disproportionately as per the S-side model in Figure 7, then the dollar tax revenues, T (the "tax base) may actually increase or, at least remain the same. In these cases, we get the refrain, “the Trump tax cuts will pay for themselves!”

Not so fast! say the critics, and most notably, the bane of the Supply-Siders, Prof. Krugman below, in "Lies, Lies, Lies....!" Krugman’s blog and the one from Bloomberg Businessweek’s economics editor following it (which actually responds to the WSJ article), presented be low, argue that: No. It is not clear that the tax cuts to businesses and personal income actually affect labor demand and supply. The evidence does not support this, they claim. In fact, in a recent meeting of Top 50 CEOs only two out of 50 told a Trump cabinet minister, Gary Cohn, that they would increase employment if given juicy corporate tax cuts. Most of the tax cuts would, according to them, show up in greater earnings for their stock-holders.

And, critics would argue further that overall tax revenues, T, have not empirically increased in past supply-side experiments. There is no "increasing of the size of the pie to allow tax cuts to pay for themselves!"

Yes, but supply-side economics is built upon much more than three pillars of lies. Neoliberal Democrats like to point fingers at the Laffer curve because the Laffer curve focuses attention on taxes and big government.

Economic neoliberalism, at its core, is about the creation of money coupled with a phony notion that creation and distribution of money is governed by natural laws of economics. And the neoliberal argument is that the rich just naturally become richer -- without having to produce anything. Neoliberal economic prosperity and affluence depends upon ability to create money. Supply-side economics is about supplying the economy with money.

The government can achieve a 5 pct increase in GDP by spending an addition $1 trillion. Under normal conditions that additional government debt is purchased with money that has already been created. But we've now entered an era where the Federal Reserve creates money to buy additional government debt. When the Federal Reserve begins creating money to pay for government programs then deficits don't matter any longer. If any administration cannot increase GDP under those conditions then they've really screwed up.

Imports and a trade deficit drains newly created money from the economy. So, if the Federal Reserve creates $1 trillion to pay for government programs and the trade deficit reaches $1 trillion then they cancel each other. The created money doesn't stay in the country; it's used to pay for imports. Neoliberals do not use productive activities to create value; neoliberals use finance to create money whose value is determined by artificial scarcity. That's where neoliberals get their argument that a trade deficit means we are trading something of no value (money) for something of tangible value (manufactured goods).

Okay, please explain how the three pillars are lies and how Trump's supply side approach was "honest".

Please, explain how tariffs fit into supply-side economics. Please, explain how raising taxes on the rich fit into supply-side economics. Please, explain how stopping cheap labor at the border fits into supply-side economics.

Why were neoliberal Democrats so outraged about Trump's tariffs, renegotiated trade deals, limits on SALT deductions, and attempts to close the border to cheap labor illegally entering the country?

"Raising taxes on the rich" does NOT fit into "supply-side economics"

Here's the second fundamental 'pillar' of the supply-side model:

2. Large personal tax cuts are supposed to increase labor supply (figure 4b). With the ensuing increases in labor demand and supply, employment is consequently supposed to increase.*

And here is the FIRST fundamental 'pillar' of the supply-side model:

1. Large business tax cuts are supposed to increase labor demand.*

Obviously those two 'pillars' of the supply-side model are what Trump's tax cuts were based on.

* These 'pillars' of supply side economics were specified in a previous comment #3.2.2. If you're going to ignore my comments; then you shouldn't try to play the home version of this discussion.

While you were out . . . Trump called. He says, "You're welcome."

I kid, but only a little. Now personally, I think the economy is more complicated than just who is in the White House. But you don't get to spend 4 whole years giving Obama credit for the Trump-era economy and then turn around and claim that Biden accomplished some kind of revolutionary economic triumph in less than a year.

Oct 2019: Joe Biden, in Scranton, Says Trump Owes Current Economy to Obama Years

July 2020: Obama Built Most of Trump’s Good Economy

Aug 2020: Data show Trump didn't 'build' a great economy. He inherited it.

Even if Biden and Congress had been working super hard on the economy all year (and we know they haven't), it's just not enough time to have an impact.

On the other hand, if you want to take full credit for these economic numbers, then you also get to take credit for the highest inflation rate . . . in 40 YEARS!

Investors brace for the highest inflation reading in nearly 40 years

And that's kind of important because it doesn't mean much if your wages increase while prices increase faster. It's not good news if GDP increases only because everything costs more.

Demonstrably so! To the point that it is a bit ridiculous to assign the quality of an economy to a single PotUS (or even to ALL PotUS').

For the most part a PotUS can harm an economy but a PotUS has very little influence to turn a bad/mediocre economy into a good (much less great) economy. Certainly nothing that would be considered 'control' over the economy (as some like to believe).

We give PotUS' far too much credit / blame for the economy (especially the one in place while they are in office).

Presidents can, with the help of Congress, pass a stimulus package (like The American Rescue Plan) that can help jump start the economy

"GDP growth in every incoming administration during the past four decades never exceeded 2.74% until 2021. Biden is now positioned to surpass Carter (5.01%) as the GDP champion of presidents since 1976. Much of the credit goes to The American Rescue Plan, which poured $66 billion into 36 million households and reduced the child poverty rate by 50%, helping the U.S. recover faster from the pandemic than most other nations.

The economy is poised to expand 5.5% in Biden's first year as president."

That I would consider to be more a power of Congress than the PotUS. And even so, that is often hit/miss. We (human beings) simply do not understand large domestic economies as a function of the global economy well enough to direct a domestic economy to a particular end. We try sensible actions and hope for the best.

Wait a minute,,,,

You leftists have been preaching for a year now that Biden's economy was on fire and the best in modern times.

What is there to "jump start"?

Where were you in 2020? The COVID pandemic caused a severe economic recession.

On June 8th, the The National Bureau of Economic Research (NBER) officially declared a recession, noting that the U.S. economy had fallen into contraction starting in February 2020. This marks the first U.S. recession since the Great Recession, which began in December 2007 and lasted until June 2009.

Today nearly 22 million Americans are receiving unemployment benefits, or about 13% of the labor force. By some measures, the total number of unemployed could be nearly double that figure. April retail sales fell nearly 22% year over year, by far the biggest monthly decline in the history of the index. Meanwhile, the Atlanta Fed’s GDPNow Survey sees the median consensus estimate for second-quarter GDP at -53.8%, which would be the worst reading in U.S. history.

Not what I said.

Leftists all over the country have been saying Biden has an economy on fire.

\The only reason Biden may hit a high GDP is because he is riding the recovery wave that Trump started before he left office. The economy is recovering because of Trump policies, not Biden.

Biden;s policies have caused record breaking inflation. Not exactly a "jump starter".

Yes, the GDP is growing at a 6.5% rate.

Wages are growing too, as is inflation.

Here are some of the stimulus packages designed to " jump start " the economy (which was suffering from COVID):

The Coronavirus Aid, Relief, and Economic Security Act , also known as the CARES Act , is a $2.2 trillion economic stimulus bill passed by the 116th U.S. Congress and signed into law by President Donald Trump on March 27, 2020, in response to the economic fallout of the COVID-19 pandemic in the United States . A later bill increased the spending by more than $300 billion.

Unprecedented in size and scope, the legislation was the largest economic stimulus package in U.S. history, amounting to 10% of total U.S. gross domestic product .

An additional $900 billion in relief was attached to the Consolidated Appropriations Act, 2021 , which was passed by Congress on December 21, 2020, and signed by President Trump on December 27, after some CARES Act programs being renewed had already expired. In March 2021, President Joe Biden and the 117th U.S. Congress passed the American Rescue Plan Act of 2021 , a $1.9 trillion COVID-relief package.

Problem is, wage growth is more than offset by inflation. There really is no real wage growth, thanks to Biden policies

Here is PEW research from 2018 (three years before Biden took office)

Facts? We don't need no stinking facts.

Most of that has yet to be implemented.

Actually, wage growth has been over 6% every month since April [April +15, May + 13, June + 12, July + 11, ect.] and the inflation rate hasn't.

Opps...

Gonna need a link for that if you can come up with one.

w age growth has been over 6% every month since April [April +15, May + 13, June + 12, July + 11, ect.] and the inflation rate hasn't.

Lol...

"Wages, though, have swelled during the period, with average hourly earnings up 4.9% year over year in October. However, compared with inflation, real hourly wages actually have declined more than 1.2% during the same time frame, according to the Labor Department."

United States Wages and Salaries Growth | 2022 Data | 2023 Forecast (tradingeconomics.com)

I believe your link and subsequent chart are comparing year over year the same month NOT a month to month raise from July to August to September etc......

That's how wage rates are cited Jim. Do you have another metric you'd like to share?

If not...

Is 15 higher than the 6.8% inflation rate Jim?

How about 13, 12 and 11?

Your post made it sound like it was PER month over the previous month NOT the previous year. My mistake??

You don't understand your chart, do you?

This is the relevant data from the US Bureau of Labor Statistics:

Your link doesn't include that block quote Sean. Try harder...

BTFW, I get an extra chuckle when a BS post gets thumbs up...

There you go. Did you figure out your mistake yet? Or are you intentionally trying to mislead people?

The mistake was on YOUR part by posting the WRONG link.

No but you are. You are citing 'hourly wages', I cited data about WAGES.

So take your apples and oranges argument elsewhere Sean.

Oh and BTFW, I'm still waiting for you to tell me how many times the mods have shown me favoritism in that other seed.

The Federal Reserve Board is supposed to be in charge of reigning in inflation.

Do you think Biden should pursue federal price fixing to control inflation?

Biden released oil from our reserves to try to contain the rise in the price of oil (and therefore gas).

Here's what Bloomberg says about the inflation rate:

"Biden, like Carter, now faces the political fallout of the accelerating inflation from global supply chain breakdowns associated with the pandemic even though maintaining stable inflation and interest rates are the primary responsibility of the Federal Reserve, and the Fed said it's prepared to tighten monetary policy in 2022."

Record GDP growth is associated with inflation. Inflation also was the result of the stimulus from the American Rescue Plan (which was supported by Mitch McConnell).

"GDP growth in every incoming administration during the past four decades never exceeded 2.74% until 2021. Biden is now positioned to surpass Carter (5.01%) as the GDP champion of presidents since 1976. Much of the credit goes to The American Rescue Plan, which poured $66 billion into 36 million households and reduced the child poverty rate by 50%, helping the U.S. recover faster from the pandemic than most other nations.

The economy is poised to expand 5.5% in Biden's first year as president."

I just think any action on the economy takes time to develop. This inflation is something economists have been forecasting for years. As for the pandemic, I don’t think it is through with our economy. It’s too soon to start celebrating.

I agree.

Since only 61.6% of us are vaccinated, there will be lots of infection and reinfection.

I hope you are vaccinated (and boosted).

I just posted this elsewhere because you and I made the bulk of our $$ many years ago

and since the crash in 2008 the IR has been manipulated by the Fed not only to NOT exceed 2.2%

but they artificially kept it at 0.25 for 7 years

US Inflation Rate by Year: 1929 - 2023 (thebalance.com)