The big tax break for New Yorkers and Californians that Trump wiped out in 2017? Democrats are determined to bring it back.

Category: News & Politics

Via: texan1211 • 3 years ago • 7 commentsBy: insider@insider.com (Juliana Kaplan,Joseph Zeballos-Roig) 18 hrs ago (MSN)

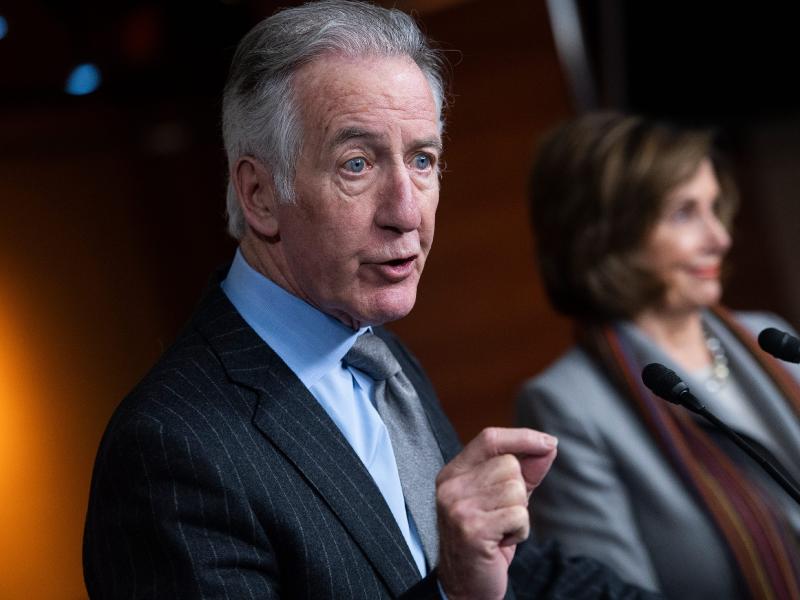

© Provided by Business Insider House Ways and Means Chair Richard Neal and House Speaker Nancy Pelosi. Tom Williams/CQ-Roll Call Inc. via Getty Images

- Democrats are still hashing out the final form of President Joe Biden's social spending plan.

- Currently, it doesn't include repeal of a Trump-era policy that cut tax breaks for people in wealthy states.

- But some Democrats want to bring it back; it also has an outsized impact on their constituents.

If you're confused about what is or isn't going to be in Democrats' proposed social spending plan, you're not alone.

A proposal for a billionaires' tax lasted less than a day. An increase on the top rate for high earners is also gone. A new surtax on multimillionaires and billionaires appeared in their place. But Democrats are still fixated on rolling back a Trump-era rule that actually hindered tax cuts for residents of wealthier areas.

It's called the SALT deduction, and it's a tax break you can claim for state and local taxes. Trump's 2017 tax plan capped the deduction at $10,000; it was previously unlimited. A group of House Democrats - in states with the highest local taxes - want to remove that cap, which would give a lot of money back to their wealthy constituents.

It's not currently in the framework released by the White House, but "SALT will be in the endgame, yes," according to House Ways and Means Chairman Richard Neal.

A report from the right-leaning Tax Foundation found that areas in New York, New Jersey, and California were among the top 10 counties with the highest state and local taxes. Representatives from all of those states have formed a bipartisan SALT Caucus that calls for restoring the deduction.

"This issue is so critical to our state and our constituents that we will reserve the right to oppose any tax legislation that does not include a full repeal of the SALT limitation," some of the group said in an April letter.

Paradoxically, as Democrats look to equalize the tax burden and make wealthier Americans pay more, the combination of removing the deduction and an increase on people earning over $400,000 could pay off for "high-income coastal professionals," The Wall Street Journal's Richard Rubin reports.

Indeed, tax expert Howard Gleckman at the nonpartisan Tax Policy Center wrote in a blog post earlier this year that households earning above $1 million annually would receive half the benefit. Around 93% of those households would get a tax cut averaging $48,000.

In stark contrast, 96% of middle-income households - those earning between $52,000 and $96,000 - would experience zero change in their tax bills.

The issue is dividing Democrats on ideological lines. Speaker of the House Nancy Pelosi has said that the cap is "mean-spirited" and "politically targeted," because it targets high earners in blue states. But key progressive Alexandria Ocasio-Cortez doesn't quite agree.

"I think it's just a giveaway to the rich," the New York representative said in the spring. "And I think it's a gift to billionaires."

The following September, the New York representative wrote on Twitter that Congress "should not endorse a full 100% repeal of SALT caps." She added that wealthy lobbyists have influence with Democrats as well as Republicans, and that a full repeal would benefit the richest of America's rich.

Democrats can only afford to lose three votes in the House and none in the Senate for the spending bill to pass using a maneuver known as reconciliation. The narrow margin of error may push Democrats to at least partially roll back the measure.

"I cannot imagine that this can get all the votes necessary without some SALT relief," Sen. Bob Menendez of New Jersey told reporters on Thursday.

As Democrats continue to hash out the details of the final social spending plan - something already causing tumult among more moderate and progressive members - the future of SALT will remain up in the air. And the months-long talks may not resolve anytime soon, with Democrats potentially squabbling through Thanksgiving.

Tags

Who is online

39 visitors

So be careful when a Democrat tells you that their party wants the rich to pay their fair share. Or when they tell you that the SALT cap hurts the middle class.

Just one more thing the Democrats can't agree on.

In NYS the salt deduction does hurt the middle class. It is because of our tax structure. The majority of our property taxes go to our schools. A modest home can be taxed way over 10K due to the school taxes.

This is not true in NYC, which uses a centralized school tax, and that is why AOC couldn't care less. Her constituents are not affected.

"In stark contrast, 96% of middle-income households - those earning between $52,000 and $96,000 - would experience zero change in their tax bills."

I am no fan of AOC, but are her constituents not affected because most of them are too poor to own their own homes, especially there?

This is an average home in the town I grew up in, Wantagh, NY. It is a very middle class town.

Look at monthly payments. The property tax, which all goes to the schools, is $1,234 monthly. That does not include the state part. So that homeowner is paying over 14K a year in taxes just to live in that town. So the 10K cap hurts this homeowner.

I lived in a house in NYC and they have a much lower tax rate, a benefit of sharing the school system. On long Island and everywhere else in the state, your school system is only as good as the taxes you are willing to pay, and most people want a decent education for their kids.

Up here there is a cascading effect whenever the federal gov cuts taxes, the lowering of transfers results in higher provincial rates followed by higher property rates and then by higher school rates. The two in the middle get the brunt of the blame, but then I am not the future, the kid next door is and I never complain when schools ask for more.

All taxes hurt someone.

Because they choose to live in a state with extraordinary high taxes doesn't mean they deserve a tax break from the feds.

If they are upset, perhaps they should petition their state legislature to lower taxes in that state so ordinary federal income taxes aren't too burdensome.

Aren't tax increases approved over time by the voters? Here in AZ we have school bond notices almost every election where it's spelled out how voting for or against will impact the tax rates.

Although in your example I would have to say that's just crazy. That house is only a couple hundred sq ft larger than mine and about $200k more in price, but my annual taxes are less than that monthly tax. If my property taxes were that high I would have to consider selling and moving to another area myself.