Biden's claim that his spending plan 'costs zero dollars'

"We talk about price tags. It is zero price tag on the debt. We're paying — we're going to pay for everything we spend."

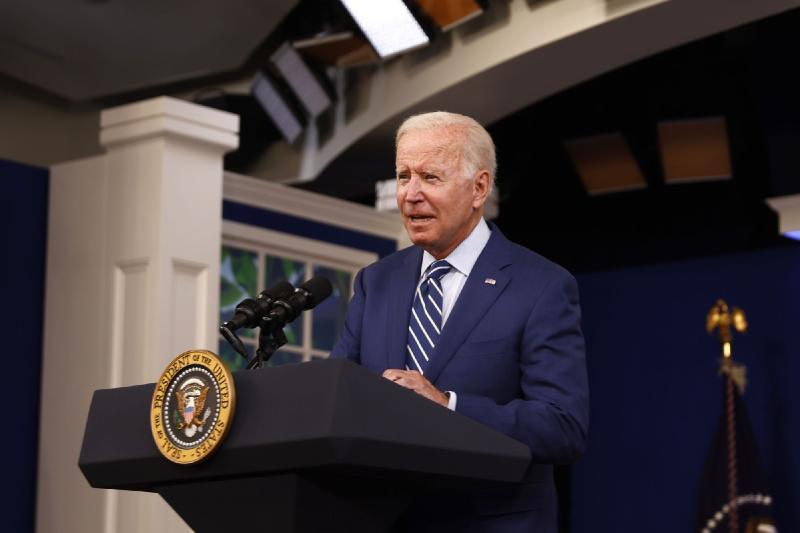

© Ting Shen/Bloomberg News

— President Biden, remarks to reporters, Sept. 24

"My Build Back Better Agenda costs zero dollars."

— Biden, in a tweet, Sept. 25

The president's spending package is often described in news reports as costing $3.5 trillion over 10 years. But the president and his aides have argued that this is misguided because Democrats are proposing to fund this spending with tax hikes on the wealthy, tougher tax enforcement and other revenue raisers. Thus, while the gross cost might be $3.5 trillion, the net cost to the Treasury would be zero.

That's the theory. But it's worth recalling that this legislative package has evolved since Biden first claimed in the spring that his spending plans would not "add a single penny to our deficit." One part of that package has already been pegged as a deficit-raiser, and in a bit of sleight of hand, the White House is now focused on the second part.

Let's dig under the hood and figure out what's going on here.

The Facts

Originally Biden's "Build Back Better" spending plan had two components — a $2.25 trillion 10-year infrastructure plan and a $1.8 trillion American Families Plan, which consisted mostly of transfer payments that would keep going, year after year, such as free prekindergarten programs, free attendance at two-year community colleges and child-care support.

Together, the two plans would have added $1 trillion to the federal budget deficit over 10 years. But over 15 years, White House officials argued, the plans would be in balance, as the tax increases used to fund the infrastructure spending would keep bringing in revenue long after the money was appropriated.

Budget analysts were divided on whether the president's math added up. The Penn-Wharton Budget Model, one of the most skeptical, calculated that Biden's twoproposals would spend $5.2 trillion and only raise $3.4 trillion in the first 10 years, putting him far short of his 15-year goal.

But since then, everything has changed through legislative sausage-making.

The infrastructure plan, which Biden wanted to pass on a bipartisan basis, shrunk to about $550 billion in new spending over 10 years and then was passed in the Senate with no tax increases — the price of winning GOP support.

The Congressional Budget Office estimated the plan would add $256 billion to the federal budget deficit over 10 years, but for complicated reasons that is a lowball figure. Marc Goldwein, senior vice president at the Committee for a Responsible Budget, says that buried in the CBO report is information that indicates the infrastructure bill would add $398 billion to the deficit.

It's also no longer funded by tax increases that would keep going; a big chunk of the funding comes from unused funds taken from a previous coronavirus bill.

Meanwhile, the other part of the plan is moving on a parliamentary track known as reconciliation. That means it can pass with a simple majority in the Senate because it is not subject to a filibuster. So no Republicans votes are needed. But it's grown from $1.8 trillion to $3.5 trillion as climate-change elements from the original infrastructure bill and other Democratic wish-list items have been added.

Under the reconciliation instructions passed by the Senate, that spending will be offset with revenue raisers — such as tax increases on the wealthy and corporations — so the impact on the deficit will be as low as zero or as high as $1.75 trillion over 10 years.

A White House official told The Fact Checker that Biden is committed to making sure the final impact is zero, which is why he has been repeating this line in recent days. "It's important to pass the bill with zero deficits," the official said.

But it's not so simple. Lawmakers are certain to play all sorts of budget games to achieve that mythical zero within the 10-year budget framework. One possible trick: terminating a new spending program early, before the 10 years is completed. That would "save" money — and require a future Congress to decide whether to continue a possibly popular benefit.

When passing tax cuts under reconciliation, such as President George W. Bush's 2001 tax cuts and President Donald Trump's 2017 tax cuts, Republicans made constant use of this tactic to lower the calculated deficit impact of the debt-financed tax cuts. The scorekeepers said the Trump tax bill inflated the deficit by $2 trillion over 10 years, but only because tax cuts for individuals — so touted by the GOP — were set to expire after 2025. That maneuver reduced the 10-year deficit forecast by about $500 billion. (Biden hopes to roll back the tax cuts for wealthier Americans to help pay for his spending plans but in theory they are due to disappear in four years anyway.)

Moody's Analytics, in a July report, said the reconciliation bill would add about $600 billion to the deficits over 10 years but would be "more-or-less paid for" when the positive economic effects are calculated.

"On paper the plan is largely paid for and does not add meaningfully to the nation's deficits and debt," said the report by Mark Zandi and Bernard Yaros. "But there is a risk that spending and tax credits in the plan that are slated to ultimately expire will not — the politics of ending any government program are vexed. Heightened tax enforcement may also not raise as much additional revenue as anticipated as wealthy taxpayers will work to avoid paying more. The result would be larger federal budget deficits and debt."

There's a separate argument about whether increased spending should be paid for with spending cuts rather than tax increases. But under conventions of budgeting in Washington, a revenue increase can offset a spending increase.

Goldwein said he viewed Biden's language as making a commitment that the reconciliation bill would not increase the deficit. "We will have to see whether he keeps that commitment," he said, but he said the increased deficits from the infrastructure bill is "not a good start."

The Pinocchio Test

This is a noteworthy pledge for the president to make. In 2017, Republicans had initially talked about a deficit-neutral tax cut but then quickly gave up.

Yet even if the reconciliation bill lands with a calculated deficit impact of zero, the president will still be in a deficit hole because of the bipartisan infrastructure bill. Originally the two bills were supposed to work in tandem, but now the White House claims only the reconciliation bill represents the president's "Build Back Better" plan. That wasn't the story in the spring.

On top of that, given our long experience in writing about the federal budget, we're pretty certain a deficit score of zero would only be accomplished with some dubious gimmicks that help disguise the true cost of Biden's agenda.

We'll keep an eye on the final outcome, but for Americans not steeped in budget arcana, the president's claim is misleading. For now, Biden earns Two Pinocchios — a number that could grow higher.

Two Pinocchios

© Provided by The Washington Post

(About our rating scale)

Send us facts to check by filling out this form

Sign up for The Fact Checker weekly newsletter

The Fact Checker is a verified signatory to the International Fact-Checking Network code of principles

Time to cue up the progressive liberal denial brigade.

Or the progressive liberal "attack the source" tactics.

Or the progressive liberal inevitable comparisons to Trump, because Trump must be the reason Biden lied.

A dumb claim. People (even the most stupid) understand that federal initiatives always require money (and lots of it). What is to be gained by making such a claim?

Even if all initiatives were covered by increasing taxes, the statement remains false. The initiative has a cost even if that cost is covered by tax revenues (and it most certainly will not be as tax revenues will be rerouted and the funding will eventually be a result of more borrowing).

Modern politics and politicians make me ill.

Is it because we know more or have the politicians managed to become even more self-serving in our lifetime?

I think the politicians have grown worse over the years.

For example, it was not that long ago when politicians actually cared about fiscal responsibility. Clearly they are beyond out of control at this point.

I am not sure if the general public really understands that money from the government comes from the tax paying citizens or is borrowed.

Sad, but you are likely correct.

Two reasons. 1) Because people believe dumb claims. They believe the Holocaust never happened. They believe the moon landings were faked. They believe you can expand government health care without raising taxes. The believe a man with a Hawaiian birth certificate was born in Kenya. They believe Mexico will pay for a border wall. They believe vaccines are part of a government tracking system. They believe that bombing Buttfuckistan will benefit our national security. The list is endless.

And 2) There is never a price to pay for being wrong. Bush promised to stop sending our troops all over the world and give up on nation building. So he started two wars and got reelected. Obama promised me I could keep my doctor and my plan (I couldn’t) but it didn’t hurt him. I don’t think Trump lost any votes when we paid for our own wall, proving that even when the media is against you, it still doesn’t hurt to be full of shit.

So you might as well claim that your massive spending plan won’t cost anything. Making the claim won’t hurt, and people already believe crazier things.

The American public then might be (on the average) more stupid than I thought.

It is one thing to make a claim that will likely be forgotten. But this is a claim that is false at the offset. Has the public become so desensitized by Trump that now politicians feel they can literally say anything?

If you thought otherwise, you have been giving too much credit.

As to the question of whether or not Trump has desensitized the public so...

That's but one example, the first that came to my head, and which is similarly situated to Biden's claim that the plan will cost nothing. Out and out lie. People may not like Trump, or his affinity towards saying whatever, apparently, he is thinking, but the lies and desensitization started long before Trump.

As well as the claim that it is paid for by the rich and nobody with an income under $400k will see a tax increase. They may not see a direct income tax increase but there are other taxes that are included in the bill (as it currently sits) that will impact a lot more than just those 1%'ers.

Under climate change, there is a $6504 lifetime methane tax on milk cows. As the average milk cow produces milk for 3 years, average annual production of 2300 gallons yields 6900 gallons of milk during their productive lifespan. The tax works out to 94 cents per gallon. Who thinks that dairy farmers can just absorb that cost? It will be passed along in increased milk prices so everybody who buys milk and milk products will be paying more.

There are many such pieces in this huge bill. While (to borrow a phrase from the current House leadership) we won't know what's in it until it's passed, there are sure to be taxes that will impact everybody who buys things.

Should legislation be required to be broken down into quantities that allow all aspects of the bill to be read and reviewed via media and online before being voted on and enacted?

The citizens of the US have no idea what is going on with our government spending and who benefits, but are required to foot the bill.

I do wish legislation would be broken down into smaller pieces centered on one issue rather than these omnibus bills. And I feel there should be sufficient time for all parties including the public to review on these bills before any vote. I know that pushes us more into a Democracy rather than what we have now with our Democratic Republic, but it seems that these large bills get pushed thru too fast and we see the surprised looks on some of our legislative leaders after the fact when they find out some buried piece of a new law they voted for and what the total cost of the new bill really turns out to be.

What a steaming pile of BULLSHIT. Tax hikes on the "rich" will, in reality, be tax hikes on the middle class (again). Additional taxes like the moronic "climate change tax" won't help either. How the fuck are tax dollars going to affect climate change? (HINT - IT WON'T. It's just another money grab under the façade of climate change.)

This "Reconciliation bill" won't go to a single damn thing the Democrats tell us it's for. Right now they will give us this big, elaborate plan that how over x number of years, the benefits will be x, y and z. The reality is, x, y and z will never happen and in x number of years we are still paying for the Democrats careless spending on things like healthcare for the illegals and Taliban they brought into the country or for their pet projects that will be of zero value to the country.

Great news! I guess we no longer have to pay taxes since there's no cost to anything the government does.

Can't wait for those tax refunds.