Nearly 100 Republicans demand Pelosi hold Biden accountable for $500B student debt handout

By: Houston Keene (Fox News via YahooNews)

$500 billion? That's more than the unprecedented, historic spending to address climate change in the Inflation Reduction Act. And the student loan forgiveness hasn't been spread over 10 years as was the IRA.

But what the heck. Biden's polling is awful and it's only money, after all.

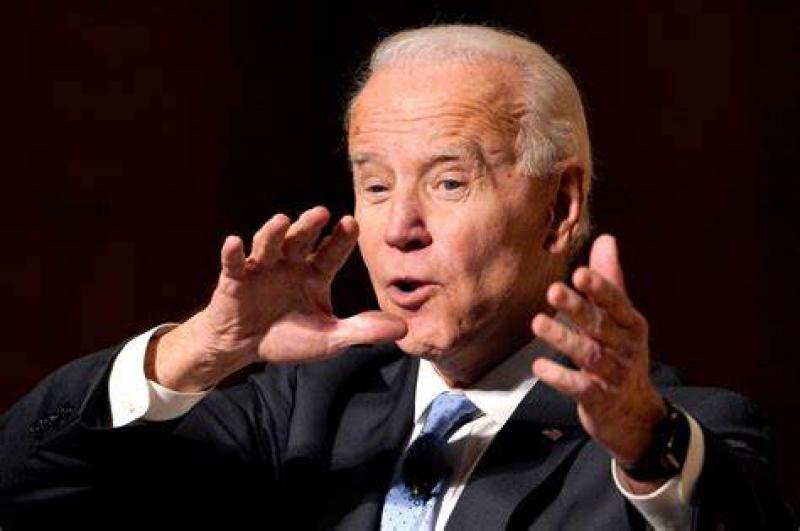

Nearly 100 House Republicans signed onto a letter to House Speaker Nancy Pelosi, D-Calif., calling on her to hold President Biden accountable for his $500 billion student debt handout.

Georgia Republican Rep. Jody Hice led the spicy letter with 93 of his colleagues to Pelosi demanding the speaker take action to hold the president accountable for his taxpayer-funded student debt handout.

"Speaker Pelosi explicitly stated in July of 2021 that President Biden 'does not have the power,' to cancel federal student loan debt. 'That has to be an act of Congress,'" Hice said in a press release exclusively obtained by Fox News Digital. "I'm demanding that Speaker Pelosi decisively act and stand by her previous statement - a direct repudiation of President Biden's executive overreach yesterday."

Rep. Jody Hice, R-Ga., led a letter with 93 of his GOP colleagues to House Speaker Nancy Pelosi, D-Calif., demanding she hold President Biden accountable for his "unconstitutional and illegal" student loan handout. CQ-Roll Call

"President Biden is a desperate politician," Hice said. "His plan to transfer $300 billion of debt onto the backs of hardworking American taxpayers is a politically craven stunt that makes a mockery of our Constitution and the rule of law."

"Speaker Pelosi has a choice to make," the Georgia Republican added. "Will she cave to the President's shockingly illegal act or will she back up her own words by taking swift action?"

The group of nearly 100 GOP lawmakers wrote in the letter exclusively obtained by Fox News Digital that they are "concerned with the massive executive overreach" by Biden "to illegally cancel federal student loan debt."

The lawmakers pointed to the move's $300 billion taxpayer-funded price tag and warned the president's plan "will drive up the cost of higher education, exacerbating the very problem President Biden pretends to address."

"Noticeably absent from the President's plan is any plausible legal authority to implement such a policy," Hice and his colleagues wrote. "The legislative and executive branches each possess defined powers under the Constitution."

"No provision of the Constitution nor any act of Congress, including the Higher Education Act, grants President Biden or the Secretary of Education the authority that they falsely claim to wield through this unilateral action," the letter continued.

The Republicans pointed to Pelosi's own statement from July 2021, saying "thankfully" the speaker "expressed her agreement" with the GOP when she warned Biden did not have the constitutional authority to cancel student debt.

"People think that the President of the United States has the power for debt forgiveness, he does not," Pelosi said. "He can postpone, he can delay, but he does not have that power. That has to be an act of Congress."

"Although we may disagree on many things, your statement in July 2021 was correct," the Republicans wrote. "President Biden's student loan giveaway is unconstitutional and illegal."

"Given your previously stated position and your leadership role as Speaker of the House, it is imperative that you act immediately in defense of our Constitution and the powers of the legislative branch," they continued.

The Republicans asked if Pelosi would "commit to supporting" her previous statement "with definitive action to stand up to this blatant overreach President Biden is enacting," further noting the president's "move transcends the policies surrounding student loans."

"This is an illegal act by a President desperate for a political win," Hice and his Republican colleagues concluded the letter. "We hope you will heed your own words and act to defend the Constitution and rule of law."

Joining Hice on the letter are 93 Republican House members including Reps. Austin Scott of Georgia, Ashley Hinson of Iowa, French Hill of Arkansas, and House Republican Conference chair Elise Stefanik of New York.

Pelosi's office did not immediately respond to Fox News Digital's request for comment.

Washington has been abuzz with bipartisan furor since Biden announced his taxpayer-funded $500,000,000,000 student loan handout on Wednesday. Initially, the cost estimate was $300 billion, but the Committee for a Responsible Federal Budget (CRFB) adjusted the number in a new analysis.

Since the announcement, the White House has been deafeningly silent on how Biden's decision to cancel between $10,000 to $20,000 in student debt for some Americans will be paid over the long run and whether it will drive tax bills higher even for average Americans.

Fox News Digital asked the administration about a new analysis from the National Taxpayers Union Foundation estimating that the student loan handout will cost the average U.S. taxpayer more than $2,000. The fiscally conservative think tank, in particular, says the federal government will need to figure out a way in the future to make up for the forgiven loans, whether it be spending cuts or tax hikes. Much of it, the group predicts, will be via the latter.

The White House did not respond to questions about the report or if it was eyeing future tax hikes to make up for Biden's student loan handout.

Maybe Biden should be demanding refunds from the academic elite instead of forcing everyone to foot the bill for overpriced education of little value. Biden is saving Medicare by negotiating bloated drug prices. But the intellectuals sequestered in their ivy towers simply can't handle accountability so throw more public money at them.

$500 billion? Never has so much money been spent in such a short amount of time to accomplish something so unimportant. Biden ain't Trump; that's for sure. We could have built ten walls along the southern border for what Biden has wasted to improve his polling numbers.

Let's try some GOP logic.

PPP was only .019% of the national debt, about $43,000 per household which is uncollectable.

Prior to WWII debts were negligible.

After Reagan debt was normalized and just kept climbing.

I don't know where the $500billion price tag is coming but if it were accurate,

it adds .0162% to the national debt.

,

The CBO recently revised it's cost estimate to $240Billion spread out over ten years. (.00078%)

Penn Wharton Budget Analysis puts it at $300Billion to $330Billion total. (.00975%)

.

If it passes, survives law suits etc.. it most likely won't survive a GOP POTUS for more than his first day in office.

More than likely a federal judge will freeze this while it is challenged,

poor tuition strapped students, graduates and non graduates will continue to grind it out

or like over 20%, default on the loans, declare bankruptcy and start over.

That's a restraint on the economy and not a contribution.

Out of every $1trillion dollars in student loans $208Billion goes uncollected anyway.

So you are obviously OK with Biden's severe power over reach?

So much for Congress "Power of the purse".

Which means you will be OK if the next Republican president decides to give small businesses carrying debt $10,000?

Biden's plan doesn't provide for those of us that have repaid our college loans already. It doesn't provide for parents that saved for their children college tuition. It doesn't provide for those that chose to attend trade schools or got apprenticeships.

It is all justifiable for a PotUS that has abysmal approval numbers to try and buy votes both for himself and Democrats at midterms.

What this comes down to is that those of us that were responsible will have to pay for those that aren't. Might as well just have left it the way it was. That way defaulters credit ratings and ability to get future loans would at least be affected. But I suppose most will pocket the $10000 Biden give away; and default anyways- so we will get to pay on both ends.

So, I take from your statement that you did not read mine.

I agree, when Trump threw $511 Billion at the COVID economy, he had the blessing of Congress.

It was already done and then some, with a ton of fraud, but Congress approved.

Boo Hoo?

Was PPP fair to everyone who emptied their savings or got traditional Small Business loans?

Partisan whining.

Do you only pay property tax while your kids are in school or does everyone share the burden?

And the economy continues to drag along.

It isn't a cash gift. It isn't transferable or legal tender. It's debt forgiveness for $10,000 which the IRS may or may not likely interpret as income.

20.1% of them default annually, this might help a lot.

Like I said over and over, it will be challenged in court and may never go through, why waste the energy and angst over it?

Then Biden is a liar, because he said no one making less than 400k was going to pay a dime more in taxes.

Boo Hoo?

Is PPP the topic?

It's debt forgiveness for $10,000 which the IRS may or may not likely interpret as income.

If the IRS insists that the forgiveness is taxable as they do in the cases of disabled people obtaining loan forgiveness, then it's a quid pro quo.

No one will be forced to accept the loan forgiveness (if it ever materializes) unless they understand the pros and cons which will vary from household to household. Some will pay the higher income tax one year to save $250.00 a month for several years. Others still won't be able to afford it I imagine.

Apparently the objection to certain government "give aways" was the topic.

So it wasn't just Trump, unlike the college loan deal--that is ALL Biden. He doesn't need no stinking Congress to give away money!

Shitty oversight by Congress isn't anything new. Look at decades of Medicare waste as a prime example.

Do you only pay sales tax when you buy stuff, or does everyone share the burden?

Oh, God, alert the President and his handlers.

Not really, it is still a debt that doesn't get paid.

Well, damn, if only Biden had listened to Nancy, he wouldn't have wasted his time and created any angst.

Either people will be taxed or not. Biden said no, they wouldn't. If they are, he is a proven liar.

Please post a link to the article you read to get that, because the one I read and am posting under is all about student loan forgiveness. Yours might be an interesting read.

Again, FDR created the WPA by executive order to save families and the economy.

Does that makes any sense to you?

Again? WTF? Have I EVER ONCE argued differently???

I am talking about the student loan forgiveness disaster hatched by Democrats and implemented by Biden.

At LEAST as much sense as to what that line responded TO.

After Congress authorized it.

And funded it.

Biden said that in 2021 specifically about the American Family Plan and the American Jobs Act.

It's disingenuous at best to suggest that he meant no one would ever be taxed again.

I pay taxes on just about every thing I choose to voluntarily purchase or subscribe to.

Cable, phone, internet etc.

Okay, I guess "This won't cost you any extra taxes for this plan" and "I'm going to raise your taxes with this other plan" makes sense and is perfectly acceptable to some folks.

But not nearly as disingenuous as suggesting I stated something I didn't. Whatever.

That is fantastic, you are just like millions and millions and millions of other taxpaying citizens. Congrats.

Penn Wharton has the cost approaching 1 trillion.

. Its an assault on the separation of powers, does nothing to solve the underlying problem, and encourages reckless behavior from universities and borrowers alike going forward.

Imagine if Trump unliterally, and illegally, gave a trillion dollars to a group of voters he needed to turn out before an election. He would be impeached, and rightfully so. Maybe Trump will promise to forgive mortgages in battleground states. That's the world Democrats want.

A link would be nice. But I found this at Fox.

After railing that the program will favor the rich? Did the Fox author write this with a straight face?

Ok, still in the $300B-$330B range...but there's no way income limits are being scrapped.

No one suggested Biden would forgive 50K. Might as well suggest that

Biden Should include a free ride to the moon on the next moon launch

which is also unrealistic.

l ink would be nic e.

Maybe no one truly sane, BUT..............

AOC Has Student Loan Debt—What Are Her Views on Forgiveness? (marketrealist.com)

Wow, just two weeks ago the WH said the cost was $330 billion, now it's $605 billion +. The sky's the limit.

I question 2 things.

Why would you in particular conflate what the WH says to what a third party says?

That's an unforced error.

As of 08/26 the WH is still at $240 billion over 10 years.

Press Briefing by Press Secretary Karine Jean-Pierre and Deputy Director of the National Economic Council Bharat Ramamurti, August 26, 2022 - The White House

Penn Wharton is at $300 billion, if not $330B or $519B or $605B maybe even $980B

depending.

Were you distracted?

Another question, If Grants are gifts why due Pell Grants need to be repaid?

They appear to be misnamed.

They don’t.

The extra 10k assumes folks who qualify for Pell Grants, lower income families, could use more help paying off their LOANS. Pell Grants DO NOT have to be paid back.

Why would you claim that when you've already been provided a link from Penn Wharton proving otherwise. Did you not understand it?

Apparently it's like all tissues are Kleenex to some folks.

This is apparently incorrect.

The last sentence makes no sense.

All it proves is that that there are two links above with basically the same but not identical information.

Absolutely. Here is the source of the FOX link.

What sentence is that? My post explains this one:

It doesn’t say the 20k is being used to pay off Pell Grants.

Your original link was outdated. The August 26th report is the current estimate.

Yes the Fox article and the original report were from 08/23/2022

and still available online and not at all substantially different from the 08/26/2022 report.

Both included the "what if" scenarios resulting in 519, 605 and 980 in the data tables.

Since both are still available online maybe you should call Penn Wharton

and ask them to take down the earlier report and data if you find it confusing.

e online and not at all substantially different from the 08/26/2022 report

Lol. Even Enron accountants would classify a hundreds of millions dollars difference as "substantial" Did you think that through before claiming that in public?

I'm curious why are you clinging to an analysis that was created before the plan was even announced and ignoring the updated model that accounts for actual announced provisions?

One might think you have a partisan agenda. . I can't think of a single honest reason to use data from an outdated analysis based on inaccurate inputs when an updated version is available, but I'm sure you have one. Why would you want to be accurate, right?

No error, obviously these two entities have different costing models and/or assumptions.

Yes depending as details on loan forbearance and income-based repayment rules emerge.

I think that the plan allows for up to $20,000 in loan forgiveness if the borrower had received a Pell Grant and $10,000 if they didn't have a Pell Grant.

Then you are beyond help or just arguing for arguments sake.

The actual article was 08/23/2022, hence the web link still active on the internet and the source of the FOX article which was updated on the 24th and 25th.

You asked where the 300 & 330 figures came from.

I provided that link.

PWBM seems comfortable joining CBO and Boeing doubling or tripling

it's own estimate within 72 hours while leaving the original data online.

Your Penn Wharton link has a summary that says

$519 Billion if future students are included

(I cannot imagine why on earth "future students" would be included, that's mind boggling)

up to $605 Billion IF future IDR program rules are changed

and the nebulous conclusion.

and the whole model could be off by 50%...

but thanks for the link.

After this president, wouldn't it be mind boggling that any Dem could run for President without the same offer?

Why wouldn't they? Granted, there's no rhyme or reason to this other than an approaching mid term, but if old students deserve a debt forgiveness, why don't current students? There's no rational basis for limiting the waiver to current debt and forcing tomorrow's students to pay their full balance.

It's not like Biden's illegal order has done anything to address the underlying problem.

and the nebulous conclusion

Because the plan is nebulous.

A: Why restrict it to a Dem POTUS?

B: The WPA was a necessary economic band aid from 1936 through 1943 which changed our infrastructure but was never repeated. It served it's purpose improving our national transportation while giving millions a purpose.

Never repeated on that scale.

Good point, both Parties now like to hand out free chicken before an election.

What would be the argument not to repeat, do you think that universities will now lower tuition?

My point was that it was an Executive order to help a class of people, to help the economy.

Current students with outstanding loans are apparently covered;

I do not understand your confusion between the definitions "current" and "future".

I do not understand your confusion at a pretty straightforward question. What's the rationale for denying it to future students? Explain how that's fair.

It seems pretty straight forward.

Fairness isn't an issue in life.

Timing is.

If you buy a new home now and the interest rates drop next year, that's too bad,

you aren't entitled to a lower rate automatically.

If you bought a car last year with a large rebate or tax credit, that's great, but today's

customer won't get the same deal, that's life. No politics involved.

So you believe the government should be deliberately unfair? because life isn't fair, the government shouldn't even try to be fair either?

But interest rates are variable and people who buy a house know that. Loans are not.

It's like forgiving loans for peoples born only on the 7th and 10th of a month. There's no rational basis for making the rule.

. No politics involved.

Buddy, if you don't believe politics are involved in this....

I can't imagine that future student debt forgiveness won't be espoused by any Dem running for President and it will be in the Party plank. Future debt will increase as their are no brakes imposed on tuition increases.

I don't know if it has to be just student debt forgiveness. Now that the standard has been applies (assuming it does go thru) what is to stop any future president from any party from giving away some sort of "debt forgiveness" on just about anything to any group they desire, provided they are the party in the majority.

Exactly, hopefully, a future President will forgive our National Debt.

Only 100?

WTF over .....

Does Biden even possess the power to do this?

Seems unlikely.

And raising taxes to PAY for this massive vote buying scheme?

So some of us get double screwed under Biden's "plan".

Good thinking there, Joe.

I wonder how many are cheering for the rest of us to get screwed over?