Fury as Biden tries to let IRS SNOOP on your bank accounts

By: Morgan Phillips, Politics Reporter For Dailymail.Com 22 hrs ago (MSN)

Strange times.

© Provided by Daily Mail MailOnline logo

One key prong of President Biden's plan to bankroll Democrats' $3.5 trillion budget plan is to monitor every inflow and outflow of an individual's bank account.

The Biden administration says such surveillance would target audits and prevent tax evasion, but some are concerned that it might run up against the Fourth Amendment and those who can't afford to fight tax audits or move their money into offshore accounts.

The proposal would require banks to report to the IRS every deposit and withdrawal from an account, including transactions from Venmo, PayPal, crypto exchanges and the like in an effort to fight tax evasion. The IRS would know how much money is in an individual's bank account in a given year, whether the individual earned income on that account and exactly how much was going in an and out.

Biden, Treasury Secretary Janet Yellen, IRS chief Charles Rettig and a number of Democrats in the Senate, most especially Elizabeth Warren, are pushing for the deep dive into individual financial transactions as part of an $80 billion plan to enforce tax compliance.

Patrick Hedger, vice president of policy at the Taxpayers' Protection Alliance, warned that such a proposal could violate the Fourth Amendment, which protects citizens from search and seizure without probably cause.

'The IRS is first and foremost, a law enforcement agency, and the Fourth Amendment protects against unreasonable searches and seizures in pursuit of, of looking for wrongdoing and criminal actions, so I think this is going to run into severe Fourth Amendment headwinds,' Hedger told DailyMail.com.

Other parts of the plan include setting up a global minimum corporate tax rate of 15% and a system that prevents multinational companies from registering profits in the lowest-tax jurisdictions and raising taxes on the rich.

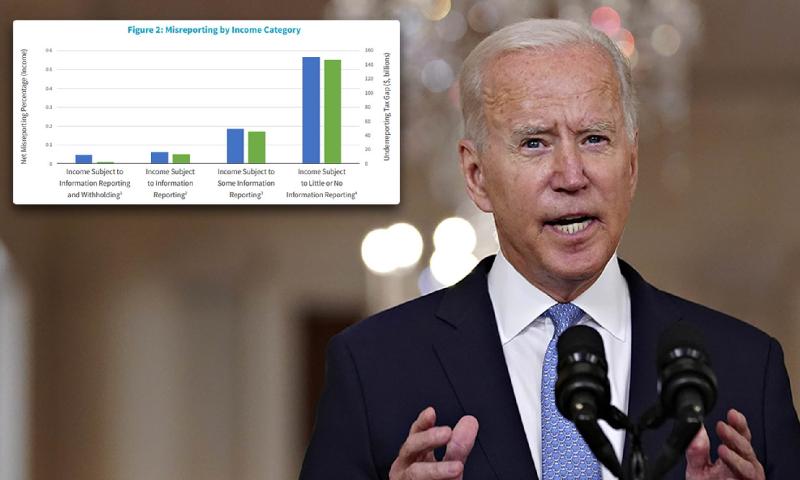

A Treasury Department report from May claimed that the tax gap totaled nearly $600 billion in 2019 and would rise to $700 trillion over the next decade if left unchecked, roughly 15% of taxes owed.

The IRS estimates that compliance on taxes due on wages is 99% while compliance on 'less visible' sources of income is only 45%.

© Provided by Daily Mail ( © Provided by Daily Mail (

The Treasury Department claimed that the plan would have little effect on 'already compliant' taxpayers, but would help the IRS better target its audits.

'For noncompliant taxpayers, this regime would encourage voluntary compliance as evaders realize that the risk of evasion being detected has risen noticeably,' the Treasury Department said.

But Hedger said the policy would disproportionately hurt the poor.

'You're going to push more folks into small cash transactions, you're going to push more banking offshore ... the big fish out there that do have sizable assets that are that are eligible for taxation offshore.'

'This is the ultimate regressive tax,' Hedger said.

'You're going to end up punishing the worst off among us ... the lower income folks in this country have historically been the targets of aggressive IRS audits because they don't have the CPAs and the lawyers to be able to fight back.'

' I don't see why they need to be going after people, you know, just the average, the average Joe and start stooping on, you know, a $600 payment,' Hedger continued.

'It doesn't make any sense, these, this is, I mean this is beyond trying to pick out low hanging fruit.'

This crackdown on unreported income is expected to generate $460 billion over the next decade, according to the Office of Tax Analysis.

Banks are largely against the proposal, which they say would impose onerous reporting requirements on institutions for little benefit.

In a letter to the Senate Subcommittee on Finance, the American Bankers Association, the Bank Policy Institute, the Consumer Bankers Association and others argued that the 'new reporting requirements for financial institutions would impose cost and complexity that are not justified by the potential, and highly uncertain, benefits.'

The trade groups also called the reporting requirements 'subjective.'

'We believe additional reporting requirements guided by subjective criteria have privacy and fairness implications and the potential to put financial institutions in an untenable position with their account holders.'

They instead suggested greater funding for audits.

But IRS chief Rettig, a Trump-era holdover, is in favor of the proposal, along with the increased IRS funding that would come with it.

'Every measure that is important to effective tax administration has suffered tremendously,' Rettig wrote in a letter to Warren last week.

'The new data will provide the IRS with a lens into otherwise opaque sources of income with historically lower levels of reporting accuracy.'

Steven Rosenthal, senior fellow at the Urban-Brookings Tax Policy Institute also said the proposal would not be worth the trouble.

'In practice, the IRS' task would be daunting and, in fact, bury the agency in a sea of unproductive information,' he said.

'Most individuals earn all of their income from wages and investment returns, which already are reported to the IRS. And larger businesses often are audited by public accounting firms. While those businesses have many ways to reduce their taxes, omitting income rarely is one of them. Why drag these individuals and businesses into the new program?'

Former Treasury Secretaries Tim Geithner, Jacob Lew, Henry Paulson Jr., Robert Rubin and Lawrence Summers also defended the Biden proposal in a New York Times op-ed. Only Paulson served under a Republican.

'Relying on financial institutions to relay some basic information about account holders is a sensible way forward,' they wrote. 'With better information for the I.R.S., voluntary compliance will rise through deterrence as potential tax evaders realize there is a risk to evasion.'

Read moreContinue ReadingShow full articles without "Continue Reading" button for {0} hours. Microsoft and partners may be compensated if you purchase something through recommended links in this article.

Surprise!!!

Feeling any remorse yet? The handlers and puppeteers are driving this bus.

'...Biden tries to let IRS SNOOP on your bank accounts.'IRS snooping is purely a partisan activity? Perhaps you'd be interested in buying this bridge I own ...

Gold is starting to look like a better and better investment.

A hedge against the Democrat's stupid inflation exploding two porkulus "infrastructure" bills.

Also to ensure the IRS knows less about my investments and what my money is doing. Why bother with savings accounts that are being tracked? Big Brother Federal Government thinks the money is really theirs; you are just borrowing it.

War is peace, freedom is slavery, ignorance is strength ..... lets party like it's 1984 ......

Another version of 'If you have nothing to hide you shouldn't object to a search of the car'.

Glut an agency with a history the IRS has, with petabytes of data. Yeah what could possibly go wrong? /s

[deleted]

Yup, set a flat tax, gut it and be done with it.

How about the IRS, a.k.a. Income Removal Service, starts at the top with Biden and Harris and works their way down through Congress!

When criminals cheat the taxman we all pay for it.

Should our government use technology to collect?

You can be sure Biden would be criticized for not...

One element here will always blame our President.

What about when the criminals are the taxmen?

I have always assumed that the IRS would look at all my bank accounts if they wanted to investigate me. If you think the IRS won't look at your bank accounts you're a fool.

So, you like Big Brother ..... Big Brother can kiss my ass.

That will never change and i'm far from alone on that sentiment.

Never said I liked it. Just being real.

Some banks offer free checking. I'm betting the number that do gets lower, and the ones that are already charging a fee increase it.

This will get more burdensome too. As noted, the employment earnings are already reported, so people will continue to deposit their checks. Who are we going after, if we are wanting to see $600 deposits? Those pesky bastards holding garage sales, or using a local shop&swap to sell items? Those people are likely experiencing a loss. Are we now required to report sales resulting in a personal loss? The bank is going to report it, and I would imagine the IRS will audit people for not reporting. Fuck. Better keep a strict accounting of your garage sale, so you can prove that the $750.00 is a personal loss, and not actually a capital gain.

Just deposit the $750.00 in chunks of less than $600.00. Well, we can't have that, so the banks will soon be required to monitor your account over any given 30 day period, and report on that. I'm sure every dollar matters, but I think this is going too far.

Wonder where Joe got the idea about using the IRS to spy on folks, hhhhmmmmmm?

The partisan overtones of the Obama administration IRS scandal meant the major media would never take it seriously. To them it was little more than conservative hype designed to embarrass the president and distract from pressing business at hand.

The Republicans in Congress who led the investigation couldn't make anything stick either. Not that they didn't try, but without the daily pressure of CNN and the New York Times repeating the allegation that Obama administration officials had used the IRS for political purposes to muzzle the tea party movement by denying organizations that sprung from it tax-exempt status, it ended up a big yawn, with just about everyone losing interest after Donald Trump was elected president.

The truth, though, matters. And if the former IRS official at the center of the controversy, Lois Lerner, gets her way, we may never know just what that is. According to a report appearing in Tuesday's Washington Times , Lerner and her former deputy, a woman named Holly Paz, have asked a federal judge to seal "in perpetuity" tapes and depositions they gave in a court case earlier this year arising from complaints made against the agency for which they both once worked.

The controversy began in 2013 when an IRS official admitted the agency had been aggressively scrutinizing groups with names such as "Tea Party" and "Patriots." It later emerged that liberal groups had been targeted, too, although in smaller numbers.

The IRS stepped up its scrutiny around 2010, as applications for tax-exempt status surged. Tea Party groups were organizing, and court decisions had eased the rules for tax-exempt groups to participate in politics.

Groups sought tax-exempt status as 501(c)(3) charities, where the organization and its donors get tax write-offs, and 501(c)(4) "social welfare" organizations, where donors' contributions are not tax deductible.

After the IRS confession in 2013, its top echelons were quickly cleaned out. Conservative groups sued. Congressional Republicans launched what became years of hearings, amid allegations the Obama White House had ordered the targeting.

The Internal Revenue Service, according to outraged Republicans and many media accounts at the time, targeted tea party organizations and other conservative nonprofit groups that were seeking tax-exempt status between 2010 and 2012. Critics said the tax agency had subjected the targeted groups to extra scrutiny, questioning and long delays, largely because their names suggested they would be political opponents of the Obama administration and the Democratic Party.

The allegations formed one of the best-known scandals of former president Barack Obama's administration and led to months of congressional hearings, official investigations and damning news coverage.

A report released Thursday by the Treasury Department's inspector general for tax matters indicates that the IRS also singled out nearly 150 organizations whose names suggested they were affiliated with liberal organizations. Without specifically characterizing the politics of the groups, the report said the IRS initiated reviews when applicants' names included words such as "occupy," "progressive" and "green energy" between 2004 and 2013.

The same Treasury watchdog had said in 2013 that the IRS reviewed about 250 conservative-sounding groups, with names that included words such as "tea party" or "patriot." That report fueled the scandal narrative: "This was a targeting of the president's political enemies, effectively, and lies about it during the election year so that it wasn't discovered until afterwards," Rep. Darrell Issa (R-Calif.), the chairman of the House oversight committee, said at the height of the controversy in 2013.

Richard Nixon.

a pile of ashes under some spit in hell...

Richard Nixon

Try FDR

... and prescott bush and many others deserved hemp neckties.

Nixon is much more recent, keep swinging you're bound to hit something sooner or later.

yes, yes we all know Prescott Bush and Queen of England colluded with Hitler to bring down the twin towers. Save your conspiracy mongering for your monthly meetings in the treehouse.

I know you need to keeps things simple, Kavika. But I prefer accuracy. FDR was the first President to wield the IRS against political enemies. Sorry if that's too much for you to handle.

... that were financing the nazi war machine, and needed bullets in the brain instead of an audit.

The question wasn't about who was first, try to keep up, Sean.

Actually, the Wilson administration was the first to use it.

Keep swinging.

As soon as Prescott Bush comes up, you know the crazy isn't far behind. Sure , Prescott Bush and his partner Averill Harriman, FDR's ambassador to Stalin, were crypto Nazis. Whatever.

Not that this has anything to do with FDR wielding the IRS as a political weapon.

Okay. Who did the IRS inappropriately target under Woodrow Wilson?

My mistake it wasn't Wilson but the Coolidge administration and it was Senator Couzens.

Yes. Looking for Nazi money.

Seems to me that if the IRS is already as understaffed as we’re told then this would be an unrealistic increase in their workload.

Only if you listen to the Biden administration. Democrats love weaponizing the IRS, so there will never be enough agents. They are doing a hiring surge- big surprise./S

Hasn't slowed down their auditing by their own admission.

Don't worry, the next time Republicans control the White and Congress they will cut the IRS back down to a more manageable size; and temporarily diminish the Democrat's toy.

They are understaffed for the current conditions. They’re not going to bulk up staff and double their workload at the same time.

They also proposed an additional $80 billion to handle that.

Anyone who has unreported income will just not put it in the bank except for those using a pay service like Paypal. Guess the Ebay sellers would be screwed unless the funds can go to a bank card or something. I have never used it myself.

I don't see who is his targets are.

This is a criminally insane proposal. Gold and silver in a safety deposit box looks better every day since the idiot became President.

A lot of people suddenly want their privacy to be respected. Imagine that.

What’s there to imagine about that. The regime has no need to know what’s in my checking, savings, or brokerage accounts, or money markets and CD’s.

But anybody helping a Texan woman by paying for her abortion doesn't have the same privacy rights. Their checking accounts are apparently open books.

That's a ridiculous assertion.

I can take cash out of my accounts and spend it on anything i want. Unless the IRS has me on 24 hour surveillance, they have no idea what i spend it on if i don't want them to.

As it should be ......

Sorry you choose not to understand. The rights of financial and medical privacy either apply to all, or none. Some people only get pissed when their own privacy is invaded. Those people are hypocrites.

I understand it perfectly. You're the one who's confused.

Unless you are a complete idiot, no one needs to know if you choose to help pay for an abortion. No one, no where in this country.

Feel free to prove me wrong with facts and i'll gladly retract my comment.

So, you're opposed to the new Texas law? Great. You might want to explain to some of your pals the hypocrisy of not wanting one's own privacy breached, while encouraging breaching the privacy of others. Because many of the same folks who are outraged about this have asserted elsewhere that privacy rights aren't really a thing. Not when it's someone else's privacy, anyway.

Can the Texas law, stop you from taking your private money and paying for an abortion if you so choose?

You can be sued for doing so, if you're paying for someone else's abortion. You can also be sued for transporting a woman to an abortion clinic.

Texas is encouraging spying on its citizens. They are encouraging breach of privacy.

So, your daughter gets an abortion in Texas. She needs help paying for it, and you give her some cash, or maybe even accompany her to the clinic, and pay for her abortion.

A private citizen unrelated to your daughter, you, or your daughter's sexual partner suspects what's happening, and decides to cash in by suing you, as is allowed under Texaa, if your daughter is further along than 6 weeks.

There will be subpoenas. One of those will involve your bank account. You withdrew cash 2 says before the appointment, in the amount of the balance due for the abortion.

Your daughter's medical privacy will have been breached. You will have no right to maintain your financial privacy. The person or group using you has been watching your comings and goings. Is your privacy being protected? Nope. Does that only bother you when it's the IRS, rather than somebody looking to cash in on your daughter's misfortune? If so, why?

You can be sued for almost anything these days. No new laws need to be passed for that to remain true.

And anyone with a modicum of intelligence could get away with paying for an abortion if they were so motivated. To allude that they couldn't is just disingenuous.

I haven't read all the language of the entire law but i highly doubt that. That said it really wouldn't surprise me if they were. After all many of you applauded the last time that happened to the entire country.

The Patriot Act.

Those on the right here seem to be afraid of the IRS. I wonder why?

remember when GOPers were all about the patriot act? "if you have nothing to hide, you have nothing to worry about" bwah ha ha ha ha...

I do remember that. Could they maybe be hiding something? Aren't they the law and order party? Something doesn't make sense here.

Have you forgotten how the obama regime weaponized them against the TEA Party? We have not.

As someone who is a CPA and defended people against the IRS, I can tell you that for over since 1970, as part of the Bank Secrecy Act, banks had to report to the IRS any transaction over $10K, but the current loophole is Venmo, PayPal, crypto exchanges, which should be treated no differently than a bank exchange. I would need to know more about this proposal before freaking out.

Which is what this bill is all about including cash payments under that $10k. Like you I really don't know enough to make a fair opinion. It would be one thing to close loopholes on people gaming the system getting paid by Venmo, quite another to flag the checks my in-laws give me every month to pay for their cells phones on my plan. I've purchase aquarium plants quite often from other hobbyists at $20 or $40 a bunch via Paypal and Venmo. Will these now be flagged and taxed? Most of those people would throw them away vs the hassle of having to report, leaving people like me to pay commercial growers more. I have questions...

I guess he figured they got away with it under Obama why not do it now.

Some individuals and organizations need their financials monitored. Follow the money.