A Value Investor's Analysis of Student Loan Forgiveness

By: Vitaliy Katsenelson

I'm always interested in the thoughts, opinions and views of immigrants who have come to America from countries where there are few of the freedoms we have come to take for granted here. They tend to have fresh eyes when it comes to viewing this country as truly a land of opportunity. I have read several of Vitaliy's articles and I like the way he thinks. He is thoughtful, rational and open-minded. In this article he had me at:

"What is the point of living in a free country if you are afraid to voice your opinion? Actually, in this case it is not even an opinion, but analysis with investment consequences.

I made a deliberate decision not to belong to a political party. I don’t want to outsource my thinking to a collective. I am innately leery of group think – a useful trait in my day job as an investor."

Enjoy and comment, and please behave.

Individual impact aside, Biden's student loan forgiveness will also affect the US currency and economy. Here's how we see it as value investors.

Vitaliy Katsenelson Sep 1, 2022 1 Share this post Copy link Twitter Facebook Email

Vitaliy Katsenelson Sep 1, 2022 1 Share this post Copy link Twitter Facebook Email

You can listen to a professional narration of this article below:

1 0:00 -11:34 Audio playback is not supported on your browser. Please upgrade.

Some of my colleagues at IMA advised me not to publish the essay you are about to read. They thought it would put me in the middle of political tribal warfare and I'd just frustrate a large group of my readers with it.

However, last December I penned an essay reminiscing about spending 30 years in America. I wrote: Tribalism in the US has become so strong that it has started to impact our freedom of speech. No, the government is not going to send you to the gulag for your political thoughts. We do it to ourselves by canceling each other… How many of us now find ourselves afraid of being cancelled, or just don't want to get into mindless, vitriolic debates with tribal drones (people who just repeat the talking points of their tribes). The more we self-censor, the less free we become.

Despite my colleagues' insistence, I decided that I am not going to self-sensor. Some readers may decide to stop reading my essays - well, they're welcome to do that.

What is the point of living in a free country if you are afraid to voice your opinion? Actually, in this case it is not even an opinion, but analysis with investment consequences.

I made a deliberate decision not to belong to a political party. I don't want to outsource my thinking to a collective. I am innately leery of group think - a useful trait in my day job as an investor.

The Slippery Slope of Student Loan Forgiveness

My wife Rachel and I had our son Jonah in 2001. I was 28 and she was 23. Rachel quit her job and became a stay-at-home mom and part-time student at CU Denver, where she was finishing her bachelor's degree.

Both Rachel and I immigrated to the US ten years earlier, from the USSR. Now, I had a master's degree in finance and a CFA license but was just a few years into my career as an analyst. I was working for a small investment firm, IMA, making $40,000 a year. As soon as Jonah was born, we opened a custodial educational account and started saving $2,000 a year for Jonah's future education.

This $2,000 in 2001 was an enormous amount of money for us; it was around 7% of my after-tax income. We had a very modest lifestyle. We were still paying off our college debt. This education money could have let us afford to eat out, enjoy a daily trip to Starbucks, or take another vacation or two. We bought used cars, drove them for decades. We made a budget and lived by it (I wrote about it here). We felt it was our responsibility as parents to make sure that our son went to college and was not burdened by college debt. The value of education had been drummed into our heads by our parents. We wanted to give Jonah every advantage he could get in this country.

We opened similar education accounts for our daughters Hannah and Mia Sarah when they were born in 2005 and 2014. Though my income was growing as my career advanced, funding these accounts was always an effort. We needed more bedrooms - we bought a house. Also, when storks bring babies, what follows are unending new expenses: diapers, daycares, after-school activities, and the kids keep growing, so they constantly need new clothes.

As I look back at those years, though they were often trying, they were some of the happiest of our lives. This is the behavior I'd want my kids to replicate: Live within your means. Don't get into credit card debt; pay off debts quickly. Save for a rainy day. Create a budget - which is basically categorizing and mindfully allocating your spending to things that are important to you. But making sure you take care of your kids' education is at the top of the list. In advice to my kids, I'd throw in some Stoic wisdom, in that happiness comes from wanting what you have. Once your basic needs are taken care of, material things bring little happiness.

And then…

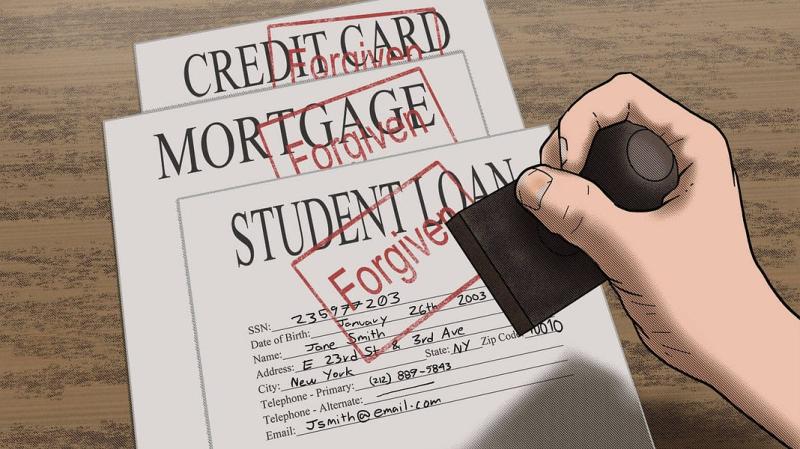

President Biden, with an executive order (a decision that did not go through Congress) "forgave" $10,000+ of many students' loans. Aside from the fact that every member of my household, including my 8-year-old daughter Mia Sarah, is now on the hook for about $1,000 for this "forgiveness", it felt like what Rachel and I were trying to teach our kids is now thrown out the window.

As I promised you, this is not a political essay, so here's the analysis part.

This loan forgiveness is a very dangerous, slippery slope. Some will argue it started with Uncle Sam bailing out the big banks during the Great Financial Crisis. That is debatable, and there are a few important differences: The government did not "forgive" the banks or give them money but provided high-interest loans. Uncle Sam came out ahead in the end. Arguably, if the US had not bailed out its financial institutions, our whole economy would have crumbled. However, I am aware these nuances are somewhat lost, as the public looks at the government's actions as a bailout. This sets a dangerous precedent. Yes, the government came out ahead, but it could have lost money.

Then, during the pandemic, the government opened the door wide-open by throwing trillions of dollars at anyone and anything with a bank account with a multi-trillion-dollar PPP shower. Arguably, this was necessary in the face of a global emergency, though the magnitude and follow-up stimulus are open to debate. Although this time around the government wanted to make sure that everyone got the money (not just the fat cats on Wall Street), due to its ineptitude a lot of this money was misappropriated. Some were showered with more PPP money than others.

Now today, anyone who went to college, has student loan debt, and makes less than $250,000 a year (per couple) receives "forgiveness" from Uncle Sam and my daughter Mia Sarah.

This executive order doesn't even attempt to fix the core issue of runaway inflation in college tuition. In fact, it will likely make tuition inflation even worse by throwing more taxpayer money at colleges and lead to endless "forgiveness" in the future.

But what about the plumber or truck driver who never went to college and thus has no college debt to forgive? This where the slippery slope turns into a giant landslide. They are next. As interest rates go up, people go upside down on their houses and mortgage interest cripples them. No worries, Uncle Sam and Mia Sarah will come to the rescue; they'll forgive those loans. But what if you are not lucky enough to own a house but have a mountain of credit card debt? Don't worry, you'll be absolved of those sins, too - you won't be left behind.

In the meantime, people who are like Rachel and I were 20 years ago, folks who give up vacations, new cars, Starbucks frappuccinos and Chipotle burritos to save for their offsprings' education are incentivized to do the opposite. Why bother?

Making choices as to what college to attend, selecting a major, and deciding how much debt to take on falls into the personal responsibility bucket, too. When the government decides to forgive student loans (and then, maybe, mortgages and credit card debt), that is a plain-vanilla wealth transfer to those absolved from their debt (their past choices) from the rest of the society, who made painful, responsible choices, and from future generations (the Mia Sarahs and those who are yet to be born).

The US has earned the right for its dollar to be a world reserve currency. It was earned because we had the strongest free market economy. There is a very good reason why most innovation doesn't take place in Europe but in the US. We are the country where people want to take risks, enjoy the fruits of their successes, and pay the price of their failures. A free market economy cannot exist without failure, just like heaven cannot exist without hell.

The reason companies fail, and empires collapse is simple - they become arrogant. They forget that their success was earned by sweat and paranoia. They start taking it for granted. They become fat, lazy, and happy. Just like companies and empires, the US is not absolved from the laws of economics.

As our government adds more debt and probably raises taxes, inflation will not be transitory but will become a nightmare of everyday life, and our economy will weaken. With every "forgiveness," the US dollar will become a less attractive currency, as it will buy fewer and fewer goods. It will be less differentiated from the currencies of other troubled countries.

As an investor who is hired to preserve and grow my clients' nest eggs, I'm finding, unfortunately, that diversifying away from the US dollar is becoming a responsible thing to do.

Van Cliburn

I have known about Van Cliburn was since I was very little. He was about the only American that (Soviet) Russians did not hate but admired (maybe the only other one I can think of off the top of my head is Louis Armstrong). Van Cliburn won the first International Tchaikovsky Competition. It was 1958. The Soviets had just kicked American … sorry … by putting Sputnik into space. To celebrate and demonstrate their cultural superiority, the Soviets started the International Tchaikovsky Competition - a Russian version of the Olympics Games, but for the performance of classical music.

A young American from Louisiana, Harvey Lavan "Van" Cliburn performed parts from Tchaikovsky's Piano Concerto No. 1 and Rachmaninoff's Piano Concerto No. 2. He was an American, in Moscow at the height of the Cold War, performing incredibly difficult concertos by two Russian composers; and he did it so well that the Russians in the audience stood and applauded him for eight minutes! Remember, those were the Russians that were brainwashed to hate "evil, imperialistic" Americans (my grandparents, my parents, and even I, for part of my life, belonged to that group of brainwashed people).

Political tensions were so high at the time that before the judges could award Van Cliburn the gold medal, they had to check with Soviet Premier Nikita Khrushchev. "Is he the best?" Khrushchev is said to have asked; "then give him the prize!" There is something very pure and uplifting about this story - how the power of music trumps hate. Hollywood should should get going on a movie.

Sadly, Van Cliburn passed away on February 27th 2013 (read his obit in the Wash Post). Just last month my kids and I were listening to Van Cliburn playing Rachmaninoff's Concerto No. 2 in the car, and I was telling them his story. Today I want to share with you Van Cliburn performing the Rachmaninoff Piano Concerto No. 3, in 1958.

Click here to listen.

Thanks for reading Vitaliy Katsenelson's ContrarianEdge! Subscribe for free to receive new posts and support my work.

Subscribe

Vitaliy Katsenelson is the CEO at IMA, a value investing firm in Denver. He has written two books on investing, which were published by John Wiley & Sons and have been translated into eight languages. Soul in the Game: The Art of a Meaningful Life (Harriman House, 2022) is his first non-investing book. You can get unpublished bonus chapters by forwarding your purchase receipt to bonus@soulinthegame.net.

Please read the following important disclosure here.

Share this post Copy link Twitter Facebook Email

Tags

Who is online

46 visitors

I think this is a good read and good topic for discussion. Please keep comments civil and rational. Thanks!

Very good article, thanks. There is little discussion on the root of the problem, decades of outrageous tuition inflation.

the root cause also has to include a change in 1996 that made education loans non dischargeable in bankruptcy.

Hence, complicated by the privatization of Sallie Mae and the switch to compound interest by the remaining lenders who are just wolves in sheepskins.

Allowing bankruptcy and limiting compound interest would fix things going forward but

does nothing for the 45 million people stuck since 1996 with these financial anchors

and we have had some really bad recessions not to mention Covid during the last 20 years.

Who is making stuff up Tessy?

Loan forgiveness is both irresponsible and irrational. The smarter approach would be to provide legislation that makes it easier for kids with proven attitude and aptitude to get more help securing higher education. Retroactive 'grants' like this should never be taken. It is always best to make the rule first and then execute the rule.

That said, I am not a fan of any government program because I have very little faith that our government has the means and will to ensure money goes to the intended parties and that the money is used effectively (as opposed to being wasted).

Thus, in general, I am in favor of the government spending its time trying to make existing funding more effective and not pass any new spending legislation. At least until they demonstrate that they are responsible stewards for our tax dollars (and the borrowed tax dollars from our great-grandchildren).

Indeed. My daughter graduated from Cal Poly in 2020 and was the only one of our kids to actually qualify via the FAFSA for Federal Student Loans. They were a combination of a lower rate unsubsidized Stafford Loan and then a much larger Parent Plus Loan with a higher rate. Due to Covid forbearance she/we were never required to make any payments after she graduated, and from the start of the forbearance no interest accrued. She got a couple great jobs, including her current job at a big law firm in San Diego, and before the forbearance even ended (still hasn't ended actually) she/we had the loans paid off.

A month or two after we had them paid off came the news that the Biden administration was likely to move forward with some sort of order regarding student loan forgiveness. My daughter calls me and says, "Shit Dad we could have had a good chunk of my loans paid by the Government like some of my professors had talked about". And I asked her, "Why should taxpayers who you don't know have to pay for YOUR choice of college education, or pay off student loans to which YOU chose to agree?" Crickets.... Not only are the colleges encouraging this out of control student debt, but they are actively teaching the students that they are "entitled" to loan forgiveness. Let that sink in for a bit.

First of all, I was totally lucky. Both of my girls got a full ride at a private university, which came from their hard work at school. That being said, some of that was crazy grants, like because they were identical twins. But at the end of the day, we were only on the hook for the parental share.

Also, planning is everything if you can save. If your kids have any savings, the school will take that first, and apply it towards any non-merit-based scholarship given, which is messed up. 529 accounts might be tax deferred, but you have to be careful who owns them, and frankly, there are better instruments to put money in for savings.

So I say this from a very unemotional standpoint, but I am against loan forgiveness. My kids, who went on to further education might have differing opinions.

My SIL was in the Coast Guard, had his undergraduate education paid for, and part of his master's. But he went on to get a Ph.D. and has about 80K in debt. My daughter did her master's at a state school, and so that didn't cost a fortune. But the SIL's 80K is being paid by him and he expected to pay for it, so he's fine with it, too.

My other daughter got 80K in debt with her master's, and feel that this bailout is a good thing. She's pissed at us that both my hubby and I don't think it's a good thing. We tried to explain to her that when you take on debt it's your responsibility to pay it. Also, this incentives universities to up the tuition, which has outpaced inflation.

I don't agree with the premise set forth by podcast, that this debt forgiveness weakens the dollar, but it is more debt added to the government, and after the debacle of the PPP monies, it is not something I feel the government can handle. Maybe addressing the root cause for the runaway tuition is a better way to address this.

And that is tough to teach someone you love when her friends, college professors, and even the POTUS are teaching her the opposite.

I think it is possible that if the general attitude towards debt leans toward making it someone else's responsibility, then that slippery slope could indeed lead to the devaluation of the dollar. But that is just an opinion as the investment advisor who penned this article makes clear.

Indeed. Here in California though, the cost of room and board is a bigger problem than the actual tuition. More often than not those costs constitute a larger percentage of the student loan burden than the tuition.

Thank you for commenting Perrie!

"This executive order doesn't even attempt to fix the core issue of runaway inflation in college tuition. In fact, it will likely make tuition inflation even worse by throwing more taxpayer money at colleges and lead to endless "forgiveness" in the future"

It's very apparent that the current administration continues to curry favor and mine for votes.

Please illuminate for us, what is the "core" cause of runaway tuition?

Easy:

Colleges have no incentive to lower their costs as they know the government will guarantee all student loans and banks are more than willing to continue to give out larger and larger loans for the same reason. When the potential of losing money is lessened by government guarantees it's easy to continue to extend that risk. After all, the only loser in the equation is the tax payer, not the bank or college.

We know that the cost to attend college has exceeded the rate of inflation for many years.

Core causes? I don't think so. The colleges set the tuition rates, how would government address that other than telling colleges what they can charge?

You've hit most of the core points. Good article HERE offering more detail on rising tuition and costs of attending college. Do not underestimate the significant burden of out of control administrative costs, this extends even down to the community college level.

My oldest son did what was recommended in the aforementioned article and got all of his general ed completed at Mesa Community College in San Diego. Near the end of his first year there we went down to visit and saw a huge palatial building being erected on campus taking out much of the student parking lot and I said to my son, "Bet you can't wait to go to classes in that building". And he says nah that's an administrative building only, no classes in there. Couple years later he transferred to San Diego State but had saved up enough money working and going to Mesa, to pay most of his tuition without using additional loans. Looking around that campus and many other state and UC campuses you see the swollen administrative staff and buildings and the resort like amenities you mentioned above. Even my alma mater Cal Poly - San Luis Obispo now has twice as many buildings as when I went there and the cost to attend has probably increased by a factor of 10. My daughter graduated from there a few years ago at the peak of the pandemic.

What do you think the core causes are?

Correct, they are incentivized to add more bells and whistles.

Here is a Forbes article from 2017 that discusses that issue specifically::

Bureaucrats And Buildings: The Case For Why College Is So Expensive

In the last 6 years it has only gotten worse, and not only at the monetary expense of of the students, but at the expense of the quality of their education as well.

Education lending for a non dischargeable debt is at an all time high because practically anyone is eligible regardless of age.

Mr Trump, SVB, Michael Jackson, MC Hammer, 50 cent, Kim Bassinger and Nicholas Cage all share one thing with Abe Lincon and Walt Disney;

they were allowed to declare bankruptcy at some point.

But no student debt can be discharged in bankruptcy. The 1996 law needs to be revised and these kids need some kind of relief from the compound interest nightmare that keeps them from getting on top of the loan balance.

We should all be equally able to walk away from our credit card, auto, mortgage, student, business, etc debt.

Actually, if one were to refinance their student loans, it is possible that the second loan could be discharged in bankruptcy. Both my sons discovered that when they went to consolidate/refi their ridiculously high interest rate private student loans (because the Fed Government wouldn't allow them to get Federal loans, or even a lower rate on a private student loans when they were applying) before they/we actually paid them off. Read up on the FAFSA and you'll get an idea of what fun we had putting our kids through college in the last 10-12 years. Every year was different, every loan was different, every school was different. Zero consistency year to year so we could financially plan. If we want to give the kids some relief, we need to start by fixing that shit.

I had an interesting discussion about this with an administrator at UC Santa Barbara when my second son was transferring from Santa Barbara City College to UCSB. We were talking about how the Federal Government has basically seized control of all student lending (not just Federal loans), including controlling the interest rates, who qualifies and for what rate, and of course the non-dischargeable debt issue you mentioned. She claimed that prior to the Federal involvement people were taking out student loans and using it to buy cars and motorcycles and then defaulting on the debt at a fairly significant rate. Banks lost money and in comes the Federal Government to save the day.

It all comes down to personal responsibility, accountability, and risk. The banks didn't like the risk so they had the Federal Government shift it back to the irresponsible consumer. Nevermind that it impacted ALL the consumers, not just the irresponsible ones.

In the mean time, in the interest of "fairness" rather than meritocracy (grades, test scores and aptitude) the Federal and State Governments decided to control not only who gets grants and free rides to the universities, but also the entire student loan market including qualification and interest rates based on needs or other quotas. There is no longer for example any lower cost tuition advantage to going to a State or UC school here in California based on CA residency, and CA kids with 4.5 GPAs and high test scores coming out of high school are routinely turned away from the best state schools due to quotas and huge increases in subsidized foreign students. All of this has led to much higher costs of education, administration, and where we are now in the student loan debt quagmire. Middle income families can no longer afford tuitions and high housing costs without student loans. So choices are limited, but somehow better choices need to be made. All of this in the last 20-25 years. We need to study what has happened and fix it so there aren't generations of kids who need "relief" going forward.

Sorry - I'm rambling now. End of a long day!

It's definitely a core cause.

Schools charge what they do because the customers have easy access to financing.

If you cap student loans at $100k lifetime, you will be amazed at how quickly education costs fall into that zone.

Honestly, I think that the bankruptcy laws need to be rewritten.

I totally agree. The compound interest is outrageous and without guidance, these kids get these loans without understanding what they have gotten into.

What logic are you using that allows student debt to be forgiven but not medical debt, or failed business debt, etc.

There is no logic involved. It's called magical thinking.

An analogy and logic aren't a deflection.

I've noticed that this is one of your favorite terms by the frequency that you use it here. It's past time that you learn the meaning of deflection. The term "deflection" is a psychological defense mechanism that involves redirecting or “deflecting” blame for one’s own mistake onto someone else in an attempt to preserve one’s own self-image. The is aware that they’re truly the one that is wrong.

My good deed of the day.

I don’t use deflection as a defense mechanism. Tomorrow I’ll teach you what projection really means. We can build your word power day by day.

Well it’s obvious that you’ve been misusing the term deflection. I didn’t try to deflect blame in 3.1.15

Tomorrow we can cover the definition of projection and include some examples.

You don’t think that I’m alive? Is this just another canned phrase that you frequently regurgitate?

You frequently misuse them. I’ve never blamed you for something that I did. I’ve not knowingly attributed to you, mistakes I’ve made.

Now projection would occur if I unconsciously take what unacceptable impulses or thoughts to me and project or attribute them to you.

I guess you never took Psych 101.

How would you know if someone is projecting?

Hey SP - found an interesting article HERE . Apparently legal consensus is already moving in a direction to reverse that.

There is also Private Student Loan Bankruptcy Fairness Act (H.R. 138) being introduced in Congress as we speak.

I'm not exactly clear on how that will help educate or discourage people from falling into the student loan burden hole. It might just increase the number of bankruptcies and defaults on student loans.

Technically correct, once a loan is privatized because of bundling or being resold in the marketplace like a subpar mortgage, the Fed no longer guarantees the loan(s).

I got stuck with one that someone said I cosigned for ...

...

When I called, the lender was gracious enough to accept back payment and sell the loan to Wells Fargo after a credit check. They in short order sold it to FirstMark at a fixed interest rate.

FirstMark reminds me monthly that this isn't a Fed backed loan that can be forgiven by the government.

Well of course, wouldn't want you to forget...

They've been buying votes since Tammany Hall.

I paid for my own education. I did it by attending schools I could afford and took the money out of my own savings. I get nothing from this loan forgiveness crap except a tax bill to pay for someone else’s education. Forgive me if I’m not a fan.

C,mon T, your taxes won't change based on this government giveaway.

Did they change when the last Administration gave $953 BILLION in PPP "loans" that didn't have to be repaid to small and medium businesses and Mega Churches that really didn't need it.

If they don't spend it on this it will be hypersonic missiles to nowhere/S

Exactly, we just at borrow the money needed to cover the deficit.

Exactly. There are so many worthwhile things we could spend money on, but we piss it away on other crap.

Exactly, we will just borrow the money by issuing Treasury bonds and securities.

You are not alone and they lied to us.

There is free lunch or in this case free college .....

This is a insult to the parents who saved, sacrificed and worked extra to be able to send their children to college and to all students who worked to pay all or some of the costs.

It is really insulting to those who worked and paid their loans back

When the previous Administration gave away a trillion dollars that did not have to be repaid by small and medium businesses who was insulted?

No one was insulted until they saw who took advantage of the program, like Mega Churches, and not much was done about it.

That was legislation passed unanimously by Nancy Pelosi's House, and required a significant percentage be paid in wages.

but sure, bipartisan legislation to avoid massive layoffs and destruction of the economy because the government closed businesses is the exact same thing as the President unilaterally altering loans that were voluntarily entered to.

Why has the DoJ sat on their hands?

They haven't. They have caught many of the scum and repossessed a record number of Lamborghinis.

These thieves and scammers weren't all that bright...

there you go again,,,thinking

is it strictly Democrats? Are you saying none of the 45 million loan holders are non Democrats?

And there is the rub. The $$ is owed to lenders that have zero risk.

The loans cannot be discharged in bankruptcy since 1996 yet are still guaranteed by the Treasury.

That's what is broken and needs to be fixed.

The issue isn't the forgiveness itself. It's the limited buying power on these loans borne by 25 to 30 million people who would otherwise be buying new cars and homes and furniture and strollers, stimulating the economy

Maybe you should investigate that a little but further.

Debt forgiveness, especially if guaranteed by the Feds, Treasury, etc., happens all the time and the IRS treats it as income.

And people who had their money in SVB are probably pissed too. Hundreds of thousands of hard working people like Donald Trump have declared bankruptcy and resurrected themselves including Abraham Lincoln.

Why can't students since 1996?

It's a mistake that needs to be corrected. All solutions are welcome.

Forgiving loans transfers hundreds of billions of dollars from debtors to the federal government and then, the taxpayers.

One can also argue it penalizes families or individuals who scrimped and saved to pay for college, as well as most Americans who don't go to college.

Some of these debtors come from upper income families and they will get good jobs with good incomes.

It’s an expensive Band-Aid that cover ups the real problem, tuition infection.

For years, the cost of college education has risen much faster than inflation, which is why we have so much student debt.

Why can’t you?

And forgiving loans will just make college costs rise even faster.

exasperating the high cost problem even further.

Actually SP, I believe the 1996 law was amended in 2005 and made applicable to all Federal and private student loans. See info HERE .

There was a documentary on this last week, the bankruptcy judge they interviewed would not accept the fact that the cancer, the healthcare costs and his inability work, let alone to pay back the student loans was "undue hardship". They granted him bankruptcy without affecting the Federally backed student laws because of the 1996 amendment to the Omnibus Bill.

CMTSU

I forgot about those who went in the military for the educational befits

My best friend out of high school joined the Army Medical Corps and they covered his Medical education in exchange for 8 years service including I believe one or two tours in Iraq. That sort of choice is still available to kids out of high school and if you ask guys like my friend, it is an excellent choice.

As did two of my children, who owe very little now and don't feel screwed at all.

Their sister however is burdened with about 40K which just never seems to go away...

They don't get screwed, since there is a limit to those benefits, but I am still against the forgiveness. That being said, those 529 accounts are not all that they are cracked up to be.

VA’s 529 worked well for my daughter, she will have her Master degree with no debt.

My SIL would be the first to say he didn't get screwed. The amount he got out of his service is way more than this forgiveness. That being said, please note that I am NOT in favor of it.

That's OK.

And while I am discussing this, I would like to point out something that a lot of indies here say. I know I am NOT taking the liberal view on this... neither is Tig. I am socially liberal, but a fiscal conservative for the most part.

... and in your little shop of tasty 'horrors' a libertarian monarchist.

I am talking about the 529 that most people get. As for the VA, there is a cap to what you get, but for the most part, it pays to serve.

529's on the whole are not all that they are cracked up to be. It depends on who owns them and there are better instruments to save.

How dare you call me a libertarian monarchist, LOL.

No, I am not a libertarian, since in theory, they would like to believe what I believe, but in practice, they are conservatives.

Sure they do. Many sign up for just that reason. The GI bill. It’s a perk. Now it’s much lesser so if they go through with loan forgiveness and I would submit that it’s just one more reason the services are missing their recruiting quotas.

They are not forced to volunteer.

Why make shit up?

No, they did not.

Not at all true, in the military, it's a possibility, not a guarantee.

How presumptuous of you.

A: it hasn't happened yet.

B: The people with the non dischargeable debt apparently went to class and did the work.

They are caught in a conundrum quietly created by Congress through no fault of their own.

No one is suggesting complete amnesty, they are seeking a merciful hand up to tens of millions of younger people caught in a trap.

A partial discharge possibly combined with Jack's or Freewill's suggestions of fixed long term loans at a reasonable interest rate seems reasonable.

As reasonable as paying farmers not to grow crops?

Right now education lending is a bankers wet dream. No credit checks, non dischargeable loans guaranteed by the Fed with compounding interest.

There ought to be a law against it.

I think that most of these changes first took place in the late 70's when Carter was president.

The law in 1976 put a condition in place that student loans could not be discharged until 5 years after the repayment period had begun.

The anonymous amendment to the 1996 Omnibus Bill reduced that to zero.

Since Congress never defined "undue hardship" and the Dept of Education has to approve any discharges through bankruptcy, only 0.04% of all cases submitted have been approved since 1976.

The Dept of Education has steadfastly believed that, despite the findings of it's own studies and others like Harvard, there is no nationwide conspiracy by teenagers to manipulate the DOE into providing them with a free education by declaring bankruptcy to avoid future repayment.

The same attitude was prevalent throughout Congress, the same body which has quite a few survivors of bankruptcy serving, even a past POTUS or 2 or 3...

Those 529 accounts...are they the ones parents/grandparents can set up when a child is young for their education later?

Thanks SP, good info.

Those who took the money should have been aware of the terms.

The loans were supposed to help them get better jobs, make more money and buy more stuff.

Did they use the education the loans were to pay for to get better jobs and make enough money to pay back what they borrowed?

They were 17, 18, 19 years old who knew nothing of long term loans with compound interest, certainly unaware that after 1996 these specific loans could not be discharged in bankruptcy.

Yes, the great fraud.

It's insulting to suggest that the students somehow failed when this country was rocked by several recessions and pandemics and had record unemployment for so long.

Perhaps 18 is too young to take a loan, maybe 21 would be better.

The reality is that no loans are taken by an 18 year-old alone. Parents have to be involved, including a lengthy FAFSA application process that dictates the type and size of the loans the family qualifies for. There are many variables at play and the result of the FAFSA application seemed almost unpredictable from year to year when my kids went through it, and it also depended on the school(s) applied for. Most middle or upper middle income families will not qualify for Federal loans at all, private loans at a rate dictated by the government is all that is available. Many who do qualify for Federal loans will find that they can only qualify for say a small unsubsidized Stafford loan at a fairly high interest rate, accompanied by a much larger "Parent Plus" loan at an even higher rate. Parent Plus meaning the parents alone take on the repayment obligation. Some Unsubsidized Federal loans and all private loans will require a co-signer, so it isn't only the student on the hook for a student loan that can't be discharged in bankruptcy. Don't let anyone fool you about that reality.

Where is a law that says you have to start college at 18?????

Yep, just one more case of no personal accountability. Take out the loan but don’t pay it back. In fact, ask people who never went to college to pay for it.

There aren’t words to describe how much this disgusts me.

The very simple solution to the student loan issue is to convert the loans to 30 or 40 year terms.

Payments become manageable, and people can pay off their loans when they get established and have more money.

Many of the loans are pretty high interest though, so a lower rate would need to be negotiated as well. There were/are quite a few organizations (Earnest, Sofi, LendKey, etc.) offering consolidation/refi loans that actually do offer longer terms and lower rates. Both my sons used Earnest I believe before they were able to pay their loans off completely.

I've wondered how many of these kids accumulate thousands or tens of thousands of dollars of debt and never graduate from college.

Or how many really have no business being in college and could do well in a trade without being buried in debt for decades.

There is some ways to cut those costs if you decide that you must go to college. Spend the first two years in a junior college to help cut the costs when you have to transfer to a four-year college. Attend a college out of the US. Canada has some fine schools as does Europe.

There have been articles on companies dropping their bachelor's degree requirements for employment in some positions. Some are Fortune 500 companies.

The numbers will shock you. Here is a report on the debt accumulated by college dropouts from just mid-2014 to mid-2016 and it is astounding.

A very sad situation indeed. And that is JUST Federal student loan debt mind you. Better choices need to be made by students and parents early before these students incur such debt, perhaps with the help of placement counselors in high school or entry counselors at the colleges. Some resources are available, but sometimes hard to find. Many students and their parents are not well enough informed before such decisions are made. And it isn't just the students on the hook mind you. Some unsubsidized Federal loans and all private student loans require parents to co-sign, and the bulk of middle income Federal loans, if one can qualify for them at all, are what they call Parent Plus loans, and the obligation/responsibility for repayment doesn't even include the student's name, just the parents. Been there, done that.

Yep - That is what my two boys did.

Wow, those stats are shocking. In debt with little to show for it.

I was lucky, my daughter got a full-ride scholarship to UCLA. My son decided he didn't want to go to college, which IMO was a good choice for him since he really wasn't a college type.

Thanks for the link.

It’s great to see your kids make the best choices for themselves. Congratulations Kavika.

I passed on a free ride to rutgers, because I hated school, I was in love, and I wanted to work with my hands. I didn't become an office rat until I was 50 and I hated every minute of it.

Thanks, Drinker.

I had the same thing, a California State Scholarship, although they did require us to also take out a small loan. As I recall, it was only $3,500. That paid for books.

I don't remember if she had to take out a loan but I don't think so. I would not have let her do that and would have tried to pay it myself if there was one.

It was a requirement when I got the scholarship. Of course, that was a long time before your daughter got her scholarship. The loan was low interest, and my parents didn't really have the money to help out very much, so it was OK.

At the job fairs I volunteer for I push the trades equality with college education. It’s sad how hard kids are programmed today that the HAVE TO go to college. Few consider the trades seriously.

Its an academia industrial complex starting in middle school ......

From everything that I've read and much of what I experienced before I retired students today look at the trades as not worthy of their time. Sad, since many of those same kids do not belong in college.

Granted many of the trades require physical work but they also require a skill that one can acquire that will give them a comfortable living for the rest of their lives.

Priorities that are ass backward seem to be prevalent.

Yep, many teachers/administrators don’t like my presence there because I offer kids options other than college. It’s pretty messed up.

Trades are wonderful. People will bless you if you can fix their dishwasher, toilet, car, or house. Just who do they think builds all of this infrastructure?

Couldn’t agree more. I taught ROTC at a university that had a large number of 1st generation college students. Of them, many had poor writing skills and study habits. I saw them accumulate debt and believed them might end up selling shoes at a mall.

My best friend’s son, decided college wasn’t for him and he became a high voltage electrician in Colorado. He and his family are living well in a nice house.

Exactly, Thomas.

Yes!

Much has been made of this student debt relief program: How it is somehow unfair to certain individuals; How people who run up massive student debts will somehow have them wiped away. The unfairness thing I personally think is mostly sour grapes, like someone walking into a store wanting a refund because the washer/dryer that they bought a week ago just went on sale. As for the $1000 that he, his daughter, and the common taxpayer has to pay, I am not really sure where he pulled that number from.

The "massive debt relief" as I understand it is up to $10,000 dollars per individual, which is a good amount, but not that massive if you have $60,000 or more in high-interest student debt.

I know that my ex-wife had student debt of up to $80,000 after four years of bouncing around trying to figure out what she was doing. (Not my fault, I swear.) Those loans I would classify as predatory. She had zero problems getting them for school and for housing, though she had nothing for income to speak of and her degree (which she finally received after returning to a state school) was to be in graphic design. She signed up for the loan and they gave her the money, I believe precisely because there was little recourse to absolve the loan.

Now you can say that she didn't need those loans and that she should have stayed in the state college, but life happens and such, so if you get into debt, it can be a long, hard hill to climb to get out of debt. Sometimes, you cannot do it at all. She declared bankruptcy but she couldn't get rid of the debt and it seemed never to grow smaller. I had suggested that she refinance and then declare bankruptcy, but for some reason, she did not do that. I am not sure exactly why. I don't know what her student loan status is now because it has been years since we spoke. But I bet it is still there somewhat and, given the pay scale of her region and the jobs local to it, I can bet that $10,000 in debt relief would be life-changing.

How much is the preponderance of student loan amounts? That is, how much does the median borrower owe? What is the breakdown for the amounts owed?

So, what do I think or what is my opinion on the student loan forgiveness program proposed by Biden, et.al.? Meh. I think that it is a good thought, but I think that it needs to be implemented in a different way, with congress weighing in. It is really too bad that nothing can get out of congress. Wait, did I just say that? Usually, I think that it is a good thing that nothing gets out of that quagmire. Occasionally, though, there are some things that would be beneficial to the country that will never survive the bickering of the partisan nonsense that is politics today. Which is why we have had so much being done by executive order. The cycle seems never-ending.

The universities are predatory. They charge as much as you can borrow.

There is some truth to that. The results of the FAFSA essentially dictate the type of loans you qualify for, the amount suggested for the university you wish to attend, and it dictates the interest rate for any Federal loans or range of rates for private lenders who then must send the loan monies to the school, not to you.

The rest of the money YOU borrowed, above and beyond the tuition, is then sent to you later by the school, often times too late to pay the first months rent and cleaning deposit for your housing.

If you live in on campus housing the school takes out those costs before sending you the balance of what YOU borrowed so that you can buy food, books and supplies. And they take their sweet ass time which they did several times to my kids every quarter or semester.

As I stated before, middle or upper middle income folks will typically not be offered Federal loans and instead be given suggestions for private loans with variable or fixed rates typically in a higher range than students with less family means. If you can get Federal loans they will be a combination of a small unsubsidized Stafford loan at a mediocre rate and then a larger Parent Plus loan at an even higher rate. My boys were allowed only private loans, my oldest son at 11% his first year, 9% the next. My second son’s private loans were in the upper 7 and lower 8% range. My daughter several years later was able to get Fed loans at I think 4 - 5% on the Stafford and our Parent Plus loans ranged 7-8%.

The principle borrowed is typically dictated by the school but the Fed government controls the interest rate that does the most damage over time.

The rather odd implication of student debt relief is that education now increases poverty.

Sounds to me like the system that governs the granting and maintenance of loans needs to be fixed.

Agree 100%.

We are giving colleges an enormous financial incentive to gouge students.

That was not my experience with my kids.

The FAFSA process assigns each family an "expected family contribution" (EFC). Families are eligible for government loans on the difference between the EFC and the net cost of the school in question after scholarships and other grants.

So if you're going to a state school or less expensive private school, the EFC may exceed the remaining cost, in which case you don't qualify for govt loans. But if the college is very expensive, you probably will qualify.... which is why it is in the best interests of the schools to raise tuition as high as they can get away with.

Interesting observation, thanks Jack. My experience was that my two boys did not qualify for Federal Loans at any point, whereas my daughter who is considerably younger did. Although what she qualified for was a small unsubsidized Stafford Loan and then a much larger Parent Plus loan which of course was signed by us, not her. And she elected to go right from high school to a 4 year State University whereas my sons started in community colleges and then transferred to the State or UC system later. It made for interesting and continually changing financial planning on the part of our kids and us to figure out the financing. I had saved quite a bit for my kids college funds from the time they were born but it certainly turned out to be much more expensive than we had projected early on.

In reading all the comments from you and others on the type, interest rate, co-signer, etc it sounds like a giant con game with the students being the ''marks''. It is a no-lose deal for the lender with high-interest rates, and you can't have the loan discharged. The lender/university has nothing to lose and everything to gain (financially). That is one hell of a deal for them. So the higher the admission and yearly costs the better off the school is.

Come into my web said the spider to the fly.

My daughter got out of all her student loans in a unique way before all of the current forgiveness. She was attending a online college about ten years ago majoring in criminal justice when all of a sudden the school went belly up and closed up shop with no warning resulting in her not having to repay the thousands in student loans owed.

I don't know if there cannot be heaven without hell. But I'm pretty certain that inflation without deflation will wreck an economy.

Everyone is dancing around the central problem of not only student debt but any debt: interest. Falling behind on repaying debt means the borrower begins paying interest on uncollected interest. The debt doesn't grow because the borrower borrowed more money. The lender increases the debt because the lender didn't collect interest. Seems clear that the problem with student debt is being caused by lenders collecting interest.

Fixing the problem of student debt would seem to require capping interest rates and, in cases of financial distress, imposing a moratorium on collection of interest. Controlling the amount of interest collected should avoid debt growing to an unmanageable size. Especially since interest is the only mechanism that allows a debt to grow. Maybe lenders need to be allowed a pound of flesh but they don't need ten pounds. Lenders are not blameless in the problem of student debt.

Student debt is rather unique because there isn't any collateral involved. Student debt has more in common with business investments than with consumer loans. One possible way to fix the problem with student debt is to back that debt with bonds rather than loans. A bond only pays the buyer/lender a fixed amount; there isn't interest that can balloon the debt. A $100k bond with a $3k yield cannot become larger than $100k. In that situation the student would only obtain $97k but would never have to repay more than $100k. A 20 year bond for $100k means the students debt payment would be $417 per month for 20 years. There wouldn't be any uncertainty.

I know college costs have gone way up and the type of summer jobs I had are gone. Summers I worked in a Union factory at a hard dirty job that paid very well, While going to school I worked a gas station and Truck Stop. I had help form my parents. I lived good, but watched my money, passed my classes and had fun when I had time, I had a Roadrunner, an old truck and a motorcycle. I graduated with money in the bank and a job at the big old factory..

Things have changed a lot

When I was growing up. I cut neighbors' grass and shoveled their snow. In high school I worked at a restaurant. In college, I worked summers and my last year at a bar.

Now, in my neighborhood, the only kids that shovel snow or cut their own grass are military officer kids.

Same here DotW. I mowed lawns, had a paper route, collected bottles and cans for the recycle money, fixed fences, washed cars, fixed mowers, edgers and rebuilt bicycles, basically anything I could as a kid to save up money. My Mom who raised me and my siblings alone even made us business cards for our car washing business using Amway products, and business was booming!

I saved up enough to buy my first car on the day I turned 16. A ‘68 Cougar XR7, loved that car!

Worked at a veterinary clinic early in high school, managed a pizza place, rebuilt engines and worked the summers in late high-school and through college for an electrical contractor as an apprentice. In college worked at a couple of breakfast places flipping pancakes and also for the micro electronics department at Cal Poly repairing computers all over campus including the old Gandalf mainframe at the time. I had a full ride scholarship for my first year and then put myself through college by working and taking just a small student loan that I was able to pay back in less than 5 years.

I never really looked at any of it as a burden. It was a means to an end. Even when I was young I enjoyed the feeling of accomplishment, the taking of responsibility and being accountable for my successes and failures. I credit my parents for instilling such a work ethic in me and my siblings and I have tried to pass that on to my kids who also worked their way through college and took pride in getting good grades. I think that mindset is important and necessary for success, not just individual success but community success as well.

To me, it's quite interesting to read what NT members did to get through college. Never having attended college I don't have those experiences. I had many very different experiences but not those particular ones. So I say, ''good on you'' for making your way using some of your own sweat to obtain your goal.

As for myself, I attended college after I retired from the Military using the GI Bill while working a regular job as a x-ray technician and a medical lab assistant and phlebotomist. The majority of my classmates were half my age, right out of high school, and horrified at the idea of having to work while going to school. The majority were utilizing grants or mommy and daddy were paying for their schooling. As I was old enough to be their father, they did not know how to take me.

I bet some of those kids thought that you were the ''undercover boss''...

Yes, I pointed out several of those differences. I started cutting grass and shoveling snow in the mid-sixties.

Allegedly?

The feeling's oh so strong

Yah got to have friends

To make that day last long

It costs a lot to get get triggered and woke these days.

What makes you think I think that?

No shit. What in your mind is different, and how do you think they became different? Once you figure that out, perhaps some ideas for solutions will come to mind?

Like who? Who here has even hinted at that?

Are you fucking kidding me with that shit Tessy? Don't you dare assume/claim that those with a differing opinion from you on this subject and the potential solutions for it don't care about our kids or their future. We all care about the future of our children and want to get to the bottom of what has happened and fix it so that other's needn't suffer or require "relief". Such comments from you are not helpful.

“It costs a lot to get get triggered and woke these days.”

It costs nothing to simply accept our differences.

Completely agree.

Well, today's generation is the ME ME ME generation who think everything should be handed to them on a silver platter by their rich Uncle Sam without having to have done anything to earn it.

Isn't it obvious?

ME so hostile? That is really fresh coming from you Tessy given your commenting record. Suggesting that people don't want their kids to have it better than they did, or somehow enjoy watching them saddled with debt, is pretty darn hostile. Do you happen to own a mirror by chance? Perhaps you should consult it from time to time.

Perhaps she is unconsciously projecting.

Weren't you just talking about your anger issues and short temper?

No...

My mistake, it was TG replying to you.

OMG! The irony.... LOL!!!!

I'm very chill . See!

. See!

Does saying "whatever" typically work for you in debates or casual conversation? Just curious.

PD&D

Maybe she meant "whatsoever" but got the two similar words mixed up.

why dont you take a break from obsessing about tessylo? it might rejuvenate your trains of thought.

Have you ever written the same to those that frequently reply to Texan?

i think people should address the topics

Well I'm flattered that you see me as an authority, but honestly how much authority do you feel a NewsTalkers mod has? Hint - about as much authority as an unpaid babysitter.

Agreed - Thanks John and I apologize for my part in the drift away from the topics.

I agree. Do you see room for logical extensions and analogies?

Call it what you really were...a vampire! LOL!

I don't think they're all like that.

But things are different today than they were back in the early 80's. For one....NO INTERNET!!!! Sometimes when I was between jobs I had a hard time finding one. But I always found work waiting tables or tending bar.

Well, that is what I introduced myself as to my patients. In a largely Spanish speaking small rural border town, I would have people on the street call out to me "El vampiro!"

LOL!

No worries Tessy. It's all good. Overall I think this has been a pretty good discussion and I really appreciate hearing all of the different opinions and experiences that people have had.

I was lucky.

Had the opportunity to start in the trades very young and was making good money as a Journeyman plumber/pipefitter by 19. So between working summers/breaks, Pell grants, sports tuition scholarships and loans, I made it work.

I also made it a point to pay off my loans ahead of schedule. All of this was done with a great sense of personal pride and accomplishment.

My how things have changed ......

My son got out of his student loans about 5 years ago when he passed away. His student loan creditors came after me for the money harassing me almost daily and telling me they would ruin my credit. I finally told them to take me to court and when the judge laughed it out court I would counter sue them to the hilt. I stopped hearing from them after that.

I never had a student loan and get calls about reducing student loans

A good debt collector is a problem solver within the framework of the law, you had an unscrupulous, bad one illegally misleading and trying to take advantage of a grieving parent.

So sorry to hear about your son Ed-NavDoc. My condolences.

Some people are assholes, others are flaming assholes!

So sorry about your son. Those creditors are despicable

Waiting tables was lucrative...so was tending bar. I always had money when I was in college

Right? My oldest son did the same thing. Server and then bartender at the main restaurant in the San Diego Zoo. He makes enough in tips in a single weekend to pay his monthly rent. I could not believe the money he made and continues to make with that job. He is a hard worker and was recently recognized by the top brass at the zoo and offered a raise and other opportunities. Pretty proud of that kid!

One of the problems with student debt is there is no collateral to back it up. Probably why it can not be gotten rid of in bankruptcy.

Not completely true. As I recall my parents had to co-sign so I could get the lower interest student loan. Default would have been on them.

Maybe that’s changed today. Wouldn’t surprise if it had ...

It has not. Co-signers are still required (or they were in the last 12-13 years when my kids were attending college) for some Federal Loans, particularly Parent Plus loans, and ALL private student loans. Especially if you seek the lower end of the interest rate range that is dictated by the Government via the FAFSA review process.

This article personifies one of the biggest problems with many liberals these days. They actually expect others, to pay debts they accrued. They seem to think that is perfectly acceptable.

Unbelievable really.

Interestingly we see little on this one from those here who claim to be socially liberal but fiscally conservative. A mutually exclusive feat much of the time. Just like this situation.

How do you measure "little"? Both Perrie and I would accept a summary of socially liberal and fiscally conservative and both she and I have opined on this.

I do not know who you have in mind, and I have to wonder about your sampling methods, but I would expect socially liberal / fiscally conservative mindsets to hold the position that it is in the best interest of our nation to ensure those with the attitude and aptitude for higher education have the opportunity to pursue it and then contribute to the nation. But that handing out money (as in loan forgiveness) (especially retroactively) is unfair, counter-productive, and just plain dumb.

My bad, I missed that you had responded but said responses help make my point. That claiming to be fiscally conservative but socially liberal is not intrinsically possible much of the time.

Being against college loan forgiveness breaks the social liberalism claim. Being for it breaks the fiscally conservative claim.

This college loan forgiveness is no small thing in either regard and outs the hypocrisy of the claim. I go round and around with a couple of my liberal friends regularly who claim the same thing. They try to pick and choose based on their own special interests. Most own businesses and are selfishly fiscally conservative on social issues that help their business and socially liberal on issues that don’t.

Like I said, fiscally conservative and socially liberal are mutually exclusive much of the time.

Yet again you claim you are 'right' even when shown to be dead wrong.

Here is how to resolve your inability to hold social liberalism and fiscal conservatism together.

Don't think in coarse grain / binary terms. Political ideology is not black or white ... it is many shades of gray. One can be socially liberal categorically and not agree with everything you might place in that category. It is not as if a socially liberal (or fiscally conservative) individual has a book of rules that must be strictly followed.

This is the problem with doing one's thinking in terms of labels rather than details. It forces one to think in terms of stereotypes and it almost certainly will cause one to presume wrong about the positions of others.

So, now consider the college loan forgiveness. I am against it because:

Social liberalism does not mean rubber-stamped approval of all government spending to benefit some or all members of the nation. It means, in principle, that one holds that bigotry is harmful, that we can do a better job of providing healthcare, housing, education, nutrition, infrastructure, etc. as part of the social fabric of our society, etc. The approval, per individual, of the above depends upon the specifics of each proposal. I am, for example, in favor of ensuring those with the attitude and aptitude be encouraged / supported in the pursuit of higher education so as to not waste the potential of those minds. I am NOT in favor of accomplishing this by, for example, having the government merely fund free higher education for all because a) I see no way to afford this and b) it is overkill and, as constructed, would be abused. So my socially liberal principles say yes to helping the right people break down roadblocks to higher education while my fiscal conservative principles say no to government merely throwing money at a problem. Like any other thinking adult, I can make a decision based on weighted factors that consider both the socially liberal and fiscally conservative principles.

In short, you are wrong to think strictly in coarse terms because doing so makes social liberalism and fiscal conservatism appear to be at odds (much of the time). You need to recognize that thinking human beings operate at the issue / proposal level and what you would perceive as mutually exclusive at the coarse grain level is easily and routinely resolved when dealing with the specifics.

Another way to look at this. As a former engineer you routinely had to navigate mutually exclusive constraints. Somehow you managed to provide durability and functionality within budget and time constraints (for example) yet categorically those are at odds. You should have no problem understanding how a human being can pick an optimal (or near optimal) course when faced with dozens (or more) competing constraints.

A decidedly non liberal concept in these times.

See above

No disagreement there

Again, a decidedly non liberal attitude. Which supports equal opportunity for all. Your biases allow you to rationalize that only “higher aptitude” students deserve government help.

Very problematic for a “social liberal.”

It is no problem for a normal adult mind to draw a conclusion by weighting competing details. We all do this routinely yet you seem to think that this is somehow a grand challenge to do with political ideology.

It is not.

Opinions do vary.

Your second disrespectful snarky response noted by the way. You should know by now that has no effect on me since I could care less what you think.

Have a nice day.

Thanks for spelling that out

With all due respect Sparty, I don't believe that is a fair characterization. There are degrees just like with any other opinions/world views. I consider myself socially liberal when it comes equal rights and opportunity, but then fiscally conservative, including on most issues involving government spending. I agree with TiG and Perrie on this particular issue.

The government by use of it's power has the ability to solve problems but also the ability to create bigger problems and set a bad example. Deficit spending for example, a problem caused by both parties which neither want to solve as long as the spending meets their party goals, is a terrible example to set for the general public or businesses when it comes to managing credit. It is difficult to teach fiscal responsibility and accountability in the face of such bad examples, but it can be done. Parents can help, and we can insist that our schools teach math and fiscal responsibility again. I recall early in high school we had classes on managing bank accounts, savings, writing checks, loans and interest rates and how they work, guidelines for how to live within one's means, etc. There is no reason why we can't go back to that again if we really want to solve these snowballing credit issues.

In 2022, a full-time worker needs to earn an hourly wage of $25.82 on average to afford a modest, two-bedroom rental home in the U.S. This Housing Wage for a two-bedroom home is $18.57 higher than the federal minimum wage of $7.25. In 11 states and the District of Columbia, the two-bedroom Housing Wage is more than $25.00 per hour. A full-time worker needs to earn an hourly wage of $21.25 on average in order to afford a modest one-bedroom rental home in the U.S.

Unfortunately, many people don’t earn $21.25 an hour, which is why they hold two or three jobs, or add Uber or Door Dash shifts to their other work. It’s hardest for minimum-wage workers. As the NLIHC observes, “ In no state can a person working full-time at the prevailing federal, state, or county minimum wage afford a two-bedroom apartment at the [fair market rate].” Furthermore, “ in only 274 counties out of more than 3,000 nationwide can a full-time worker earning the minimum wage afford a one-bedroom rental home at the [fair market rate].”

For people living at or below the poverty line, the situation is even direr, which is why so many end up unhoused, whether couch-surfing among friends and family or pitching a tent on the street.

In the coming months, the situation is only expected to worsen now that pandemic-era eviction moratoriums and the $46.5 billion federal Emergency Rental Assistance Program are expiring. According to the Pew Research Center , those programs prevented more than a million people from being evicted.

It Wasn’t Always This WayPeople have always experienced poverty, but in the United States, the poor have not always gone without housing. Yes, they lived in tenements or, if they were men down on their luck, in single-room occupancy hotels. And yes, the conditions were often horrible, but at least they spent their nights indoors.

Indeed, the routine presence of significant populations of the urban unhoused on this country’s city streets goes back only about four decades. When I moved to the San Francisco Bay Area in 1982, there was a community of about 400 people living in or near People’s Park in Berkeley. Known as the Berkeley Beggars, they were considered a complete oddity, a hangover of burnt-out hippies from the 1960s.

During President Ronald Reagan’s administration, however, a number of factors combined to create a semipermanent class of the unhoused in this country: High interest rates implemented by the Federal Reserve’s inflation fight drove up the cost of mortgages; a corruption scandal destroyed many savings & loan institutions from which middle-income people had long secured home mortgages; labor unions came under sustained attack, even by the federal government ; and real wages (adjusted for inflation) plateaued .

Declaring that government was the problem, not the solution, Reagan began a four-decade-long Republican quest to dismantle the New Deal social safety net implemented under President Franklin Delano Roosevelt and supplemented under President Lyndon Johnson. Reagan savaged poverty-reduction programs like Food Stamps and Medicaid, while throwing more than 300,000 people with disabilities off Social Security. Democrat Bill Clinton followed up , joining with Republicans to weaken Aid to Families with Dependent Children (“welfare”).

A decade earlier, scandal-ridden state asylums for the mentally ill began to be shut down all over the country. In the late 1960s, Reagan had led that effort in California when he was governor. While hundreds of thousands were freed from a form of incarceration, they also instantly lost their housing. (On a personal note, this is why, in 1990, my mother found herself living in unsupervised subsidized housing for a population of frail elderly and recently deinstitutionalized people with mental illnesses. This wasn’t a good combination.)

By the turn of the century, a permanent cohort of people without housing had come to seem a natural part of American life.

And It Doesn’t Have to Be Like This ForeverThere is no single solution to the growing problem of unaffordable housing, but with political will and organizing action at the local, state, and federal levels it could be dealt with.

After we do something about the housing crisis, then let's worry about the national debt or how to make students more willing and able to accept the edicts of the plutocracy/oligarchy.

People who dont have enough money will go into debt. Not to mention the people who do have enough money who go into debt. Without debt the economy of the United States would collapse so fast it would make heads spin.

Exactly, inflation and housing costs suck. What do you think the cost drivers are?

We have an economic system that requires poor people, and low wage people, to function properly. So since there will always be low wage workers ( the so called race to the bottom on wages) why dont we have a national policy of creating affordable housing for all the poor and low wage earners? Why should people have to work three jobs in order to be able to afford a place to live?

We dont extract from the 'financial class' the means to keep supporting the economic system AND let people afford housing and other necessities. Taxes should be the cost of doing business.

Is that ahead of saving Medicare, Social Security and governmental pension plans?

How much will more debt improve the economy?

After all, what's $31,460,000,000,000 in federal debt? The good news is that we are only spending about a trillion more each year than we collect in taxes.

Last month. the CBO projected that annual net interest costs would total $640 billion in 2023 and double over the upcoming decade, 739 billion in 2024 to $1.4 trillion in 2033 and summing to $10.5 trillion over that period.

There will always be low wage workers. Always. Capitalism requires that workers be paid as little as possible. We have had capitalism for a couple hundred years - has there ever been a time when there were no low wage workers? Of course not, and there never will be. Devise a tax on business that funds housing for the low wage earners.

What are the housing cost drivers in Chicago?

Is the cost much higher than the IL average? Is it much higher than the US national average? If the Cook County population remains in decline, what accounts for these housing costs?

What does communism require?

The Soviet Union, Cuba, Venezuela, African countries, just haven't had enough time to show us how it's done.

Freewill, I know a few “independents” who like to make that claim. It is not reasonable on this one. Sure one can convince themself that it is but it is not. Not really.

College loan forgiveness is a hugely social issue. To rationalize that you are against it negates the socially liberal clam. I’m sure you and others here will disagree but that just speaks to the rationalization component of the claim.

Why not? Please be specific.

Why? Because most Democrats / liberals support it and most Republicans / conservatives do not? I submit that it is a hugely fiscal issue. With a total debt level approaching $2 trillion and an executive order for forgiveness costing to the tune of $400 billion as projected by the CBO, I'd say that makes it a fiscal issue.

Let's compromise and say it is both. Policies pushed by both Democrats and Republicans in the last 40 years have created the rapidly accelerating cost of tuition and room and board that forms the basis or need for ever growing student loans. During that time the Federal government has systematically seized control of the entire student loan industry and I think we can all see that it has become progressively worse as a result.

At the same time we have failed to encourage and teach fiscal responsibility and accountability in our schools at all levels while our Federal Government sets a terrible example by accruing what is now just north of $31 trillion in debt with no end in sight. From a socially responsible standpoint I think it is time that we address the root causes of the accelerating cost of higher education, and this student loan issue and do everything in our power to educate folks to make better financial choices and not fall into unmanageable debt. We can also be honest about the fact that this debt burden is not falling only on the fledgling college graduate, there are more financially established co-signers involved in most of these cases.

My contention is that forgiveness does not help to achieve the goal of correcting the root causes, at best it is a perpetual Band-Aid that won't stop the bleeding. And it just further encourages people to make bad financial choices which hurts them even worse in the long run. It is irresponsible in that regard. It also transfers the responsibility for bad choices to others who did not make them, also not fiscally or socially responsible.

I will need to disagree with that as I do not equate being socially liberal with strict allegiance to the dogma of the extremely progressive left. Please feel free to call me a classical liberal if you really find it necessary to affix labels. Anyway, that is my "rationalization" in a nutshell, and it is not dependent on party allegiance or labels, it is based on logic and reason.

I don't know what commentary you have been reading, but I have been in direct conflict with how the liberals feel about this issue. And while I consider myself a social liberal, I am most definitely not fiscally, as demonstrated with my comments through this article.

I think that the problem is this:

You seem to have made up your mind and somehow totally dismissed any comments by either Freewill (who posted this) and Tig, who has commented throughout, and not just the comments made by me.

This epitomizes the problem in politics today. People either see or don't see what suits them.

Nope. This is hardly the first time I’ve had this conversation.

One of my best friends hypocritically claims to be fiscally conservative but socially liberal. He picks and choses based on what works best for him and his. Not necessarily what’s best socially. Student loan forgiveness is a hugely social issue for a “social liberal” to not be supporting.

But, when it doesn’t directly affect him and his negatively, he is socially liberal, big time. Big time. His kids college loans are already paid off so he has no more horses in the race. He says that makes no difference to him. I’m not so sure of that. I’ve seen it happen before.

Your friend makes choices and you are insisting that his choices fit neatly within a particular label and, worse, how you interpret that label.

That is silly. I do not think: “hmmm, what should a socially liberal (or fiscally conservative) person do in this situation?”; I decide based on the details at hand. When all is said and done, my aggregate decisions are accurately categorized as socially liberal / fiscally conservative. But my decision-making process is not driven by some ideological playbook.

I doubt I am unique here.

You don’t know my friend in the least and yet act qualified to judge his actions

You are not. Not in the least

I responded to what you told us of your friend. I made no judgment of him. You, however, certainly judged him.

You are deflecting … ignoring my point rather than offering a rebuttal.