What Downturn? Cisco Sees Double-Digit Growth Ahead. | The Motley Fool

By Timothy Green - Feb 18, 2023 at 7:00AM

Key Points

- Cisco reported better-than-expected revenue and earnings on Wednesday.

- The company's guidance was exceptionally strong.

- Cisco stock looks like a good deal based on valuation and the dividend.

- Motley Fool Issues Rare "All In" Buy Alert

NASDAQ: CSCO

Cisco Systems

Market Cap $209B Today's Change Arrow-Thin-Down (-0.43%) -$0.22 Current Price $50.77 Price as of February 17, 2023, 4:00 p.m. ET

Market Cap $209B Today's Change Arrow-Thin-Down (-0.43%) -$0.22 Current Price $50.77 Price as of February 17, 2023, 4:00 p.m. ET

Demand for enterprise networking equipment has held up despite an uncertain economic environment.

Networking hardware giant Cisco Systems (CSCO -0.43%) is sensitive to prevailing economic conditions. When its enterprise customers are facing uncertainty, they tend to delay orders of pricey networking gear. This caution from customers can lead to significant declines in Cisco's top and bottom lines.

Given the current state of the economy, with elevated inflation and rising interest rates pressuring consumers and businesses, Cisco's strong earnings report on Wednesday came as a bit of a surprise. The company reported a 7% year-over-year rise in revenue and a 5% jump in non-GAAP earnings per share (EPS). Both metrics came in ahead of analyst expectations.

Cisco's guidance was even more impressive. The company now expects to grow revenue in fiscal 2023 by 9% to 10.5%, well above analyst expectations of roughly 5.7% growth. Non-GAAP EPS for the full year should now come in between $3.73 and $3.78, well above the $3.55 analyst consensus.

Stable demand and surging software sales

Despite the economic backdrop, Cisco is seeing a relatively stable demand environment. Some areas of its business are doing better than others. The core enterprise switching and routing segment is booming, with sales up 14% year over year in the fiscal second quarter. Meanwhile, the Internet of the Future segment, which consists of 5G, optics products, and silicon, suffered a 1% decline. The collaboration segment was down 10%, not a huge surprise as pandemic tailwinds fade away.

While software is spread across all of Cisco's segments, the company breaks out total software sales. Cisco generated $4.2 billion of revenue from software in the quarter, up 10% year over year and around 30% of total revenue. Subscription software accounted for $3.5 billion of that total, up 15% year over year. Overall subscription revenue, which includes software subscriptions and other recurring revenue, grew 9% to $6 billion.

Product orders are down, but there's a good reason

One possible cause for concern is the big year-over-year drop in product orders Cisco reported along with its results. Total product orders plunged 22% in the quarter, with double-digit declines across every geography and end market.

However, the comparison is a little unfair. In the prior-year period, product orders surged 34% year over year, one of the best performances in Cisco's history. Supply chain issues were hindering Cisco's ability to deliver products a year ago, leading to long customer lead times and an urgency among customers to get orders in. Cisco is now seeing customer buying patterns normalize.

The dividend gets a boost

On the back of Cisco's strong results and guidance, the company is raising its quarterly dividend by 3% to $0.39 per share. At the current stock price, the new dividend represents a forward yield of about 3.1%.

Cisco's strong cash flow and cash-rich balance sheet easily support this increased payment. Free cash flow through the first six months of fiscal 2023 totaled $8.4 billion, and the company had around $22 billion of cash and investments on its balance sheet. Dividend payments ate up just $3.1 billion through the first six months of the fiscal year.

With Cisco expecting non-GAAP EPS as high as $3.78 in fiscal 2023, the stock currently trades at a forward price-to-earnings ratio of just 13.5. While demand could deteriorate if global economies enter recessions this year, it's hard to argue that Cisco stock isn't a compelling stock for value and dividend investors alike.

The recession, if you call it one, ended June 2022!

Motley Fool you say? "Given the current state of the economy, with elevated inflation and rising interest rates"

I guess we'll find out who the greater fool is eventually.

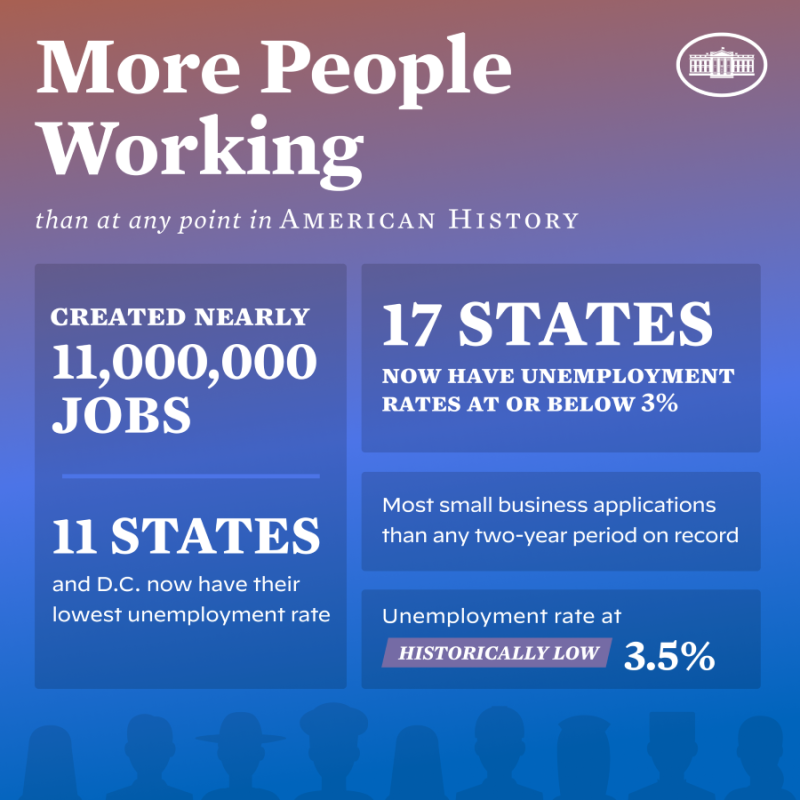

What they call a growing economy with record low unemployment? "Not a recession!"

It is pretty sad that the same old memes have to be dragged out to try and prove something. One of them from a Whitehouse that is not on friendly terms with the truth. The DNC would be proud.

Why are you sad America's economy is growing?

Did I say I was? Why do you like to make stuff up? It is called misinformation. Why do you like spreading misinformation?

Just another old worn out meme.

The inconvenient truth the seeder is denying is that while the economy is supposedly good and that inflation is easing...

is that grocery price have barely come down, and while gas is a bit cheaper, the prices for electricity and natural gas has been skyrocketing.

Deja vu all over again for what? The fourth or fifth time? No matter. Time to call bullshit again on this turd that is now hardening and getting stale.

Created 11 million jobs? Bullshit. Many of those jobs already existed.

Disinformation, misrepresentation and disingenuousness. Served up in heaping portions by sleepy Joe and his minions.